SEC Crypto Staking Shift Draws Fire: What Does It Mean for Investors?

The US Securities and Exchange Commission (SEC) is facing mounting criticism from current and former officials over its evolving stance on crypto staking services.

On May 29, the SEC’s Division of Corporation Finance issued new guidance on crypto staking services, claiming that certain offerings may not constitute securities and effectively exempting proof-of-stake blockchains from registration requirements under the Securities Act.

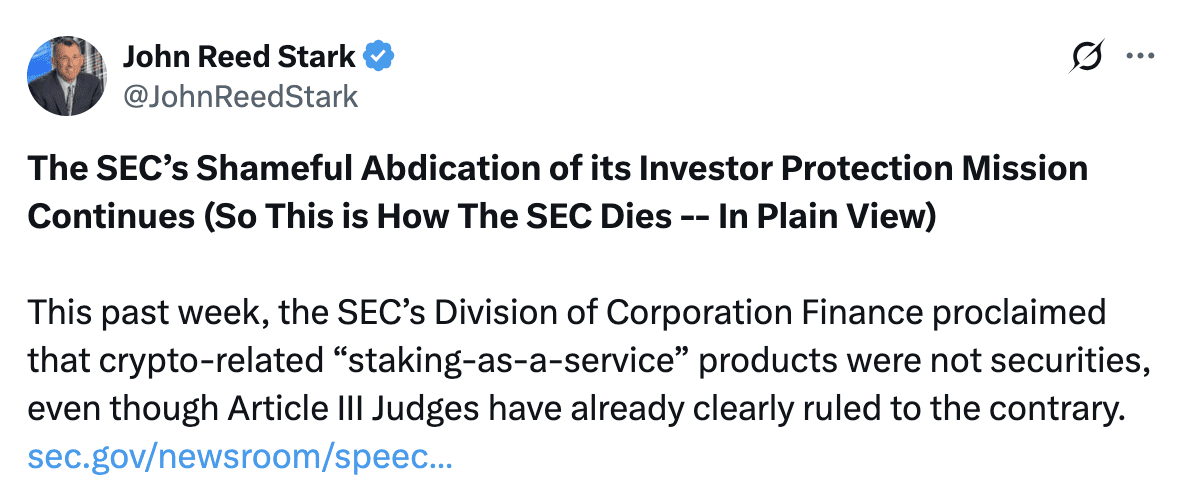

However, the SEC’s fresh interpretation may diverge from several federal court rulings, according to former SEC chief of Internet Enforcement, John Reed Stark.

In a statement on X, Stark argued the Commission’s latest move contradicts judicial findings in high-profile cases against crypto exchanges Binance and Coinbase, where judges previously allowed allegations that staking products qualified as securities under long-standing legal precedent.

“This is how the SEC dies – in plain view,” Stark wrote in a lengthy response to the agency, calling the shift “a shameful abdication of its investor protection mission.”

As for Binance, while the SEC alleged that the exchange’s staking services constituted unregistered securities offerings, the case was ultimately dismissed with prejudice in May 2025, preventing the agency from filing similar claims.

Similarly, in March 2024, a federal judge allowed the agency’s case against Coinbase to proceed, indicating that the SEC had “sufficiently pled” that the staking program involved the unregistered offer and sale of securities. The case was also dismissed in February 2025 as part of a broader shift in the SEC’s approach to crypto regulation.

Sitting Commissioner Caroline Crenshaw also issued a statement on May 29 in response to the agency’s approach to crypto staking, warning that the staff’s conclusions did not align with established case law or the Howey test.

“The staff’s analysis may reflect what some wish the law to be, but it does not square with the court decisions on staking and the longstanding Howey precedent on which they are based,” Crenshaw wrote, adding that:

“This is yet another example of the SEC’s ongoing ‘fake it till we make it’ approach to crypto — taking action based on anticipation of future changes while ignoring existing law.”

