Key points:

-

US President Donald Trump shifts focus from Elon Musk, urging Fed Chair Jerome Powell for interest-rate cuts.

-

Bitcoin rebounds from the Trump-Musk fallout, even with strong US employment data.

-

Liquidity concerns spark fears of a potential BTC price decline.

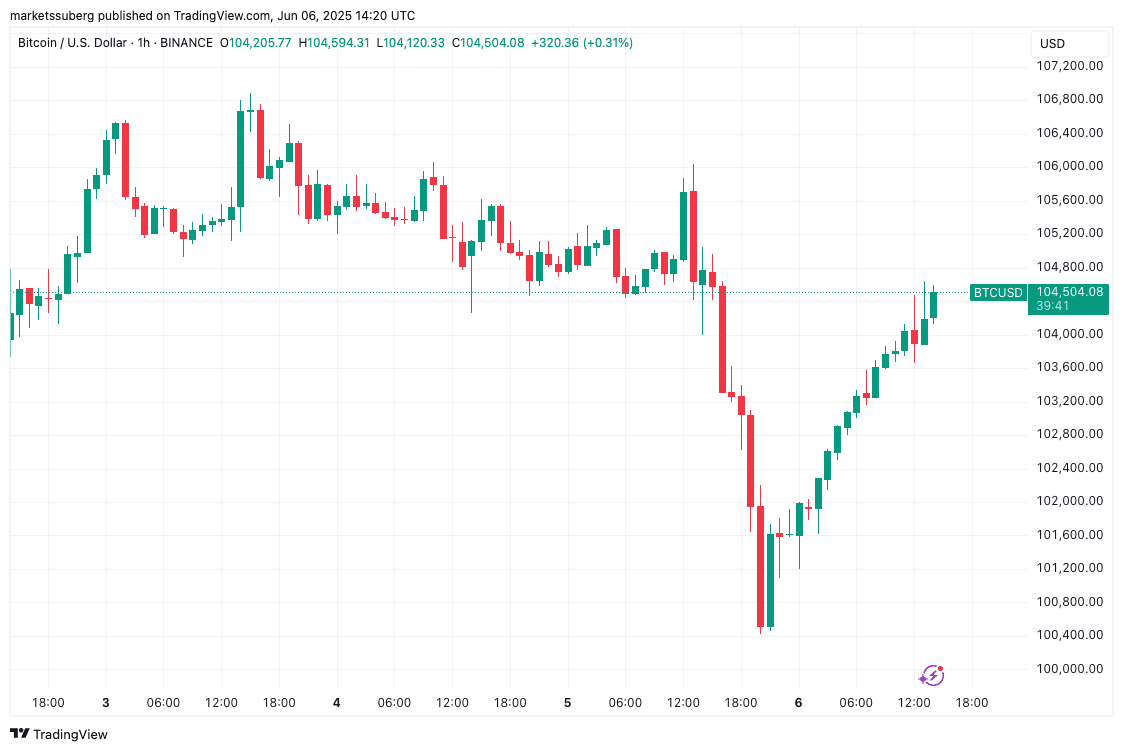

Bitcoin (BTC) surpassed $104,000 as of June 6, coinciding with strong US labor market data and renewed calls for interest-rate cuts.

Bitcoin Edges Higher Amid Trump’s Fed Pressure

Data indicates BTC/USD is up 2.5% on the day.

After recovering from losses linked to the Trump-Musk dispute, the market is now reacting to Trump’s focus on the Federal Reserve.

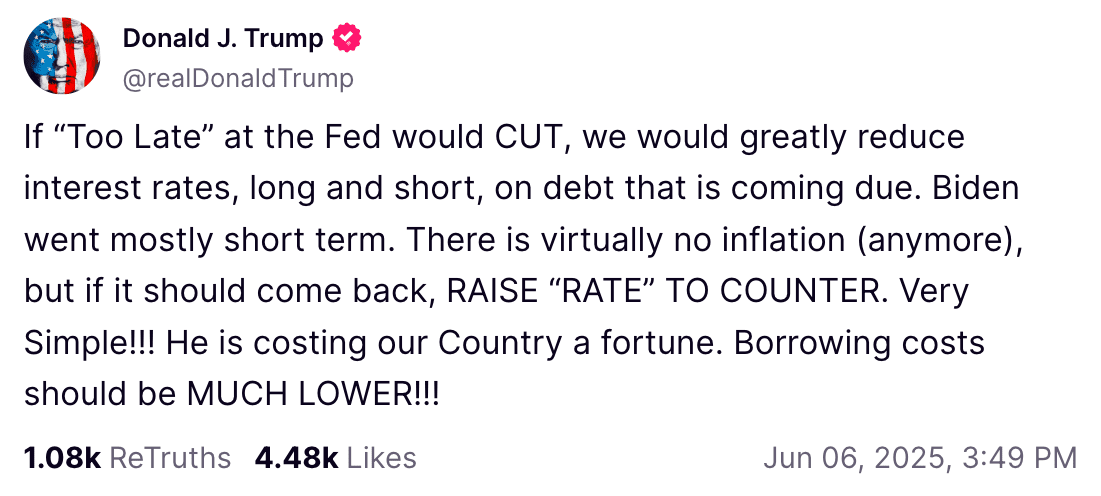

Trump voiced his opinion on Truth Social, criticizing the Fed’s policies and Chair Jerome Powell, advocating for interest-rate cuts to benefit risk assets like crypto.

