Japanese investment company Metaplanet has become the world’s eighth-largest corporate holder of Bitcoin, continuing its aggressive strategy to promote Bitcoin adoption across Asia.

The company acquired an additional 1,088 Bitcoin (BTC) at an average price of $108,400 per coin for a total of $117.9 million, the investment firm announced in a June 2 X post.

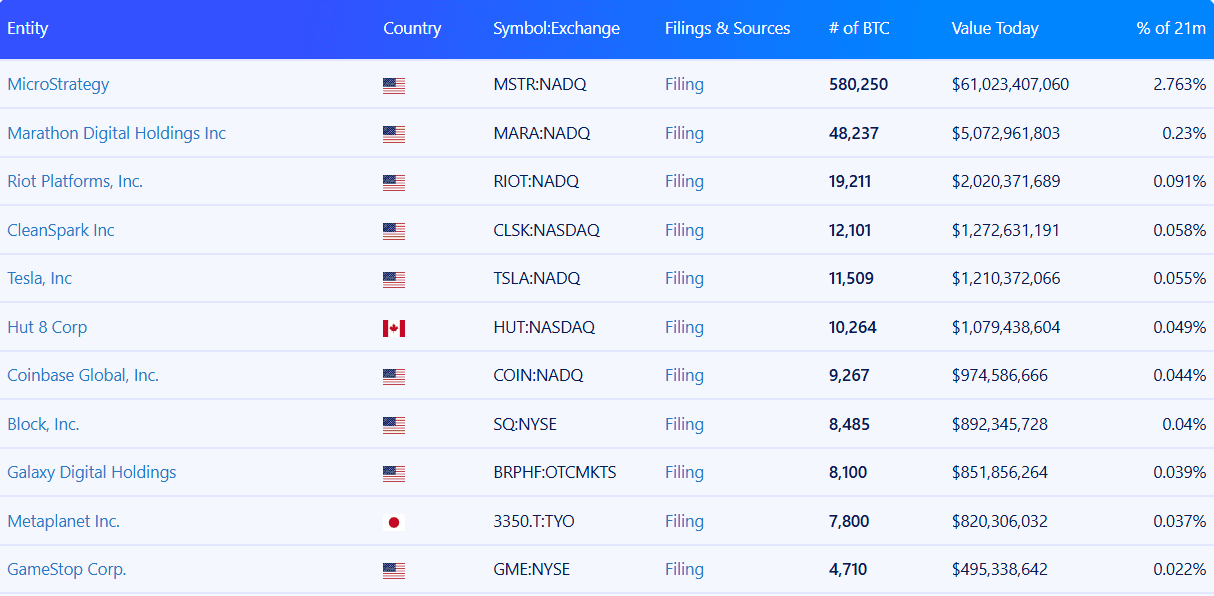

The latest acquisition pushed Metaplanet’s total holdings to over 8,888 BTC, making it the world’s eighth-largest corporate Bitcoin holder, surpassing Galaxy Digital Holdings’ 8,100 BTC and Block Inc.’s 8,485 BTC, according to Bitbo data.

Quick Summary of the News

- Metaplanet purchased an additional 1,088 BTC for $117.9 million.

- This brings their total holdings to 8,888 BTC.

- Metaplanet is now the 8th largest corporate Bitcoin holder, surpassing Galaxy Digital and Block.

- The purchase was made at an average price of $108,400 per BTC.

Why It Matters

Metaplanet’s aggressive Bitcoin accumulation strategy is significant for several reasons. First, it signals growing institutional confidence in Bitcoin as a store of value, particularly in the face of macroeconomic uncertainty. Second, it highlights the increasing adoption of Bitcoin in Asia, a region with immense potential for crypto growth. Finally, it raises questions about whether such aggressive buying is sustainable and if it’s creating a premium on related assets.

Market Impact

The news of Metaplanet’s purchase has had a modest positive impact on Bitcoin’s price, reinforcing its support level above $100,000. However, analysts are watching closely to see if this translates into sustained upward momentum or if it’s a temporary bump.

Corporate Bitcoin Holdings Comparison:

| Company | Bitcoin Holdings |

|---|---|

| MicroStrategy | 214,400 BTC |

| Marathon Digital Holdings | 17,631 BTC |

| Tesla | 9,720 BTC |

| Metaplanet | 8,888 BTC |

Expert Take and Personal Insight

Metaplanet’s move is a bold bet on the future of Bitcoin. While institutional investment is generally a positive sign, the speed and scale of Metaplanet’s accumulation raise concerns about a potential premium bubble forming around their stock. Investors should be cautious and understand the underlying risks before investing in companies solely for their Bitcoin exposure.

Actionable Insight

Here’s what traders and investors should watch:

- Bitcoin Price Action: Monitor BTC’s price movement to see if it can sustain gains above $110,000.

- Metaplanet Stock: Keep an eye on Metaplanet’s stock price and its premium relative to Bitcoin’s price. A widening premium could indicate speculative activity.

- Macroeconomic Factors: Pay attention to global economic indicators and geopolitical events, as these can influence Bitcoin’s price and investor sentiment.

Conclusion

Metaplanet’s strategic Bitcoin buy underscores the growing institutional interest in cryptocurrency. Whether this aggressive strategy will pay off remains to be seen, but it undoubtedly puts a spotlight on Bitcoin’s potential as a hedge against economic uncertainty and a valuable asset in a diversified portfolio. The coming months will be crucial in determining if this is a smart move or a sign of market froth.