Monero (XMR) Price Surge Following Suspected $330M Bitcoin Theft: An In-Depth Analysis

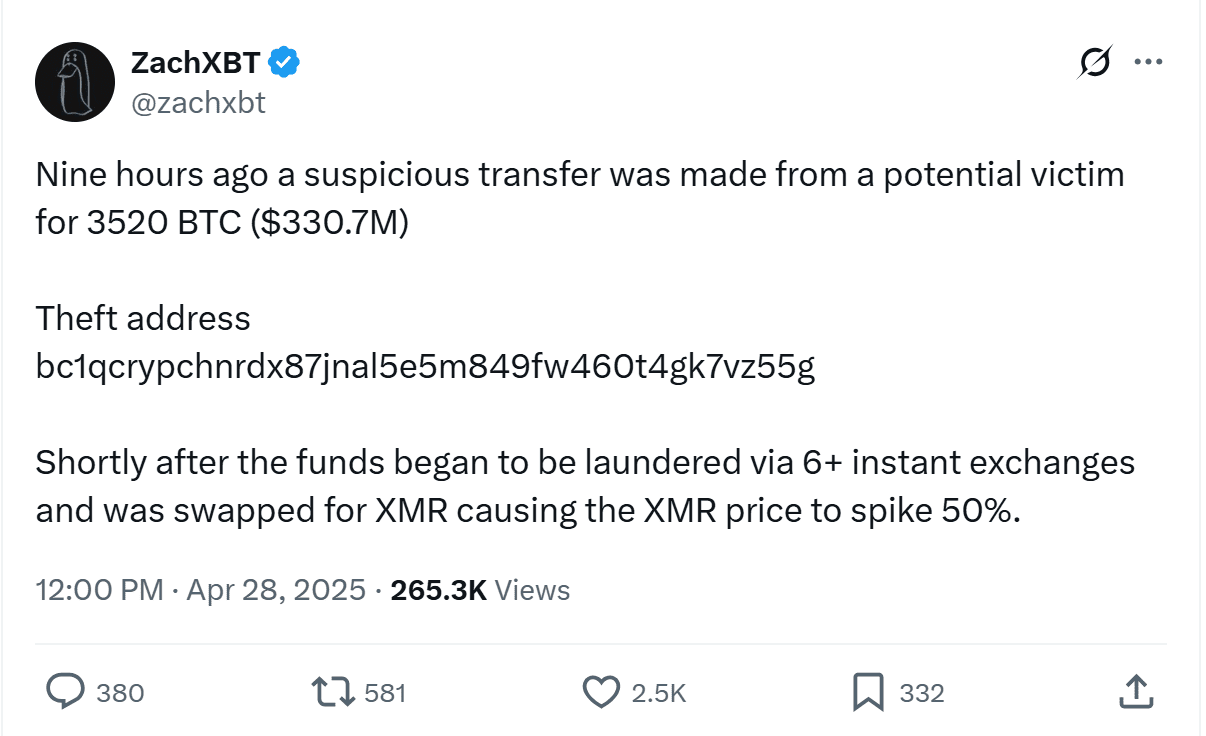

On April 28th, onchain investigator ZachXBT reported a suspicious transaction involving 3,520 Bitcoin (BTC), worth approximately $330.7 million. The funds were transferred from a potential victim’s wallet to the address bc1qcry…vz55g, raising concerns about a major theft.

Following the transfer, the stolen Bitcoin was rapidly laundered through multiple instant exchanges and converted into Monero (XMR), a privacy-focused cryptocurrency.

This large-scale conversion is believed to have contributed to a significant 50% spike in Monero’s price, reaching an intraday high of $339, according to CoinMarketCap data. While the price has slightly corrected, XMR remains up 25% in the past 24 hours, trading at around $289.

The Incident and Its Impact

The suspected theft and subsequent laundering through Monero have reignited discussions about the role of privacy coins in illicit activities. While ZachXBT dismissed the possibility of North Korea’s Lazarus Group being involved, suggesting independent hackers were responsible, the incident highlights the challenges in tracking and recovering stolen funds when privacy-enhancing cryptocurrencies are used.

Several factors contributed to Monero’s popularity for money laundering in this case:

- Privacy Features: Monero’s primary feature is its enhanced privacy. It uses technologies like Ring Signatures, Ring Confidential Transactions (RingCT), and Stealth Addresses to obfuscate transaction details, making it harder to trace the sender, receiver, and amount transacted.

- Decentralization: As a decentralized cryptocurrency, Monero operates without a central authority, making it resistant to censorship and control.

- Instant Exchanges: The use of instant exchanges allowed the perpetrators to quickly convert the stolen Bitcoin into Monero, further complicating the tracking process.

Are Privacy Coins Primarily Used for Illegal Activities?

Chainalysis, a blockchain analysis firm, has noted that while privacy coins raise concerns, the majority of criminal transactions still involve mainstream cryptocurrencies like Bitcoin, Ethereum, and stablecoins.

These mainstream cryptocurrencies remain attractive to bad actors due to their:

- Cross-border Functionality: Enabling seamless transactions across international borders.

- Instant Settlement: Providing rapid transaction confirmations.

- High Liquidity: Ensuring ease of buying and selling.

Chainalysis further argues that privacy coins have limitations for criminals due to:

- Reduced Liquidity: Making it more difficult to convert large amounts of funds.

- Delisting by Major Exchanges: Limiting the availability of privacy coins for trading and conversion.

Even with privacy coins, blockchain transparency can still allow law enforcement to trace and potentially recover illicit funds. For instance, a leaked Chainalysis video in 2024 suggested that Monero transactions could be traceable despite its privacy features.

Monero’s Growing Acceptance

Despite the concerns surrounding its use in illicit activities, Monero is also experiencing growing acceptance in legitimate contexts. Recently, two Spar supermarket locations in Switzerland began accepting XMR for payments, facilitated through partnerships with DFX Swiss and OpenCryptoPay.

This move indicates a growing interest in privacy-focused cryptocurrencies for everyday transactions.

In April 2025, Spar introduced Bitcoin payments via the Lightning Network at its Zug, Switzerland, outlets, demonstrating the company’s openness to cryptocurrency adoption.

Conclusion

The recent Monero price surge following the suspected $330 million Bitcoin theft highlights the complex relationship between privacy coins, illicit activities, and mainstream adoption. While concerns remain about the use of Monero for money laundering, its growing acceptance in legitimate retail environments suggests a potential future for privacy-focused cryptocurrencies in specific use cases. The ongoing debate surrounding privacy, transparency, and regulation in the cryptocurrency space is likely to continue as the technology evolves.