Cryptocurrency exchange-traded products (ETPs) experienced a significant rebound, attracting substantial investment and achieving their third-largest inflows on record last week, according to data from CoinShares.

Key Takeaways:

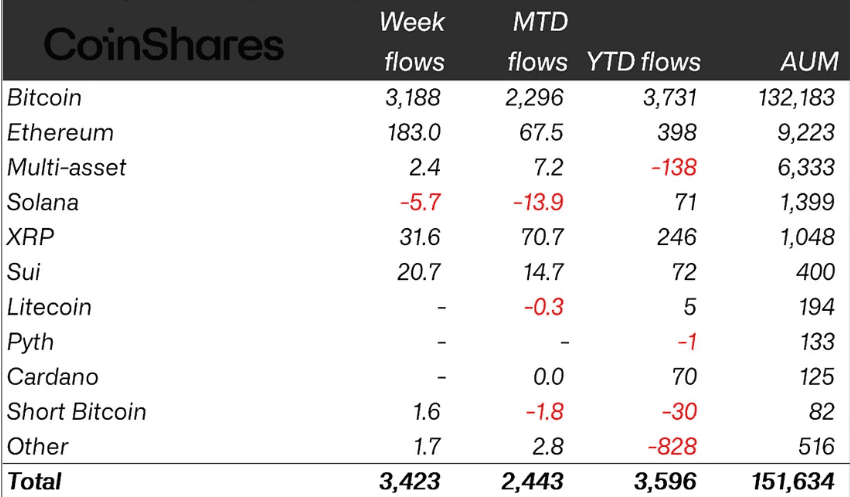

- Record Inflows: Crypto ETPs saw $3.4 billion in inflows during the week of April 21-25, marking the highest level since December 2024.

- Bitcoin Dominance: Bitcoin ETPs led the surge, attracting $3.18 billion as BTC price consolidated above $90,000.

- Solana Outflows: Solana (SOL) was the only crypto ETP to experience outflows, totaling $5.7 million.

- Ether Gains: Ether (ETH) broke an eight-week outflow streak with $183 million in inflows.

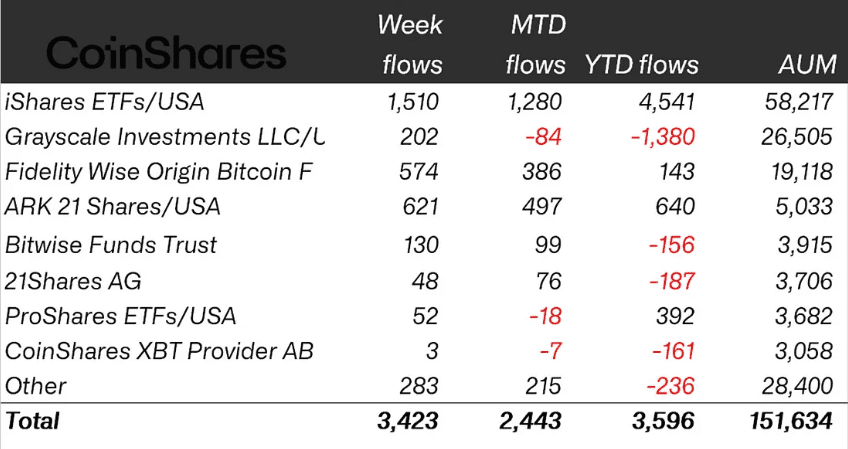

- Broad Participation: Inflows were distributed across major issuers like BlackRock, ARK, and Fidelity.

This surge in investment interest coincided with Bitcoin breaking above $90,000, a level not seen since early March. The inflows effectively reversed previous outflows seen since the beginning of April, pushing year-to-date (YTD) inflows to $3.7 billion.

Bitcoin ETFs Lead the Charge

Bitcoin ETPs were the primary beneficiaries of this renewed interest, capturing $3.18 billion of the total inflows. This influx pushed Bitcoin ETP’s assets under management (AUM) to $132 billion, contributing to a total AUM for all crypto ETPs of $151.6 billion.

Solana Bucked the Trend

While most crypto ETPs saw positive inflows, Solana-based investment products experienced outflows of $5.7 million. In contrast, Ether (ETH), the second-largest cryptocurrency, saw $183 million in inflows, ending its eight-week run of outflows.

Other altcoins also benefited, with Sui (SUI) and XRP seeing inflows of $20.7 million and $31.6 million, respectively. This indicates a diversified interest beyond just Bitcoin, although Bitcoin remains the dominant force.

Issuer Performance

The inflows were distributed across all major issuers, including those in the United States and Europe. BlackRock’s iShares ETFs led the way with $1.5 billion in inflows, followed by ARK with $621 million and Fidelity with $574 million.

Despite the overall positive trend, some issuers, including Grayscale, ProShares, and CoinShares, continued to see outflows month-to-date (since April 1). This suggests a complex landscape where some investors are still withdrawing funds while others are aggressively entering the market.

Driving Forces Behind the Inflows

CoinShares’ James Butterfill attributes the new inflows to concerns over potential tariff impacts on corporate earnings and a weakening US dollar. These factors may have fueled demand for safe-haven assets, including Bitcoin and other cryptocurrencies.

Additionally, a recent decline in gold prices after reaching new highs may have contributed to the shift towards crypto assets. Investors might be re-evaluating their portfolios and diversifying into cryptocurrencies as an alternative store of value.

Understanding Crypto ETPs

Crypto ETPs provide investors with exposure to cryptocurrencies without directly holding the underlying assets. They are regulated investment vehicles traded on traditional stock exchanges, making them more accessible to a wider range of investors.

Types of Crypto ETPs:

- Bitcoin ETPs: Track the price of Bitcoin.

- Ether ETPs: Track the price of Ether.

- Altcoin ETPs: Track the price of other cryptocurrencies like Solana, Sui, or XRP.

- Basket ETPs: Track a diversified portfolio of cryptocurrencies.

Benefits of Crypto ETPs:

- Accessibility: Easy to buy and sell on traditional stock exchanges.

- Regulation: Subject to regulatory oversight, offering a degree of investor protection.

- Diversification: Allow investors to diversify their portfolios with crypto exposure.

The recent surge in crypto ETP inflows highlights the growing interest in cryptocurrencies as an investment asset. While Bitcoin continues to dominate, other altcoins are also attracting attention, indicating a maturing market with increasing diversity. Understanding the factors driving these inflows and the benefits of crypto ETPs is crucial for investors looking to navigate this evolving landscape.