The United States exchange Nasdaq has filed with regulators seeking approval to list a 21Shares exchange-traded fund (ETF) that holds Dogecoin (DOGE). This move follows similar applications from other asset managers like Bitwise and Grayscale, signaling increasing institutional interest in Dogecoin.

To list and trade the fund, Nasdaq requires approval from the Securities and Exchange Commission (SEC). This regulatory review process will determine if Dogecoin becomes more accessible to a wider range of investors through an ETF structure.

The Rise of Altcoin ETFs

The filing comes amidst a surge in requests to list various altcoin ETFs. This increased interest may be influenced by factors such as a potentially more favorable regulatory environment and growing investor demand for exposure to cryptocurrencies beyond Bitcoin and Ethereum.

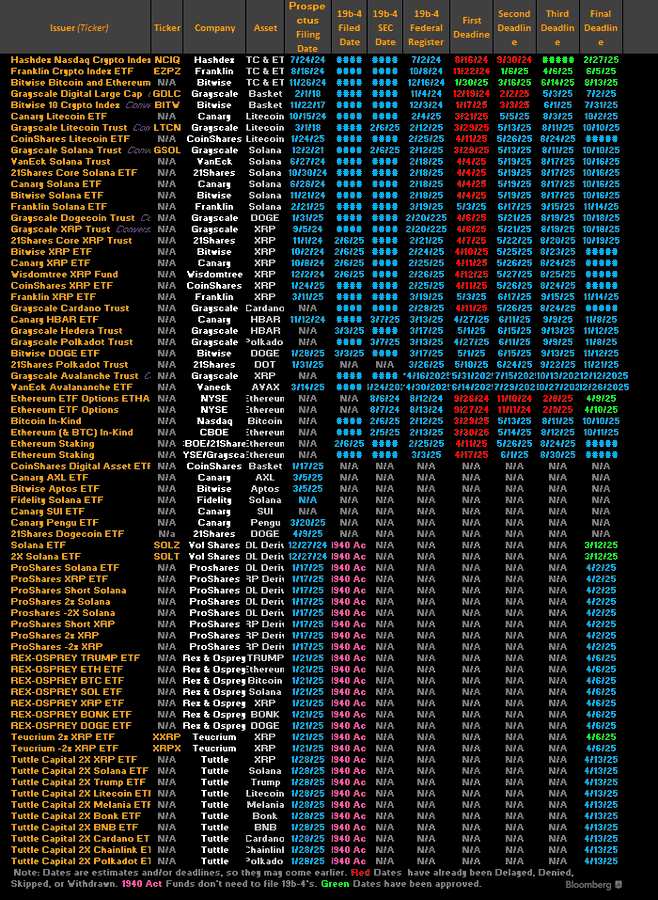

As of April 2025, over 70 crypto ETFs are awaiting SEC review, encompassing various alternative layer-1 (L1) tokens like Solana (SOL) and Sui (SUI), as well as memecoins like Bonk (BONK) and Official Trump (TRUMP).

While exchanges like Nasdaq aim to list more crypto ETFs, they also advocate for stricter regulatory oversight of digital assets. They’ve urged the SEC to apply the same regulatory standards to digital assets as securities if they function as “stocks by any other name.”

