Melania Memecoin Team Offloads $1.5M as Price Shows Resilience

The team associated with the Official Melania Meme (MELANIA) token has been actively selling off their holdings, raising questions about the project’s long-term viability. Over the past three days, they’ve reportedly sold more than $1.5 million worth of MELANIA tokens, suggesting a pre-planned selling strategy that could put downward pressure on the token’s price. This activity comes at a time when the broader memecoin market is showing signs of weakness.

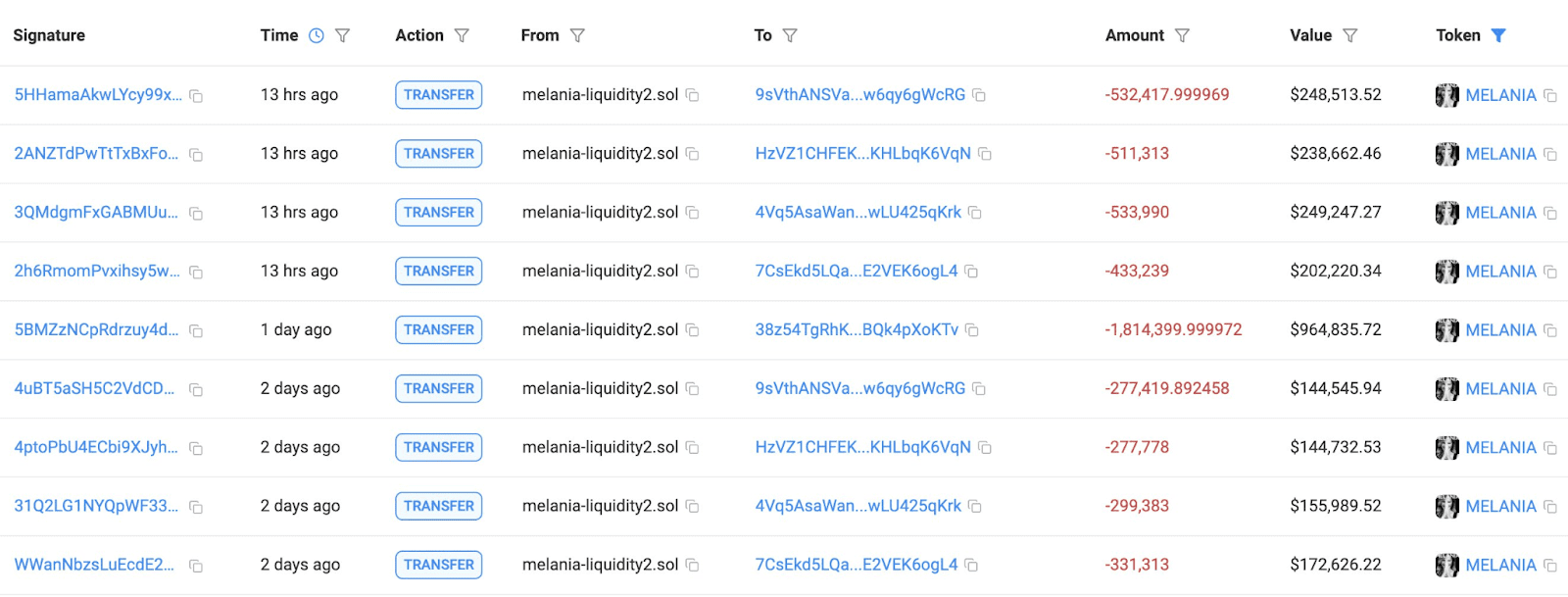

Blockchain data reveals that the Melania memecoin team sold another $930,000 worth of tokens on April 28th, following an earlier sale of $630,000 just two days prior. This consistent selling pattern has been identified by crypto intelligence platform Lookonchain as a form of dollar-cost averaging (DCA).

Key Takeaway: The Melania memecoin team is selling tokens using a dollar-cost averaging (DCA) strategy.

“The #Melania team didn’t just add or remove liquidity to sell $MELANIA, they also employed a DCA strategy for direct sales!”

