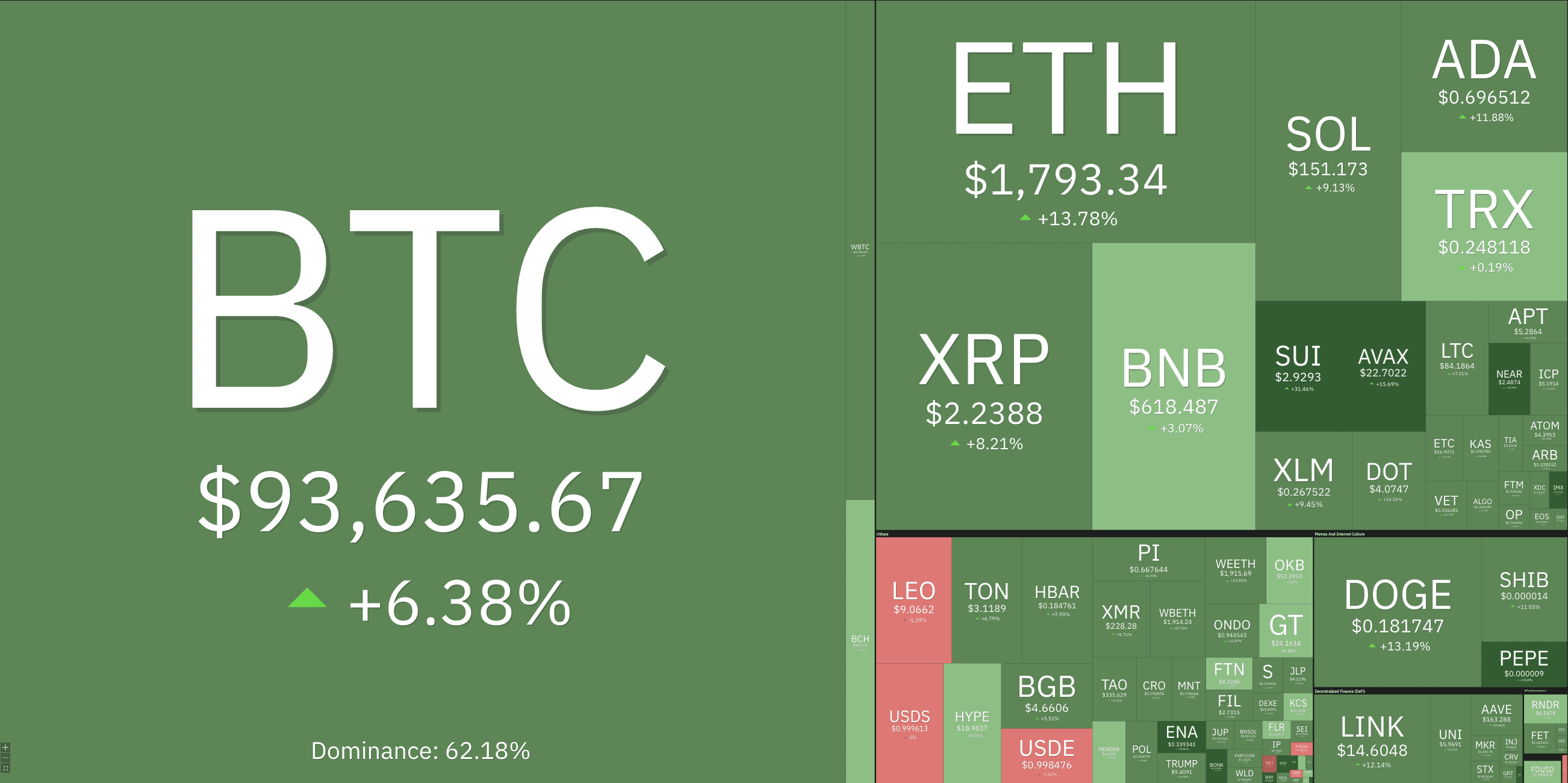

The cryptocurrency market experienced a notable surge today, with the total market capitalization increasing by approximately 6.7% to reach $2.94 trillion on April 23. Bitcoin (BTC) and Ether (ETH) led the gains, rising by roughly 6.4% and 13%, respectively. Several factors contributed to this positive market movement. Let’s break down the primary catalysts:

