Cryptocurrency investment products maintained their multi-week inflow streak last week despite significant selling pressure stemming from Bitcoin’s drop to $103,000.

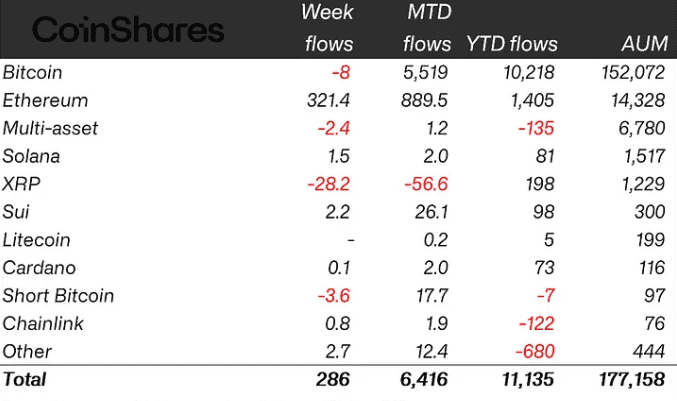

Global crypto exchange-traded products (ETPs) recorded $286 million of inflows in the week ending May 30, bringing a seven-week run of inflows to $10.9 billion, CoinShares reported on June 2.

Despite the inflows, total assets under management (AUM) declined from the all-time high of $187 billion to $177 billion by the weekend amid market volatility triggered by uncertainty over US tariffs, said CoinShares’ head of research, James Butterfill.

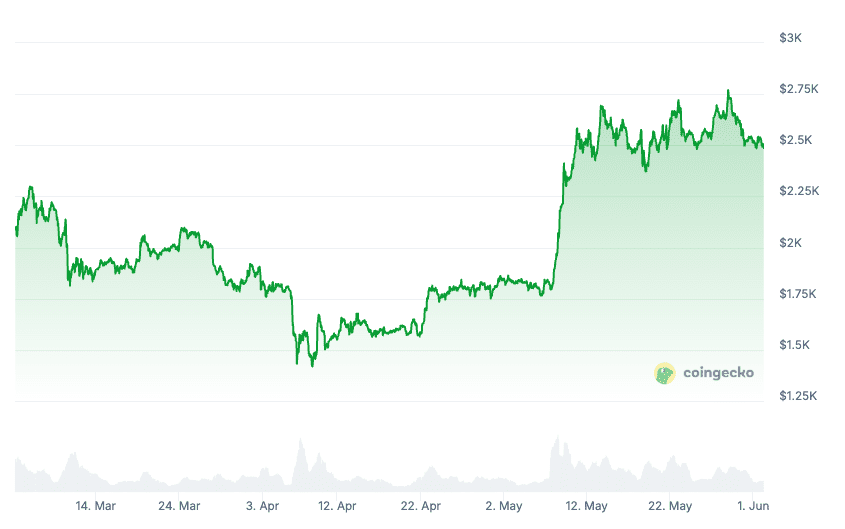

The new inflows came as Bitcoin (BTC) tumbled about 6% from $110,000 last Monday to an intraweek low of $103,400 by May 30, according to data from CoinGecko.

Ether ETPs lead inflows

Ether (ETH) ETPs led last week’s crypto ETP buying with inflows totaling $321 million, marking the strongest run since late December 2024 and reflecting a significant sentiment improvement.

Bitcoin ETPs saw $8 million in outflows after a major flow reversal following a New York Court decision to declare US tariffs illegal, Butterfill said.

XRP investment products posted the biggest outflows last week, totaling $28 million. The outflows marked a second week running of losses for XRP, Butterfill noted.

iShares ETFs top inflows despite BTC ETF outflows

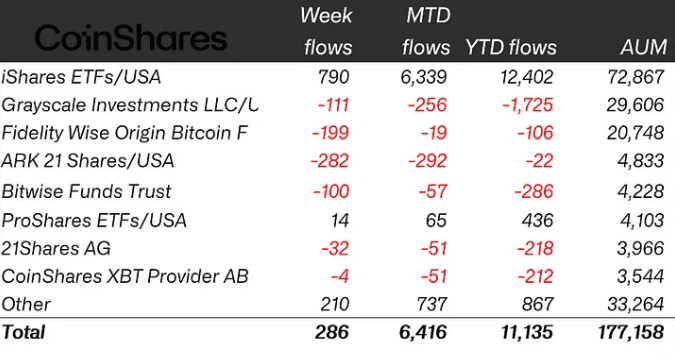

BlackRock’s iShares exchange-traded funds (ETFs) led inflows among issuers last week despite seeing massive outflows from Bitcoin ETFs at the end of the week.

