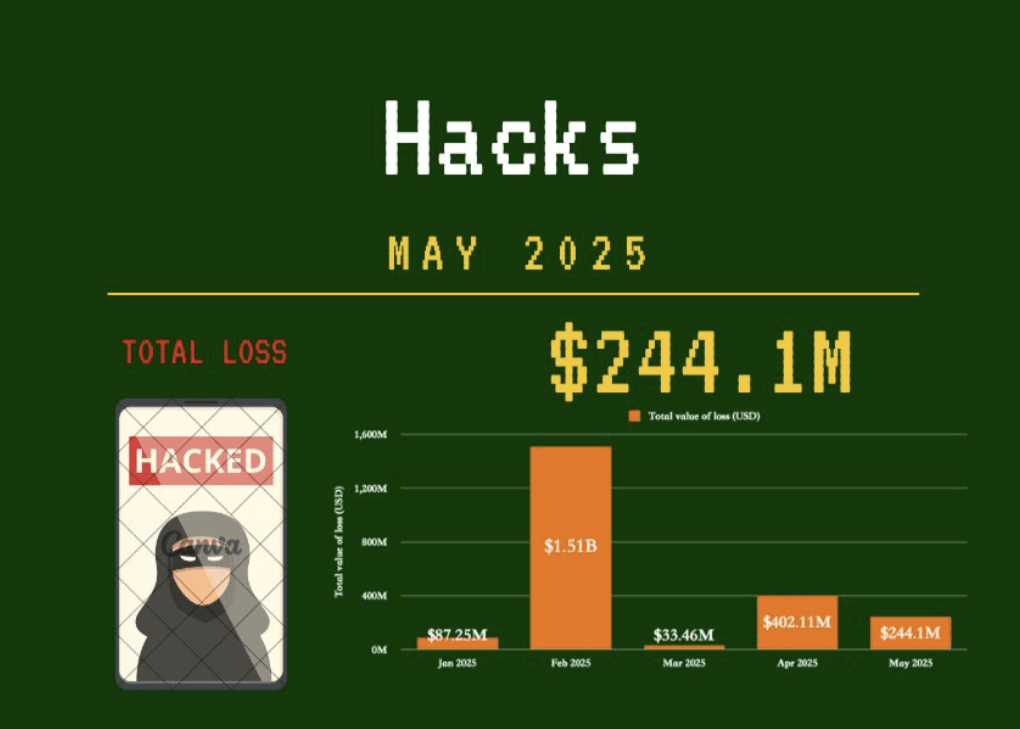

Crypto Hack Losses Plummet 40% in May, $244M Targeted: PeckShield Report

In May, the total amount stolen from crypto hacks declined drastically compared to April, with the largest incident making up around 90% of the month’s total, according to blockchain security firm PeckShield.

The decline comes as the crypto industry has been stepping up its efforts to stay ahead of hackers. “In May 2025, ~20 major crypto hacks were recorded, resulting in total losses of $244.1M — a 39.29% decrease from April,” blockchain security firm PeckShield said in a May 31 X post.

Quick Summary of the News:

- Total crypto hack losses decreased by 39.29% in May compared to April.

- Approximately 20 major crypto hacks were recorded in May.

- The total amount stolen in May was $244.1 million.

- The largest hack of the month targeted the Cetus decentralized exchange, accounting for the majority of the losses.

- Cetus and the Sui Network managed to freeze $157 million in stolen funds.

Why It Matters

The decrease in crypto hack losses is a positive sign for the industry, indicating that security measures are becoming more effective. However, the fact that $244.1 million was still stolen highlights the ongoing risks and the need for constant vigilance. The Cetus hack, in particular, demonstrates the potential for significant losses in DeFi platforms. The ability to freeze a substantial portion of the stolen funds also showcases the increasing effectiveness of collaborative efforts between exchanges and security firms.

Market Impact

While a single month’s data doesn’t define a trend, the reduction in losses can positively influence market sentiment. Reduced hack incidents can lead to increased investor confidence and potentially attract more participants to the crypto space. However, the market remains sensitive to security breaches, and any future large-scale hacks could quickly reverse this positive sentiment. The ability of protocols to quickly react and freeze stolen funds is also a major factor. If protocols and CEX are able to work together to retrieve stolen funds the market could see hacks as temporary issues.

Expert Take

The decrease in hack losses is encouraging, but we must remain cautious. The sophistication of hacking techniques is constantly evolving, and the industry needs to stay one step ahead. DeFi platforms, in particular, need to prioritize security audits and implement robust risk management protocols. Furthermore, the collaborative effort between security firms, exchanges, and blockchain projects is crucial in minimizing the impact of these attacks.

Actionable Insight

- Traders: Stay informed about security audits and vulnerabilities of the platforms you use. Diversify your holdings across multiple platforms to mitigate risk.

- Investors: Consider the security track record of projects before investing. Look for projects that prioritize security and have a proactive approach to addressing vulnerabilities.

- Developers: Prioritize security in your code and conduct thorough audits. Collaborate with security firms to identify and address potential vulnerabilities.

Conclusion

The decrease in crypto hack losses in May offers a glimmer of hope for a more secure future. However, the fight against cybercrime in the crypto space is far from over. Continued vigilance, collaboration, and innovation in security technologies are essential to protect the industry from malicious actors and foster greater trust among participants. The next few months will be crucial in determining whether this downward trend will continue.