Key Takeaways:

- BONK price has surged 73% since April 22, reaching a five-month high of $0.00002167.

- BONK’s open interest (OI) saw a massive 290% increase, hitting $43.2 million, indicating strong speculative interest.

- The rally is fueled by a broader recovery in the memecoin market and positive technical indicators.

BONK, a prominent Solana-based memecoin, has experienced a remarkable resurgence, climbing approximately 73% from its April 22 low of around $0.00001247 to an intraday high of $0.00002167 on April 28. This surge has captured the attention of crypto enthusiasts and investors alike.

Currently, BONK is trading around $0.00001923, marking a 3% increase over the past 24 hours and a substantial 60% gain over the last week. This impressive performance prompts the question: Is this a temporary spike or the beginning of a sustained rally for BONK and the Solana memecoin ecosystem?

Several factors appear to be contributing to BONK’s recent price momentum. Let’s delve into these drivers to understand the potential sustainability of this uptrend.

Memecoin Market Recovery: A Rising Tide Lifts All Boats

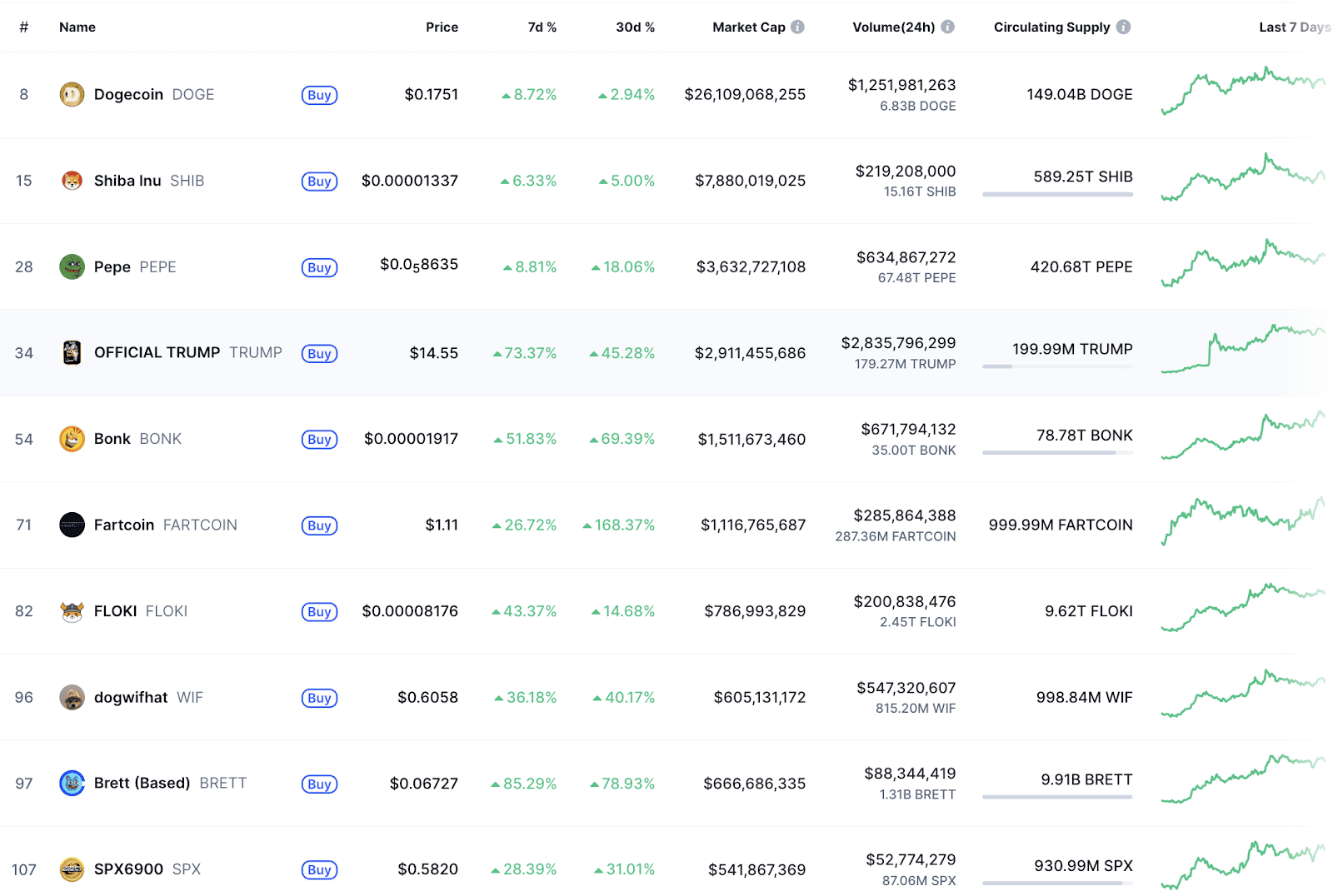

BONK’s upward trajectory aligns with a broader recovery observed across the cryptocurrency market, particularly within the memecoin sector. Many memecoins have posted significant gains in the past week, suggesting renewed investor interest in these high-risk, high-reward assets.

