Pakistan Minister of State for Crypto and Blockchain Bilal Bin Saqib is actively pursuing collaboration with Wall Street, marking a significant step in the country’s evolving crypto strategy.

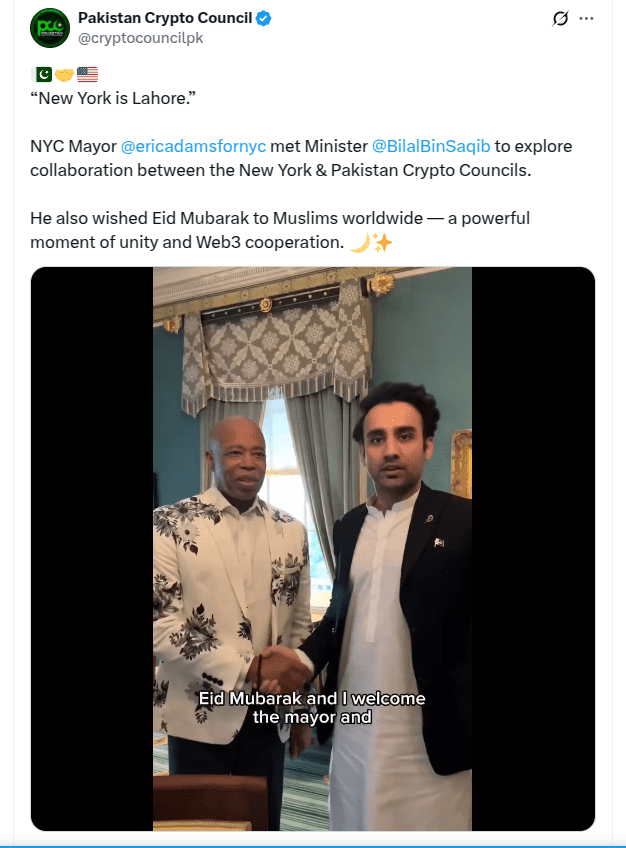

Recent activity highlights this push. On June 6, the Pakistan Crypto Council shared on X that Saqib met with Brandon Lutnick, CEO of global financial services firm Cantor Fitzgerald. Separately, a video showed Saqib meeting with New York City Mayor Eric Adams, a vocal proponent of Bitcoin who has pledged to launch a Bitcoin bond in the city. The post featured the quote:

“New York is Lahore.”

The meeting with Lutnick is particularly noteworthy given Cantor Fitzgerald’s increasing involvement in the crypto space. Discussions reportedly covered tokenization, Bitcoin mining, Pakistan’s Web3 aspirations, and potential collaborative ventures.

Cantor Fitzgerald, a major player in investment banking and financial technology with approximately $14.8 billion in assets under management, signals a significant shift as they delve deeper into the crypto landscape.

Wall Street Giant Cantor Deepens Crypto Ties

This recent engagement builds upon Cantor Fitzgerald’s growing crypto footprint. In April, reports emerged of Lutnick partnering with SoftBank, Tether, and Bitfinex to establish a $3 billion crypto acquisition company. Furthermore, in late 2024, the firm reportedly acquired a 5% stake in stablecoin issuer Tether.

Cantor Fitzgerald has also partnered with Anchorage Digital and Copper, leveraging them as Bitcoin custodians and collateral managers for its new digital asset financing business aimed at institutional investors.

Pakistan’s Crypto Friendship with the US

These developments follow Saqib’s meeting with Robert “Bo” Hines, Executive Director of former US President Donald Trump’s Council on Digital Assets, at the White House. Discussions centered on potential collaborations between Pakistan and the US, including decentralized finance initiatives.

In late May, Saqib unveiled Pakistan’s plan to establish a strategic Bitcoin reserve, a significant departure from the country’s previous stance against crypto.

Saqib’s appointment as Special Assistant to the Prime Minister on Blockchain and Crypto followed Pakistan’s allocation of 2,000 megawatts of surplus electricity specifically for Bitcoin mining and AI centers.

Quick Summary of the News:

- Pakistan’s crypto minister, Bilal Bin Saqib, met with Cantor Fitzgerald CEO Brandon Lutnick to discuss crypto collaboration.

- Saqib also met with New York City Mayor Eric Adams, a Bitcoin advocate.

- Cantor Fitzgerald is increasing its presence in the crypto space, including a potential $3 billion acquisition company.

- Pakistan is planning to establish a strategic Bitcoin reserve.

- Pakistan has allocated 2,000 MW of electricity for Bitcoin mining.

Why It Matters

This news carries significant weight because it suggests a potential sea change in Pakistan’s approach to crypto. The country was previously hesitant, but the appointment of a dedicated crypto minister, coupled with these high-profile meetings, indicates a growing acceptance and potential embrace of digital assets. Furthermore, Cantor Fitzgerald’s deepening ties to the crypto world signal increasing institutional interest and validation of the industry.

Market Impact

While the immediate market impact may be limited, the long-term implications could be substantial. Increased institutional investment in crypto, facilitated by firms like Cantor Fitzgerald, could drive up demand and prices. Pakistan’s potential strategic Bitcoin reserve could also contribute to increased scarcity and value of Bitcoin.

Expert Take or Personal Insight

Pakistan’s strategic shift towards crypto is a welcome development. However, the devil is in the details. The success of this endeavor will hinge on the clarity and effectiveness of the regulatory framework the government establishes. Without a well-defined regulatory environment, these initiatives could be stifled.

Actionable Insight

Traders and investors should closely monitor Pakistan’s regulatory developments regarding cryptocurrencies. A favorable regulatory environment could present significant investment opportunities. Keep an eye on Cantor Fitzgerald’s crypto-related activities and announcements, as their moves often reflect broader institutional trends.

Conclusion

Pakistan’s evolving stance on crypto, marked by high-level meetings and strategic initiatives, suggests a potentially bullish future for digital assets in the country. Whether this translates into tangible benefits for the crypto market remains to be seen, but the signs are encouraging. The next few months will be crucial in determining whether Pakistan can truly capitalize on the potential of the crypto revolution.