What is Dollar-Cost Averaging (DCA)?

Dollar-cost averaging (DCA) is an investment strategy where a fixed amount of money is invested in a particular asset at regular intervals, regardless of the asset’s price. This strategy aims to reduce the impact of volatility by averaging out the purchase price over time.

Benefits of DCA:

- Reduces the risk of investing a large sum at the wrong time.

- Removes emotional decision-making from investing.

- Simplifies the investment process.

MELANIA’s Market Performance: A Mixed Bag

Despite the team’s selling activity, MELANIA has experienced a recovery of over 21% in the past seven days. However, it’s important to note that the token remains significantly below its all-time high of $13.7, which was reached on January 20th (Donald Trump’s inauguration day). As of now, it is still 96% below its all-time high.

Whales Bet Against Trump Memecoin (TRUMP)

While the Melania memecoin faces challenges, the Official Trump (TRUMP) memecoin is also attracting attention. Some large investors are actively betting on the price of TRUMP to decline.

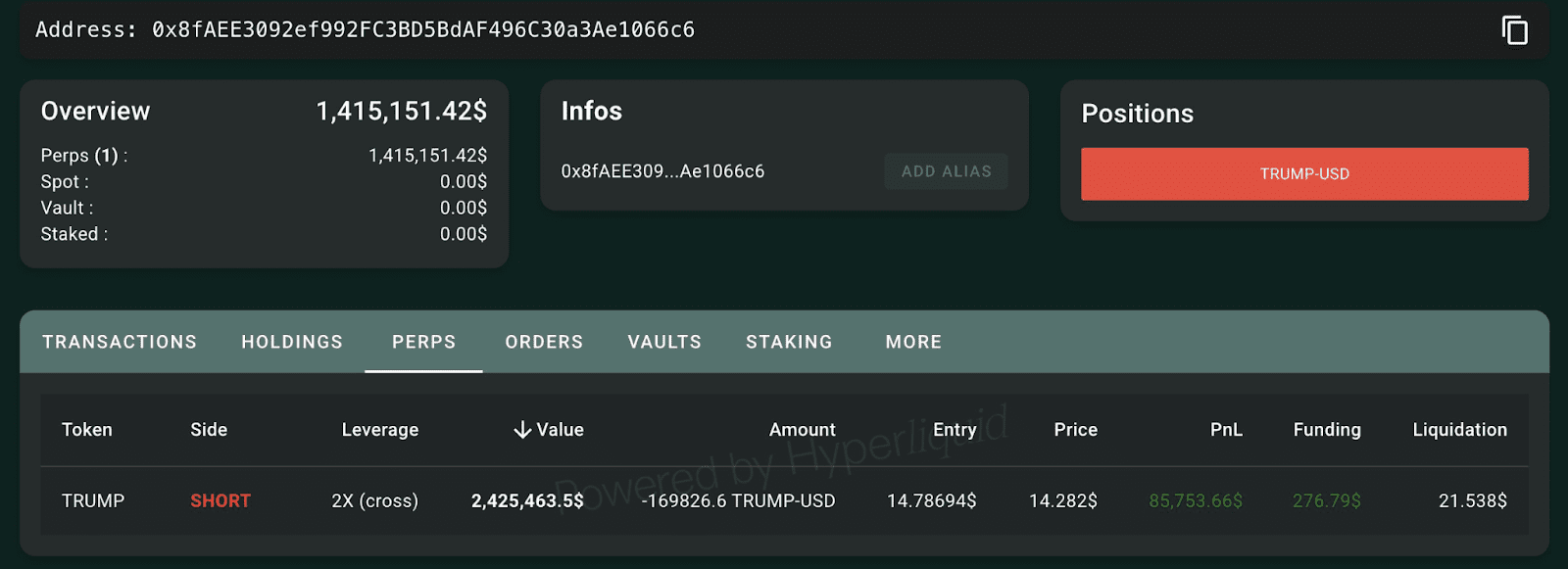

Specifically, a newly created whale wallet deposited $1.33 million worth of USDC stablecoins to open a short position with 2x leverage at $14.7. This means the whale is betting that the price of TRUMP will go down. The short position would be liquidated if the Trump token’s price rises above $21.50.

