Bitcoin (BTC) has shown resilience, recently holding near its two-month high around $94,000 after gaining 11% between April 20 and April 26. This rally was fueled by signals from the Trump administration regarding easing import tariffs and strong corporate earnings. A key factor influencing Bitcoin’s potential to reach new all-time highs is the dynamic between retail and institutional investor behavior, coupled with macroeconomic influences.

Key Factors Influencing Bitcoin’s Price:

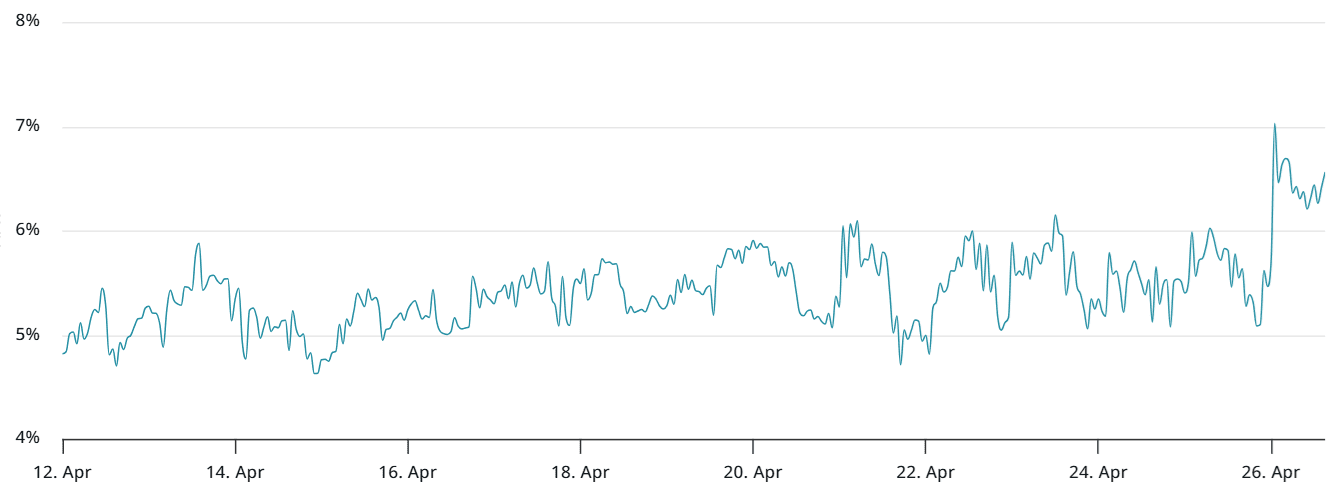

- ETF Inflows: Spot Bitcoin ETFs experienced a record $3.1 billion in net inflows over five days, indicating strong investor confidence.

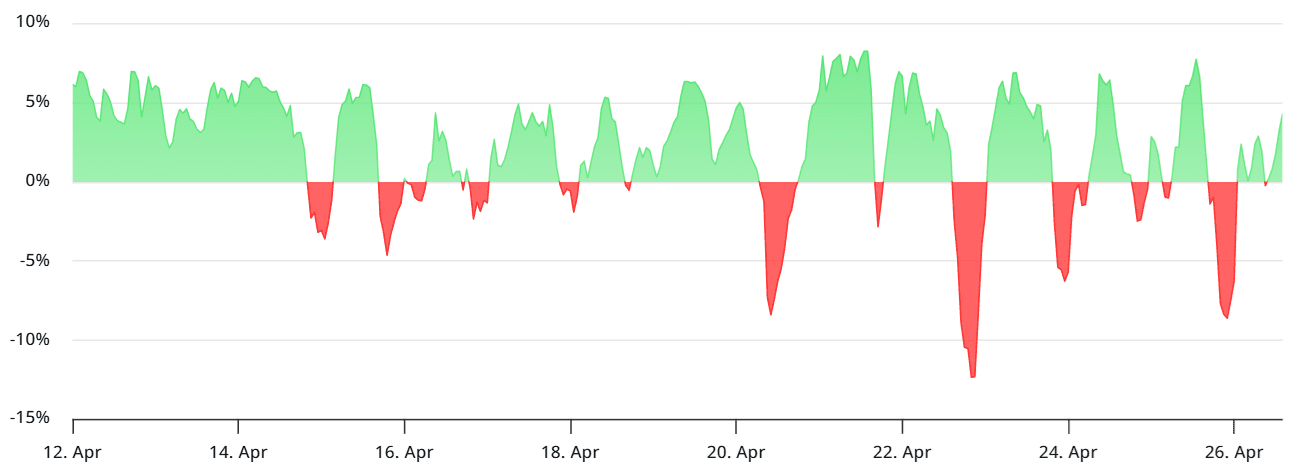

- Derivatives Market Signals: Bearish momentum in BTC derivatives raises questions about the $100,000 target.

- Funding Rates: Sharp negative funding rates in perpetual futures contracts, unusual during bull markets, suggest stronger demand from sellers.

