Key points:

- Bitcoin is attempting a key support retest as trading activity increases ahead of the weekly close.

- Liquidity analysis indicates conditions are ripe for a substantial short squeeze in BTC.

- Despite potential dips, the $100,000 level remains a viable target for Bitcoin.

Bitcoin (BTC) was hovering around $105,500 on June 8, as traders hoped the recent price correction was complete.

Bitcoin Liquidation Risk Intensifies as Price Consolidates at $105,000

Data from TradingView indicates that BTC/USD is solidifying its rebound following a dip to $100,500 on June 5.

Having nearly returned to its weekly opening level, Bitcoin is once again encouraging traders to anticipate an upward trend and the continuation of the bull market.

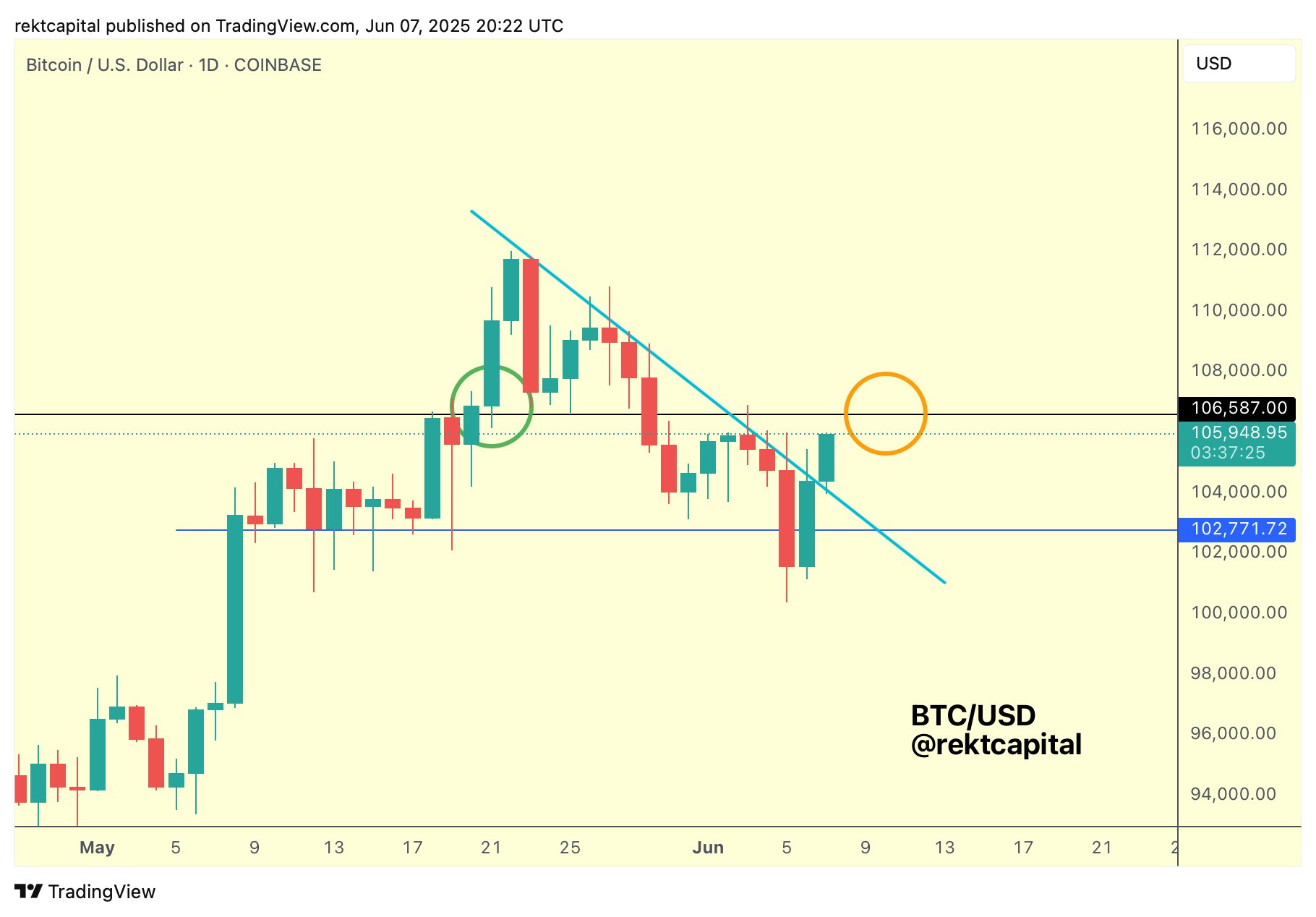

According to Rekt Capital, a popular trader and analyst, Bitcoin is showing signs of breaking its two-week downtrend on the daily timeframe, potentially turning it into a support level. He noted that a daily close and retest of around $106,600 would further support trend continuation.

BTC price action has already achieved a daily close above its 10-day simple moving average (SMA) — a condition trader SuperBro considered necessary to “invalidate the bear case.”

