Bitcoin Reaches New All-Time High as Crypto Regulations Advance in the US: May 2025 in Review

May 2025 was a landmark month for the cryptocurrency market, highlighted by Bitcoin (BTC) reaching a new all-time high and notable regulatory advancements in the United States. Coinbase also made headlines by joining the S&P 500.

Here’s a closer look at the key events and their potential impact:

Quick Summary of the News:

- Bitcoin All-Time High: BTC reached a new peak above $111,000.

- US Crypto Regulations: Five US states enacted new laws related to cryptocurrencies.

- Coinbase Joins S&P 500: Coinbase became the first crypto company included in the S&P 500 index.

- US-China Trade Deal: A temporary trade deal between the US and China provided a brief boost to the market.

- World Expansion: World, a digital identity project, announced its expansion into the US amid regulatory scrutiny elsewhere.

Why It Matters:

The surge in Bitcoin’s price to a new all-time high signals growing mainstream adoption and investor confidence in the cryptocurrency. The regulatory developments in the US indicate increasing acceptance and efforts to integrate crypto into the existing financial framework. Coinbase joining the S&P 500 further legitimizes the crypto industry and opens it up to a wider range of institutional investors. However, regulatory scrutiny on projects like World highlights ongoing concerns about data privacy and the need for responsible innovation.

Market Impact:

The events of May 2025 have had a multifaceted impact on the crypto market:

| Event | Impact |

|---|---|

| Bitcoin All-Time High | Increased market capitalization, positive sentiment, and greater media attention. |

| US Regulatory Developments | Clarity for crypto businesses operating in the US, attracting further investment. |

| Coinbase in S&P 500 | Enhanced credibility for Coinbase, access to a broader investor base, and potential for increased trading volume. |

Expert Take or Personal Insight:

The convergence of bullish price action, regulatory progress, and mainstream acceptance paints a promising picture for the future of cryptocurrency. However, it’s crucial to approach the market with caution, as volatility remains a significant factor. The regulatory landscape is still evolving, and projects must prioritize compliance and user privacy to ensure long-term sustainability. While Bitcoin’s price surge is encouraging, a healthy and sustainable market requires a diverse ecosystem of innovative projects and responsible market participants.

