May saw significant bullish momentum in crypto markets as Bitcoin (BTC) reached a new all-time high above $111,000 and Coinbase joined the S&P 500.

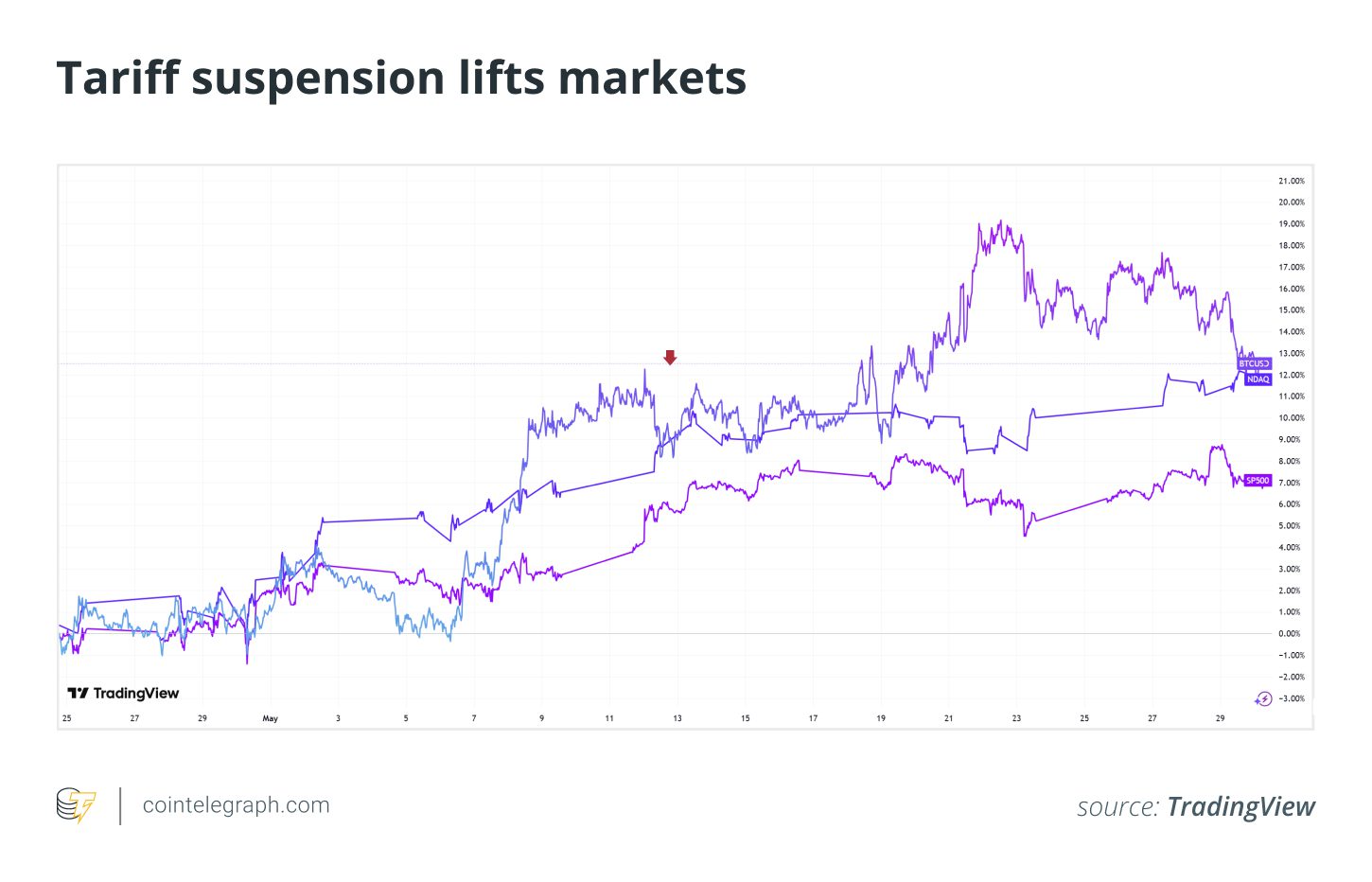

Markets reacted positively when, on May 12, a trade deal was reached, putting a hold on tariffs that had previously caused market instability. The news saw BTC price initially surge to $105,000, before settling around $102,000.

