Key Takeaways:

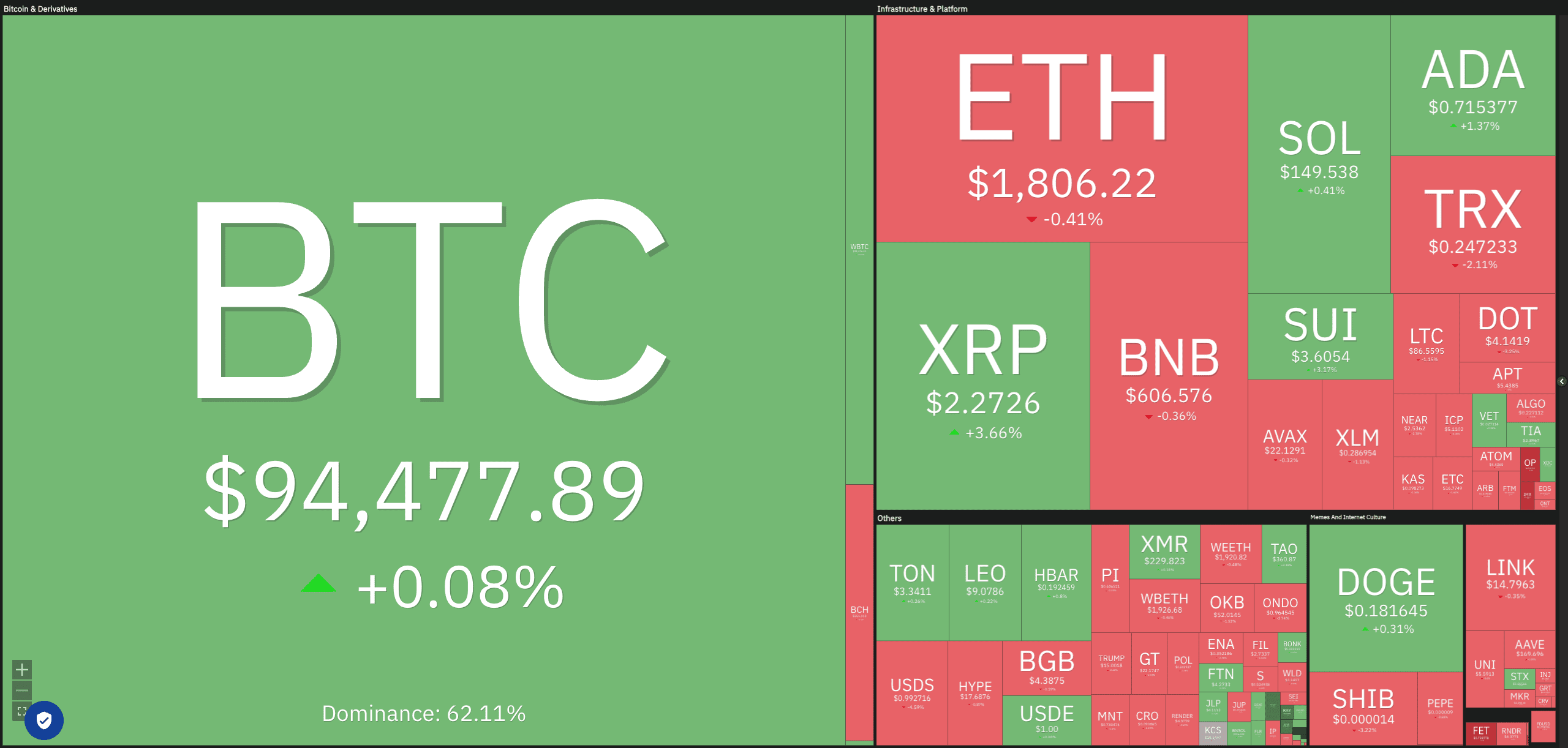

- Bitcoin (BTC) shows bullish momentum, aiming for $100,000 after a 10% weekly gain.

- Strong inflows into US spot Bitcoin ETFs support the upward trend.

- Altcoins like SUI, AVAX, TRUMP, and TAO display potential breakout opportunities.

- Technical analysis suggests key support and resistance levels for each cryptocurrency.

Bitcoin’s recent surge has reignited optimism in the cryptocurrency market, with analysts predicting further gains. This analysis delves into the factors driving Bitcoin’s price and examines the potential for select altcoins to follow suit.

