Today’s crypto news covers regulatory updates, political developments, and technical challenges within the digital asset space. Singapore is cracking down on overseas crypto services, South Korea’s upcoming election promises further crypto adoption, and the TON blockchain experienced a temporary disruption.

Singapore Orders Crypto Firms to Cease Overseas Activity

Singapore’s central bank, the Monetary Authority of Singapore (MAS), has  , set a June 30 deadline for local crypto service providers targeting overseas markets to halt operations. This directive is part of MAS’s response to industry feedback on its regulatory framework for Digital Token Service Providers (DTSPs) under the Financial Services and Markets Act of 2022 (FSM Act). Companies failing to comply face fines up to $200,000 and potential imprisonment.

, set a June 30 deadline for local crypto service providers targeting overseas markets to halt operations. This directive is part of MAS’s response to industry feedback on its regulatory framework for Digital Token Service Providers (DTSPs) under the Financial Services and Markets Act of 2022 (FSM Act). Companies failing to comply face fines up to $200,000 and potential imprisonment.

Quick Summary:

- MAS sets June 30 deadline for Singapore-based crypto firms to cease overseas digital token (DT) services.

- Directive is part of the regulatory framework under the Financial Services and Markets Act (FSM Act).

- No transitional arrangements will be made; firms must either cease operations or obtain a license.

- Violators face fines up to $200,000 and imprisonment up to three years.

- The rule applies even to companies where overseas token activities are not their primary business.

Why It Matters

This move signals a more stringent regulatory environment in Singapore, a major crypto hub. The MAS aims to protect investors and maintain financial stability by ensuring that local crypto firms operating overseas are properly regulated. This decision could lead to some companies relocating or restructuring their businesses to comply with the new rules.

Market Impact

The immediate market impact might be limited, but in the long term, it could lead to a consolidation of crypto firms in Singapore. Companies with strong compliance frameworks will likely thrive, while smaller players might struggle to meet the requirements. Here’s a possible scenario:

| Scenario | Potential Impact |

|---|---|

| Firms Comply | Increased regulatory burden, higher operational costs, but greater investor confidence. |

| Firms Relocate | Potential loss of jobs and tax revenue for Singapore, but could boost other crypto-friendly jurisdictions. |

South Korea’s Crypto-Positive Election

South Korea’s crypto industry is poised to benefit from the upcoming presidential elections on June 3. Both leading candidates have expressed support for the crypto industry, promising to ease regulations and expand crypto access. This is significant, considering South Korea is one of the world’s most active crypto markets.

Quick Summary:

- South Korea’s presidential election is set for June 3, with both candidates pro-crypto.

- Lee Jae-myung (Democratic Party) wants to allow the national pension fund to invest in crypto and create a won-backed stablecoin.

- Kim Moon-soo (People Power Party) pledges to ease regulations and expand crypto adoption.

- Both candidates support legalizing spot crypto ETFs.

- South Korea has over 16 million crypto users, with daily trading volumes sometimes exceeding stock indexes.

Why It Matters

The pro-crypto stance of both candidates indicates a growing acceptance of digital assets in South Korea. Easing regulations and allowing institutional investment could attract more capital into the crypto market and boost innovation in the blockchain space.

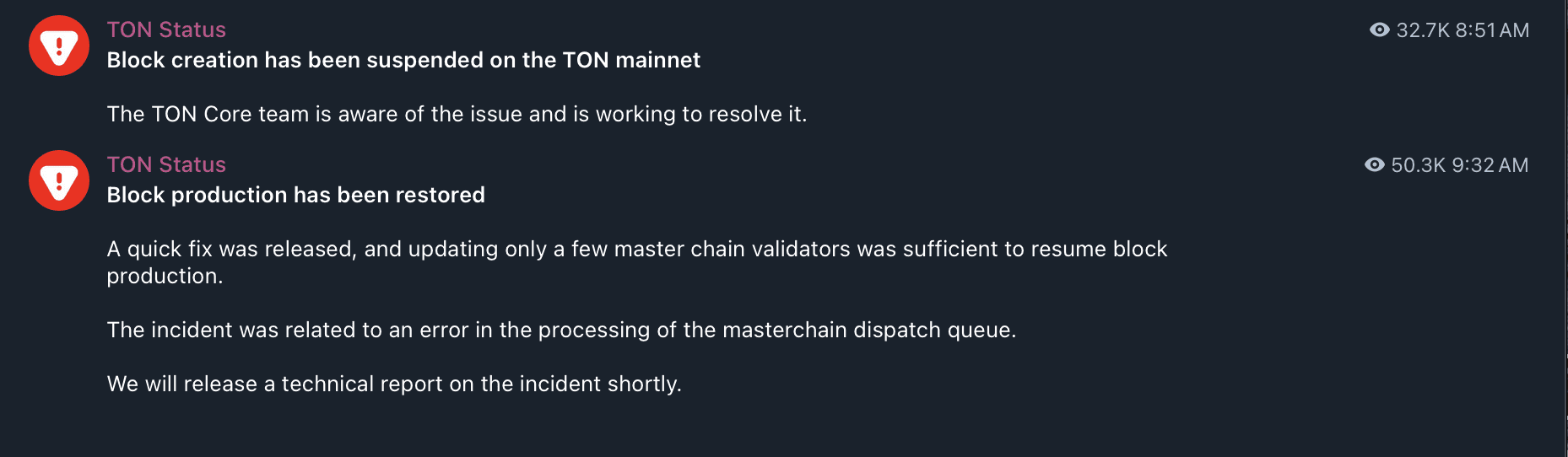

TON Blockchain’s Brief Downtime

The Open Network (TON) experienced a brief network outage on June 1 due to an error in the masterchain dispatch queue. The issue was resolved within 40 minutes, and network services were quickly restored.

Quick Summary:

- The Open Network (TON) experienced a brief outage on June 1.

- The issue was caused by an error in the masterchain dispatch queue.

- The network was restored within 40 minutes after the issue was discovered.

- A quick fix was released, and updating a few masterchain validators was sufficient.

- The incident highlights potential challenges in high-throughput blockchain networks.

Why It Matters

While the outage was brief, it serves as a reminder of the technical challenges inherent in blockchain technology. High-throughput networks are complex and require robust infrastructure to ensure stability. Quick resolution of such issues is crucial to maintaining user confidence.

Expert Take or Personal Insight

The Singaporean regulations, while potentially restrictive in the short term, could foster a more sustainable and compliant crypto ecosystem. The South Korean election results will be interesting to watch, as either candidate could significantly impact the country’s crypto market. As for TON, the rapid response to the outage demonstrates the network’s resilience and the team’s ability to address technical challenges effectively. Overall, the market is maturing, but the long-term effect is still unknown.

Actionable Insight

For traders and investors:

- Singapore: Monitor how local crypto firms adapt to the new regulations. Consider potential opportunities in companies that successfully navigate the regulatory landscape.

- South Korea: Keep an eye on the election outcome and the specific crypto policies implemented by the new administration.

- TON: Evaluate the network’s performance and stability in the coming weeks to assess its long-term viability.

Conclusion

The crypto landscape continues to evolve, with regulatory changes, political developments, and technical challenges shaping the market. Staying informed and adapting to these changes is crucial for investors and industry participants alike. The next few months will be pivotal as Singapore’s regulations take effect, South Korea elects a new leader, and TON continues to develop its network.