Bitcoin Volatility Hits 563-Day Low: Hayes Predicts $1M BTC by 2028 – A Comprehensive Analysis

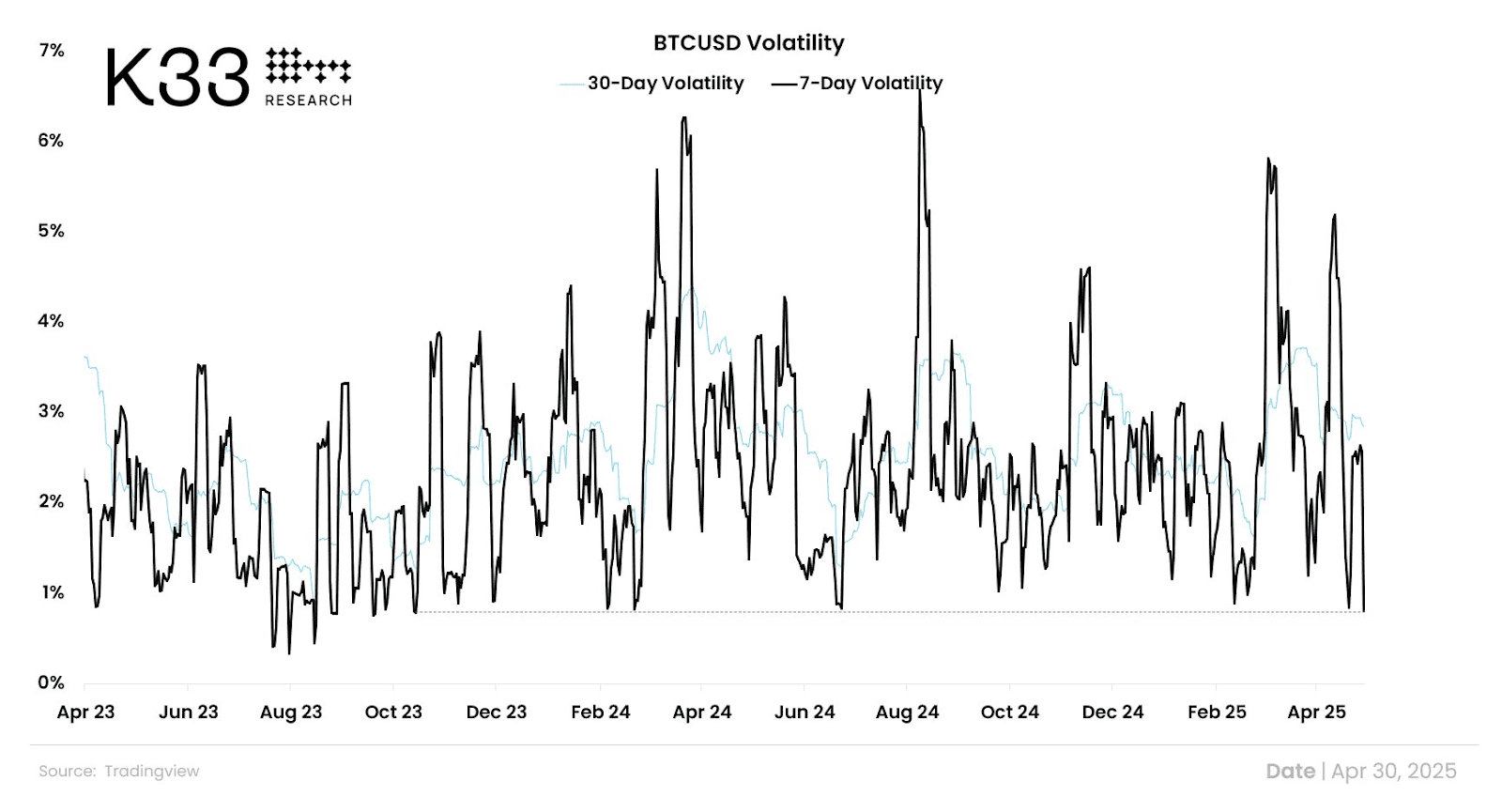

Bitcoin (BTC) is demonstrating increasing stability, with its weekly price volatility reaching a 563-day low on April 30, according to K33 Research. This indicates a potential shift in Bitcoin’s perception from a highly speculative asset to a more established financial instrument.

What is Volatility and Why Does it Matter?

Volatility refers to the degree of price fluctuation over a specific period. High volatility signifies rapid and unpredictable price swings, while low volatility suggests more stable and gradual price movements. For Bitcoin, decreasing volatility can be interpreted as a sign of growing acceptance and maturity, potentially attracting more risk-averse investors.

Vetle Lunde, the head of research at K33 Research, highlighted this milestone, emphasizing the growing maturity of Bitcoin as a global financial asset.