Key Catalysts Behind the Crypto Market Rally

-

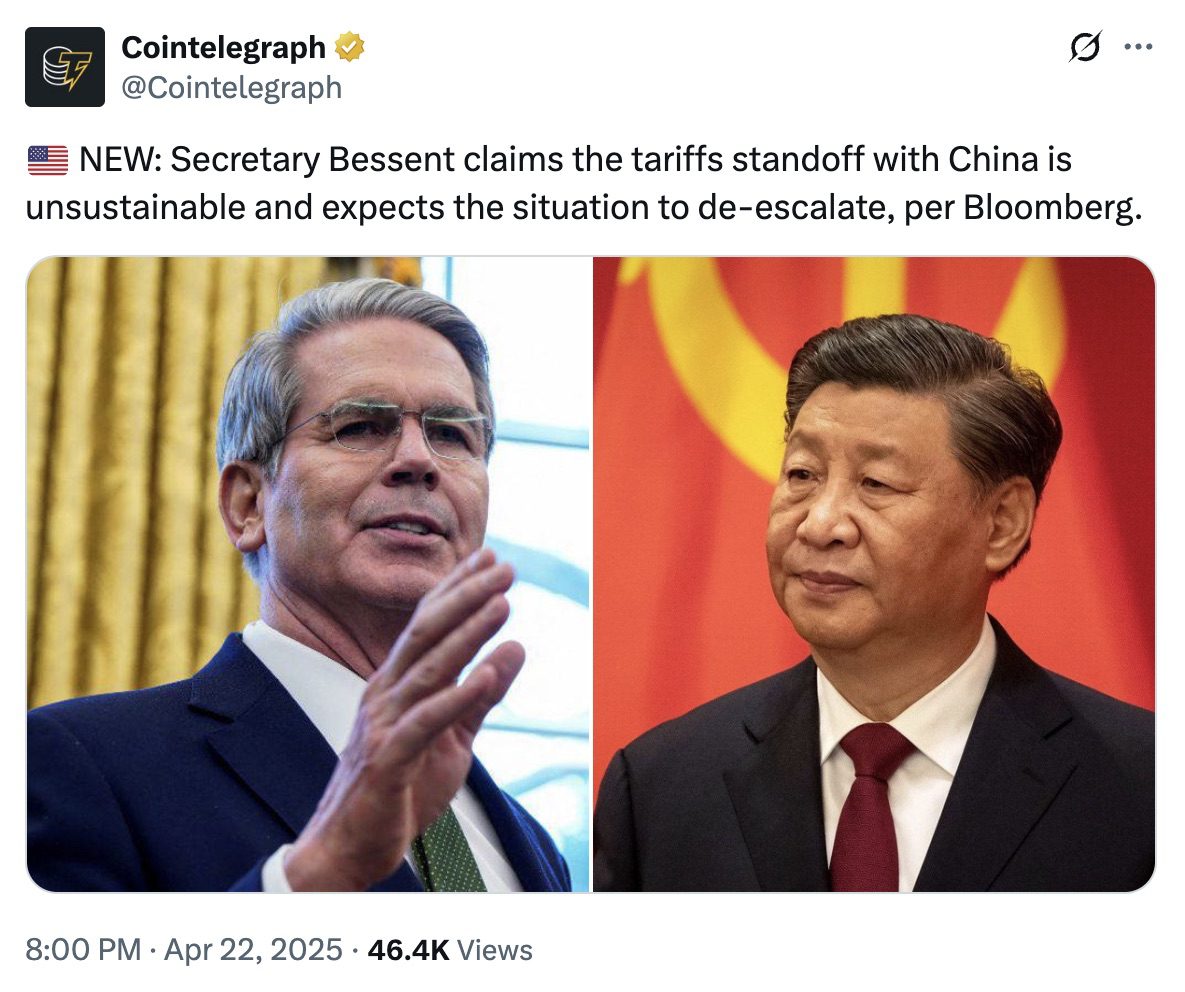

Easing US-China Trade War Tensions: Optimism surrounding a potential de-escalation of trade tensions between the United States and China played a significant role. Recent statements from US officials hinted at a possible reduction in tariffs, boosting investor confidence and positively impacting the crypto market.

