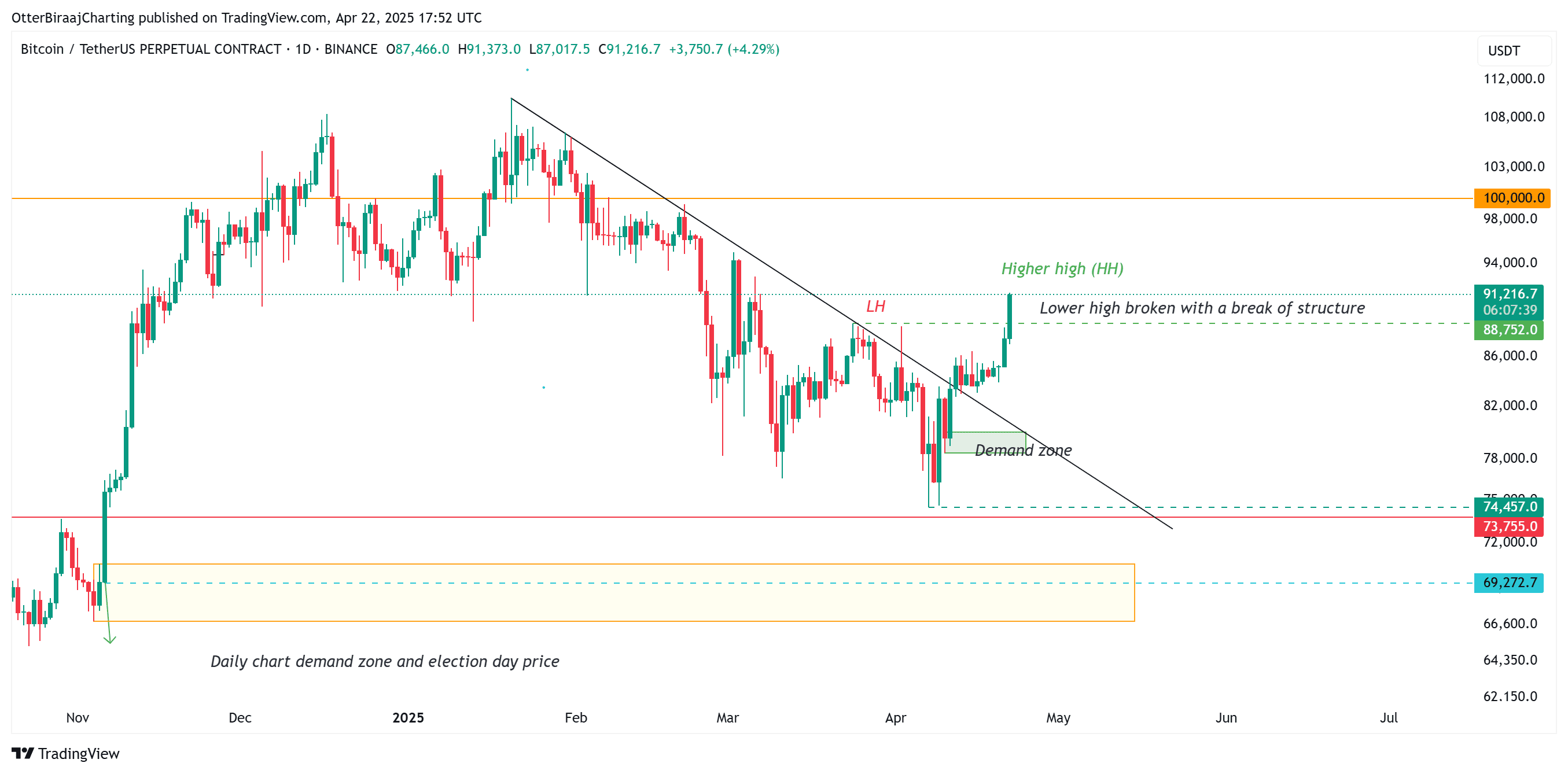

Bitcoin (BTC) has shown signs of a potential uptrend, breaking past $91,000 on April 22, marking its first higher high breakout of the year. This follows a period of persistent downtrend since January. The surge is supported by increased buying volumes within the Bitcoin market.