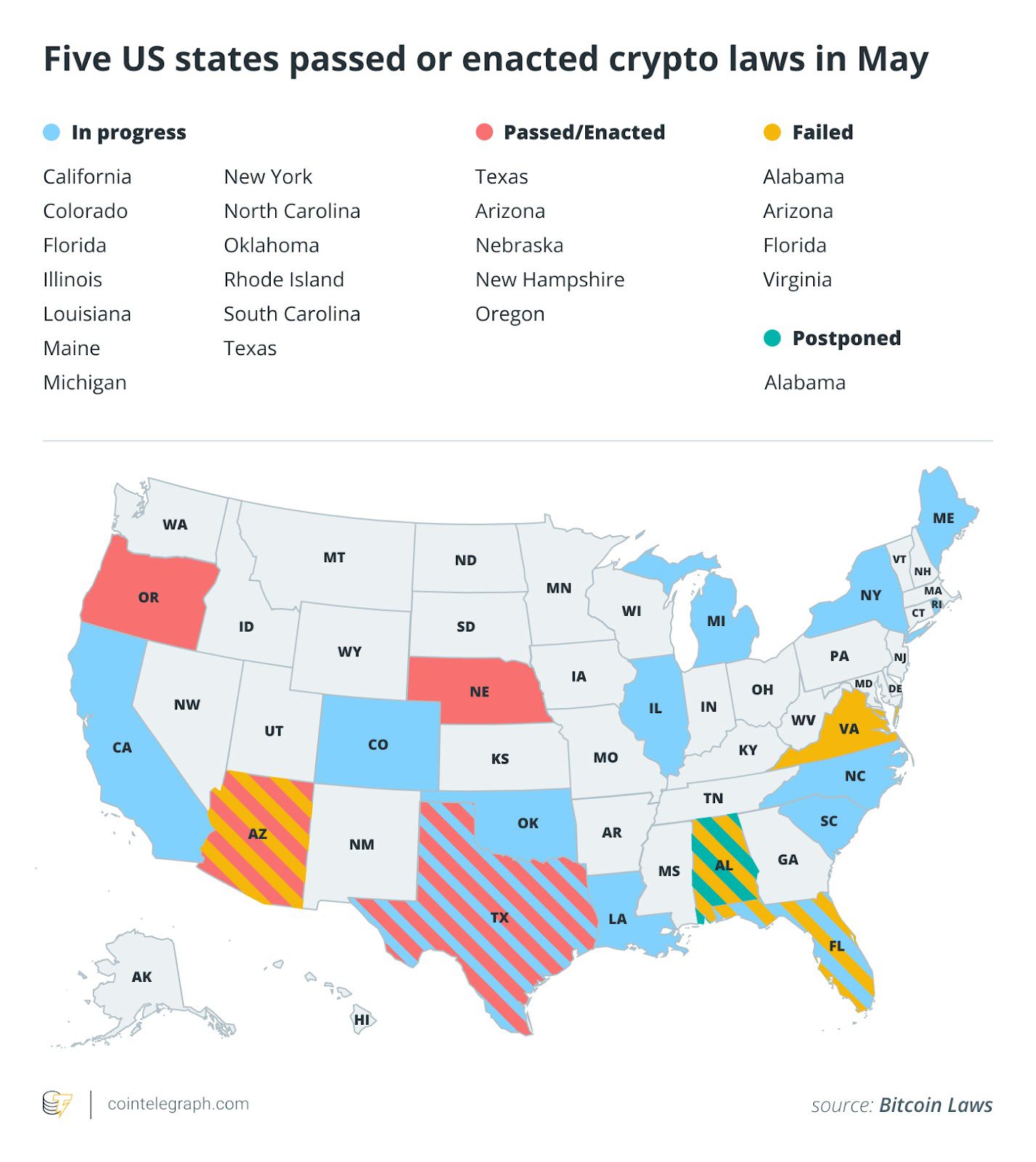

Five states enact crypto-related laws in May, Texas passes Bitcoin reserve bill

In the US, cryptocurrency legislation is moving ahead on multiple fronts, with five states passing or enacting cryptocurrency-related bills.

In Texas, the state passed a bill that establishes a state Bitcoin (BTC) reserve. New Hampshire made a similar move, enabling the state treasurer to invest in public funds containing precious metals and digital assets like Bitcoin with the passage of HB302.

In Arizona, the newly formed Bitcoin and Digital Assets Reserve Fund will hold unclaimed digital assets. The state of Arizona can now claim ownership of abandoned digital assets if the owner fails to respond to contact attempts for three years. The state can also stake the assets in the fund to earn airdrops and rewards.

In Nebraska, public power utilities now have some authority over Bitcoin miners. LB526, which passed in final reading on May 14, allows them to require Bitcoin miners using 1 megawatt or more to cover the cost of infrastructure upgrades. It also introduces a permit regime and reporting requirements for power consumption.

Oregon has included crypto in its Uniform Commercial Code.

