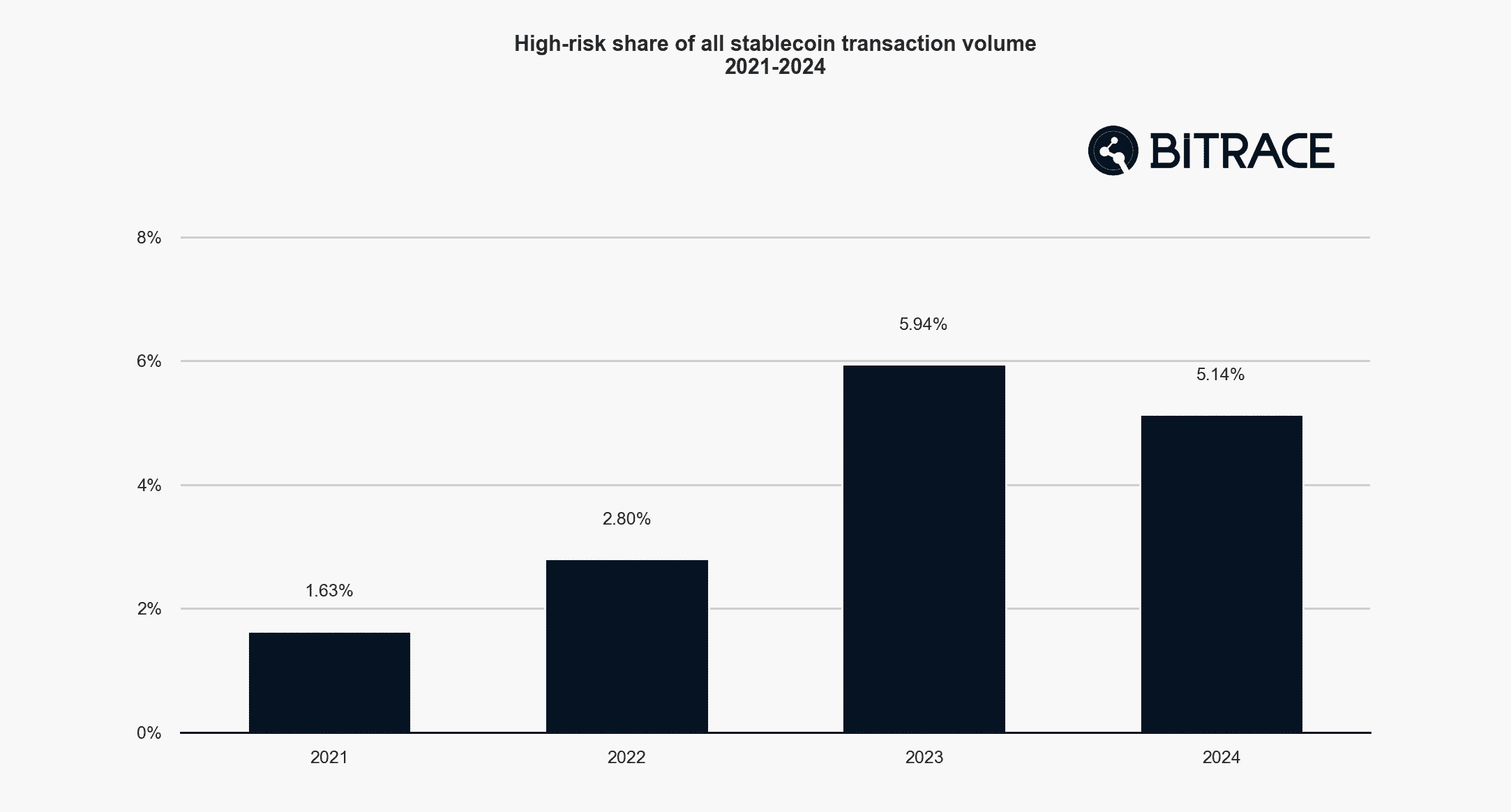

A recent report by cryptocurrency compliance firm Bitrace has revealed that a staggering $649 billion worth of stablecoins was transferred through addresses classified as high-risk in 2024. This figure represents approximately 5.14% of the total stablecoin transaction volume for the year, raising concerns about the use of these digital assets in illicit activities.