Memecoins Losing Steam? Q1 Performance and Market Trends

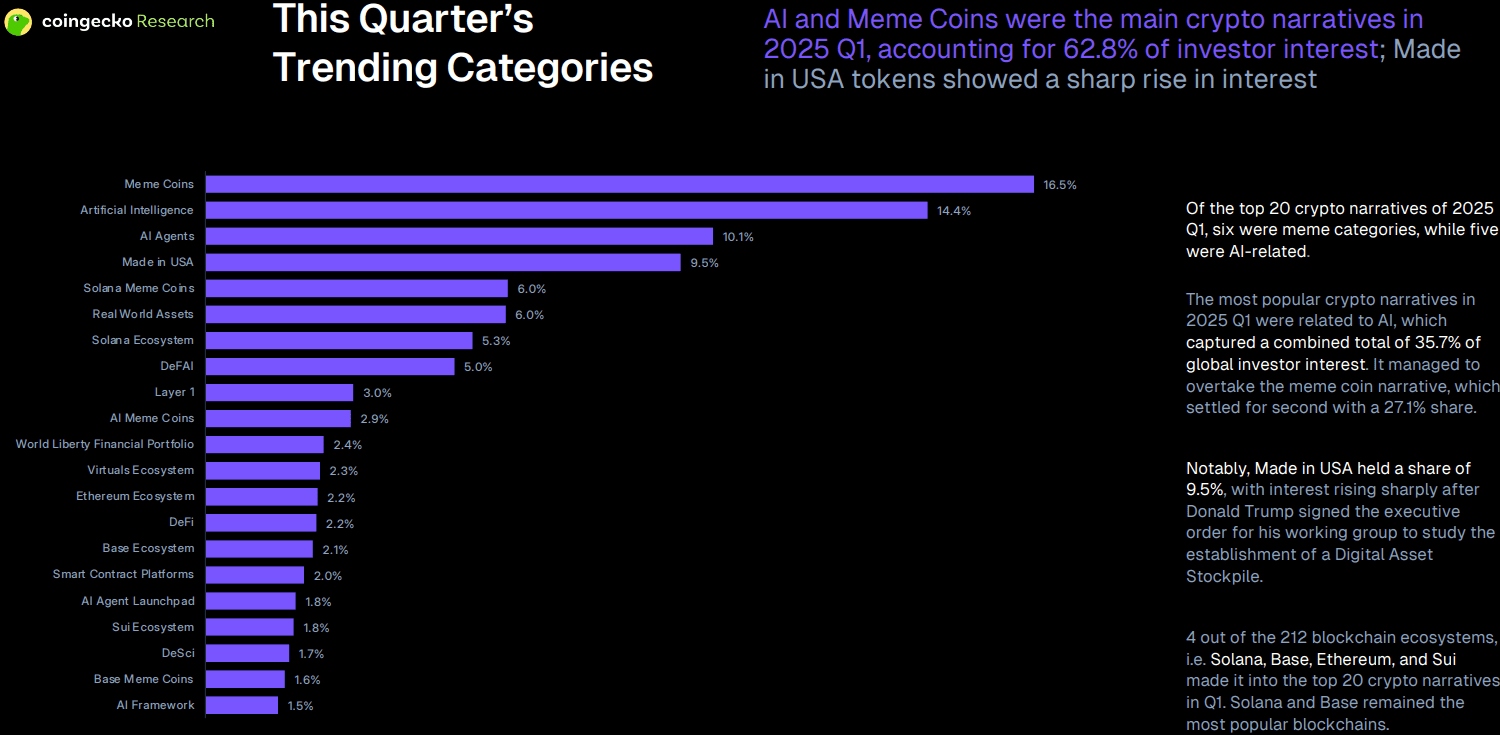

Memecoins were a significant force in the cryptocurrency market during the first quarter of 2025, ranking as the second-most dominant investment narrative. However, there are indications that the memecoin frenzy may be cooling off.

