Strategy, the world’s largest corporate Bitcoin holder, is significantly increasing its bet on Bitcoin with a planned $1 billion stock offering to fund further Bitcoin purchases.

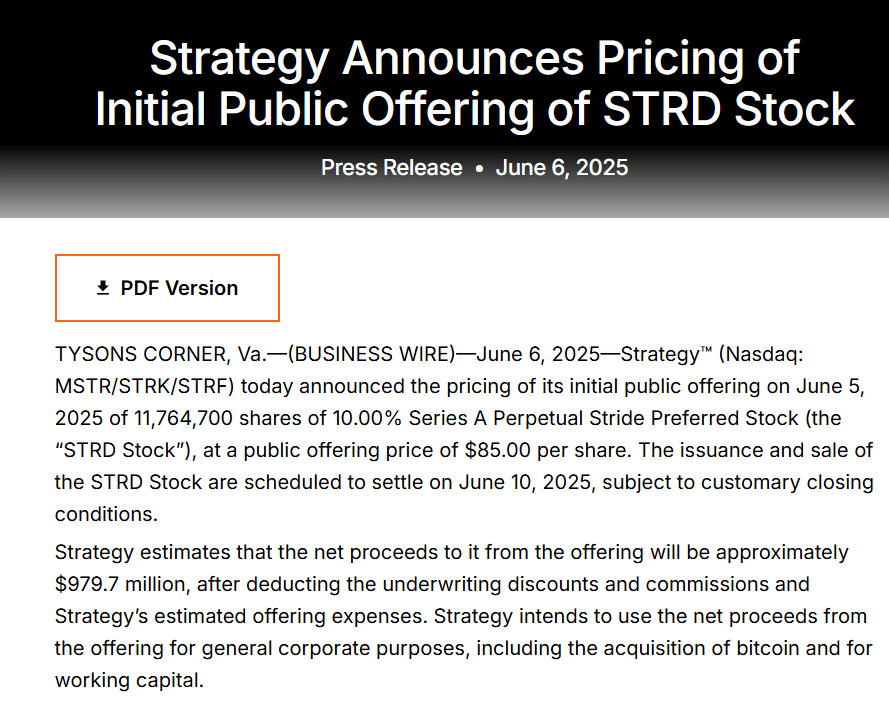

The company, helmed by executive chairman Michael Saylor, intends to issue 11,764,700 shares of 10.00% Series A Perpetual Stride Preferred Stock at a public offering price of $85 per share.

Strategy anticipates raising approximately $979.7 million from the net proceeds after deducting underwriting discounts, commissions, and offering expenses, according to a June 6th announcement.

The company plans to allocate this nearly $1 billion for “general corporate purposes, including the acquisition of Bitcoin and for working capital.”

Quick Summary of the News

- Strategy announces a $1 billion stock offering to purchase more Bitcoin.

- The offering involves 11,764,700 shares of Series A Perpetual Stride Preferred Stock at $85 per share.

- The raised capital will be used for general corporate purposes, primarily Bitcoin acquisition.

- This move significantly increases the company’s Bitcoin investment strategy.

- VanEck estimates Strategy’s Bitcoin premium at over 112%.

Why It Matters

Strategy’s aggressive Bitcoin acquisition strategy is a bold move that can significantly impact the crypto market. This substantial investment demonstrates a strong belief in the long-term value of Bitcoin. Moreover, the method of funding – issuing preferred stock – introduces a new dynamic into the company’s capital structure.

This move can influence market sentiment, potentially driving Bitcoin’s price upward. It also signals to other corporations that Bitcoin can be a viable treasury asset. The increased demand resulting from Strategy’s purchases could tighten supply, further supporting price appreciation.

Market Impact

The announcement has already generated considerable buzz in the crypto community. Here’s a simplified view of potential impacts:

| Factor | Potential Impact |

|---|---|

| Bitcoin Price | Potential upward pressure due to increased demand. |

| Market Sentiment | Positive, reinforcing Bitcoin’s legitimacy as a store of value. |

| Corporate Adoption | May encourage other companies to consider Bitcoin as a treasury asset. |

| Strategy Stock (MSTR) | Potential increase in stock price, but also increased volatility tied to Bitcoin’s price movements. |

Expert Take & Personal Insight

Michael Saylor’s unwavering commitment to Bitcoin is well-known. While some might view this aggressive strategy as risky, Saylor’s conviction has proven profitable in the past. However, it’s crucial to acknowledge that Strategy’s performance is heavily correlated with Bitcoin’s price. This creates a scenario where the company’s fortunes are inextricably linked to the volatile crypto market.

My take is that while this move will likely provide a short-term boost to Bitcoin, it also amplifies the risks for Strategy shareholders. The high premium on Strategy shares, as highlighted by VanEck, suggests that investors are paying a hefty price for this Bitcoin exposure. A significant Bitcoin correction could disproportionately impact Strategy’s stock price.

Actionable Insight

Here’s what traders and investors should watch:

- Bitcoin Price Movement: Closely monitor Bitcoin’s price action following the announcement. Any significant surge could indicate strong market confidence in Strategy’s move.

- Strategy Stock (MSTR): Track Strategy’s stock price and trading volume. A sharp increase could present short-term trading opportunities, but be wary of potential volatility.

- Bitcoin On-Chain Metrics: Analyze on-chain data, such as exchange outflows and active addresses, to gauge the broader market’s response to this news.

- Alternative Investments: Consider diversifying crypto holdings across various assets to mitigate risk.

Conclusion

Strategy’s latest move underscores the growing acceptance of Bitcoin as a legitimate asset. However, it also highlights the importance of understanding the risks associated with highly leveraged Bitcoin strategies. As the crypto market continues to evolve, it’s crucial for investors to conduct thorough research and exercise caution when making investment decisions. The long-term implications of Strategy’s strategy will depend on Bitcoin’s continued performance and the broader macroeconomic environment.