The commission has recently undertaken a series of deregulatory steps over digital assets, including closing investigations, dropping lawsuits and launching roundtables to discuss regulation with industry participants.

“This crypto-deregulatory blitzkrieg,” Stark wrote, “has destroyed a once-proud 90-year legacy.”

While the SEC has framed its recent actions as part of an effort to provide regulatory clarity, critics contend that the result has been further confusion.

In a June 2 statement, Crenshaw questioned the consistency of the commission’s approach, pointing to instances where the agency appeared to treat certain digital assets, such as Ether (ETH) and Solana (SOL) tokens, as securities.

“How is it that these crypto assets are supposedly not securities when it comes to registration requirements, but conveniently are securities when a registrant sees an opportunity to sell a new product?” Crenshaw said.

Speaking at the Bitcoin 2025 conference in Las Vegas, Nevada, Commissioner Hester Peirce pushed back against criticism of the agency’s new take on crypto, noting that the classification of a securities transaction depends more on the nature of the deal than the asset itself:

“Most crypto assets, as we see them today, are probably not themselves securities. That doesn’t mean that you can’t sell a token that is not itself a security in a transaction that is a securities transaction. That is where we really need to provide some guidance.”

Quick Summary of the News

- The SEC issued new guidance suggesting some crypto staking services may not be securities.

- Former SEC officials and current commissioners criticize the guidance as inconsistent with court rulings.

- Critics argue the SEC’s approach creates confusion rather than clarity.

- Commissioner Peirce defends the SEC, stating the classification depends on the deal’s nature, not just the asset.

- SEC’s recent actions are seen by some as a move towards crypto deregulation.

Why It Matters

The SEC’s evolving stance on crypto staking has significant implications for the market. If staking services are not classified as securities, they could avoid registration requirements, potentially lowering barriers to entry and fostering innovation. However, the lack of clarity and the perceived inconsistencies in the SEC’s approach could lead to increased regulatory uncertainty, making it difficult for businesses to operate and potentially scaring off investors. The legal battles surrounding Binance and Coinbase highlight the complexities and potential consequences of these classifications. This ultimately impacts the overall sentiment and adoption of cryptocurrencies.

Market Impact

The following table is for illustrative purposes only and doesn’t represent real-time market data, and also the table data is just simple placeholder information:

| Event | Potential Impact | Example |

|---|---|---|

| SEC classifies staking as not a security | Positive for staking platforms; Increased investment | ETH staking rewards increase by 5% |

| SEC changes stance again | Market uncertainty; potential price drops | Bitcoin (BTC) drops 3% |

Expert Take or Personal Insight

The SEC’s handling of crypto regulation, particularly regarding staking, appears to be a balancing act between fostering innovation and protecting investors. While some argue for deregulation to allow the industry to flourish, others emphasize the need for clear rules to prevent fraud and protect consumers. The conflicting statements from current and former officials indicate a lack of consensus within the agency itself. My personal take is that a middle ground is needed. Clear guidelines based on existing legal frameworks, adapted for the unique characteristics of crypto, are essential. A piecemeal approach creates more confusion and ultimately harms the industry’s long-term prospects.

Actionable Insight

Traders and investors should closely monitor the SEC’s actions and statements regarding crypto staking. Keep an eye on any potential legal challenges or further guidance issued by the agency. Diversifying your portfolio and allocating a smaller percentage to staking-related assets may be prudent until more clarity emerges. Consider the regulatory landscape when evaluating staking platforms and choose those that prioritize compliance. Also, follow legal experts and commentators who are closely watching these developments.

Conclusion

The future of crypto staking in the US hinges on the SEC’s approach to regulation. While the agency’s recent moves suggest a potential shift towards deregulation, the conflicting opinions and legal challenges indicate that the path forward is far from clear. Investors and businesses in the crypto space must remain vigilant and adapt to the evolving regulatory landscape.