According to a CoinGecko report, memecoins captured approximately 27% of investor mindshare, while artificial intelligence (AI) tokens held over 35%.

Bobby Ong, co-founder of CoinGecko, noted that the market seems to be recycling old narratives, suggesting a lack of new and innovative trends.

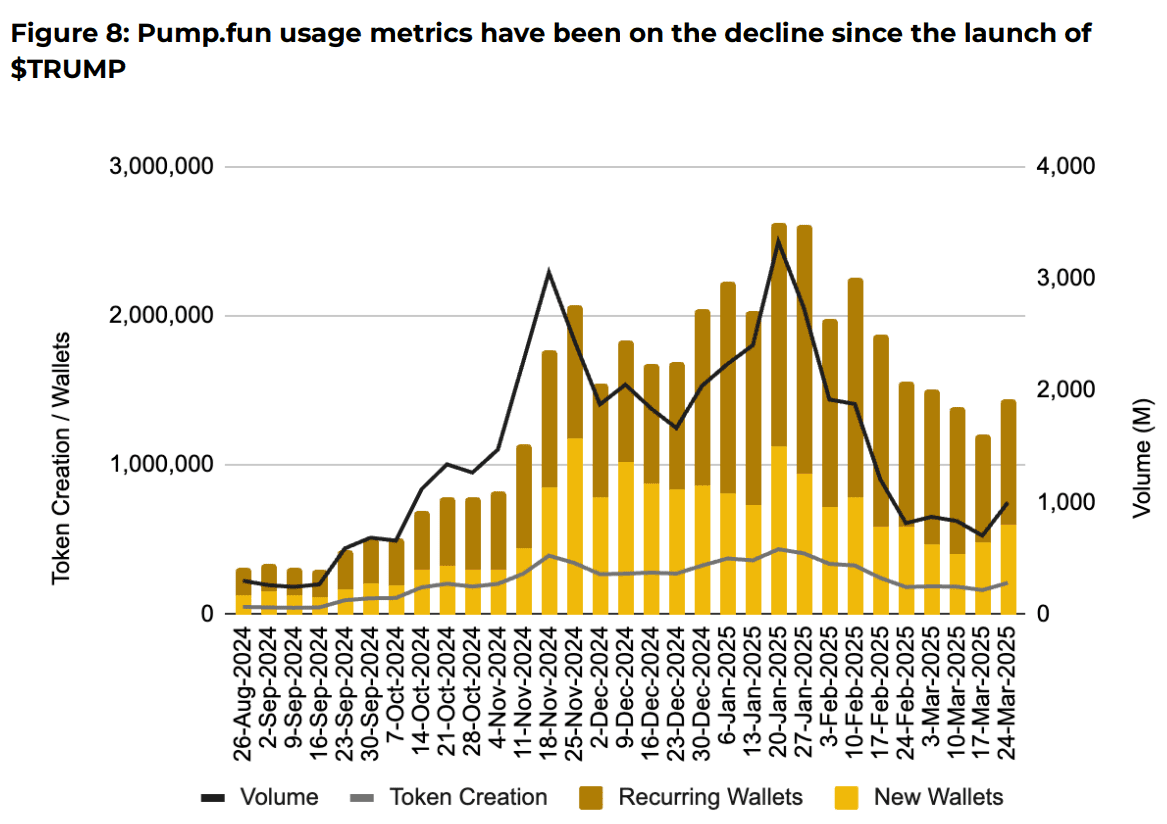

The launch and subsequent performance of the TRUMP token may have signaled the end of the memecoin supercycle. Data from the memecoin launchpad Pump.fun shows a significant decline in weekly usage activity, from 2.85 million active wallets in late January to just 1.44 million by the end of March. This suggests a decrease in interest and participation in the memecoin market.

Memecoin Market: Key Factors

- Team Selling: Selling tokens can create negative pressure.

- Market Saturation: The meme coin market could be seeing a decrease in attention.

- Whale Activity: Short position shows an opportunity to decline further.