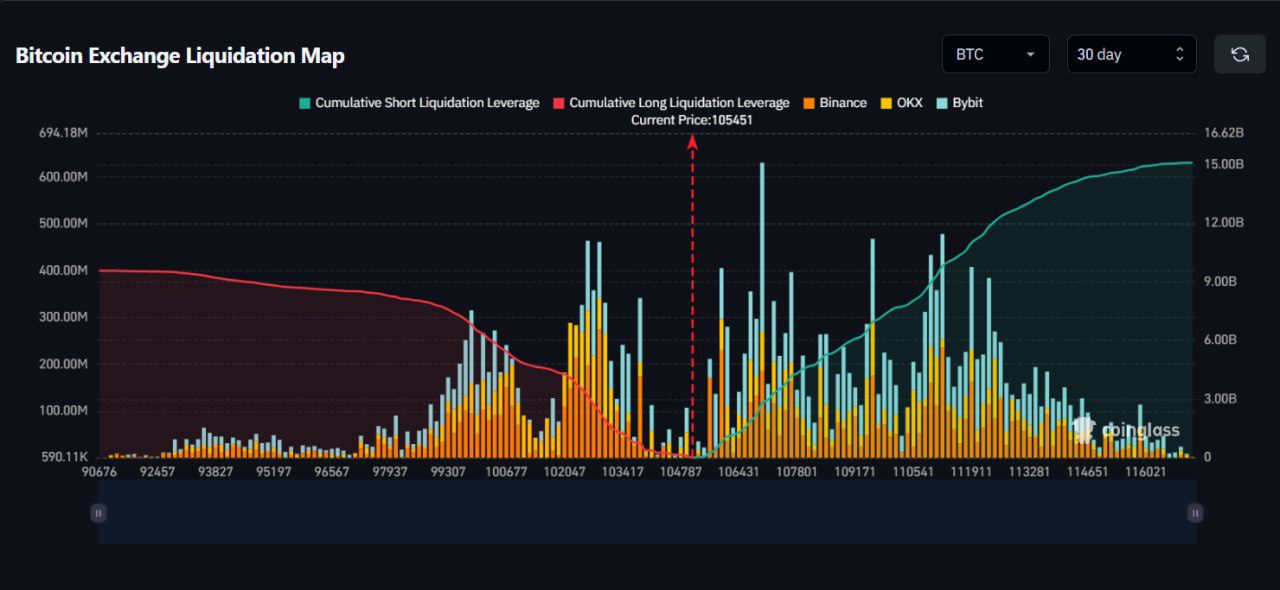

Trader Cas Abbe is monitoring order book liquidity to gauge price direction.

With liquidity building both above and below the current spot price, Abbe anticipates a magnet-like movement to “grab” the liquidity.

Abbe summarized that BTC liquidation clusters are signaling a potential upside move. A 10% increase in BTC’s price from its current level could trigger the liquidation of $15.11 billion in short positions. Conversely, a 10% downside move could liquidate $9.58 billion in long positions.

Abbe also pointed out that negative funding rates suggest the emergence of “big short positions” over the weekend.

He concluded that a significant move for BTC is likely in the coming week, potentially pushing it above the $109,000-$110,000 range.

$104,400: A Critical Level for the Weekly Close

Some analysts foresee the possibility of additional support retests before a major move.

CrypNuevo, another popular trader, indicated that $100,000 is a strong psychological support level and a logical area to establish long BTC positions, with an easy invalidation point below that level.