Bitcoin (BTC) Price Analysis

Bitcoin experienced a significant rally, gaining over 10% in the past week. This surge is primarily attributed to substantial inflows into US spot Bitcoin ETFs, indicating strong institutional demand. Bloomberg ETF analyst Eric Balchunas noted the rapid shift from minimal to significant inflows, highlighting the increased investor confidence in Bitcoin.

Sina, co-founder of 21st Capital, suggests Bitcoin has reclaimed its power-law price, projecting a range of $130,000 to $163,000 by the end of 2025. Other analysts have even more bullish targets for 2024.

Key Bitcoin Price Levels:

- Resistance: $95,000 (immediate), $100,000, $107,000 – $109,588 (strong resistance zone)

- Support: $88,619 (20-day EMA), $73,777

Short-Term Outlook: A close above $95,000 could trigger a rally towards $100,000. However, failure to hold above the 20-day EMA could lead to a pullback towards the $73,777 level.

Altcoin Predictions: SUI, AVAX, TRUMP, and TAO

Beyond Bitcoin, several altcoins are exhibiting potential for significant price movements. The following analysis provides insights into the technical outlook for SUI, AVAX, TRUMP, and TAO.

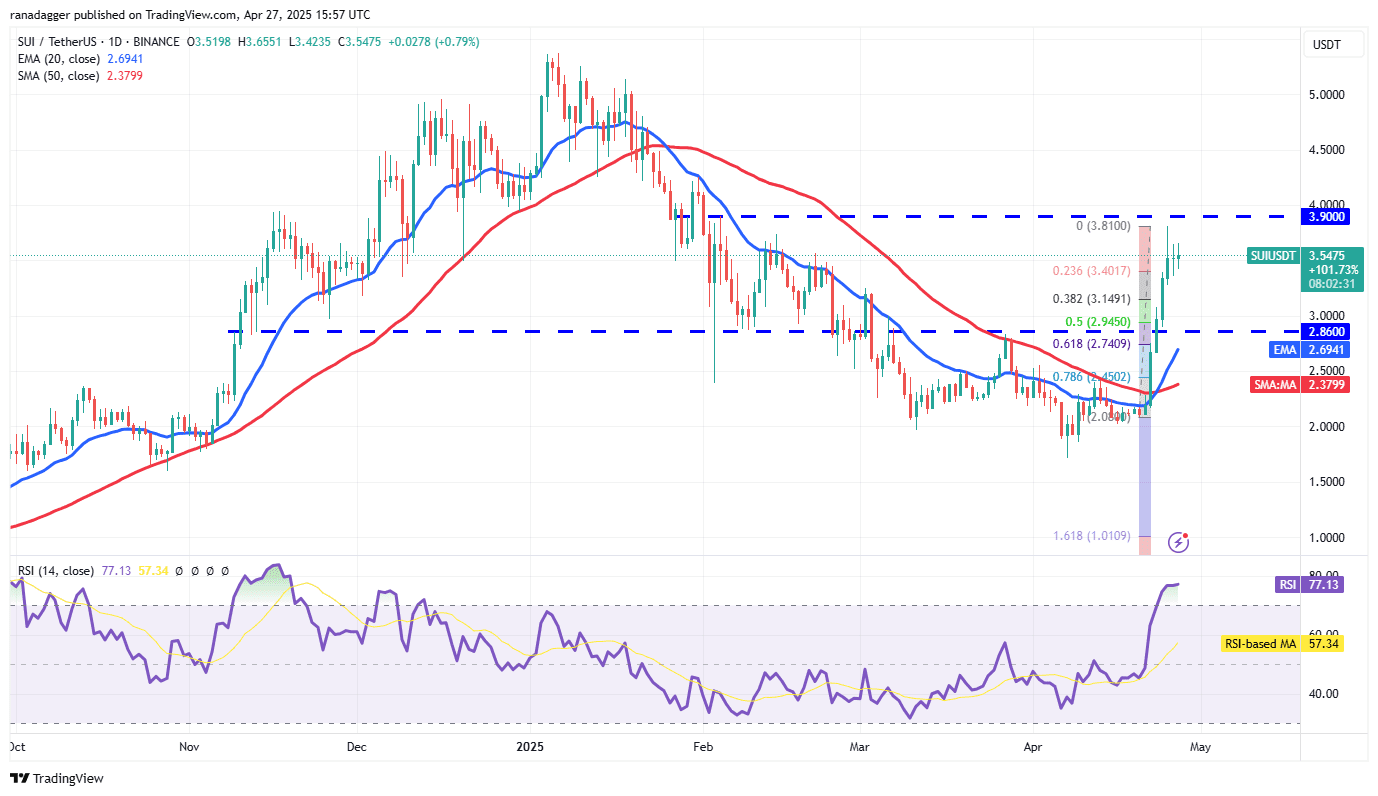

Sui (SUI) Price Analysis

Sui faces resistance near $3.90, but its shallow pullbacks suggest strong buying interest. A break above $3.90 could propel it towards $4.25 and potentially $5.