For instance, DOGE and Shiba Inu (SHIB), the leading memecoins by market capitalization, have also experienced gains, although more modest at 3% and 5% respectively. Other notable performers include Official Trump (TRUMP), with a 73% weekly increase, and Base’s Brett (BRETT), which rallied by an impressive 83%.

This widespread rally has propelled the total memecoin market capitalization to $55.51 billion, representing a 17.5% increase in the past week alone. Trading volume for memecoins has also surged, exceeding $7.96 billion in the last seven days, an 85% weekly change. This resurgence indicates a renewed appetite for risk-on assets among investors.

Open Interest Surge: Speculative Activity on the Rise

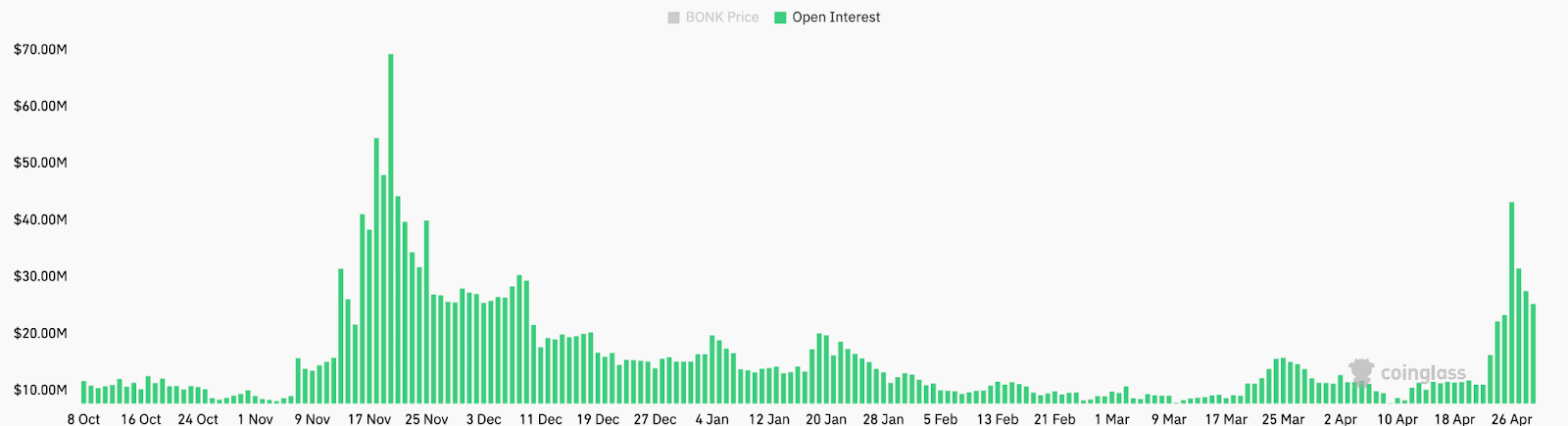

The price surge in BONK coincides with a significant increase in its open interest (OI). Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. A rising OI suggests that new money is flowing into the market and that traders are increasing their positions.

BONK’s total OI across all exchanges jumped by 290% from $11 million on April 22 to $43.2 million on April 26. While it has since retraced to around $28 million, it remains significantly higher than levels seen since December 2024. This surge in OI reflects growing trader participation in BONK futures, indicating heightened speculative activity and a bullish sentiment.

