Today in crypto, an announcement of a Trump wallet went awry after the president’s sons denied the family was involved, education company Classover announced a Solana strategic reserve, and a Revolut job listing shows it’s planning to build a crypto derivatives business.

Trump wallet announcement spirals into confusion

A June 3 announcement of a Trump-branded crypto wallet to be launched by a business linked to the Trumps became muddled after US President Donald Trump’s sons distanced the family from it.

Non-fungible token (NFT) marketplace Magic Eden and the firm behind the president’s memecoin that is linked to his sprawling holding company, the Trump Organization, said they were linking up to launch the “Official $TRUMP Wallet by President Trump.”

But the president’s sons, Eric, Barron and Donald Trump Jr., all said they knew “nothing about it” and that the Trump Organization has “zero involvement” with the product. Donald Trump Jr. then added the family’s crypto platform, World Liberty Financial, “will be launching our official wallet soon.”

Crypto skeptic Molly White said the saga was “absolute chaos” and speculated a breakdown in communication between the various Trump-linked businesses.

The Trump Wallet website said the project is a partnership with Magic Eden and GetTrumpMemes.com — the latter is owned by Fight Fight Fight LLC, which is co-owned by a company affiliated with the Trump Organization called CIC Digital LLC. Those two companies together own a majority of the supply of Trump’s memecoin.

Classover signs $500M convertible note deal for Solana reserve

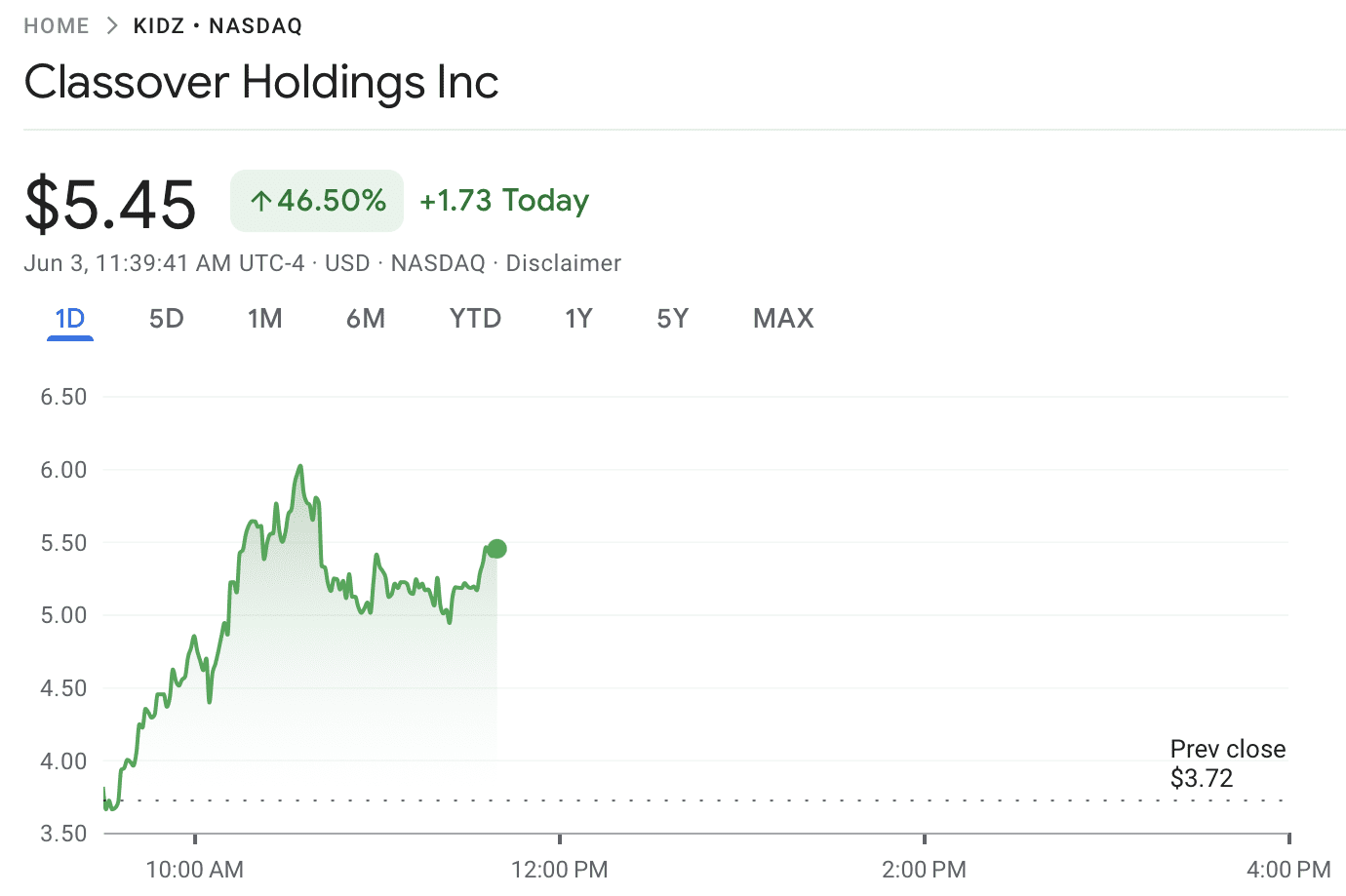

Classover, a K-12 education company, has announced a move into crypto through the creation of a Solana reserve.

The company plans to issue up to $500 million in senior convertible notes, with 80% of the proceeds allocated to purchasing Solana (SOL). The move follows a growing pattern of companies expanding into crypto-related strategies along with their core businesses.

According to a June 2 announcement, Classover has already purchased 6,472 SOL worth approximately $1.1 million to start its reserve. The issuance of $500 million in convertible notes comes through a partnership with Solana Growth Ventures.

Classover is an online education company offering learning courses for K-12 students worldwide. On June 3, a day after the announcement, its shares reached $5.45 on the Nasdaq, an intraday rise of 46.5% at the time of publication.

According to the company, the issuance of up to $500 million in convertible notes could be complementary to Classover’s $400 million equity purchase agreement. Combined, these two financing methods would bring the company’s Solana purchasing power to $900 million.

Revolut eyes crypto derivatives push, job listing suggests

Fintech giant Revolut appears to be gearing up for a move into the crypto derivatives market as a new job posting hints at plans to build the business from scratch.

A recent listing for a “General Manager (Crypto Derivatives)” role shows that Revolut is actively recruiting in London, Barcelona and Dubai. The position would oversee the end-to-end launch of the derivatives platform, from product architecture and trading infrastructure to regulatory compliance and commercial strategy.

According to the listing, the goal is to create “one of the most trusted, scalable, and profitable derivatives offerings in the world,” leveraging Revolut’s 50 million-strong global customer base.

The move comes as Revolut continues to expand its crypto offerings. On May 19, the company announced plans to invest more than 1 billion euros ($1.1 billion) in France and apply for a local banking license.

“We can confirm we’re hiring to expand our expertise in crypto products and services across several markets, particularly for institutional clients but we’re in the early stages of recruitment and don’t have additional details to share at this time,” a Revolut spokesperson told Cointelegraph.

“These job listings reflect our ongoing exploration and consideration of future opportunities, rather than a confirmation of imminent product launches,” they added.