Key SUI Price Levels:

- Resistance: $3.90, $4.25, $5

- Support: $3.14 (38.2% Fibonacci retracement), $2.94 (50% Fibonacci retracement), $2.69 (20-day EMA)

Short-Term Outlook: Holding above $3.14 is crucial for a potential breakout. A break below this level could trigger a deeper correction.

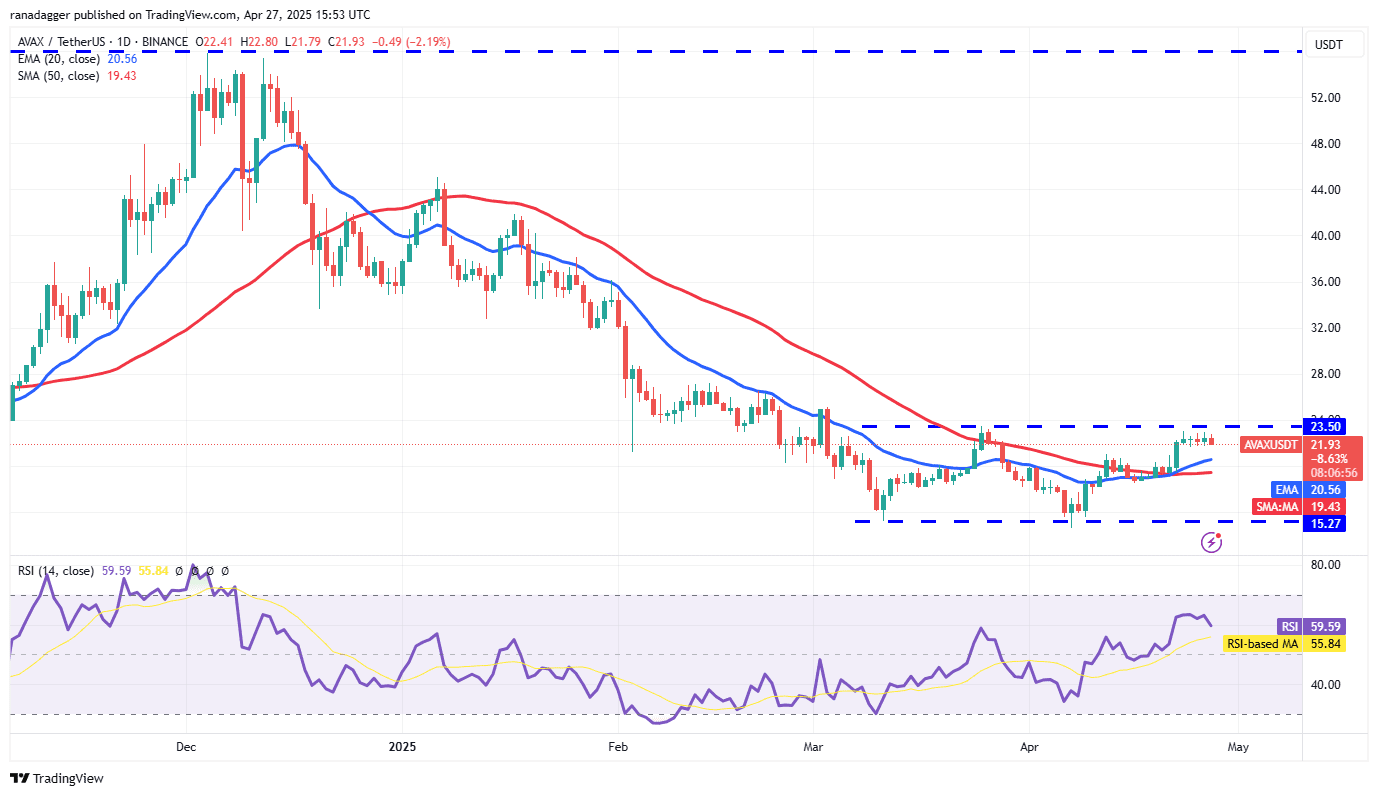

Avalanche (AVAX) Price Analysis

Avalanche has been trading within a range of $15.27 to $23.50. A break above $23.50 could trigger a double-bottom pattern with a target objective of $31.73.

