Bitcoin to $200,000 by 2025? Institutional Demand Fuels Optimistic Forecasts

Two independent research reports from Standard Chartered and Intellectia AI suggest that Bitcoin (BTC) could surge to $200,000 per coin in 2025. This bullish prediction is primarily driven by increasing demand from financial institutions, particularly through Bitcoin exchange-traded funds (ETFs) and traders using Bitcoin as a hedge against macroeconomic uncertainties.

Fei Chen, Intellectia AI’s chief investment strategist, cautioned that unforeseen events could disrupt this trajectory: “While the forecast is optimistic, it’s also conditional. Any black swan — from a major regulatory clampdown to a geopolitical event — can disrupt trajectories.”

Key Factors Driving the Bitcoin Bull Run:

- Institutional Investment: The primary catalyst for the projected price increase is the growing acceptance and adoption of Bitcoin by institutional investors.

- Bitcoin ETFs: The launch of spot Bitcoin ETFs in the US has opened up Bitcoin to a wider range of investors, facilitating significant inflows.

- Macroeconomic Hedging: Investors are increasingly turning to Bitcoin as a hedge against inflation, geopolitical risks, and potential trade wars.

Bitcoin’s Recent Performance

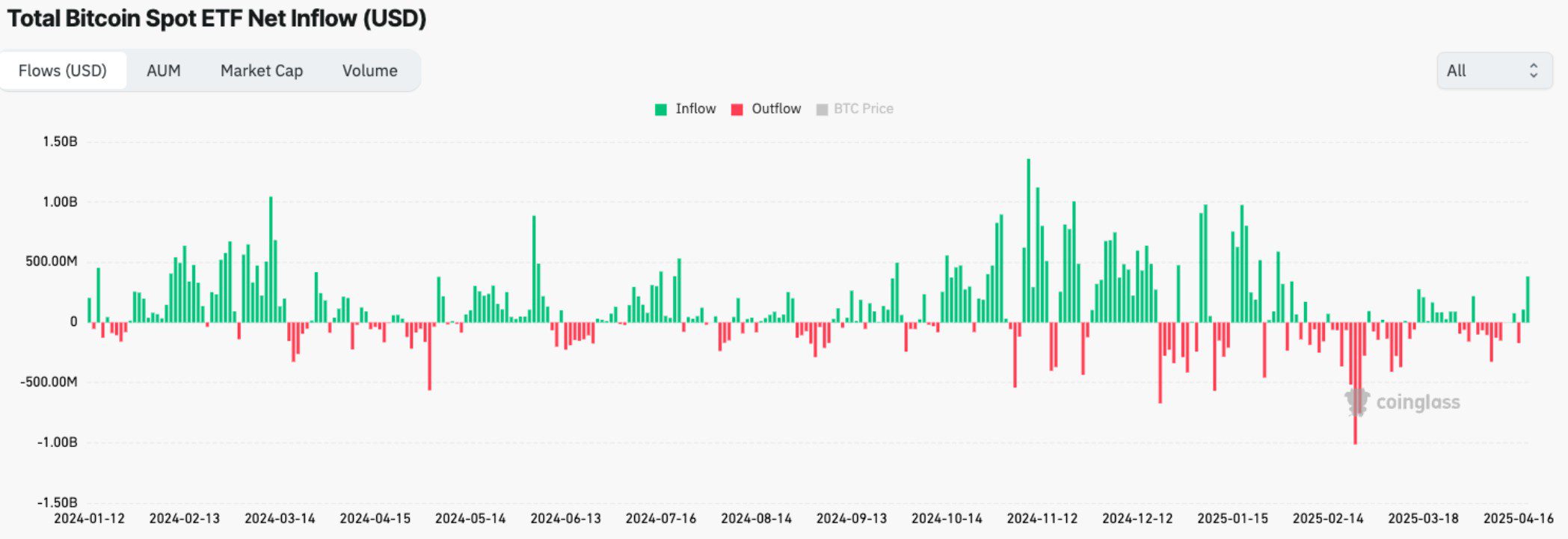

In April 2025, Bitcoin surpassed $90,000, marking a six-week high. This surge coincided with substantial net inflows into US spot Bitcoin ETFs, reflecting renewed trader confidence in Bitcoin and gold as safe-haven assets.

Data from CoinGlass revealed that US spot BTC funds collectively attracted over $380 million in net inflows on April 21st.