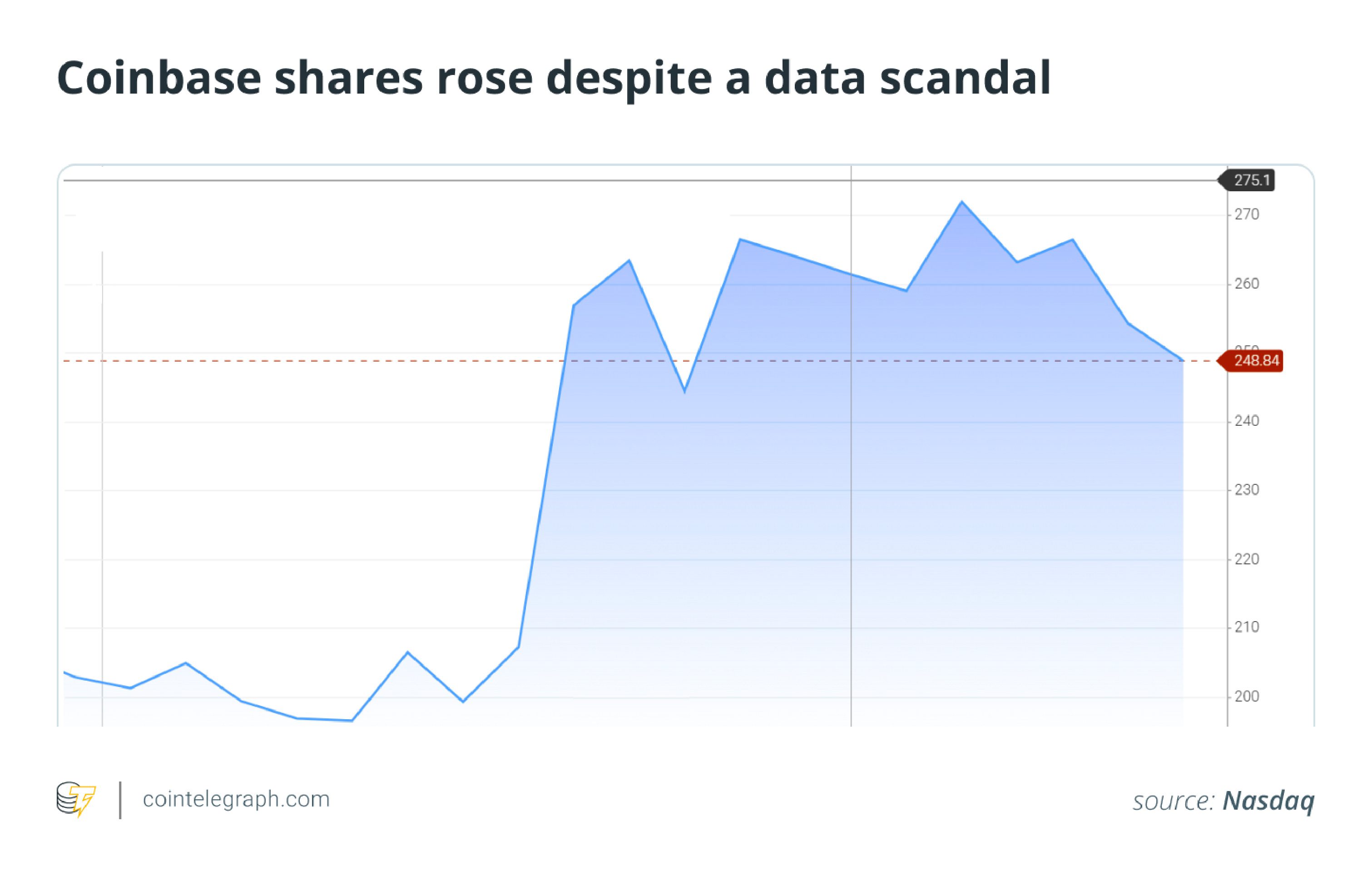

Coinbase stock up 19.37% in May, joins S&P 500

The stock price of crypto exchange Coinbase is up 19.37% over the month, despite disclosing a $400 million security incident on May 15.

Despite the eye-watering sum of the attack, which has reportedly triggered an investigation by the US Department of Justice, the stock price closed May 29 at $248.84.

Furthermore, the crypto company became the first to be included in the benchmark S&P 500 Index, which the crypto industry hailed as a new high for crypto adoption and industry growth.

Not everyone is pleased. Concerns about security and the overall volatility of the stock market have left some observers doubting the exchange’s inclusion in the renowned index. “All I can tell you is this is not good,” said business and economics commentator Ed Elson.