Bitcoin’s Rising Market Capitalization

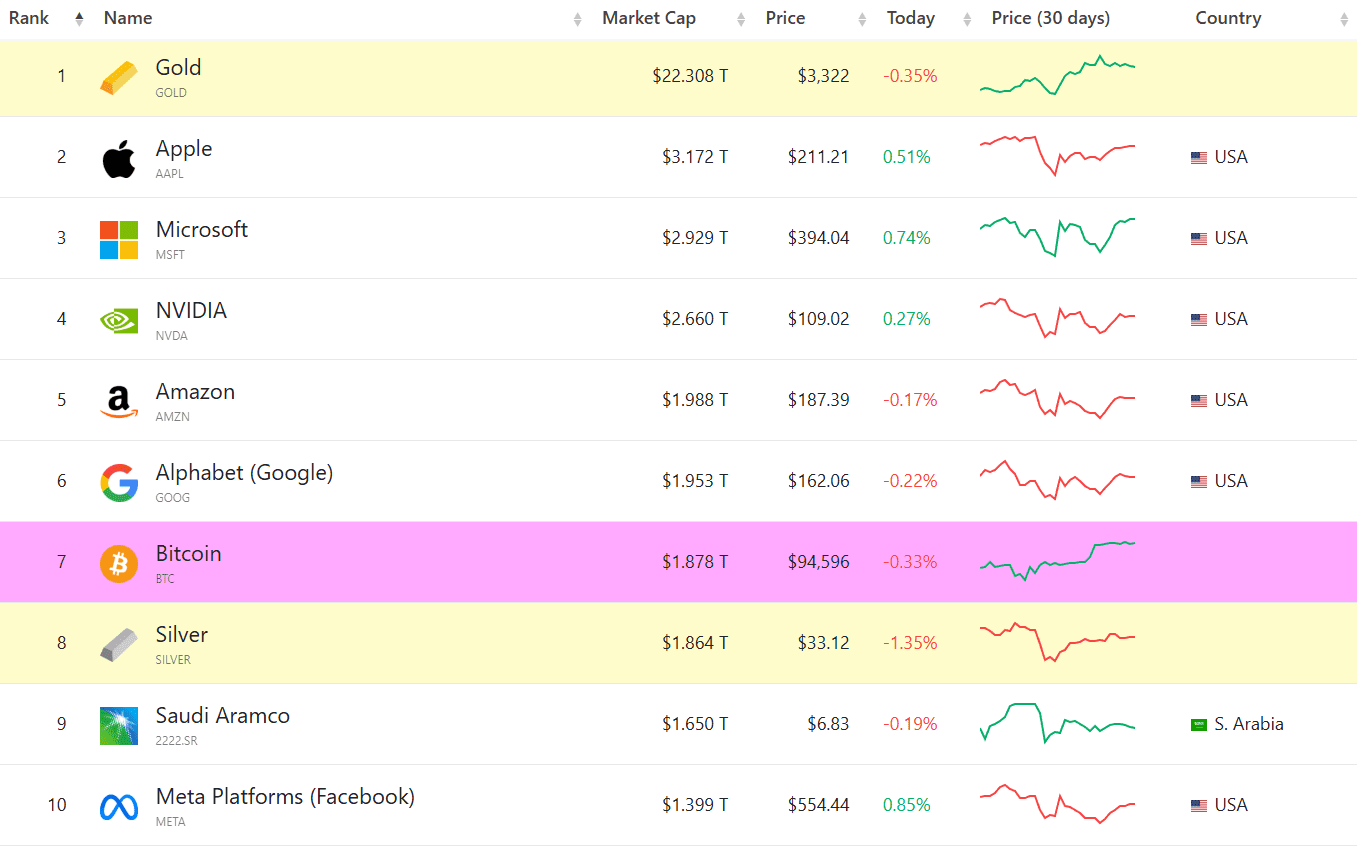

Bitcoin’s market capitalization has steadily increased, now ranking it among the top global assets. Surpassing Silver, Meta, and Saudi Aramco, Bitcoin’s $1.87 trillion valuation places it as the seventh-largest asset worldwide, according to Companiesmarketcap.

Decreasing Exchange Deposits

Analysts from Bitfinex exchange have noted a significant decline in Bitcoin exchange deposits. This trend suggests reduced selling pressure and an increased inclination towards long-term holding, further supporting the notion of growing confidence in Bitcoin’s future value.

According to Bitfinex analysts, the divergence between price stability and shrinking exchange balances is particularly noteworthy, especially following a $7.2 billion options expiry and heightened macro volatility. They suggest that similar patterns in the past have preceded upside continuation, as reduced supply meets sustained ETF and institutional bid.

BlackRock’s Bitcoin ETF Inflows

The demand for Bitcoin is further evidenced by the substantial inflows into Bitcoin ETFs. BlackRock’s Bitcoin exchange-traded fund (ETF) recently recorded $970 million worth of inflows, marking its second-largest day of investments on record. This indicates growing institutional interest and confidence in Bitcoin as an investment vehicle.