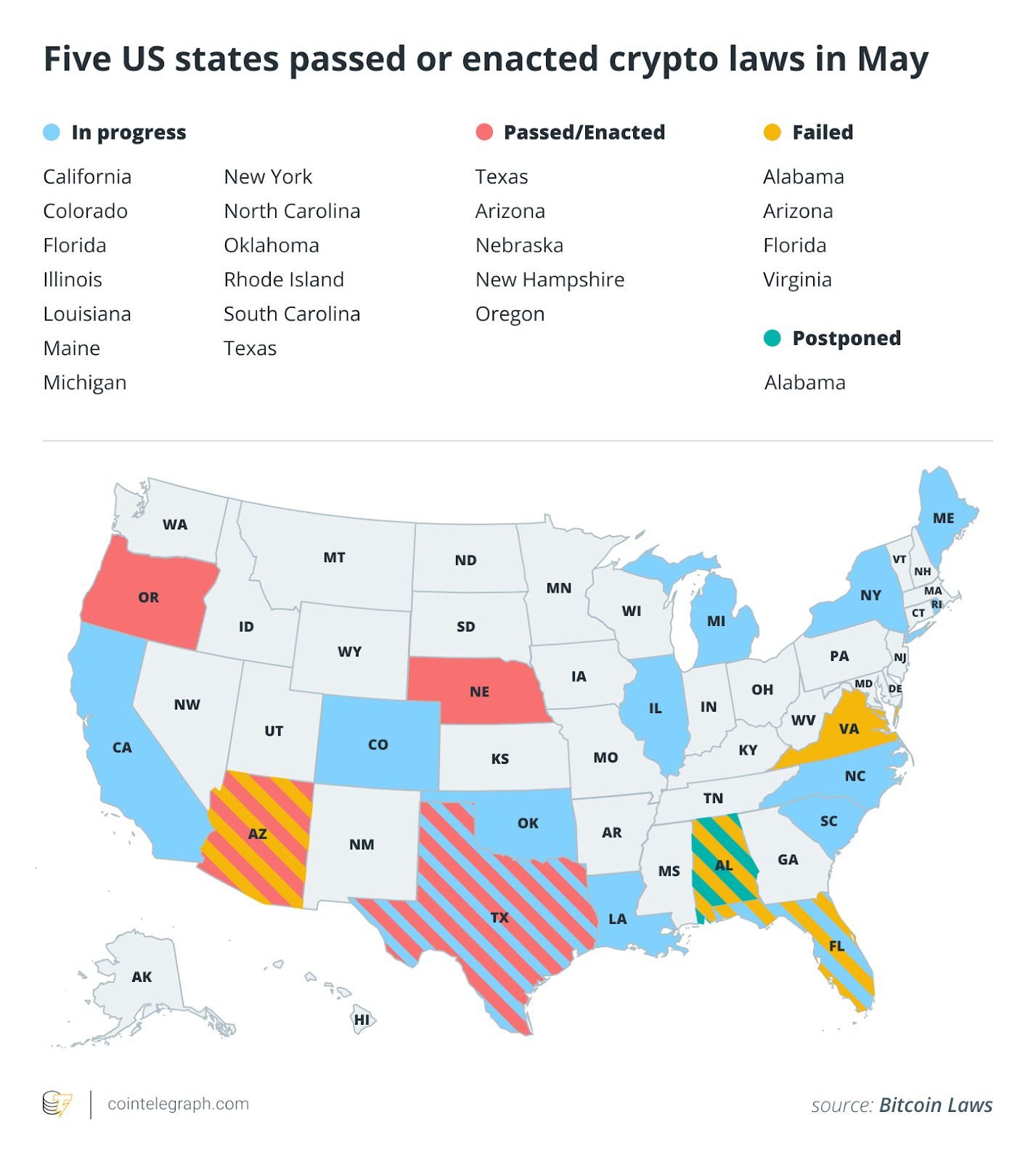

On the regulatory front, five US states enacted new Bitcoin laws, showcasing growing acceptance. Texas established a state Bitcoin reserve. In Alabama, a proposal to exempt crypto from specific taxes was delayed.

OpenAI is expanding its World project in the US, setting up eye-scanning Orb stations across several cities. This follows legal challenges against World in multiple countries.

Here’s a breakdown of May’s key events:

Five states enact crypto-related laws in May, Texas passes Bitcoin reserve bill

Cryptocurrency legislation advanced on numerous fronts in the US, with five states passing or enacting cryptocurrency-related bills.

In Texas, a bill was passed to establish a state Bitcoin (BTC) reserve. New Hampshire took a similar step, enabling the state treasurer to invest public funds in precious metals and digital assets like Bitcoin through the passage of HB302.

In Arizona, the Bitcoin and Digital Assets Reserve Fund will hold unclaimed digital assets. The state can now claim ownership of abandoned digital assets if the owner doesn’t respond to contact attempts for three years. The state can also stake these assets to earn rewards.

In Nebraska, public power utilities now have regulatory authority over Bitcoin miners. LB526 allows them to require Bitcoin miners using 1 megawatt or more to cover infrastructure upgrade costs. It also introduces a permit system and reporting requirements for power consumption.

Oregon has incorporated crypto into its Uniform Commercial Code.