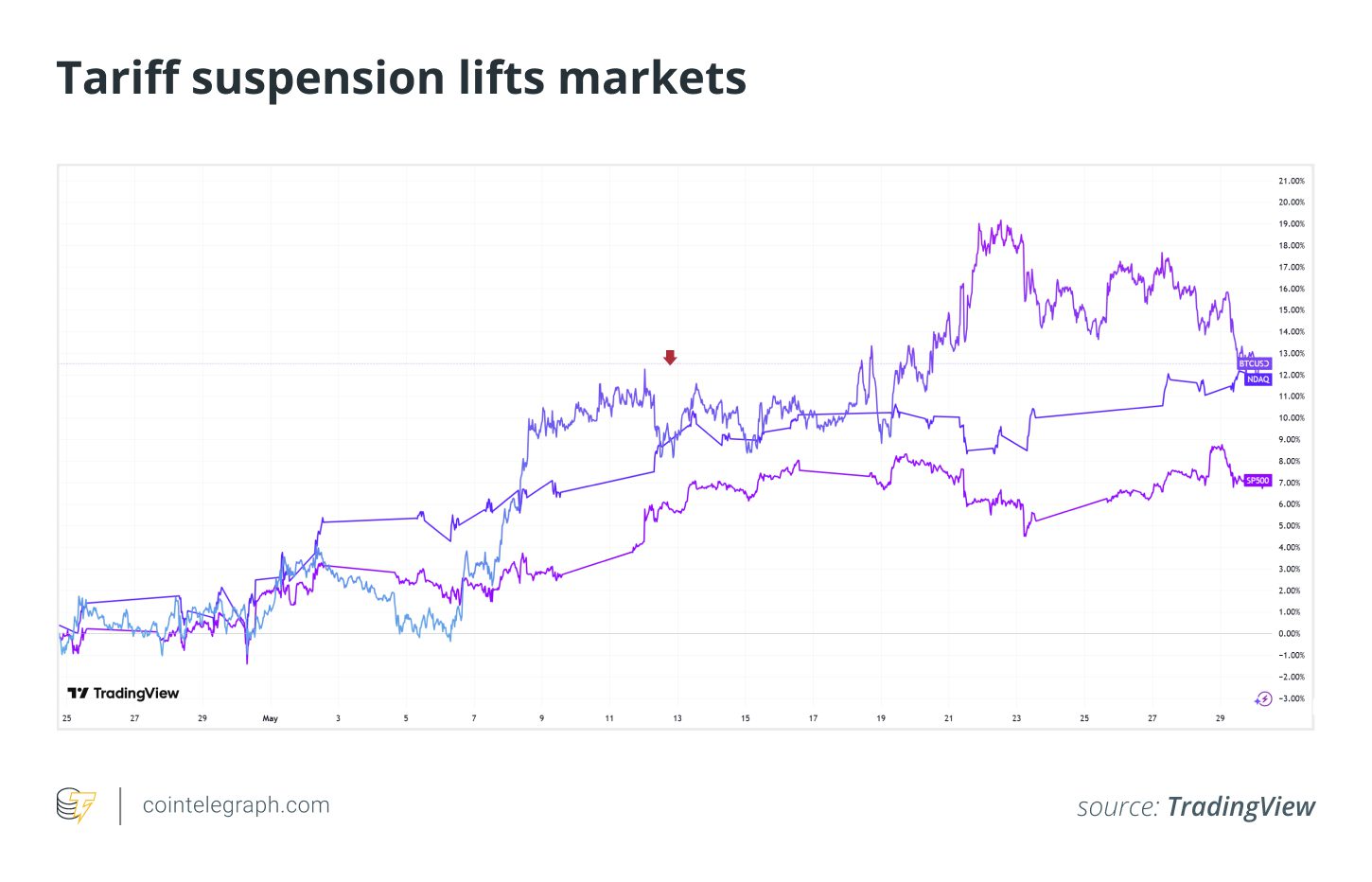

Major indexes bounce back after 90-day US-China tariff deal

On May 12, the Trump administration announced that it had reached a deal with China to suspend tariffs for 90 days, with the S&P 500 and the Nasdaq seeing nominal gains of 4.5% and 3%, respectively, a day after the news. Bitcoin was also up 2%.

According to a market analysis by Cointelegraph, Bitcoin failed to smash expectations in the days that followed, as macroeconomic conditions favored stocks over investments like Bitcoin or gold, the latter of which fell 3.4% on May 12.

Before trading opened on May 30, the Nasdaq-100 index was up 9.16% for the month, while the S&P 500 climbed 6.16%.

Bitcoin “Pizza Day” sees market cap top Amazon at $2.2 trillion, BTC ATH

On May 22, “Bitcoin Pizza Day,” the market capitalization of Bitcoin crossed $2.2 trillion, overtaking the market cap of e-commerce giant Amazon.

Pizza day, which marks Bitcoin OG Laszlo Hanyecz’s 10,000 BTC pizza purchase in 2010 (worth $41 at the time), also saw Bitcoin price hit a new all-time high at just over $109,000. Bitcoin broke the record a few days later by reaching $111,970.

By the end of the month, Bitcoin’s rally cooled as demand for the asset slowed, with spot Bitcoin exchange-traded funds snapping a 10-day inflow streak and recording $347 million in net outflows on May 29.

