Japanese investment company Metaplanet’s shares spiked on market opening after announcing its plan to raise $5.4 billion to buy Bitcoin last week.

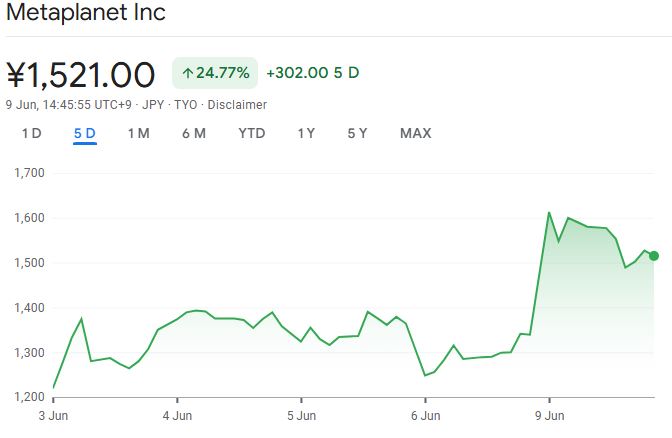

Metaplanet’s stock (3350T) shot up over 12% in the June 9 trading session, trading at 1,505 yen ($10.42), according to Google Finance. However, at its peak of the trading session so far, Metaplanet’s stock reached highs of 1,641 yen ($11.36), representing a 22% increase.

Metaplanet updated its Bitcoin (BTC) acquisition plans to acquire 210,000 BTC by the end of 2027 in a June 6 stock acquisition rights program announcement, increasing its previous target of 21,000 BTC.

Quick Summary of the News

- Metaplanet’s stock (3350T) jumped over 12% on the Tokyo Stock Exchange following the announcement.

- The company plans to acquire 210,000 BTC by the end of 2027, a significant increase from its previous target of 21,000 BTC.

- This acquisition would potentially make Metaplanet the second-largest corporate holder of Bitcoin, behind MicroStrategy.

- The company already holds 8,888 Bitcoin and needs to acquire 201,112 more to meet its 2027 goal.

- Metaplanet first announced buying Bitcoin in July 2024, and its stock price has since increased dramatically.

Why It Matters

Metaplanet’s ambitious Bitcoin acquisition plan signals a growing trend of corporate adoption of Bitcoin as a treasury asset. This move highlights Bitcoin’s increasing acceptance as a store of value and a hedge against inflation. The potential impact on the market is substantial, as a large influx of capital into Bitcoin could drive up its price and further legitimize it as an investment.

This news is significant for several reasons:

- Validation of Bitcoin as a Treasury Asset: More companies viewing Bitcoin as a viable treasury reserve could trigger a domino effect, encouraging others to follow suit.

- Potential Price Impact: A large buy like this could significantly impact Bitcoin’s price, especially if other companies follow suit.

- Shift in Corporate Strategy: This represents a shift in how some companies view and manage their assets, moving towards a more digitally-focused strategy.

Market Impact

The immediate market reaction was positive, with Metaplanet’s stock price surging. However, the long-term impact will depend on the company’s ability to execute its plan and the broader market sentiment towards Bitcoin.

Here’s a look at how other companies’ stocks have reacted to Bitcoin-related news:

| Company | Event | Stock Price Change |

|---|---|---|

| Metaplanet | Announced $5.4B Bitcoin acquisition plan | Up over 12% (initial reaction) |

| Blockchain Group | Started buying Bitcoin | Spiked 225% |

| DigiAsia Corp | Announced plans to raise $100M for Bitcoin buys | Rose nearly 91% |

| GameStop | Announced plans to purchase Bitcoin | Jumped nearly 12% initially, then dropped 11% after first purchase. |

Expert Take & Personal Insight

Metaplanet’s move is undeniably bold and reminiscent of MicroStrategy’s aggressive Bitcoin accumulation strategy. Whether this will be a successful venture remains to be seen, but it certainly puts them on the map in the crypto world. My take is that while there’s inherent risk in tying a company’s fate so closely to a single, volatile asset, the potential upside is significant. The success of this strategy hinges on Bitcoin’s continued growth and adoption.

It’s also worth noting that while some companies have seen their stock prices surge after announcing Bitcoin-related initiatives, others have experienced mixed results. This highlights the importance of timing, market conditions, and the company’s overall financial health.

Actionable Insight

For traders and investors, here’s what to watch:

- Metaplanet’s Execution: Monitor the company’s progress in acquiring Bitcoin and its impact on their balance sheet.

- Market Sentiment: Keep an eye on the overall market sentiment towards Bitcoin and any regulatory developments that could impact its price.

- Copycat Effect: Look for other companies that might be inspired by Metaplanet’s move and consider adding Bitcoin to their treasuries.

Conclusion

Metaplanet’s $5.4 billion Bitcoin acquisition plan is a significant event that could have far-reaching implications for the crypto market. It represents a bold bet on Bitcoin’s future and signals a growing trend of corporate adoption. While the outcome remains uncertain, this move is sure to generate excitement and further legitimize Bitcoin as a valuable asset.