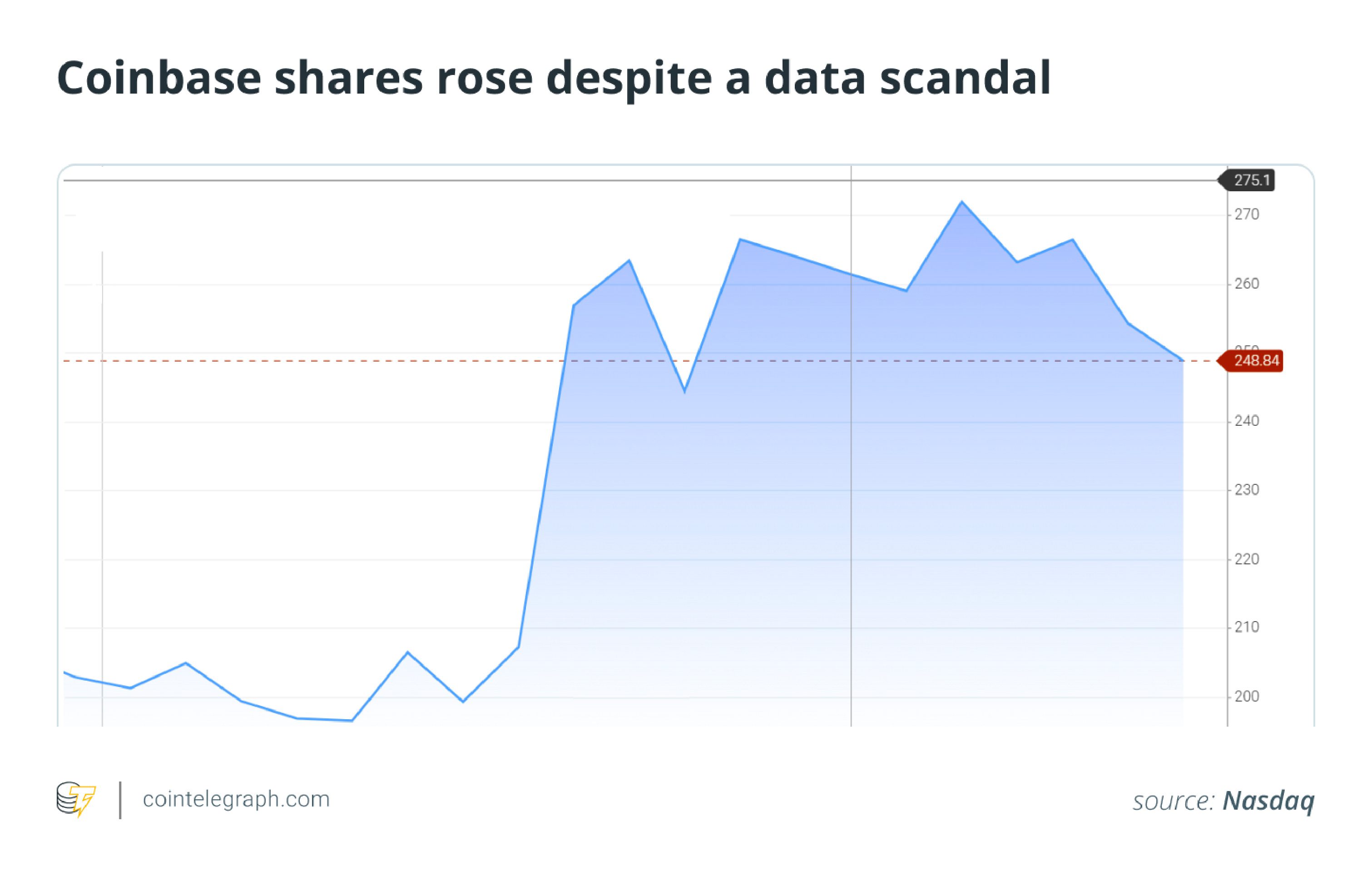

Coinbase stock up 19.37% in May, joins S&P 500

The stock price of crypto exchange Coinbase increased by 19.37% over the month, despite a security incident disclosed on May 15.

Despite the scale of the attack, the stock price closed May 29 at $248.84.

Furthermore, the crypto company became the first to be included in the S&P 500 Index, hailed by the crypto industry as a significant milestone for crypto adoption and growth.

However, concerns about security and market volatility have led some to question the exchange’s inclusion in the index.

Major indexes bounce back after trade deal

On May 12, the trade deal was announced, leading to gains of 4.5% and 3% in the S&P 500 and the Nasdaq, respectively. Bitcoin also saw a 2% increase.

According to analysis, Bitcoin failed to exceed expectations in the following days, as macroeconomic conditions favored stocks over investments like Bitcoin or gold.

Before trading opened on May 30, the Nasdaq-100 index was up 9.16% for the month, while the S&P 500 climbed 6.16%.