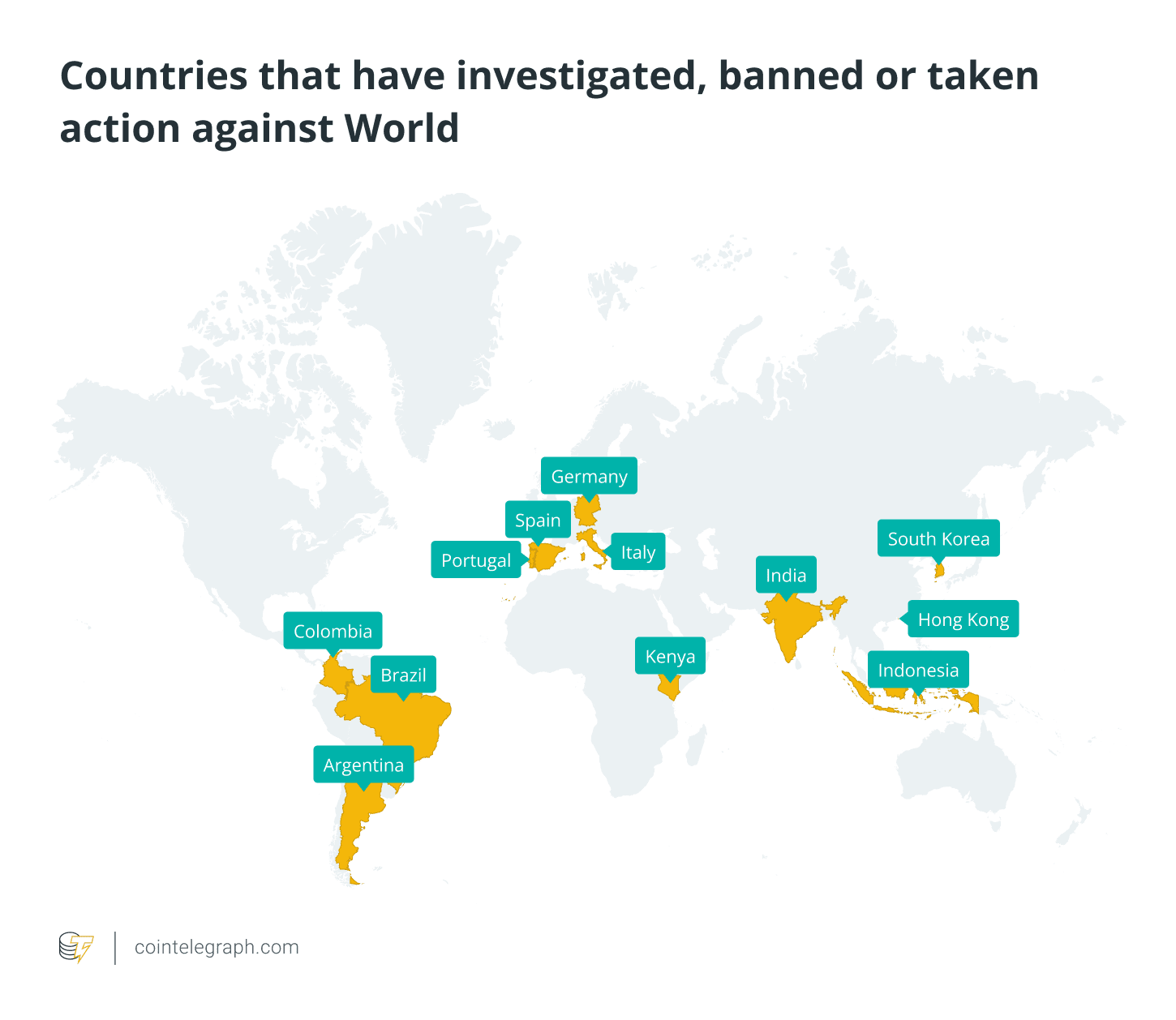

World moves to US after enforcement actions in 12 countries

On April 30, OpenAI CEO Sam Altman announced that digital identity project, World, would be setting up in the United States.

Regulators in 12 different countries have taken some form of legal action against World, with stated reasons ranging from data privacy and protection (Kenya) to concerns over possible economic manipulation through its token (Brazil). In Hong Kong, the project is banned outright.

World has addressed privacy concerns by stating that it holds no identifying information attached to the unique eye scan recorded on its Orb devices. It also states that it does not control or own that information, but that users own and control that information in the form of their World ID.

Actionable Insight:

Traders and investors should closely monitor regulatory developments in the US and other key jurisdictions. Keep an eye on Bitcoin ETF flows as an indicator of institutional demand. Stay informed about the evolving landscape of digital identity projects and their potential impact on data privacy. Conduct thorough research before investing in any cryptocurrency or related project.

Conclusion:

May 2025 was a pivotal month for the crypto market, marked by significant milestones and emerging trends. While the future remains uncertain, the industry’s continued growth and increasing acceptance suggest a promising outlook. Staying informed and adapting to the evolving landscape will be crucial for navigating the opportunities and challenges ahead.