“Go for a full point, Rocket Fuel!”

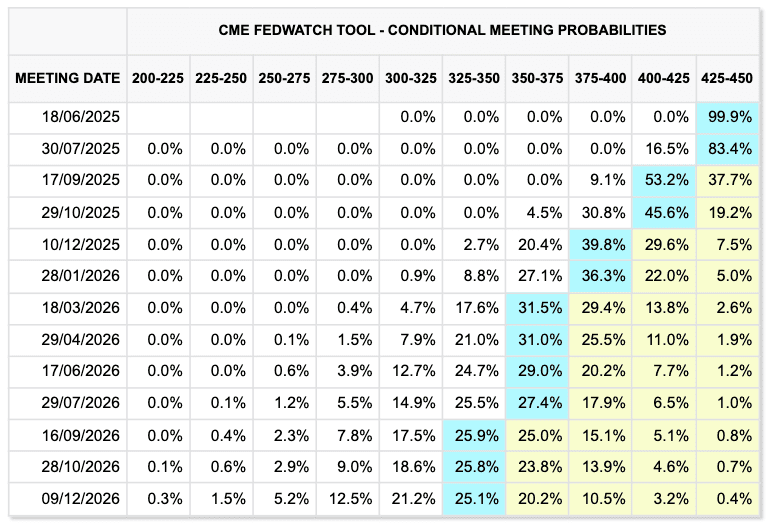

Currently, markets anticipate potential rate cuts no earlier than the Fed’s September meeting, with Trump’s ‘full point’ cut largely unpriced in.

Recent nonfarm payrolls data supports the Fed’s cautious stance, showcasing a resilient labor market.

The US Bureau of Labor Statistics (BLS) reported a 139,000 increase in total nonfarm payroll employment in May, with the unemployment rate remaining at 4.2 percent.

Analysis Warns of Bitcoin Liquidity Trap

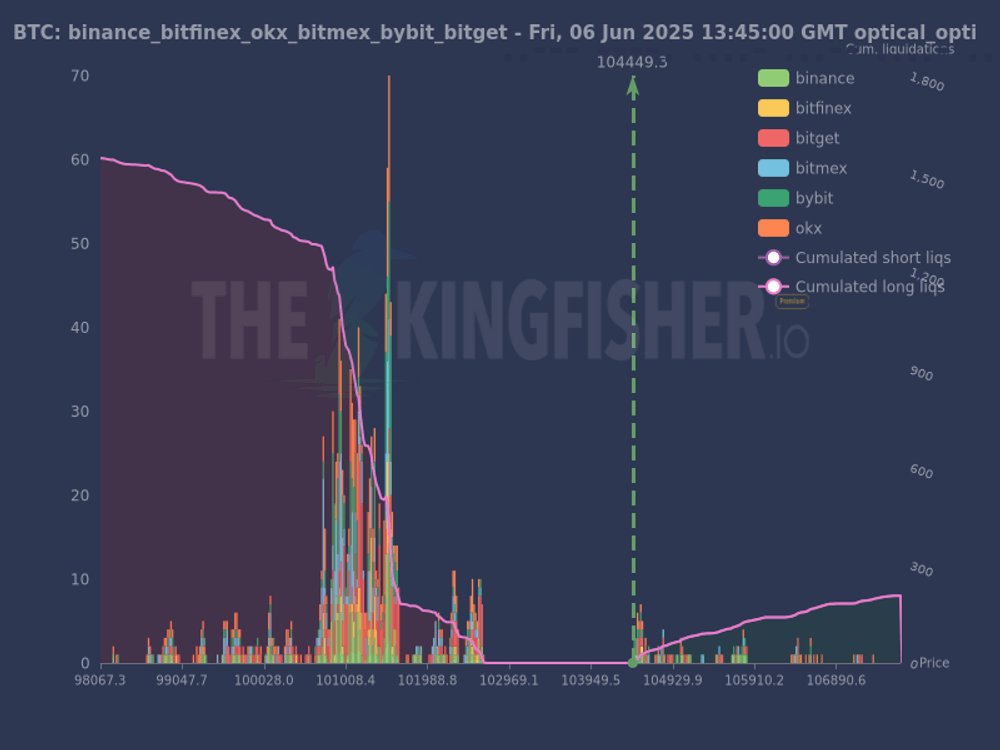

Trader TheKingfisher analyzed order book liquidity to gauge market direction.

Earlier reports indicated potential downside price targets for Bitcoin, suggesting a possible drop below $100,000.

An X post highlighted a significant concentration of long liquidations between $99,000 and $102,000.

“That’s a huge magnetic zone below current price. In contrast, short liquidations above ~104.5k are minimal.”

TheKingfisher noted that this imbalance increases the risk of a downward liquidity cascade.

“Normies see support; we see a liquidation trap,” the post concluded.

This article is for informational purposes only and does not constitute financial advice. Trading involves risk; conduct thorough research before making decisions.