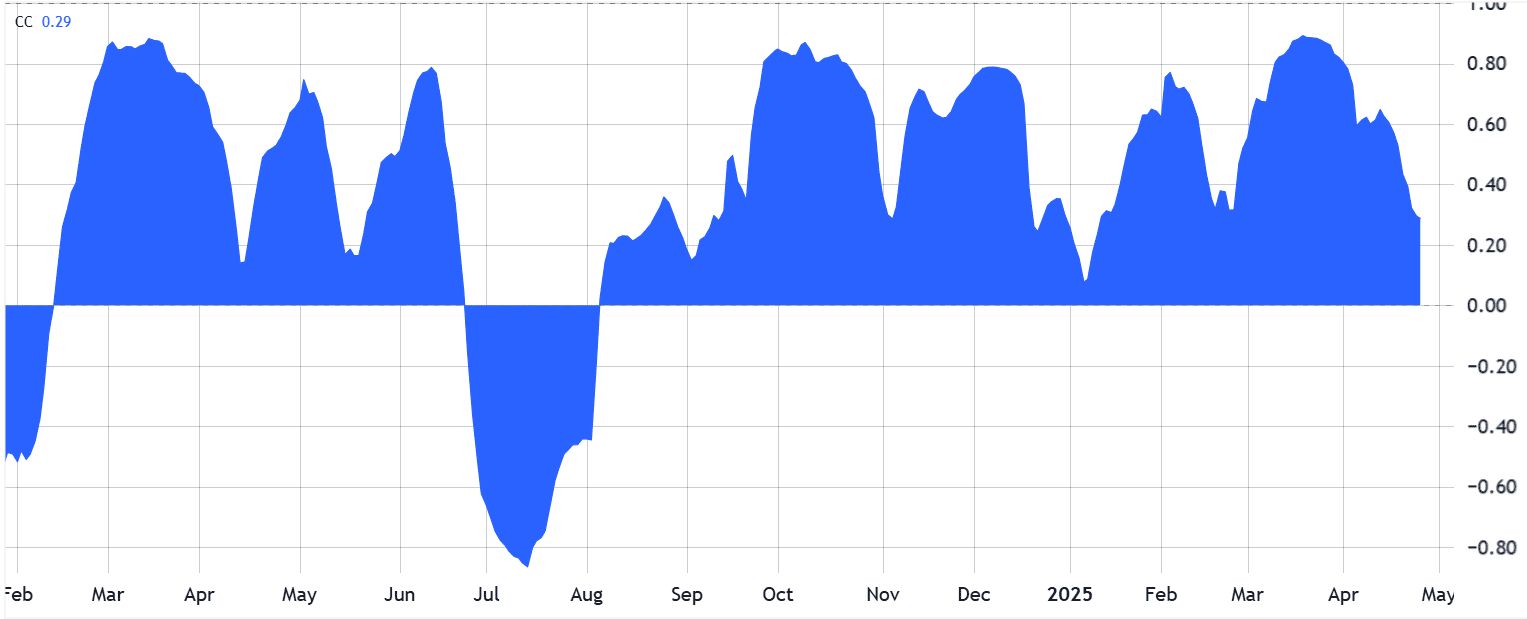

- Correlation with S&P 500: Bitcoin’s weakening correlation with stocks (currently at 29%) highlights its growing independence as an asset.

- Institutional vs. Retail Sentiment: Bullish institutional investor positioning contrasts with retail traders’ caution.

Understanding the Market Dynamics

The price of Bitcoin is influenced by a complex interplay of factors. Here’s a deeper dive:

- Liquidation Events: Heavy liquidations of short positions have played a role in Bitcoin’s price movements. For instance, over $450 million in BTC short positions were liquidated after Bitcoin climbed above $94,000.

- Macroeconomic Factors: Initially, gains were influenced by the S&P 500’s weekly gain. However, uncertainties surrounding trade negotiations introduce volatility.

- Decoupling from Traditional Markets: Unlike before, Bitcoin’s price is no longer closely correlated with the S&P 500. This suggests it’s emerging as an independent asset.

Bitcoin’s Strengthening Independence

Gold’s performance is also relevant. Its inability to maintain bullish momentum after reaching an all-time high is seen as strengthening Bitcoin’s case as an independent asset class. The longer Bitcoin stays above $90,000, the more investor confidence grows, potentially paving the way for further gains.

Contrasting Sentiment: Perpetual vs. Monthly Futures

There’s a notable difference in sentiment between retail and professional traders. Retail traders often use perpetual Bitcoin futures, while institutional investors prefer monthly Bitcoin futures contracts. Monthly contracts avoid fluctuating funding rates, providing more predictable leverage costs.

On April 26, the two-month Bitcoin futures premium (basis rate) rose to its highest level in seven weeks. While this metric remains within a neutral range, it signals increasing interest in bullish positions.

Institutional Accumulation and Future Price Potential

Even with cautious retail traders, substantial accumulation by institutions could drive Bitcoin’s price above $100,000 soon. The disconnect between leverage demand in perpetual futures and monthly BTC contracts indicates diverse market perspectives.

Will Bitcoin Reach New All-Time Highs in May?

Considering the strong ETF inflows, the weakening correlation with the S&P 500, and the potential for institutional accumulation, Bitcoin has a reasonable chance of reaching new all-time highs in May. However, traders should closely monitor funding rates, macroeconomic factors, and regulatory developments to assess market sentiment and price trajectory. The continued decoupling of Bitcoin from traditional markets and growing confidence in its role as ‘digital gold’ are also key indicators to watch.