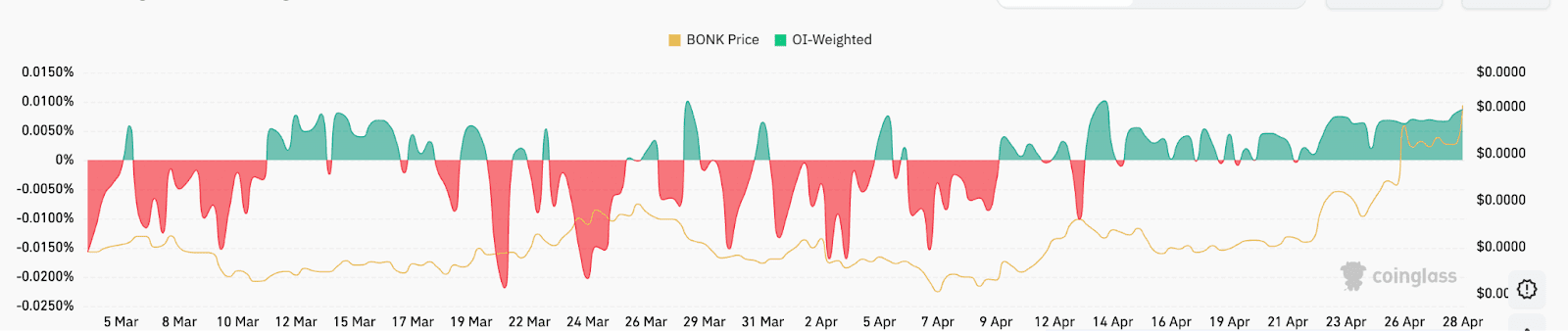

Data from CoinGlass reveals increasing demand for leveraged long positions in BONK, evidenced by the OI-weighted futures funding rate. Funding rates are periodic payments exchanged between buyers and sellers in perpetual futures contracts to keep the contract price close to the underlying asset’s price. Positive funding rates suggest that long positions are dominant and willing to pay short positions, indicating a bullish outlook.

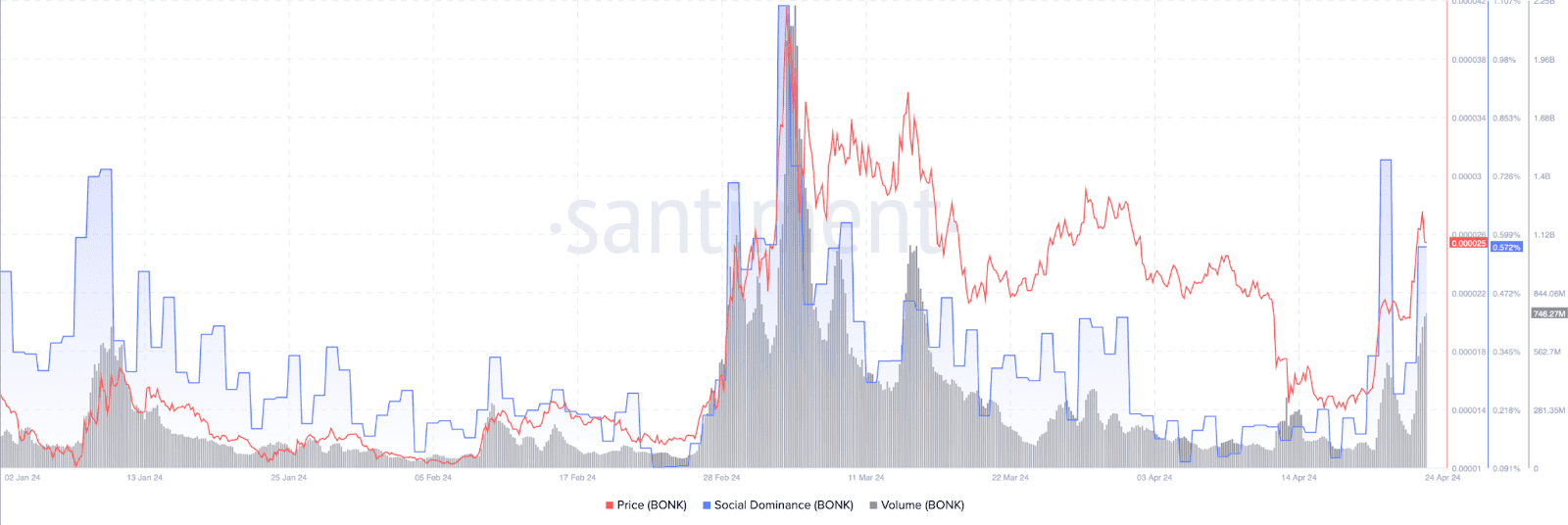

Social Dominance: Increased Awareness and FOMO

BONK’s social dominance has also experienced a significant spike, indicating heightened social activity and increased awareness. Santiment data shows that BONK’s social dominance rose from 0.091% to 0.572% between April 20 and April 26. This surge in chatter on social media platforms reflects rising retail and institutional interest, potentially amplifying FOMO (fear of missing out) and driving demand.