This comprehensive report, released on April 29th, sheds light on the evolving landscape of crypto crime and the role stablecoins play within it. Understanding these trends is crucial for regulators, crypto businesses, and users alike to mitigate risks and foster a safer digital economy.

Bitrace defines high-risk blockchain addresses as those associated with illegal entities involved in receiving, transferring, or storing stablecoins. These addresses are flagged based on various factors, including involvement in known scams, money laundering schemes, and other criminal activities. Crypto compliance firms use sophisticated scoring systems to assess the risk level of crypto wallet addresses, helping businesses identify and avoid transactions with potentially illicit sources.

While the 5.14% figure is significant, it’s worth noting that it represents a decrease of 0.8% compared to the 5.94% reported in 2023. However, it’s substantially higher than the 2.8% recorded in 2022 and the 1.63% in 2021, indicating a fluctuating trend in the use of stablecoins for illicit purposes.

Key Findings of the Bitrace Report

The Bitrace report provides several key insights into the use of stablecoins in illicit activities. These findings include:

- Significant Volume: $649 billion in stablecoins linked to illicit activity.

- Percentage of Total Volume: 5.14% of all stablecoin transactions.

- Year-over-Year Trend: Decrease from 5.94% in 2023, but higher than previous years.

Tron-Based USDT Dominates High-Risk Transactions