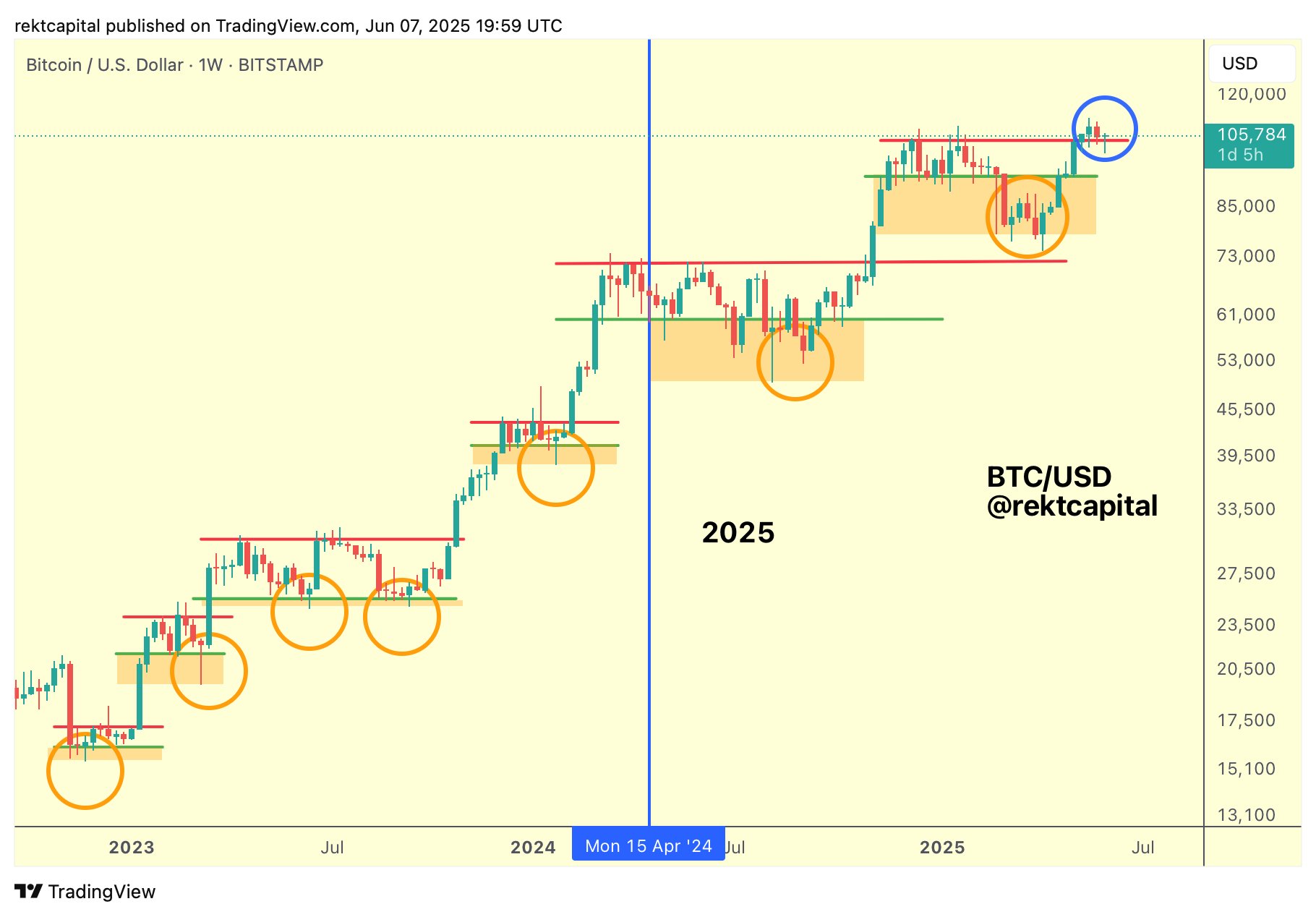

Rekt Capital has described the support retest following May’s all-time highs on weekly timeframes as successful.

He questions whether Bitcoin can successfully confirm this retest with a weekly close above $104,400, marking the fourth consecutive week above this level.