Circle and Onafriq Partner to Transform Cross-Border Payments in Africa

Stablecoin issuer Circle has joined forces with Onafriq, Africa’s leading payments gateway, to tackle the high costs associated with cross-border transactions across the continent. The partnership leverages the power of USDC, a stablecoin pegged to the US dollar, to streamline payments and reduce fees.

This initiative aims to address a critical challenge in African finance: the reliance on traditional correspondent banking networks. Currently, over 80% of intra-African transactions are routed through banks outside the continent, settled in foreign currencies like the US dollar or euro. This process incurs approximately $5 billion in fees annually, hindering economic growth and financial inclusion.

Key Benefits of the Circle-Onafriq Partnership:

- Reduced Transaction Costs: USDC settlements within Onafriq’s network will significantly lower the fees associated with cross-border payments.

- Increased Efficiency: Streamlining the payment process through stablecoins eliminates intermediaries and reduces processing times.

- Enhanced Transparency: Blockchain technology ensures transparent and auditable transactions, fostering trust and accountability.

- Financial Inclusion: By making cross-border payments more accessible and affordable, the partnership promotes financial inclusion for individuals and businesses across Africa.

How USDC Integration Works:

Onafriq’s extensive network connects over 500 wallets and 200 million bank accounts in more than 40 African countries. By integrating USDC, Onafriq will enable users to send and receive payments seamlessly using the stablecoin. This bypasses the traditional correspondent banking system, resulting in faster, cheaper, and more transparent transactions.

Dare Okoudjou, founder and CEO of Onafriq, emphasizes the importance of this collaboration: “By integrating USDC, we aim to simplify financial transactions for institutions and individuals, reduce costs, and strengthen trust in digital financial services.”

Africa’s Growing Appetite for Stablecoins:

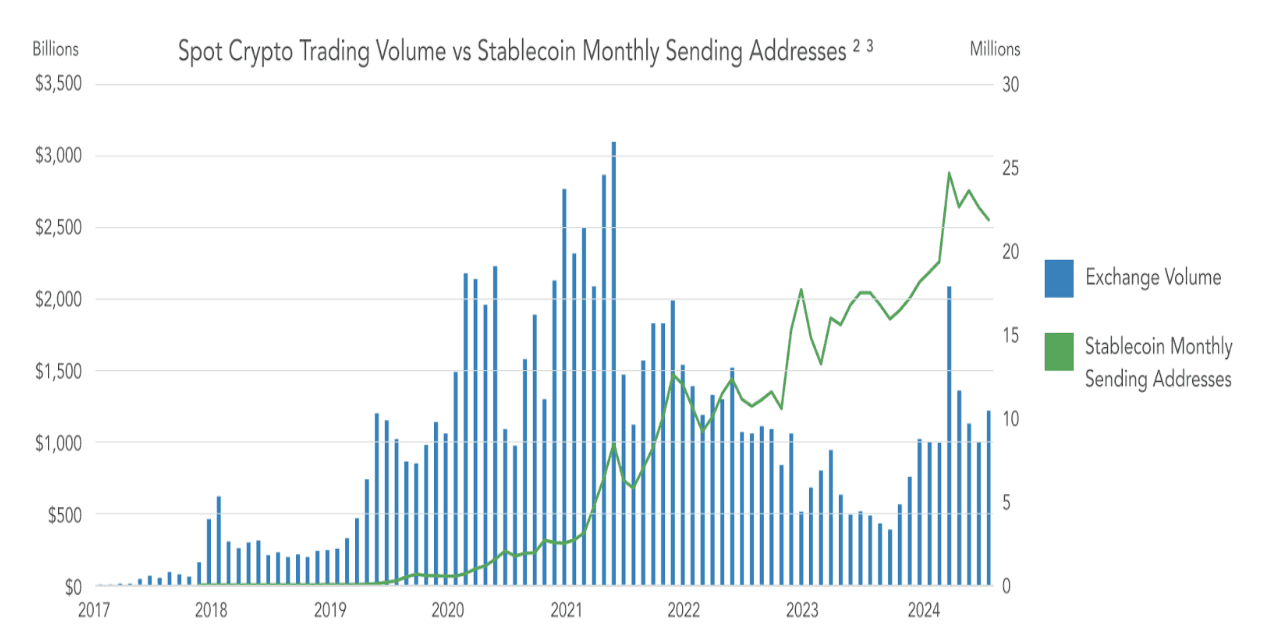

Africa is increasingly embracing stablecoins as a solution to currency devaluation and the inefficiencies of traditional payment systems. In Sub-Saharan Africa, stablecoin transactions accounted for approximately 43% of the region’s total transaction volume by October 2024, according to Chainalysis.

Miriam Kiwan, Vice President at Circle, highlights Africa’s potential for digital asset innovation: “Africa holds tremendous potential for digital asset innovation, particularly in the adoption of stablecoins for cross-border payments. Together, we aim to transform how money moves across borders, offering secure and transparent digital payment rails that enhance economic empowerment and connectivity.”

Circle’s Global Expansion Strategy:

This partnership aligns with Circle’s broader strategy of expanding USDC adoption globally. The company recently launched the Circle Payments Network (CPN), a consortium of financial institutions aimed at streamlining global fund movement using stablecoins. Circle has also received in-principle approval to operate as a regulated money services provider in Abu Dhabi, further expanding its reach in the Middle East.

The Future of Cross-Border Payments in Africa:

The collaboration between Circle and Onafriq marks a significant step towards revolutionizing cross-border payments in Africa. By leveraging the power of USDC, the partnership promises to reduce transaction costs, increase efficiency, and promote financial inclusion across the continent. As Africa continues to embrace digital innovation, stablecoins are poised to play an increasingly important role in facilitating economic growth and empowering individuals and businesses.

Potential Challenges and Considerations:

While the partnership holds immense potential, it’s crucial to acknowledge potential challenges. Regulatory frameworks surrounding stablecoins in Africa are still evolving, and navigating these complexities will be essential. Additionally, ensuring widespread adoption and educating users about the benefits and risks of stablecoins will be critical for the success of the initiative.

Conclusion:

The Circle and Onafriq partnership represents a significant advancement in the quest to improve cross-border payments in Africa. By embracing stablecoins and leveraging innovative technology, the collaboration has the potential to unlock new economic opportunities and empower individuals and businesses across the continent.