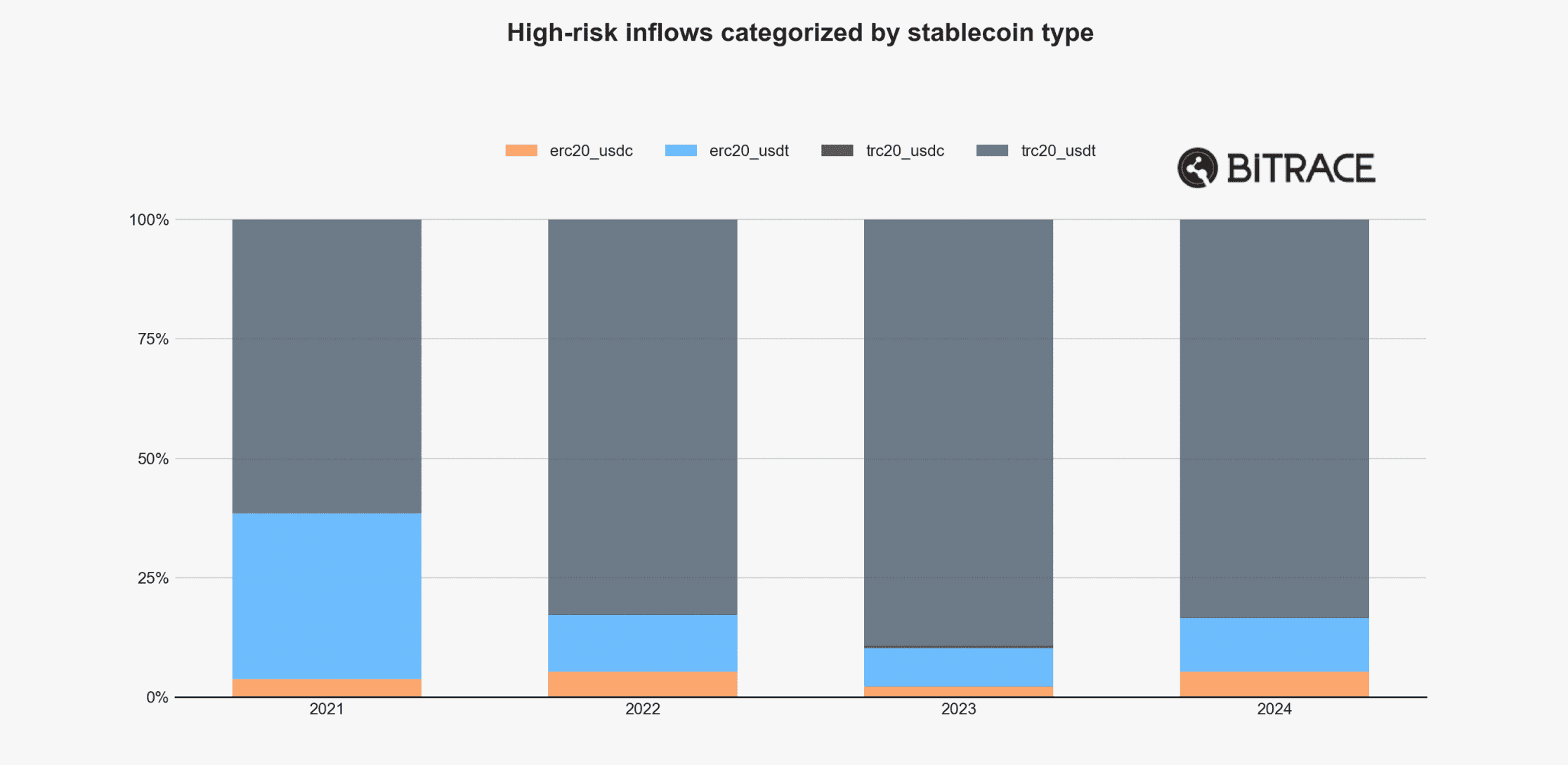

The report highlights that Tron-based USDt (USDT) is the dominant stablecoin used in high-risk transactions. Bitrace data indicates that well over 70% of the illicit stablecoin volume moved on the Tron network. The remaining portion is primarily Ethereum-based USDt and a small amount of USDC (USDC).

The prevalence of USDT is likely due to its widespread adoption and larger market capitalization compared to other stablecoins. As of the latest data, USDT boasts a market cap of over $148 billion, while USDC stands at over $62 billion. This higher liquidity and broader acceptance make USDT a more attractive option for both legitimate and illicit actors.

While Ethereum remains a popular choice for stablecoin users overall, Tron holds a significant portion of the USDT supply. Currently, Tron holds approximately 47.4% of the total USDT supply, slightly more than Ethereum’s 45.44%. This dominance in USDT supply on the Tron network contributes to its higher usage in high-risk transactions.

The Role of Decentralization and Regulatory Challenges

The decentralized nature of the Tron network may also contribute to its higher usage in illicit transactions. Decentralized platforms often face challenges in implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) measures, making it easier for bad actors to operate without detection. However, Tether, the issuer of USDT, has been actively working to combat illicit activity on the Tron network and has even launched a financial crime unit in collaboration with Tron.