-

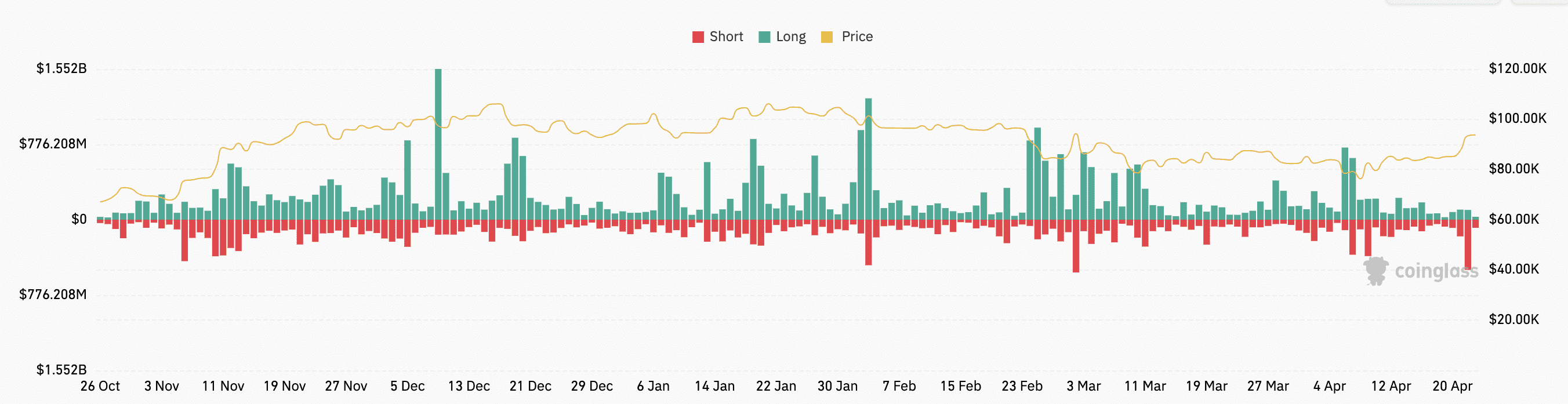

Massive Short Liquidations Fueling a Short Squeeze: A substantial “short squeeze” occurred in the derivatives market, resulting in over $624 million in crypto positions being liquidated, with $545 million representing short position liquidations. This amplified the price surge, particularly for Bitcoin.