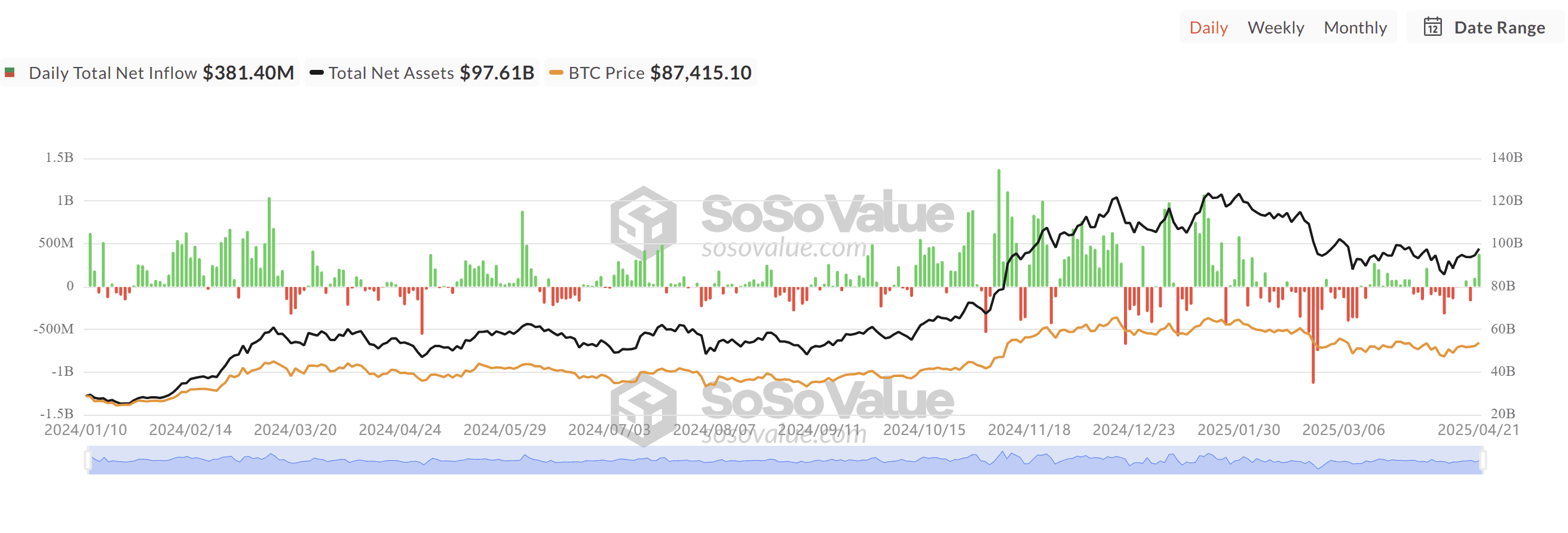

Spot Bitcoin ETF Inflows Surge

US spot Bitcoin ETFs recorded significant net inflows of $381 million on April 21, reaching levels not seen since January 30. This resurgence in ETF inflows, coupled with Bitcoin’s price increase, suggests a potential revival in institutional demand for Bitcoin. This shift in ETF trends could counteract the selling pressure that has constrained BTC’s price for several months.