According to CoinShares, iShares ETFs saw $790 million of inflows, with YTD inflows surging to $12.4 billion. At the same time, iShares’ AUM slipped from $74.8 billion in the previous week to $72.9 billion last week, reflecting a downward trend in Bitcoin ETFs.

ARK Invest and 21Shares’ crypto investment products saw the biggest losses among issuers last week, totaling $282 million and bringing YTD flows to $22 million of outflows.

Profit taking and seasonal weakness for BTC

The flow reversal in Bitcoin ETPs came after six weeks of healthy inflows in BTC products, with the new losses being attributed to many factors supporting the overall decline of crypto markets last week.

According to Cointelegraph Markets, crypto prices have historically seen mixed performances in the month of June, suggesting potential seasonal weakness.

Previous reports also suggested that some investors have been taking advantage of Bitcoin surging past $110,000, with long-term investors quietly capitalizing on the recent price drops.

Ether ETPs have been on the rise amid improving network fundamentals and resilient ETH futures markets.

Ether’s renewed growth followed a long bearish period, which forced some trading firms to drop ETH support in early May and view it “like a memecoin.” On the other hand, some ETH supporters speculated that Ether’s decline in May marked the asset’s bottom, which hinted at a potential reversal of the negative trend.

According to CoinGecko, Ether was trading at $2,486 by publishing time, down from $2,771 on May 28. The cryptocurrency has added 36% to its value in the past 30 days.

Quick Summary of the News

- Crypto ETPs saw $286 million in inflows during the week ending May 30.

- Ether ETPs led the surge with $321 million in inflows.

- Bitcoin ETPs experienced $8 million in outflows.

- iShares ETFs led inflows among issuers with $790 million.

- XRP investment products saw the biggest outflows, totaling $28 million.

Why It Matters

This news highlights a potential shift in investor sentiment within the crypto market. Despite Bitcoin’s price volatility and resulting outflows, the strong inflows into Ether ETPs suggest growing confidence in Ethereum’s fundamentals and future prospects. This could be driven by factors such as the upcoming network upgrades, increasing adoption of DeFi protocols on Ethereum, and overall positive sentiment surrounding the Ethereum ecosystem.

Market Impact

The data from CoinShares indicates a divergence in investor focus. While Bitcoin is still considered the leading cryptocurrency, investors may be diversifying their portfolios to capitalize on the potential growth of alternative cryptocurrencies like Ether.

ETP Flows by Asset (Week Ending May 30, 2025)

| Asset | Inflows/Outflows (USD Million) |

|---|---|

| Ether (ETH) | $321 |

| Bitcoin (BTC) | -$8 |

| XRP | -$28 |

Expert Take or Personal Insight

The significant inflows into Ether ETPs are particularly noteworthy. It appears investors are anticipating further growth and development within the Ethereum ecosystem, potentially driven by increased DeFi adoption and future upgrades. While Bitcoin remains a dominant force, this data could be a leading indicator of a broader trend towards altcoin diversification. I predict we’ll see further capital allocation to layer-2 solutions and other innovative projects within the Ethereum ecosystem in the coming months.

Actionable Insight

Traders and investors should closely monitor the performance of both Bitcoin and Ether, paying attention to factors driving their respective price movements. Keep an eye on Ethereum network upgrades, DeFi adoption rates, and regulatory developments. Consider diversifying portfolios to include Ether and other promising altcoins, while remaining aware of the inherent risks associated with cryptocurrency investments.

Conclusion

The crypto market continues to evolve, with shifts in investor sentiment creating new opportunities and challenges. The dominance of Ether inflows amidst Bitcoin outflows suggests a potential realignment of investment strategies. Looking ahead, it will be crucial to stay informed and adapt to the changing dynamics of the crypto landscape.