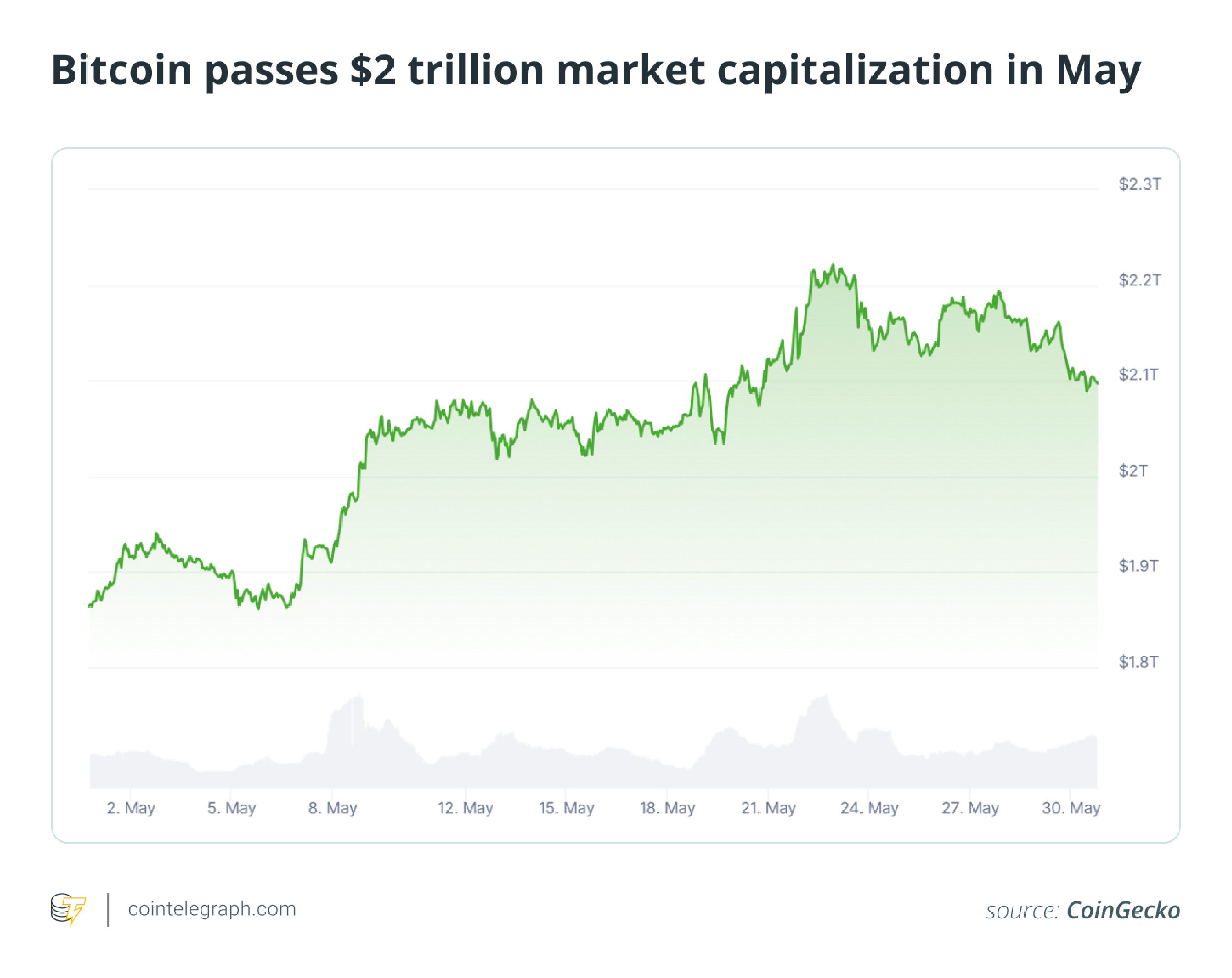

Bitcoin “Pizza Day” sees market cap top Amazon at $2.2 trillion, BTC ATH

On May 22, “Bitcoin Pizza Day,” Bitcoin’s market capitalization crossed $2.2 trillion, surpassing Amazon’s.

Pizza Day, which commemorates the 10,000 BTC pizza purchase in 2010, also saw Bitcoin price hit a new all-time high at over $109,000. Bitcoin broke the record a few days later, reaching $111,970.

By the end of the month, Bitcoin’s rally cooled as demand slowed, with spot Bitcoin exchange-traded funds recording net outflows on May 29.

OpenAI moves world project to US after enforcement actions in 12 countries

OpenAI is setting up its digital identity project, World, in the United States.