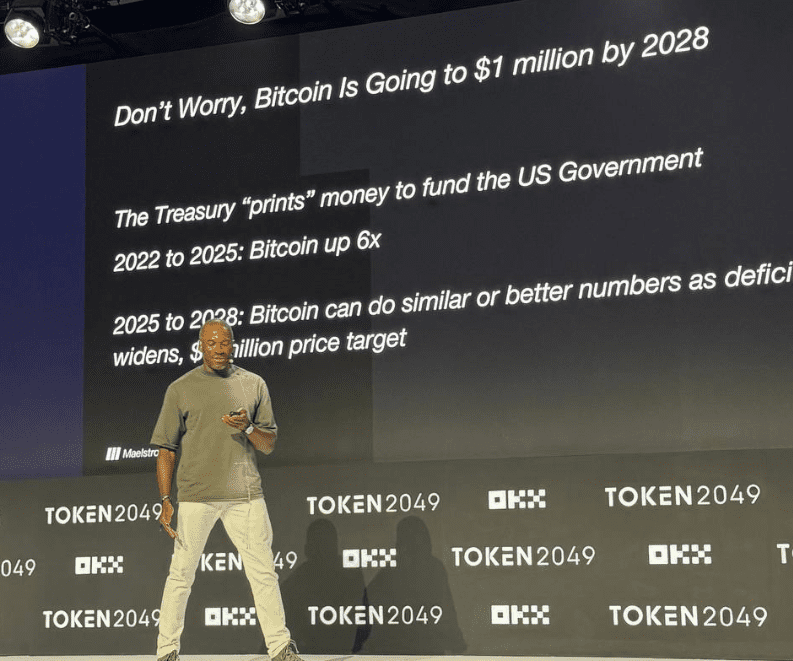

Arthur Hayes’ Bold Prediction: $1 Million Bitcoin by 2028

BitMEX co-founder Arthur Hayes has predicted that Bitcoin could reach $1 million by 2028. He attributes this potential surge to aggressive monetary policy and increasing institutional adoption.

Speaking at Token2049 in Dubai, Hayes stated, “It’s time to go long everything. Don’t worry, Bitcoin is going to $1 million by 2028,” citing upcoming money printing from the US Treasury as a key driver.

The Role of US Treasury Buybacks

Hayes also suggested that US Treasury buybacks could serve as a catalyst for Bitcoin’s next rally, potentially presenting a final opportunity to acquire Bitcoin below $100,000.

Treasury buybacks involve the US Treasury Department repurchasing its outstanding bonds from the open market. This process can increase liquidity, manage federal debt, and stabilize interest rates, potentially impacting the overall financial landscape and influencing investor behavior.

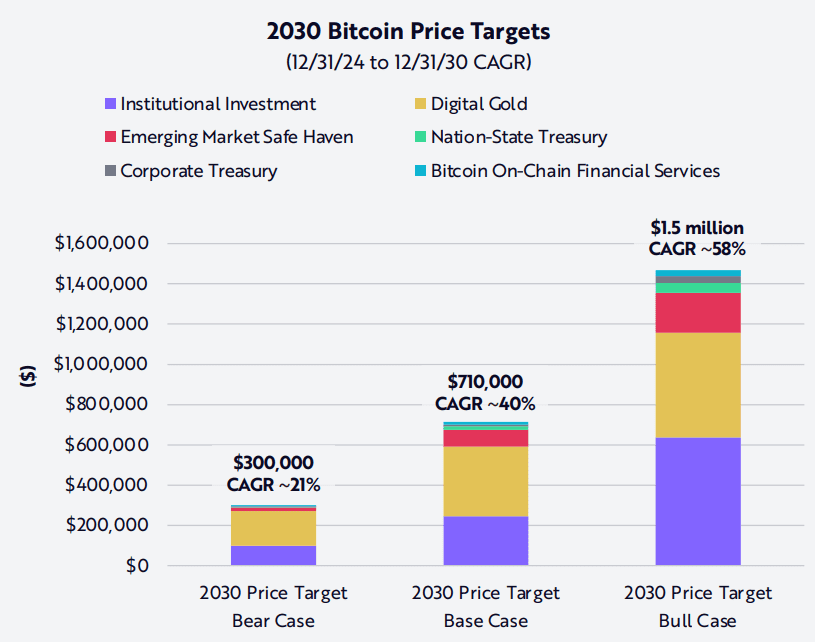

Cathie Wood’s $1.5 Million Target by 2030

ARK Invest CEO Cathie Wood has expressed increasing confidence in Bitcoin’s long-term potential, suggesting that it could surpass $1.5 million by 2030. This projection is based on the increasing institutionalization of the asset.

Wood believes that many institutional investors are now considering adding Bitcoin to their asset allocation strategies due to its unique return and risk profile.

A potential rally to $1.5 million would require Bitcoin to achieve an average compound annual growth rate of 58% over the next five years.

Key Takeaways:

- Bitcoin’s volatility has decreased significantly, indicating growing maturity.

- Bitcoin’s market capitalization ranks among the top global assets.

- Decreasing exchange deposits suggest reduced selling pressure.

- Bitcoin ETFs are experiencing substantial inflows, driven by institutional interest.

- Experts predict Bitcoin could reach $1 million (Hayes) or $1.5 million (Wood) in the coming years.

These factors collectively contribute to a more optimistic outlook for Bitcoin’s future, suggesting a potential shift towards greater price stability and broader acceptance as a mainstream financial asset.