Loopscale Recovers $2.8M After DeFi Hack: A Detailed Analysis and Recovery Efforts

DeFi protocol Loopscale has made significant progress in recovering funds after a recent exploit that initially resulted in a loss of $5.7 million. Through ongoing negotiations with the attacker and a proposed bounty deal, Loopscale has successfully recovered nearly half of the stolen funds, amounting to approximately $2.8 million.

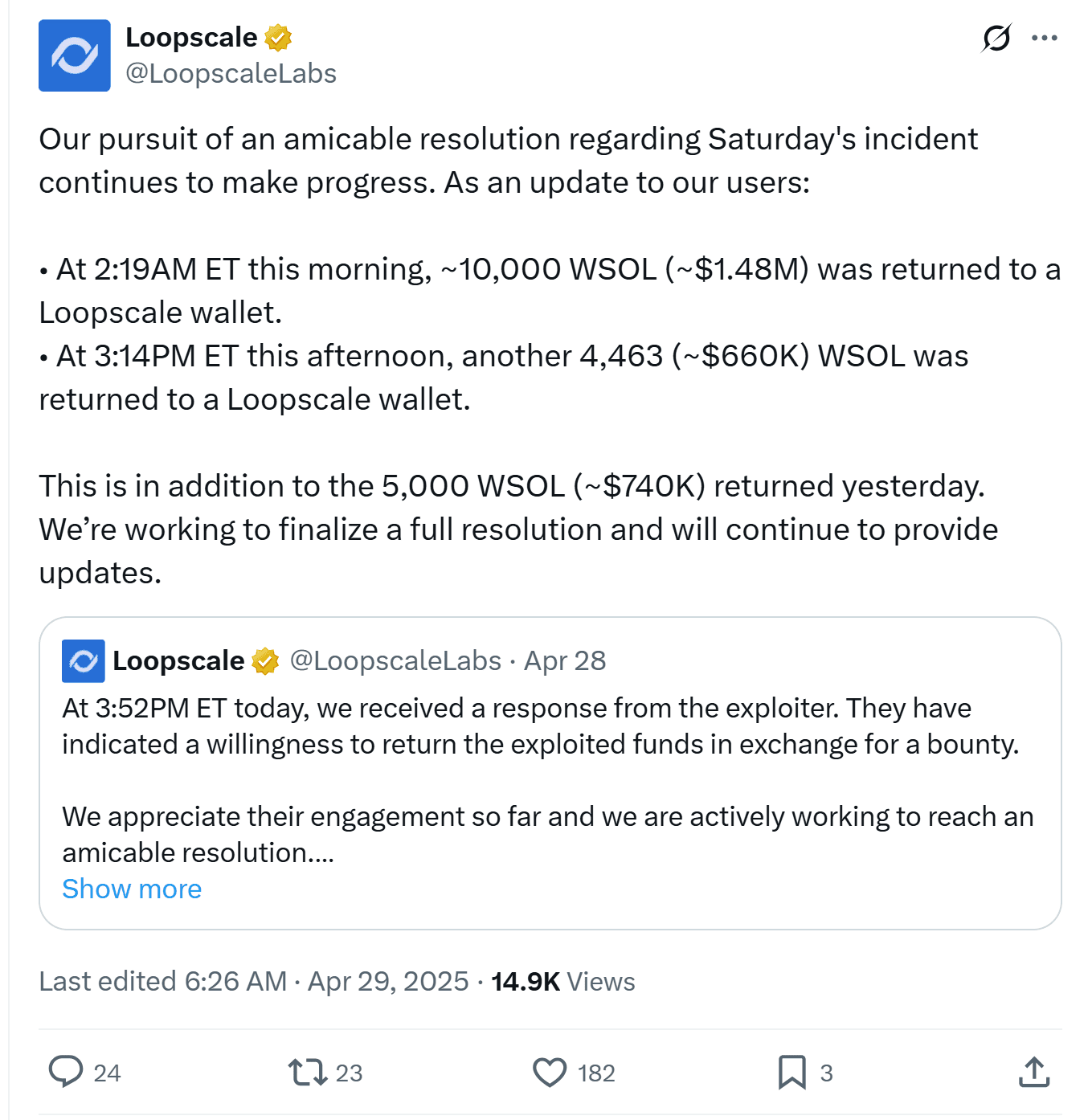

In an official statement released on April 29, Loopscale confirmed the return of 19,463 Wrapped SOL (WSOL), equivalent to around $2.88 million, to its designated wallets since April 28. The recovered funds were returned in multiple transactions, including initial returns of 10,000 WSOL (~$1.48 million) and 4,463 WSOL (~$660,000), following an earlier recovery of 5,000 WSOL (~$740,000).

“Our pursuit of an amicable resolution regarding Saturday’s incident continues to make progress,” the Loopscale team stated, indicating ongoing efforts to secure the remaining stolen funds.

Details of the Loopscale Exploit

The exploit, which occurred on April 26, involved the manipulation of Loopscale’s RateX PT token pricing functions. This manipulation allowed the attacker to steal approximately $5.7 million in USDC and 1,200 Solana (SOL) from Loopscale’s USDC and SOL vaults. The stolen amount represented approximately 12% of the platform’s total funds and primarily affected vault depositors.

Specifically, the attacker exploited a vulnerability in how the RateX PT token’s price was calculated, allowing them to artificially inflate the price and drain funds from the vaults. This type of attack highlights the importance of robust security measures and thorough code audits in the DeFi space.

Loopscale’s Response: Offering a Bounty

In an effort to recover the stolen funds, Loopscale’s team initiated communication with the attacker via an on-chain message. They offered a 10% bounty and a full release of liability in exchange for the return of 90% of the stolen funds.

Loopscale also set a deadline, warning that if no agreement was reached within 24 hours, they would involve law enforcement. This approach demonstrates the increasing willingness of DeFi projects to pursue legal avenues in cases of cybercrime.

The attacker responded, expressing a willingness to negotiate a return in exchange for a bounty. This communication led to the subsequent return of $2.8 million, showcasing the potential effectiveness of negotiating with hackers in certain situations.

Recoveries in DeFi: An Increasing Trend

While recoveries are not always guaranteed in decentralized finance, there has been a growing trend of successful fund returns in recent times. This is due to a combination of factors, including improved communication channels, increased collaboration between DeFi projects and security firms, and a greater willingness of attackers to negotiate.

