Strategy, the world’s largest corporate Bitcoin holder, is planning to raise nearly $1 billion through a stock offering to fund additional Bitcoin purchases. This move underscores the company’s aggressive Bitcoin-centric strategy and could signal broader market confidence or, conversely, raise concerns about leveraged exposure to BTC.

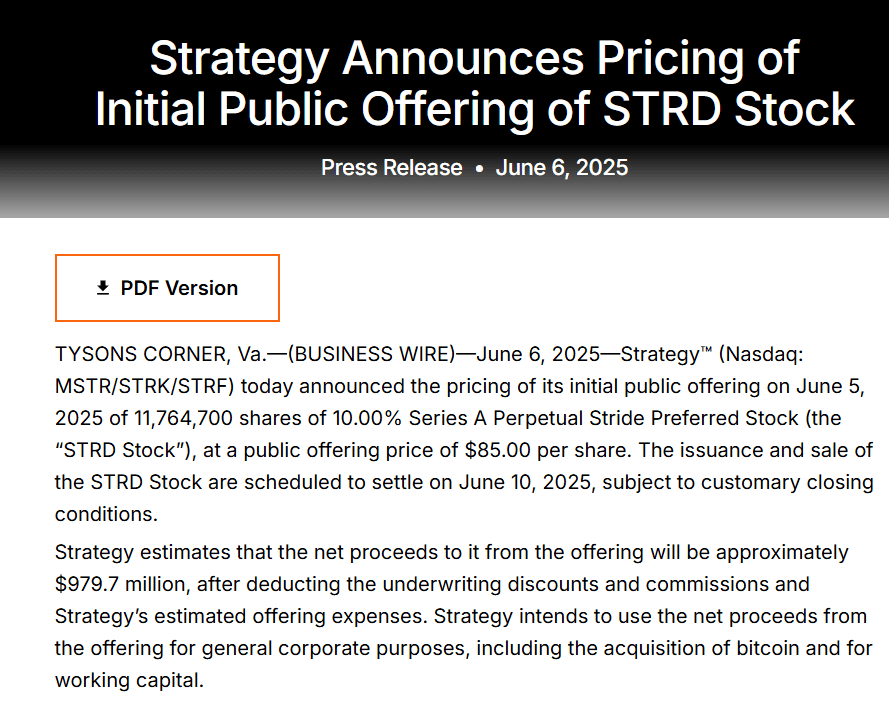

The company, led by executive chairman Michael Saylor, intends to issue 11,764,700 shares of 10.00% Series A Perpetual Stride Preferred Stock at a public offering price of $85 per share.

Here’s a quick summary of the news:

- Strategy aims to raise approximately $979.7 million through a stock offering.

- The funds will be used for “general corporate purposes, including the acquisition of Bitcoin and for working capital.”

- The offering involves 11,764,700 shares of Series A Perpetual Stride Preferred Stock.

- This upsizes the previously announced raise from $250 million.

- The preferred stocks will pay professional and institutional investors non-cumulative dividends equal to 10% of the stated amount.

Why It Matters

This significant capital raise signals Strategy’s unwavering commitment to Bitcoin. However, it also raises questions about the sustainability of relying on stock offerings to fund Bitcoin acquisitions. The market impact could be multifaceted:

- Positive Sentiment: Reinforces Bitcoin’s narrative as a store of value and institutional asset.

- Price Impact: The potential purchase of nearly 9,633 BTC could exert upward pressure on Bitcoin’s price, depending on the execution.

- Market Risk: It increases Strategy’s leverage and its correlation to Bitcoin’s price, making it more vulnerable to market downturns.

- Investor Caution: Investors should consider the high premium on MSTR shares and evaluate whether they are overpaying for Bitcoin exposure.

Market Impact

Here’s a simplified view of the potential impact:

| Factor | Potential Impact |

|---|---|

| Bitcoin Purchase | Potential short-term price increase |

| Strategy Stock (MSTR) | Increased volatility due to Bitcoin correlation |

| Overall Market Sentiment | Boost in confidence, but also increased risk awareness |

Expert Take or Personal Insight

Michael Saylor’s strategy is undoubtedly bold. While his conviction in Bitcoin is admirable, consistently funding acquisitions through stock offerings carries inherent risks. The high premium on MSTR shares suggests that investors are betting on Saylor’s continued success in timing the market. However, a significant Bitcoin correction could severely impact MSTR’s value, leaving investors exposed.

Actionable Insight

Traders and investors should consider the following:

- Monitor Bitcoin’s Price Action: Any major swings will directly affect MSTR.

- Assess MSTR’s Premium: Is the premium justified given the risks?

- Diversify: Avoid overexposure to MSTR, especially if Bitcoin comprises a significant portion of your portfolio.

- Due Diligence: Understand the terms of the Series A Perpetual Stride Preferred Stock.

Conclusion

Strategy’s $1 billion stock offering is a significant event that underscores the growing intersection of traditional finance and the crypto world. While it reinforces Bitcoin’s prominence, investors must remain vigilant about the associated risks. The long-term success of this strategy hinges on Bitcoin’s sustained growth and Strategy’s ability to navigate the volatile crypto landscape. Keep a close eye on how this unfolds; it will likely set a precedent for other companies considering similar moves.