Technical Breakout: A Bullish Signal?

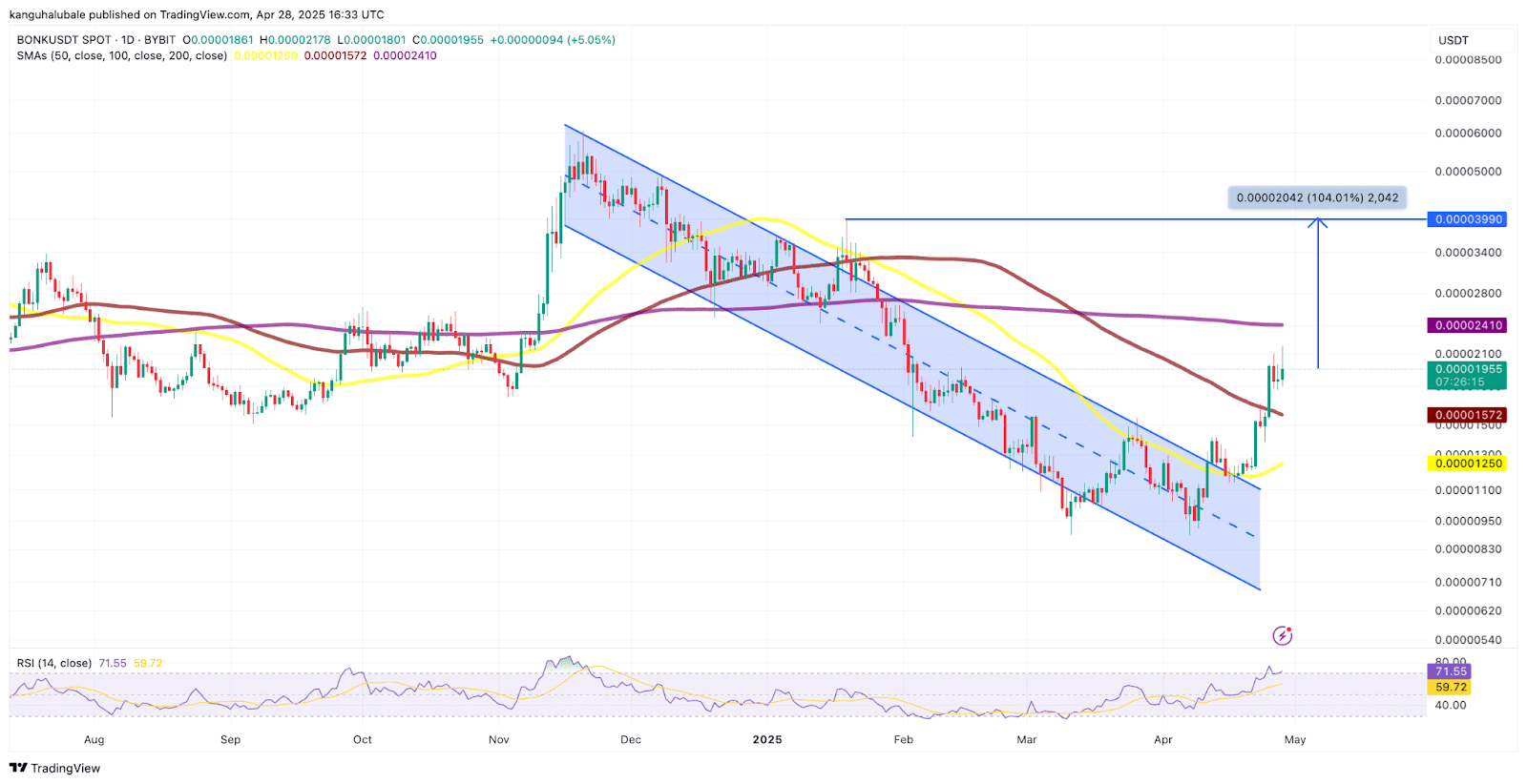

From a technical analysis perspective, BONK’s price broke out of a descending parallel channel on April 13, signaling a potential shift in momentum. This breakout was followed by the price flipping the 50-day and 100-day exponential moving averages (EMAs) to support, further reinforcing the bullish outlook.

