MEXC Launches $100 Million User Protection Fund: A Safety Net for Crypto Traders?

Crypto exchange MEXC has rolled out a $100 million user protection fund aimed at shielding its users from major platform breaches, technical failures or other serious security threats.

The fund is structured to compensate users in the event of major security incidents, including breaches of the platform’s infrastructure, critical system vulnerabilities or large-scale targeted hacks, the exchange told Cointelegraph.

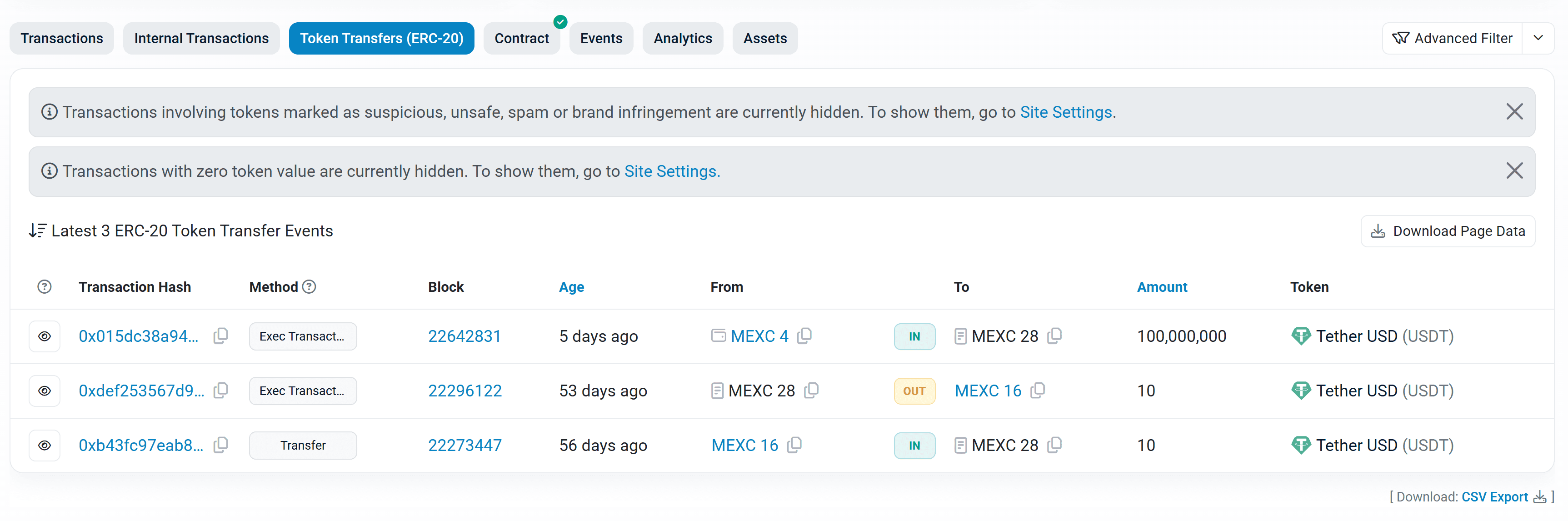

MEXC has also published wallet addresses linked to the fund on its website, allowing users to verify balances and monitor fund activity in real-time. A dedicated web portal will also provide information about the fund’s structure, covered scenarios and ongoing compensation cases.

According to the company, the fund will offer coverage in cases where MEXC systems are directly compromised or affected by serious vulnerabilities.

“This isn’t just about promises, it’s about accountability and delivering visible safeguards when they matter most,” said Tracy Jin, MEXC’s chief operating officer.

Quick Summary of the News:

- MEXC launches a $100 million user protection fund.

- The fund aims to protect users from platform breaches and security threats.

- Wallet addresses are public for transparency.

- Compensation decisions are made by an internal team.

- MEXC is exploring third-party auditing for enhanced oversight.

Why It Matters:

In the volatile world of cryptocurrency, security is paramount. MEXC’s initiative addresses growing concerns about exchange vulnerabilities and the potential loss of user funds. By creating a substantial protection fund, MEXC aims to build trust and attract users who prioritize platform security. This move could set a precedent for other exchanges and potentially raise the bar for security standards across the industry.

Market Impact:

The launch of this fund could positively impact MEXC’s trading volume and user base. Here’s a comparative look at how MEXC stacks up against other major exchanges:

| Exchange | User Protection Fund | Daily Spot Trading Volume (USD) |

|---|---|---|

| MEXC | $100 Million | $3.98 Billion |

| Binance | SAFU Fund | ~$10 Billion |

| Coinbase | Insurance Coverage | ~$2 Billion |

Note: The SAFU fund size is not public, Binance uses 10% of all trading fees in its SAFU fund.

Expert Take/Personal Insight:

MEXC’s move is a welcome step towards enhancing user security. While the fund size is relatively small compared to the exchange’s daily trading volume (approximately 2.5%), the commitment to transparency with publicly viewable wallet addresses is a significant positive. It signals a willingness to be accountable. However, the long-term effectiveness hinges on the speed and fairness of the compensation process. Future partnerships with reputable auditing firms will be crucial in solidifying user confidence.

Actionable Insight:

For traders and investors, this news underscores the importance of platform security when choosing an exchange. Here’s what you should do:

- Monitor MEXC’s fund activity: Keep an eye on the public wallet addresses to track fund balances and transactions.

- Evaluate MEXC’s compensation process: Follow news and user reports regarding compensation payouts to assess the fund’s effectiveness in real-world scenarios.

- Diversify your holdings: As a general risk management strategy, avoid keeping all your crypto assets on a single exchange.

- Compare security measures: Research and compare the security protocols and protection funds offered by different exchanges.

Conclusion:

MEXC’s user protection fund is a positive development that could contribute to a more secure crypto trading environment. As the industry matures, initiatives like this will be vital in fostering trust and encouraging wider adoption. It remains to be seen how effectively the fund will operate in practice, but the move signals a growing awareness of the need for robust security measures within the crypto space.