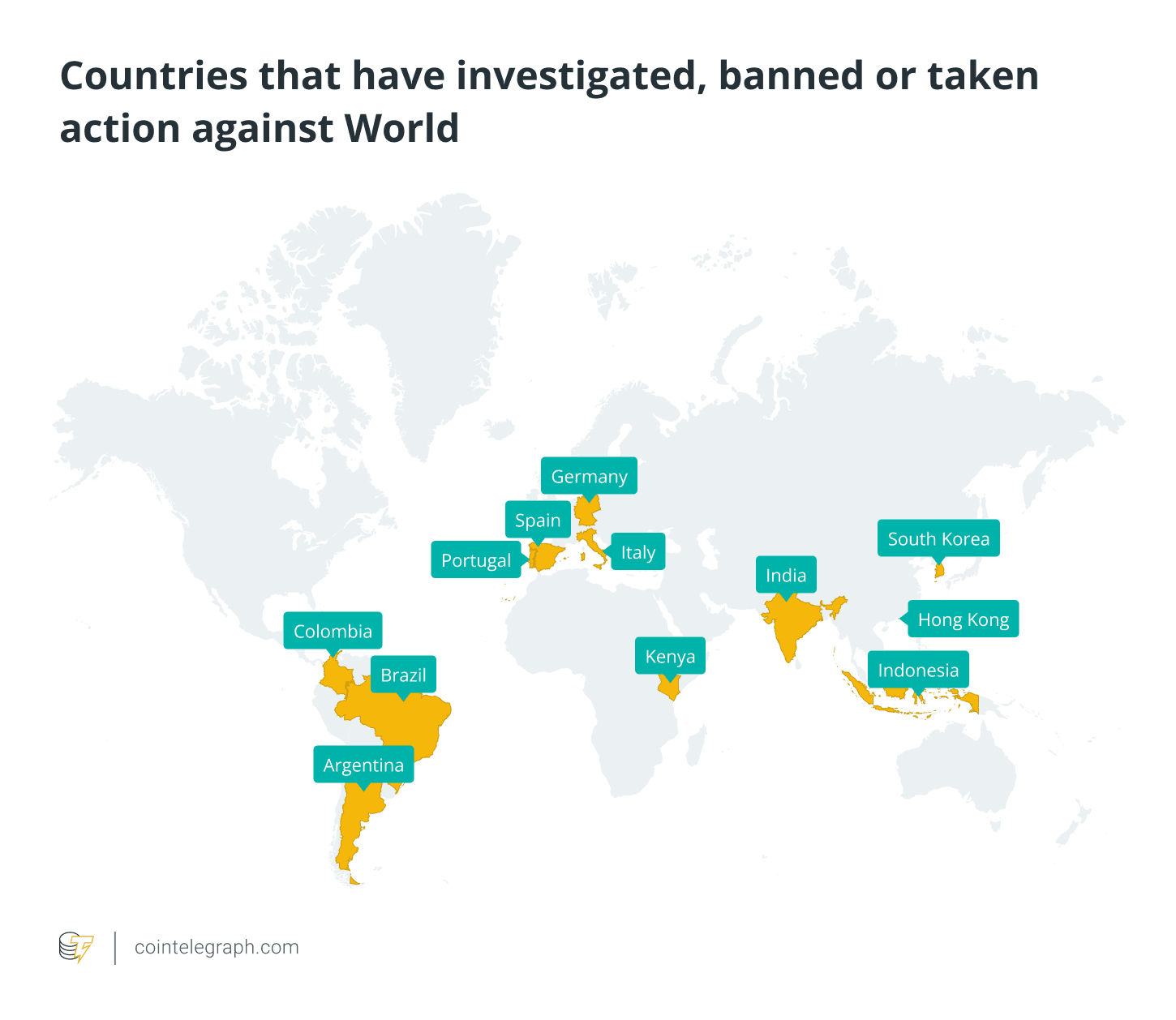

Regulators in multiple countries have taken legal action against World, citing concerns about data privacy, protection, and potential economic manipulation. The project is banned outright in Hong Kong.

World has addressed privacy concerns by stating that it holds no identifying information linked to eye scans. It maintains that users own and control their World ID.