Humanitarian aid organization World Vision Korea is the first nonprofit to sell crypto in South Korea after the country ushered in new rules around institutional crypto trading.

World Vision Korea sold 0.55 Ether (ETH), worth roughly 1.98 million won ($1,436) on Upbit, according to a June 1 statement from Dunamu, the parent company of the crypto exchange.

The Ether, which was held by Chairman Myung-hwan, was donated as a result of a campaign in March that asked Upbit users to donate crypto to help underprivileged youth who can’t afford school items such as uniforms and bags.

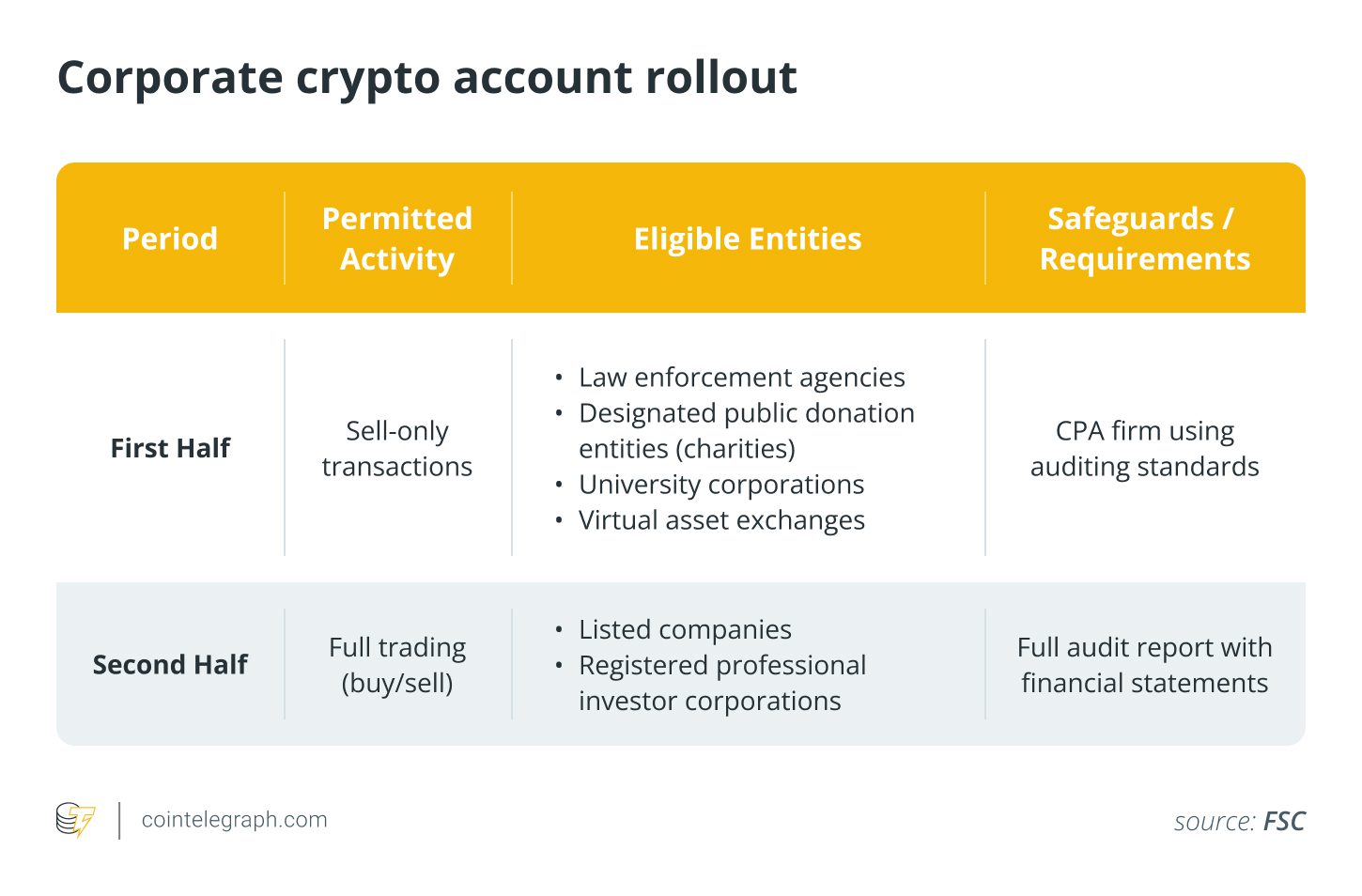

During a May 20 meeting, South Korea’s Financial Services Commission updated its rules to allow nonprofit organizations and virtual asset exchanges to sell cryptocurrencies under new compliance standards.

Quick Summary of the News:

- World Vision Korea becomes the first nonprofit in South Korea to sell cryptocurrency after a regulatory change.

- They sold 0.55 ETH (approximately $1,436) on the Upbit exchange.

- The ETH was donated through a campaign to help underprivileged youth.

- South Korea’s Financial Services Commission (FSC) updated rules to allow nonprofits and exchanges to sell crypto under specific conditions.

- The new regulations aim to balance innovation with investor protection.

Why It Matters

This event signifies a crucial step in South Korea’s evolving crypto landscape. By allowing nonprofits to engage with cryptocurrencies, the FSC is signaling a more open approach to digital assets. This move could pave the way for greater institutional adoption, bringing more liquidity and stability to the South Korean crypto market. It also highlights the potential for crypto to be used for charitable purposes, increasing its social impact.

Market Impact

While the initial transaction was relatively small, the symbolic impact is substantial. This move could lead to:

- Increased confidence in the crypto market among South Korean investors.

- More nonprofits exploring crypto fundraising.

- Greater regulatory clarity, attracting further institutional investment.

Here’s a brief comparison of Q4 2024 vs Q1 2025 trading volume on Upbit:

| Period | Trading Volume |

|---|---|

| Q4 2024 | $561.9 Billion |

| Q1 2025 | $371 Billion |

Despite the drop in trading volume from the previous quarter due to market conditions, the new regulations could help revitalize the market in the coming months.

Expert Take or Personal Insight

The South Korean government’s measured approach to crypto regulation is commendable. By gradually opening the doors to institutional participation while maintaining strict compliance standards, they are fostering innovation without sacrificing investor protection. I predict we’ll see more nonprofits and eventually publicly listed companies in South Korea embrace crypto in the near future.

Later this year, the FSC will allow publicly listed companies and entities registered as professional investors to buy and sell crypto.

Actionable Insight

Traders and investors should keep a close eye on the following:

- FSC announcements regarding further regulatory changes.

- The performance of Upbit and other South Korean exchanges.

- The adoption rate of crypto among South Korean institutions.

Consider researching promising South Korean crypto projects and exchanges.

Conclusion

World Vision Korea’s pioneering move marks the beginning of a new era for crypto in South Korea. As regulations continue to evolve, we can expect increased institutional participation and further integration of digital assets into the country’s financial system. This could position South Korea as a key player in the global crypto landscape.