-

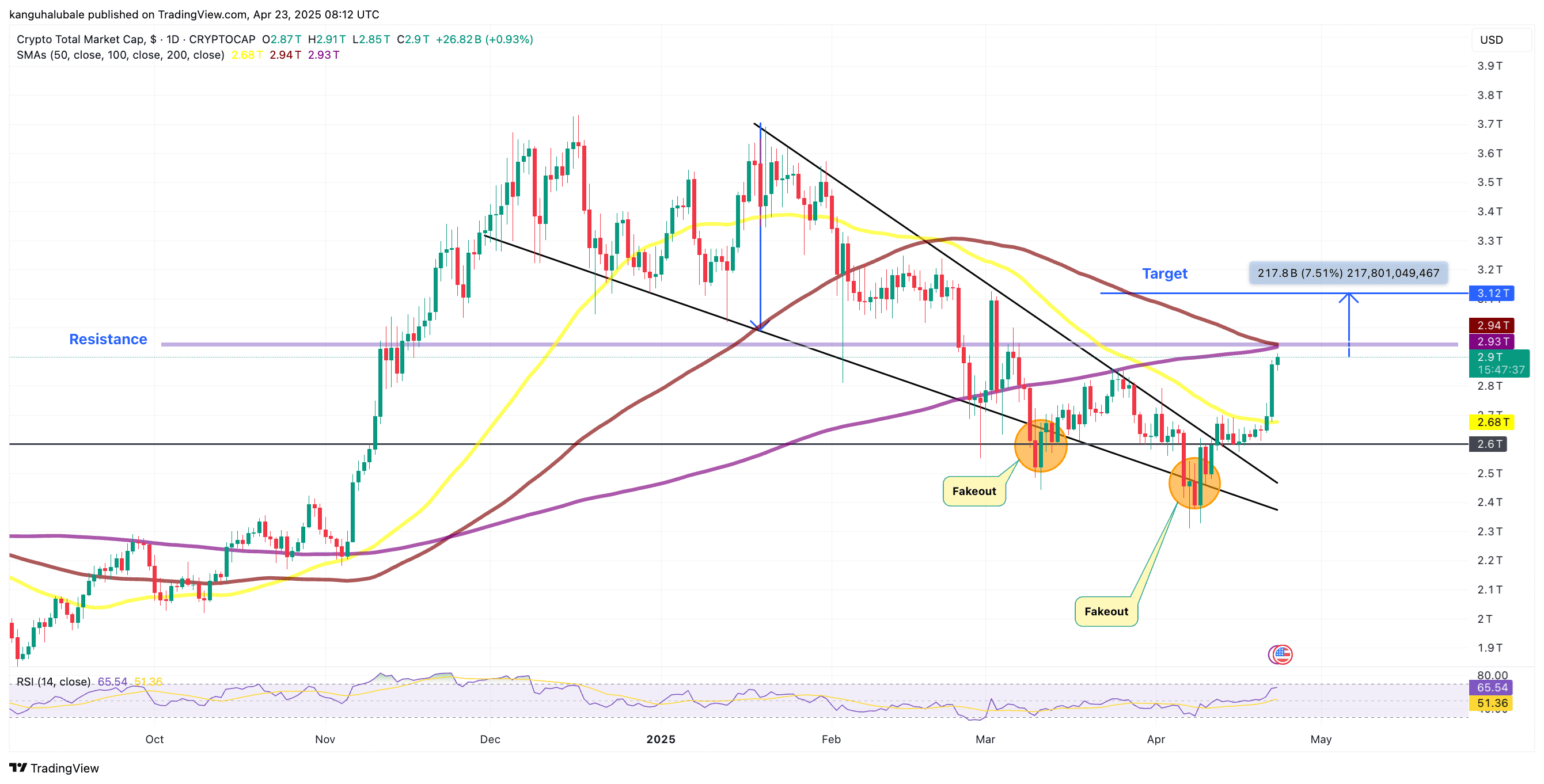

Strengthening Technical Outlook: The overall technical analysis of the crypto market indicates a bullish trend. The total market capitalization (TOTAL) has broken out of a multimonth downtrend, specifically a falling wedge pattern, suggesting further potential gains.

Diving Deeper into the Driving Forces

Easing US-China Trade War Tensions

The potential de-escalation of the trade war between the US and China provided a boost to the crypto market. Statements suggesting a willingness to reduce tariffs injected confidence into the market, as global trade stability often correlates with positive movements in risk-on assets like cryptocurrencies. The sentiment surrounding international trade can significantly impact investor appetite and, consequently, market performance.

The Power of a Short Squeeze

A “short squeeze” happens when a significant number of traders bet against an asset (i.e., take short positions). If the price of the asset unexpectedly rises, these traders are forced to buy back the asset to cover their positions, further driving up the price. The large-scale short liquidations observed today created upward pressure, contributing significantly to the price surge.

The magnitude of today’s short squeeze was substantial, exceeding those seen in recent months. This sudden shift in market dynamics had a particularly strong impact on Bitcoin, which led the charge toward higher prices.

Technical Analysis: A Bullish Breakout

From a technical analysis perspective, the crypto market demonstrated a bullish signal. The total market capitalization broke out of a falling wedge pattern, a technical formation that often precedes an upward trend. This breakout, confirmed by a retest of the upper resistance line, suggests that the market has the potential to continue its upward trajectory.

The technical target of the wedge pattern is around $3.12 trillion, indicating a potential 7.5% increase from current levels. However, the market must first overcome resistance levels around $2.93 to $2.94 trillion.

The Relative Strength Index (RSI), a momentum indicator, has also climbed, suggesting increasing bullish momentum.

Additional Factors Influencing the Crypto Market

While the above factors are significant, other variables can also contribute to crypto market movements:

- Regulatory Developments: Positive or negative regulatory news can significantly impact market sentiment.

- Technological Advancements: Breakthroughs in blockchain technology or new applications of cryptocurrencies can drive investor interest.

- Macroeconomic Conditions: Global economic trends, inflation rates, and interest rate policies can influence investment decisions and affect the crypto market.

- Adoption by Institutional Investors: Increased participation by institutional investors can provide greater liquidity and stability to the market.

Conclusion

The crypto market’s upward momentum today is a result of a combination of factors, including easing trade war tensions, a substantial short squeeze, and a positive technical outlook. While these factors are promising, it is important to remember that the crypto market is inherently volatile. Investors should conduct thorough research and exercise caution before making any investment decisions.