Key AVAX Price Levels:

- Resistance: $23.50, $31.73 (double-bottom target)

- Support: $15.27, Moving Averages

Short-Term Outlook: A break above $23.50 signals potential upside. Failure to hold above moving averages could lead to further consolidation within the range.

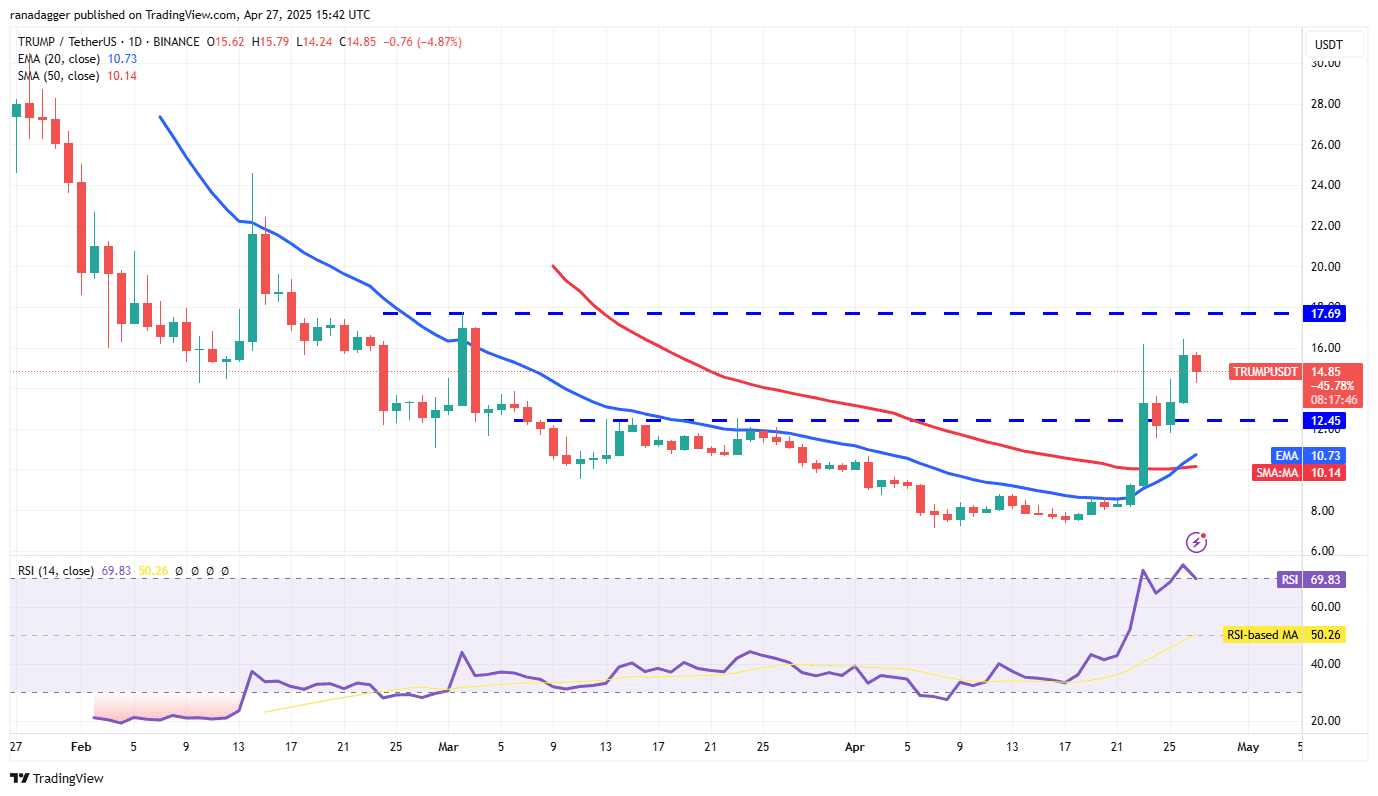

Official Trump (TRUMP) Price Analysis

TRUMP broke above $12.45 and held the retest, indicating bullish momentum. A rally above $16 could lead to targets of $17.69, $19.60, and $22.40.

Key TRUMP Price Levels:

- Resistance: $16, $17.69, $19.60, $22.40

- Support: $11.56 – $12.45 (support zone), $10.73 (20-day EMA)

Short-Term Outlook: Holding above $12.45 supports the bullish outlook. A break below $10.73 could signal a trend reversal.

