Bitcoin exchange-traded funds (ETFs) in the United States experienced a downturn as market sentiment soured, influenced by a developing dispute between former US President Donald Trump and entrepreneur Elon Musk.

After a short-lived recovery between June 3rd and 4th, US spot Bitcoin (BTC) ETFs faced renewed outflows on June 5th, reaching $278 million, according to data from SoSoValue.

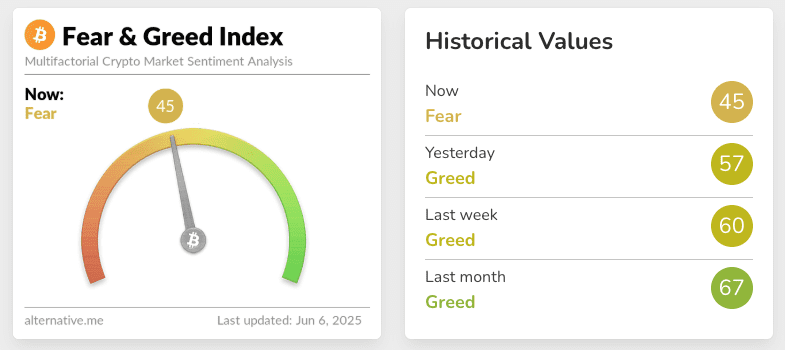

This outflow coincided with the Cryptocurrency Fear & Greed Index transitioning from “Greed” to “Fear” on June 6th. This shift likely mirrors the market’s reaction to the escalating tension between Trump and Musk, played out across social media.

Quick Summary of the News

- US Spot Bitcoin ETFs experienced $278 million in outflows on June 5th.

- The Crypto Fear & Greed Index shifted from “Greed” to “Fear.”

- This shift correlates with a public disagreement between Trump and Musk.

- Tesla (TSLA) shares plunged 14%, while Trump Media (DJT) shares dropped 8%.

- Ether ETFs continue to see inflows, albeit at a reduced rate.

Why It Matters

The recent outflows from Bitcoin ETFs highlight the increasing sensitivity of the crypto market to external factors, particularly those involving influential figures. The Trump-Musk situation illustrates how geopolitical and social media events can rapidly impact investor sentiment and trigger market volatility. This is especially true for relatively new investment products like Bitcoin ETFs, which are still establishing their footing in the traditional financial world. The situation spills over into traditional markets, where both Tesla and Trump Media saw significant drops.

Market Impact

The following table summarizes the ETF flow data:

| Date | Event | Impact |

|---|---|---|

| May 29 – June 2 | Series of Outflows | $1.2 Billion outflow |

| June 5 | Trump-Musk Fallout | $278 Million outflow |

| June 5 | ARKB ETF | $102 Million outflow |

Expert Take or Personal Insight

It’s easy to overreact to short-term market fluctuations. However, this event serves as a crucial reminder that the crypto market isn’t isolated. While the long-term potential of Bitcoin remains strong, external factors, including the pronouncements and actions of influential figures, can create short-term volatility. The fact that even established figures like Trump and Musk can impact the market shows the level of uncertainty that’s still baked into the crypto market. It may be years, or even decades, before it acts with the independence of more traditional investment markets.

Actionable Insight

Here’s what traders and investors should consider:

- Monitor External Events: Keep an eye on geopolitical news, social media trends, and statements from key figures that could impact market sentiment.

- Diversify: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes to mitigate risk.

- Consider Dollar-Cost Averaging: Implement a dollar-cost averaging strategy to buy Bitcoin gradually over time, reducing the impact of short-term price fluctuations.

- Look at ETH: ETH ETPs topped inflows at $321 million, providing investors with an alternative.

Conclusion

The recent Bitcoin ETF outflows linked to the Trump-Musk situation underscore the market’s vulnerability to external influences. While this event has triggered short-term volatility, it also presents an opportunity for investors to learn and adapt. By staying informed, diversifying their portfolios, and adopting a long-term perspective, investors can navigate these challenges and position themselves for future success in the evolving crypto landscape.