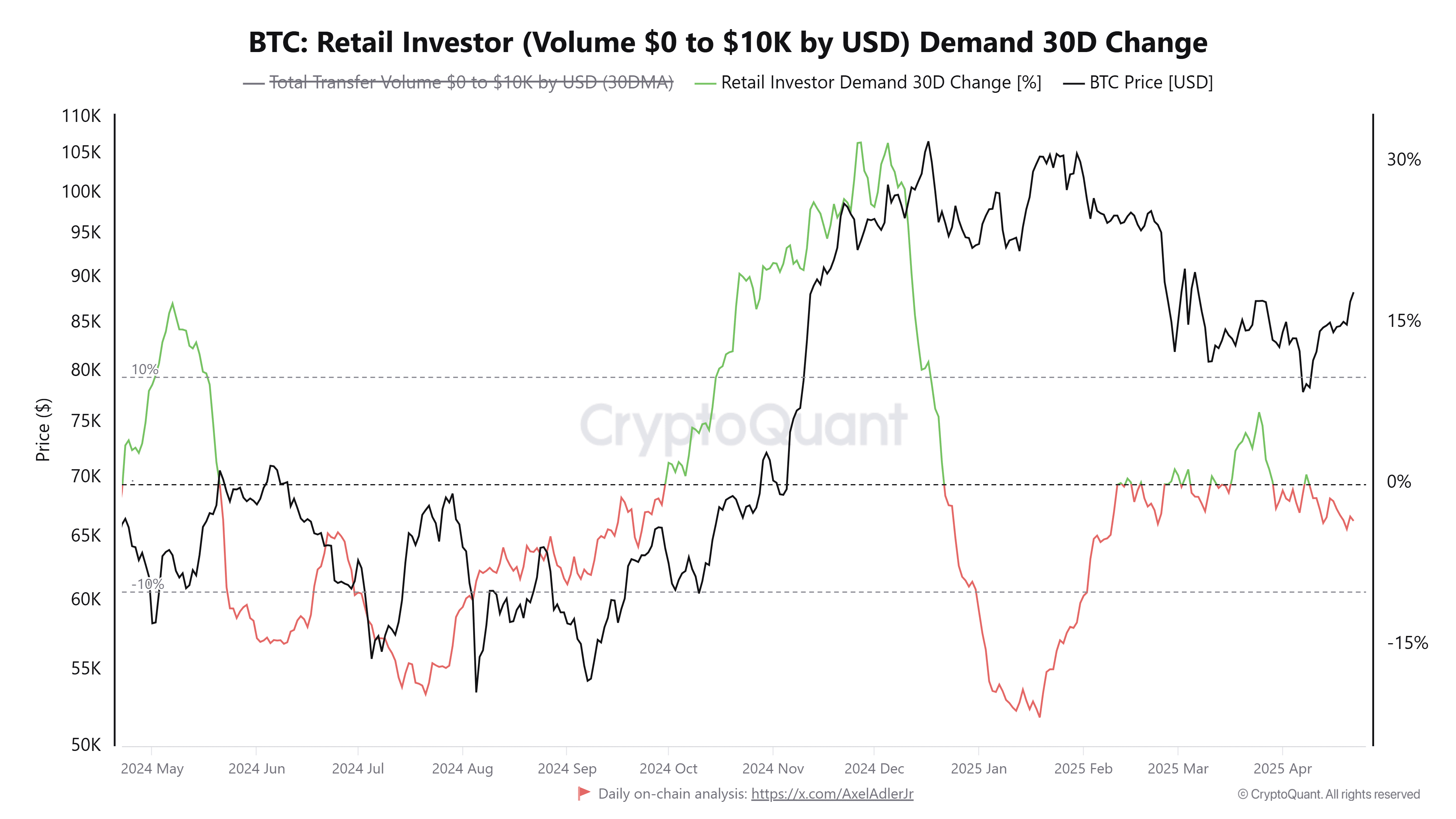

Retail Investor Demand Lagging

Despite the positive momentum, retail investor demand (buy volumes between $0 and $10,000) remains below 0%. This indicates that smaller volume buyers have not yet fully returned to the market. Historically, these investors tend to lag behind initial BTC price breakouts but typically strengthen price momentum once their volume turns positive.

Leverage-Driven Rally

Analysis suggests that the current rally is primarily driven by leverage rather than spot volume. Bitcoin futures open interest (OI) has increased significantly, indicating a higher level of speculative activity. For Bitcoin price to maintain a strong position above $90,000, the disparity between futures traders and retail traders needs to narrow.