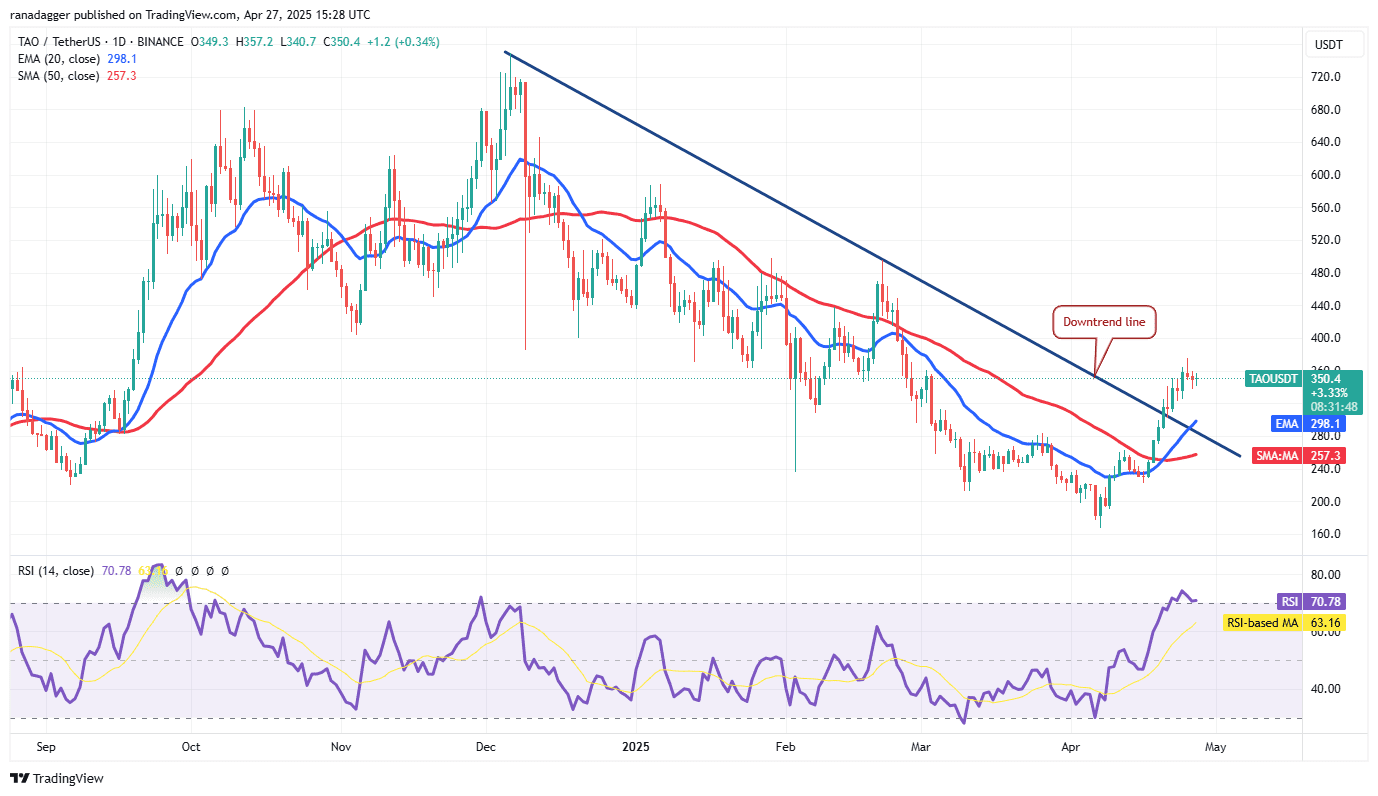

Bittensor (TAO) Price Analysis

TAO broke above the downtrend line, indicating a potential shift in momentum. A solid bounce off the 20-day EMA could lead to a rally towards $375 and potentially $495.

Key TAO Price Levels:

- Resistance: $375, $495

- Support: $298 (20-day EMA), Downtrend Line, $222

Short-Term Outlook: A bounce off the 20-day EMA is crucial for continued upside. A break below the downtrend line could lead to further downside.

Conclusion

Bitcoin’s bullish momentum, fueled by strong ETF inflows, suggests a potential retest of the $100,000 level. Altcoins like SUI, AVAX, TRUMP, and TAO are showing promising signs, but careful monitoring of key support and resistance levels is essential for informed trading decisions. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions in the volatile cryptocurrency market. Remember that cryptocurrency investments are inherently risky.