The bulls are now targeting the next significant resistance level at $0.00002410, which corresponds to the 200-day simple moving average (SMA). A decisive break above this level, accompanied by strong trading volume, could pave the way for a move towards the January 19 range high near $0.000040, representing a potential 104% increase from current levels.

The relative strength index (RSI) has also surged into overbought territory, currently at 71, indicating strong buying pressure. However, overbought conditions can also signal a potential pullback or consolidation before the uptrend continues.

Analyst Perspectives

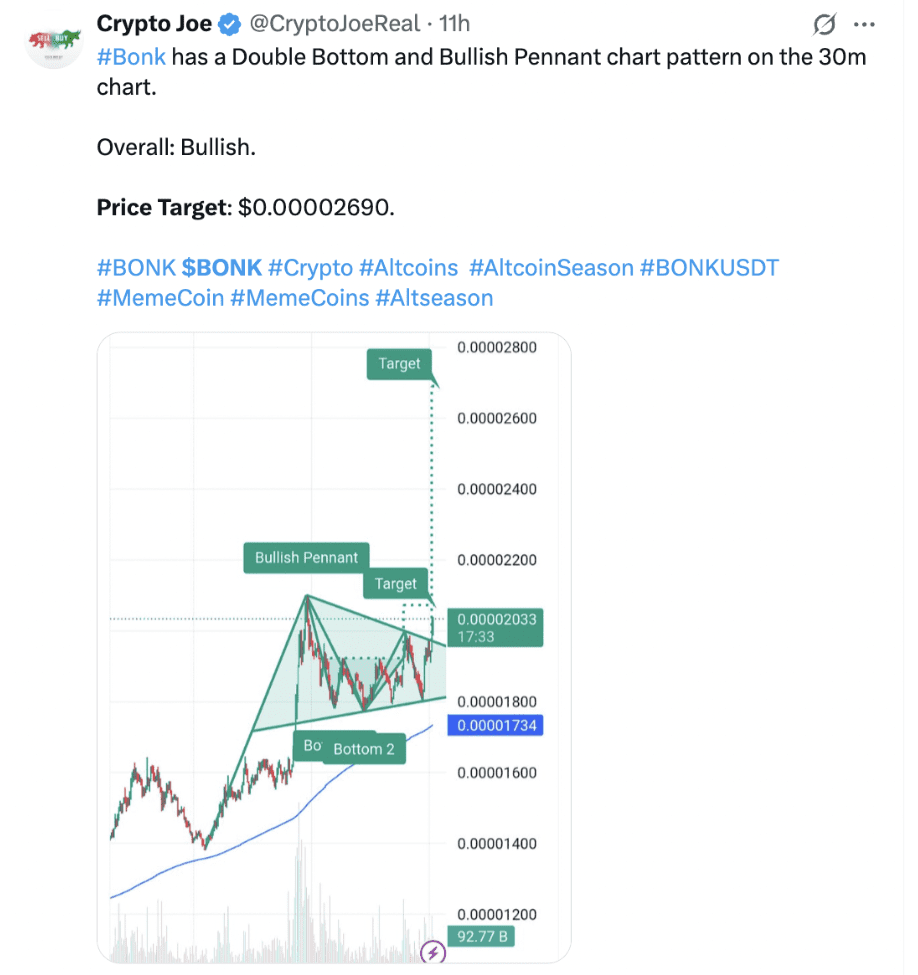

Popular crypto analysts have also weighed in on BONK’s recent performance. World of Charts noted that BONK’s descending trendline has been cleared, anticipating a potential 2x increase in the coming days. Crypto Joe spotted BONK breaking out of a bullish pennant pattern on the 30-minute timeframe, targeting a price of $0.00002690.

Conclusion: Is BONK’s Rally Sustainable?

BONK’s recent price surge appears to be driven by a confluence of factors, including a broader recovery in the memecoin market, increased open interest and speculative activity, heightened social dominance, and positive technical indicators. While the rally is undeniably impressive, it’s essential to remember that memecoins are inherently volatile and speculative assets. Investors should exercise caution, conduct thorough research, and manage their risk appropriately. It remains to be seen whether BONK can sustain its upward momentum, or if this is simply a temporary spike before a correction.