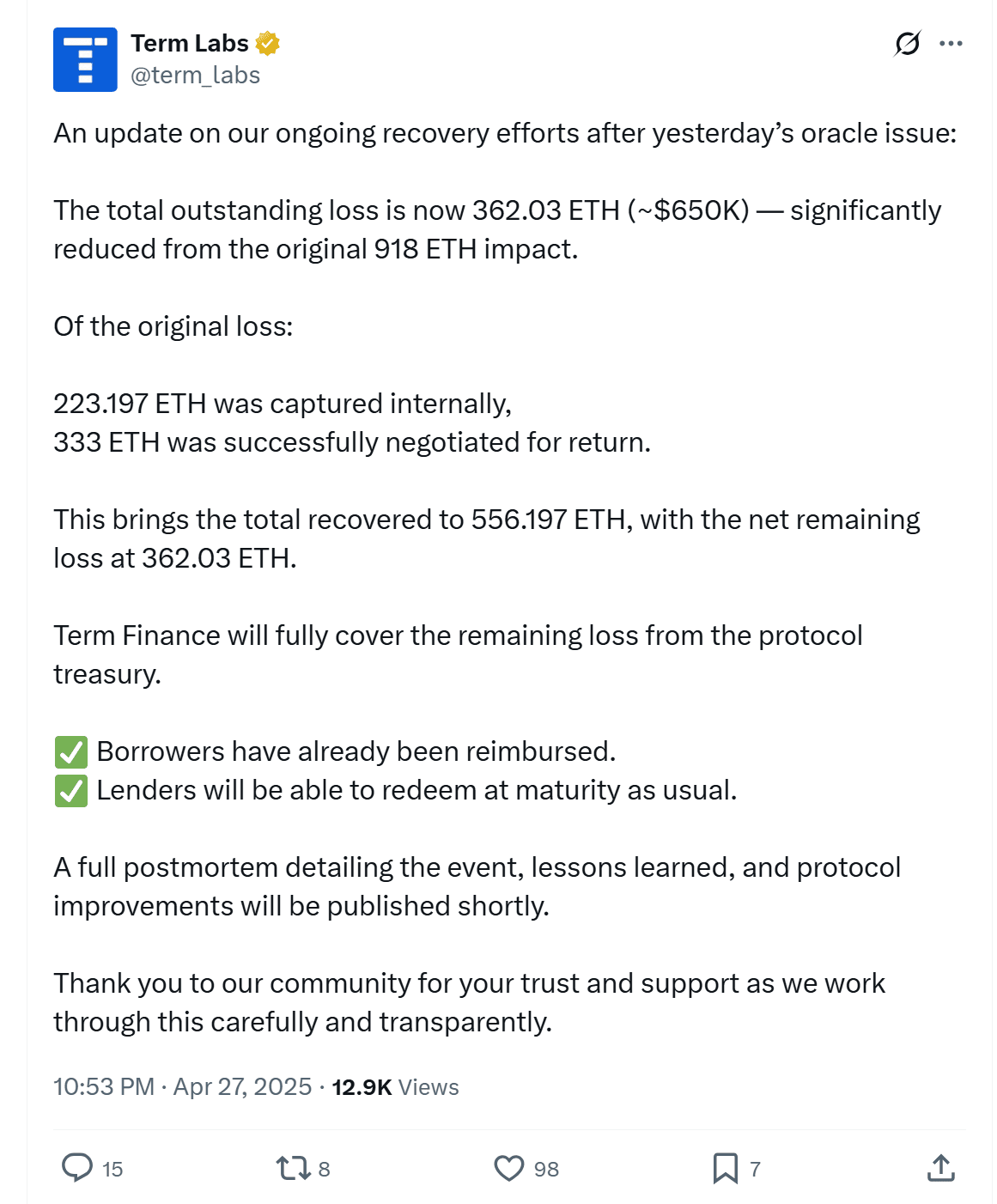

On April 27, Ethereum-based lending protocol Term Finance announced the recovery of $1 million out of the $1.6 million lost in an incident involving a misconfigured oracle on its Treehouse (tETH) market. The team recovered 223 Ether (ETH) internally and another 333 ETH through negotiations.

The Bigger Picture: Crypto Hack Losses in Q1 2025

Despite the positive developments in recovery efforts, the broader landscape of cryptocurrency security remains challenging. In the first quarter of 2025, hackers stole more than $1.6 billion worth of crypto from exchanges and on-chain smart contracts, according to blockchain security firm PeckShield.

A significant portion of these losses, over 90%, can be attributed to a $1.5 billion attack on Bybit, a centralized cryptocurrency exchange, allegedly carried out by the North Korean hacking group Lazarus Group. This highlights the continued vulnerability of both centralized and decentralized platforms to sophisticated cyberattacks.

Implications for DeFi Security

The Loopscale hack and subsequent recovery efforts have several important implications for DeFi security:

- Importance of Robust Security Audits: Thorough code audits are crucial to identify and address potential vulnerabilities before they can be exploited.

- Incident Response Planning: DeFi projects should have well-defined incident response plans in place to quickly address security breaches and minimize losses.

- Communication and Negotiation: Establishing communication channels with potential attackers and being willing to negotiate can be effective in recovering stolen funds.

- Collaboration and Information Sharing: Increased collaboration between DeFi projects, security firms, and law enforcement agencies is essential to combat cybercrime in the DeFi space.

Conclusion

Loopscale’s recovery of $2.8 million after a $5.7 million exploit is a significant achievement and demonstrates the potential for successful fund recovery in the DeFi space. However, the broader context of increasing crypto hack losses highlights the ongoing challenges and the need for continuous improvement in security measures. As the DeFi ecosystem continues to evolve, it is crucial for projects to prioritize security, implement robust protocols, and collaborate to protect users and their assets.