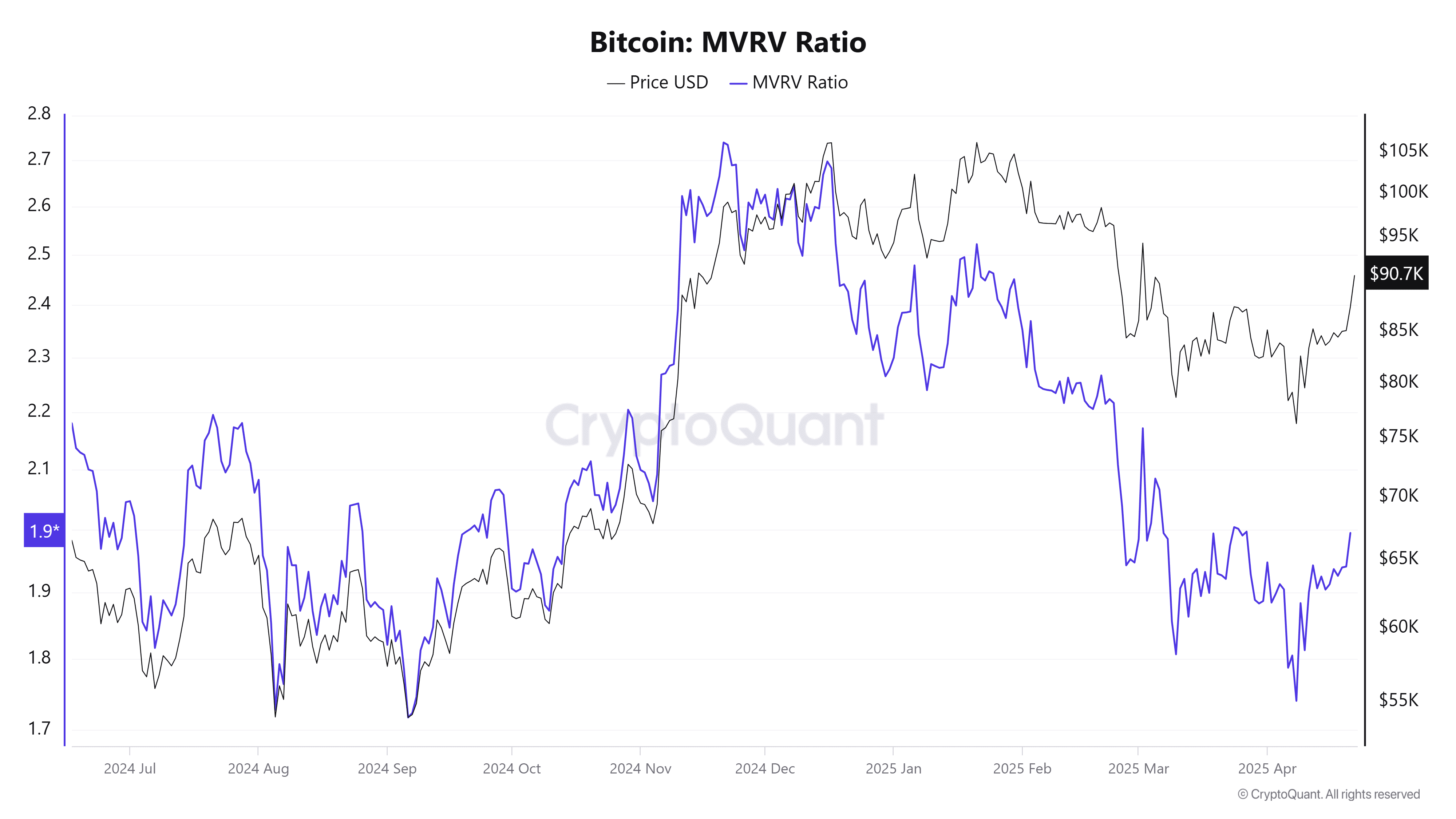

Potential for 70-80% Gain

According to crypto founder Hitesh Malviya, BTC could potentially gain 70% to 80% if it sustains an MVRV (Market Value to Realized Value) ratio of 2 for the next six weeks. The MVRV ratio compares Bitcoin’s market capitalization to its realized capitalization, providing insights into potential overvaluation or undervaluation.

Understanding the MVRV Ratio

The Market Value to Realized Value (MVRV) ratio is a crucial onchain metric used to assess Bitcoin’s valuation. It compares Bitcoin’s market cap to its realized cap. Historically, MVRV values above 3.7 often signify overvaluation and potential market tops, while values close to 2 have preceded robust price rallies. Bitcoin’s MVRV remained above 2 during its rise to all-time highs between October 2024 and February 2025. After falling below 2 during a market correction, the metric is now attempting to reclaim this pivotal level.

Key Takeaways:

- Bitcoin’s Recent Surge: Broke past $91,000, signaling a potential shift towards an uptrend.

- Spot ETF Inflows: Significant inflows indicate renewed institutional interest.

- Retail Investor Participation: Retail demand remains low, suggesting potential for future growth as they re-enter the market.

- MVRV Ratio: Maintaining an MVRV above 2 could lead to substantial price gains.

- Leverage-Driven Market: Current rally is fueled by futures trading, highlighting the need for balanced market participation.

In conclusion, while the recent surge in Bitcoin’s price is encouraging, several factors need to align for sustained growth. Increased retail participation and a balanced market dynamic between futures and spot trading are crucial for Bitcoin to realize its potential and maintain its position above $90,000.