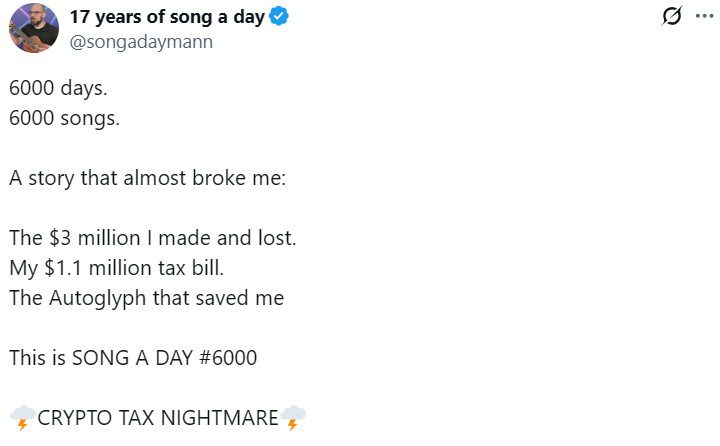

Non-fungible token (NFT) artist Jonathan Mann, the musician behind the “Song A Day” project, has turned his crypto tax ordeal into a cautionary musical tale.

In a new track shared on X, Mann recounted how he made $3 million selling his entire back catalog as NFTs, only to see it vanish as the market crashed during the Terra ecosystem collapse.

“This is the story of how I made three million dollars and lost it,” Mann sings. “And how I owed the IRS more money than I made in 10 previous years.”

Quick Summary of the News

- Jonathan Mann, known for his “Song A Day” project, made $3 million by selling his music catalog as NFTs.

- He held onto the ETH, anticipating further price increases, but the market crashed, particularly with the Terra (LUNA) collapse.

- Mann faced a $1.1 million tax bill based on the initial value of ETH when received, despite its subsequent decline.

- He used ETH as collateral on Aave, but the loan was liquidated during the crash, erasing a significant portion of his holdings.

- Mann ultimately sold a rare Autoglyph NFT for $1.1 million to cover his tax obligations.

Why It Matters

Mann’s experience highlights several crucial aspects of the crypto market:

- Tax Implications: Crypto assets are subject to taxation, and gains are generally taxed as income. The value at the time of receipt, not at the time of sale (or loss), determines the tax liability in some jurisdictions, creating a potential cash flow mismatch.

- Volatility Risk: The crypto market is notoriously volatile. Holding assets without a clear strategy can lead to significant losses, especially during market downturns.

- DeFi Risks: Using crypto as collateral in DeFi lending protocols carries the risk of liquidation if the asset’s value drops sharply.

- Importance of Planning: Proper financial planning and risk management are essential for anyone participating in the crypto market.

Market Impact

This story, while personal, resonates with many crypto investors who experienced similar challenges during the 2022 market downturn. It reinforces the need for caution and due diligence. The Terra (LUNA) collapse, mentioned in the story, had a cascading effect on the entire crypto ecosystem.

Terra (LUNA) Collapse Impact

| Metric | Before Collapse (April 2022) | After Collapse (June 2022) |

|---|---|---|

| LUNA Price | ~$100 | ~$0.0001 |

| UST Market Cap | ~$18 Billion | ~$0 |

Expert Take or Personal Insight

Mann’s story is a cautionary tale but not a unique one. Many individuals were lured into the NFT space during its peak, often without fully understanding the risks or tax implications. This highlights a need for greater financial literacy within the crypto community and more transparent regulatory guidance from governments. While NFTs offer creative opportunities for artists, they are not a guaranteed path to riches. The focus should be on sustainable projects and long-term value creation, not short-term hype.

Actionable Insight

For traders and investors, here are a few takeaways:

- Diversify: Don’t put all your eggs in one basket, especially with volatile assets.

- Understand Tax Laws: Consult with a tax professional familiar with cryptocurrency regulations in your jurisdiction.

- Risk Management: Use stop-loss orders and other risk management tools to limit potential losses.

- Due Diligence: Research projects thoroughly before investing, and avoid FOMO (Fear Of Missing Out).

Conclusion

Jonathan Mann’s experience serves as a valuable lesson for the crypto community. While the potential rewards in the crypto space are significant, so are the risks. Navigating the complexities of taxes, volatility, and DeFi requires careful planning, sound financial advice, and a realistic understanding of market dynamics. As the crypto market matures, a more informed and cautious approach will be essential for long-term success.