Crypto Gambling Fuels Stablecoin Transactions

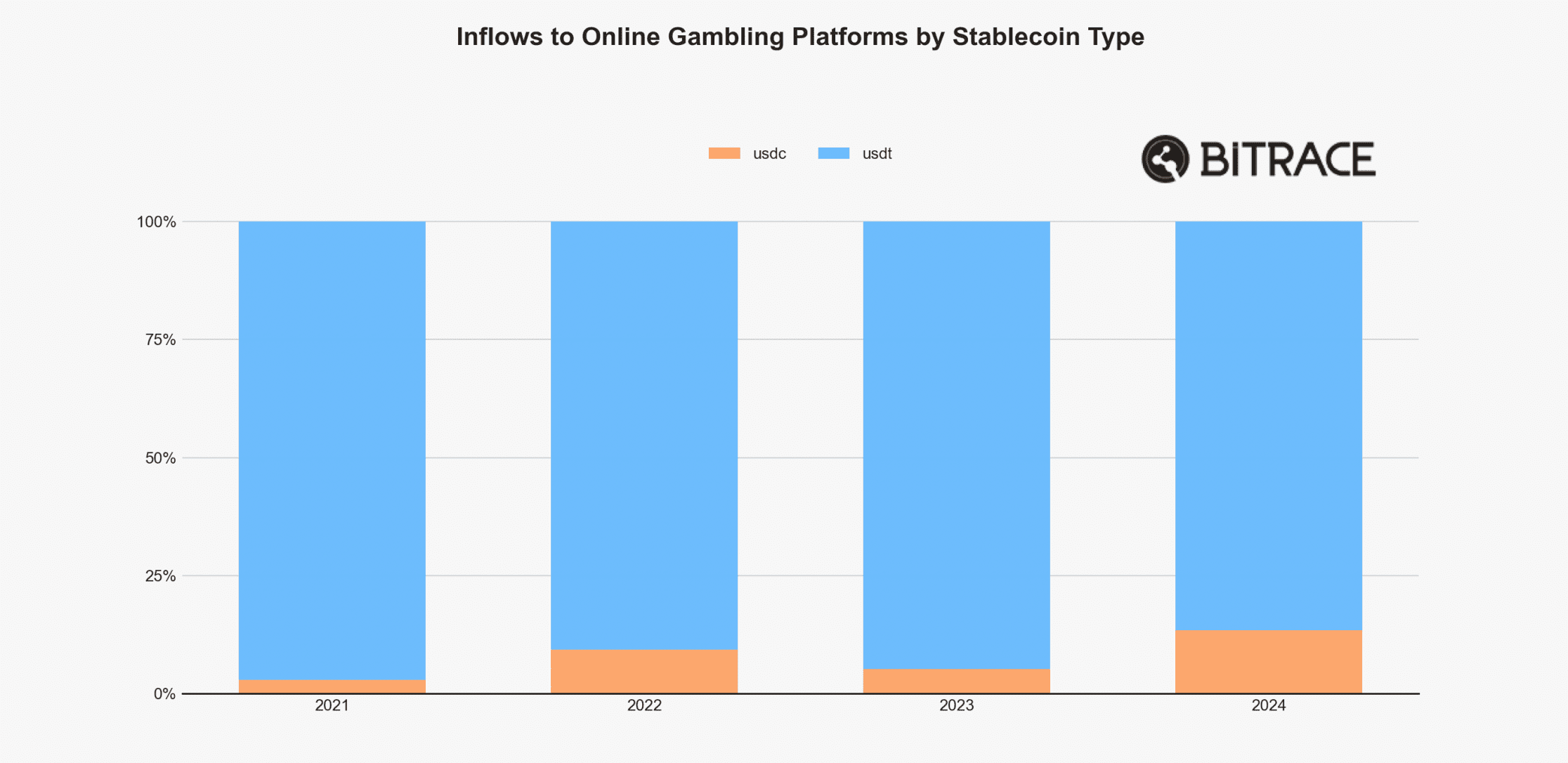

Another significant finding of the Bitrace report is the growing use of stablecoins in online gambling platforms. In 2024, these platforms processed $217.8 billion worth of stablecoins, marking a 17.5% increase over the previous year.

USDT again dominated this activity, but USDC’s market share is rapidly increasing. In 2024, USDC accounted for 13.36% of stablecoin inflows to gambling platforms.

Increased Scrutiny and Regulatory Action

The rise of crypto gambling and its connection to stablecoin usage has drawn increased scrutiny from regulators worldwide. Many jurisdictions are cracking down on unlicensed crypto casinos, blocking access to these platforms and imposing stricter regulations on crypto transactions. The blurred lines between gambling and other forms of investment also make regulation more challenging.

Implications for the Crypto Industry

The Bitrace report serves as a crucial reminder of the ongoing challenges the crypto industry faces in combating illicit activities. While the overall percentage of stablecoin transactions linked to crime has decreased slightly, the sheer volume of funds involved remains substantial. Key takeaways for the industry include:

- Enhanced Compliance: Crypto businesses must strengthen their KYC and AML procedures to identify and prevent illicit transactions.

- Collaboration with Regulators: Proactive engagement with regulatory bodies is essential to develop effective frameworks for combating crypto crime.

- Transparency and Traceability: Improving the transparency and traceability of stablecoin transactions can help law enforcement agencies track and recover illicit funds.

- Ongoing Monitoring: Continuous monitoring of blockchain activity is necessary to identify emerging trends and adapt strategies to combat evolving criminal tactics.

By addressing these challenges and working together, the crypto industry can build a more secure and trustworthy ecosystem, fostering greater adoption and innovation in the years to come.