Bitcoin (BTC) experienced a notable surge, reaching a 45-day high, coinciding with gold’s record highs. This movement reflects investor anxieties surrounding potential economic downturns amidst global trade uncertainties. This article delves into the factors influencing Bitcoin’s price, examining whether data supports a rally above $95,000.

Key Takeaways:

- Bitcoin’s Surge: Reached a 45-day high, mirroring gold’s performance amid economic concerns.

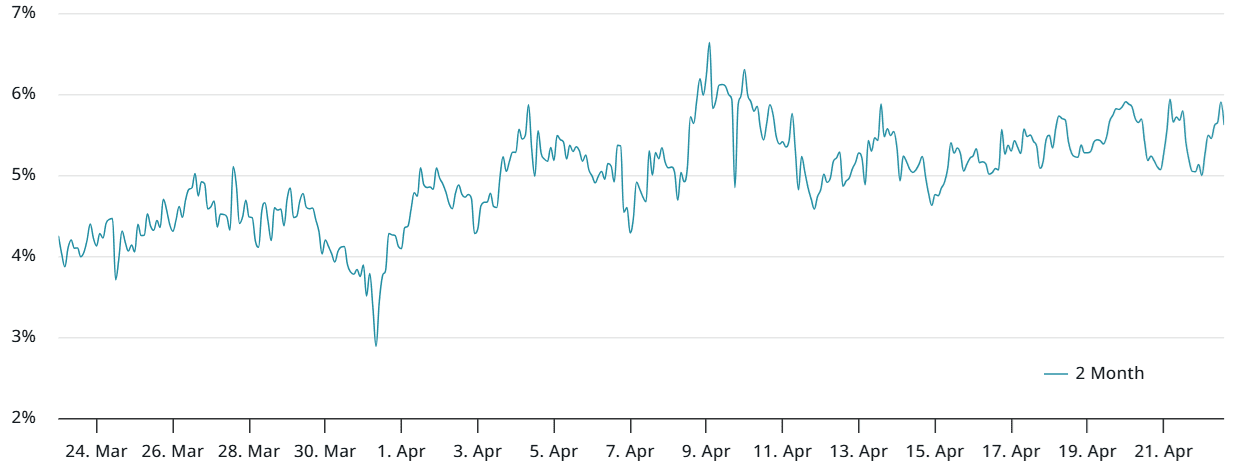

- Futures Premium: Currently at 6%, considered neutral, suggesting limited bullish conviction despite recent gains.

- Trader Skepticism: Lingering doubts due to Bitcoin’s previous failures to sustain levels above $90,000.

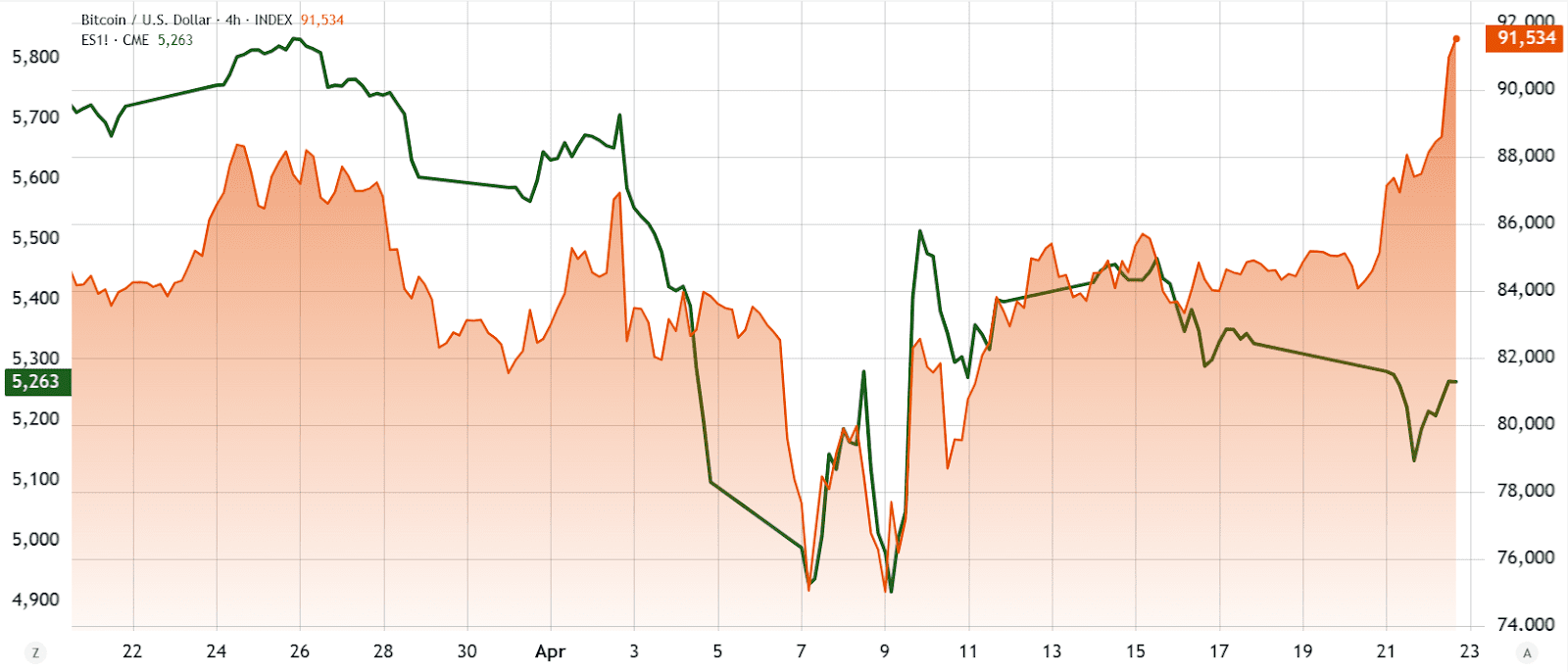

- Correlation with S&P 500: Bitcoin’s performance mirrors the S&P 500’s decline, indicating a shift away from excessive risk-taking.