Understanding Dogecoin’s Value and Utility

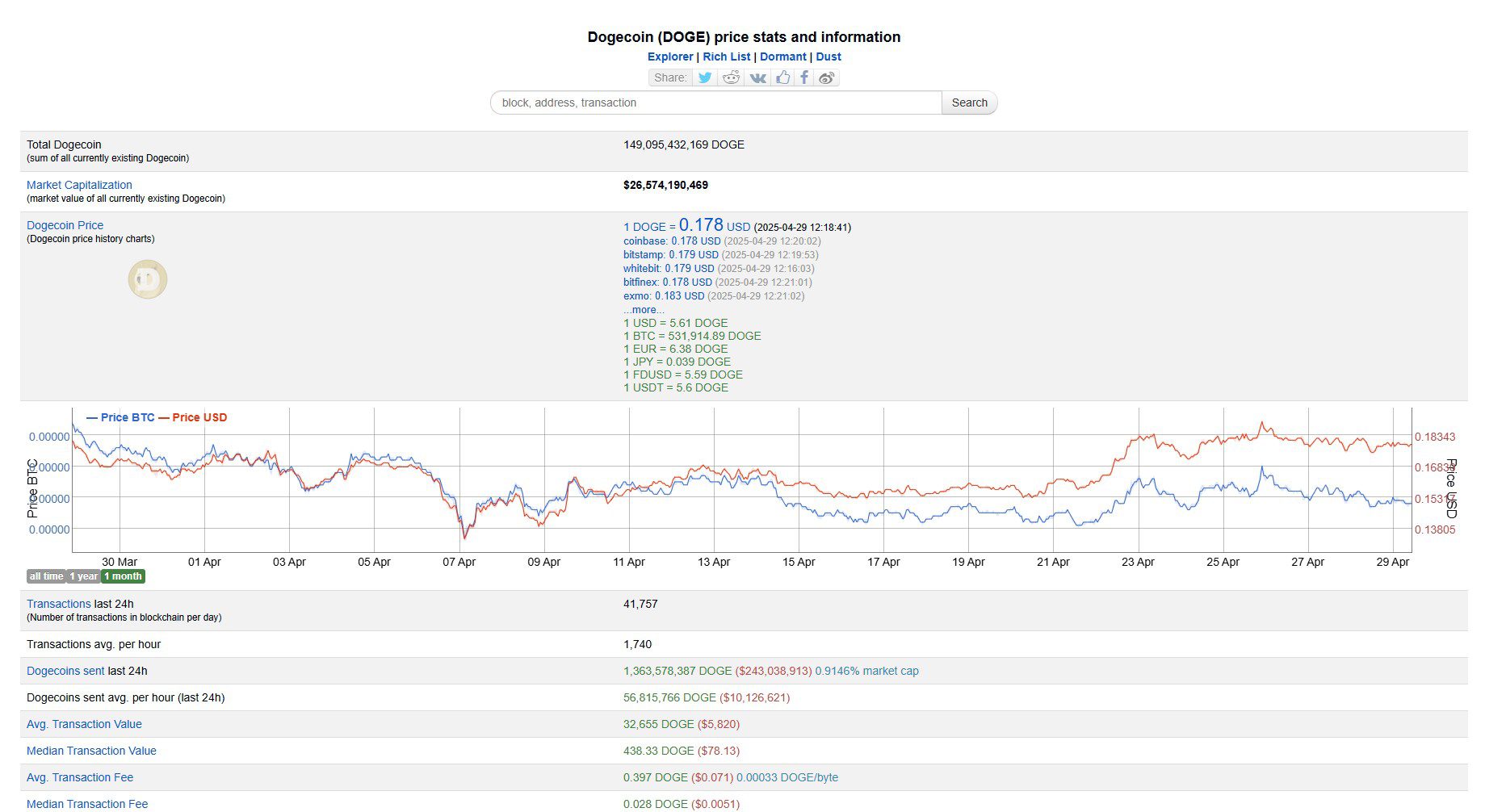

Dogecoin (DOGE) is a popular memecoin with a significant market capitalization. Despite its origins as a meme, Dogecoin has evolved into a functional cryptocurrency with a dedicated community.

Key features and characteristics of Dogecoin include:

- Transaction Speed: Designed to be a faster, cheaper alternative to Bitcoin for peer-to-peer payments.

- Active Network: Processes a substantial number of transactions daily, indicating ongoing usage.

- Community Support: Benefits from a large and active community that contributes to its development and adoption.

- Layer-2 Solutions: Developers are exploring layer-2 scaling solutions to enhance Dogecoin’s capabilities, including enabling smart contracts.

Potential Impact of a Dogecoin ETF

The approval of a Dogecoin ETF could have several significant implications:

- Increased Accessibility: An ETF would make Dogecoin accessible to a wider range of investors, including those who prefer traditional investment vehicles.

- Price Discovery: The ETF could contribute to more efficient price discovery for Dogecoin, as it would be traded on regulated exchanges.

- Institutional Investment: Approval could attract further institutional investment in Dogecoin, potentially boosting its price and adoption.

- Market Validation: An SEC-approved Dogecoin ETF would represent a significant validation of the cryptocurrency market, potentially paving the way for more altcoin ETFs.

Challenges and Considerations

Despite the potential benefits, there are also challenges and considerations associated with a Dogecoin ETF:

- Regulatory Uncertainty: The SEC has historically been cautious about approving crypto ETFs, and the approval process can be lengthy and uncertain.

- Volatility: Dogecoin, like other cryptocurrencies, is subject to significant price volatility, which could make it a risky investment for some.

- Market Manipulation: The relatively smaller market capitalization of Dogecoin compared to Bitcoin could make it more susceptible to market manipulation.

Conclusion

Nasdaq’s filing for a 21Shares Dogecoin ETF marks a significant step in the evolution of Dogecoin and the broader cryptocurrency market. While the SEC’s decision remains uncertain, the potential for increased accessibility, institutional investment, and market validation makes this a noteworthy development for DOGE enthusiasts and the digital asset space as a whole. Investors should carefully consider the risks and potential rewards before investing in Dogecoin or any cryptocurrency ETF.