- Trade War De-escalation: Positive comments from US Treasury Secretary regarding trade tensions potentially boosting investor confidence.

- Investor Shift to Bonds: Increased demand for US Treasurys signals a preference for safety over high returns.

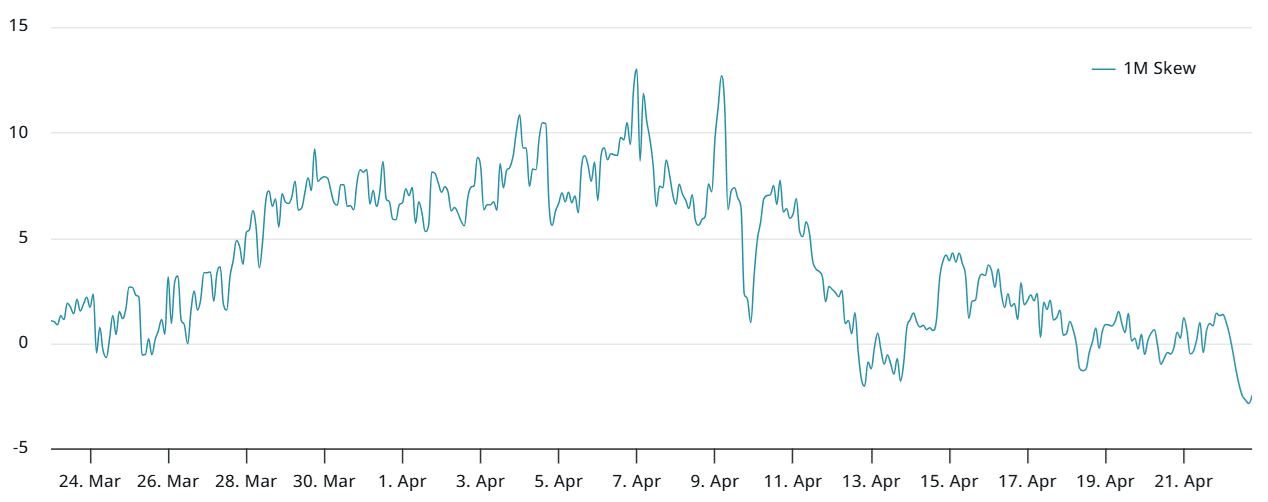

- Options Market Sentiment: Neutral, with no clear indication of a sustained rally above $95,000 anticipated by large investors.

Bitcoin’s Recent Performance

Bitcoin’s upward movement correlated with gold hitting all-time highs, driven by investor concerns about a potential economic recession fueled by global trade tensions. The question remains: can Bitcoin sustain this momentum and break through the $95,000 resistance level?

Analyzing Bitcoin Futures

The Bitcoin futures premium, typically between 5% and 10% in neutral markets, currently stands at 6%. While positive, it doesn’t signal strong bullish sentiment, even with Bitcoin’s recent price appreciation. This suggests a cautious approach from investors, despite the positive price action.

Trader Sentiment and Past Failures

Memories of Bitcoin’s inability to maintain levels above $90,000 in early March contribute to trader skepticism. The repeated failures to sustain upward momentum have instilled a lack of conviction among bullish investors, especially compared to gold’s consistent performance.

Bitcoin’s Correlation with Traditional Markets

Bitcoin’s 16% decline from its all-time high mirrors the S&P 500’s 14.5% drop, indicating a potential return to more risk-averse investment strategies. Even at its lowest point, Bitcoin’s drawdown was less severe than those experienced by major tech stocks, highlighting its relative resilience.

Impact of US Trade Policy and Monetary Policy

Comments from US Treasury Secretary Scott Bessent, suggesting a possible de-escalation of the trade war with China, have eased investor concerns. However, President Trump’s criticism of Federal Reserve Chair Jerome Powell adds another layer of complexity to the economic outlook.

Investor Shift to Government Bonds

The increased demand for short-term US Treasurys, evidenced by the declining yield on the 2-year note, demonstrates a preference for safety over higher returns. In this environment, Bitcoin’s 6.3% price increase stands out, suggesting a degree of investor confidence despite the broader economic uncertainties.

Bitcoin Options Market Analysis

The Bitcoin options market reflects limited enthusiasm following the recent price surge. The 25% delta skew indicator remains within the neutral range, indicating no clear expectation of a sustained rally above $95,000 among large investors and market makers. The last period of bullish sentiment occurred in late January, when Bitcoin traded near $105,000.

Broader Market Context

Despite some weak macroeconomic data, market participants anticipate a strong first-quarter earnings season, particularly from the “Magnificent 7” companies. These companies are projected to achieve significant earnings growth compared to the previous year.

Conclusion: The Path to $95,000

While Bitcoin retains a reasonable chance of revisiting $95,000 or higher, many traders are awaiting further developments in the US-China trade war before committing to additional bullish positions. The combination of macroeconomic factors, investor sentiment, and options market data suggests a cautious, yet optimistic outlook for Bitcoin’s near-term price action.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.