The Role of Corporate Bitcoin Treasuries

Beyond ETFs, corporate Bitcoin treasuries are also contributing to increased demand. Companies are holding significant amounts of Bitcoin on their balance sheets, with corporate Bitcoin treasuries holding nearly $65 billion worth of BTC, according to Bitcointreasuries.net.

Bitcoin as a Hedge: Gold vs. Bitcoin

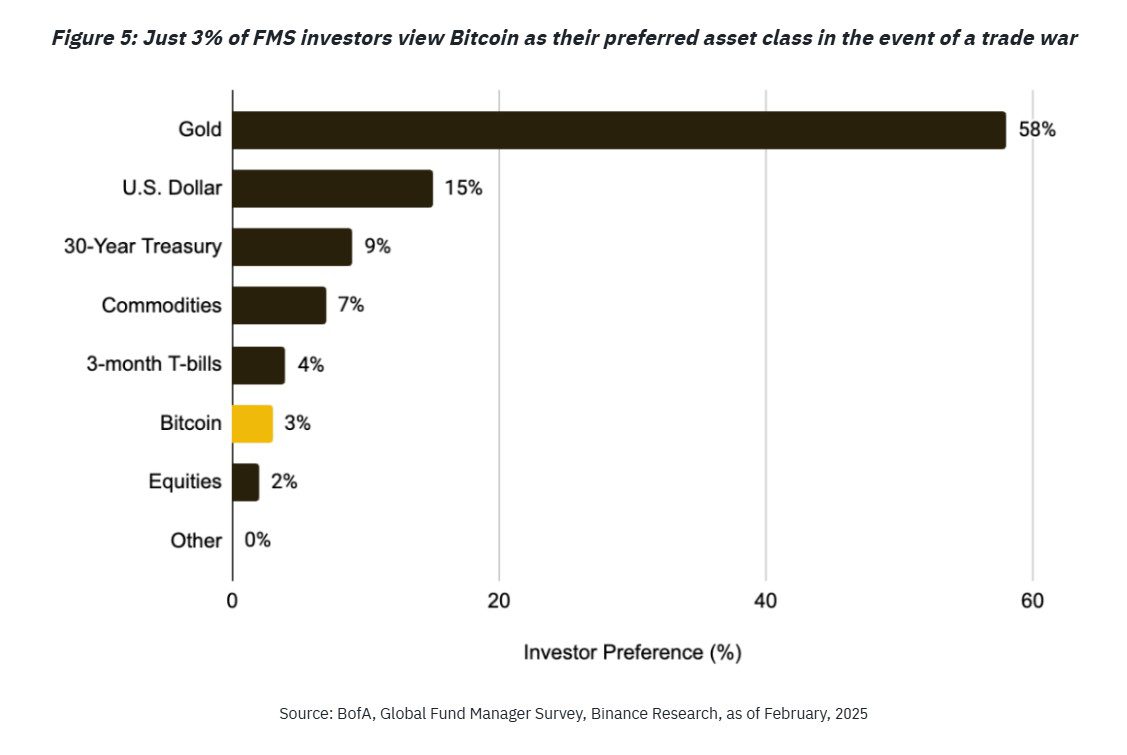

While Bitcoin is being increasingly viewed as a hedge against economic uncertainty, its correlation with gold, traditionally the preferred safe-haven asset, has fluctuated. JP Morgan noted that both gold and Bitcoin are becoming more prominent in investor portfolios for hedging purposes.

However, Binance Research observed that Bitcoin’s correlation with equities has been stronger than its correlation with gold in certain periods, particularly following specific macroeconomic events.

The Debate: Hedging vs. Speculation

Some experts suggest that sustained ETF inflows could paradoxically diminish Bitcoin’s appeal as a macroeconomic hedge. Spencer Yang from Fractal Bitcoin argues that Bitcoin’s long-term viability depends on real-world usage, not just speculative investment.

Yang emphasized that Bitcoin’s future depends on the utility gained through transactions, building applications, and experimentation on the network, as opposed to simple speculation.

Potential Risks and Considerations

Despite the optimistic forecasts, several factors could hinder Bitcoin’s price appreciation:

- Regulatory Scrutiny: Increased regulatory oversight could negatively impact investor sentiment and market activity.

- Geopolitical Instability: Unforeseen geopolitical events could trigger market volatility and reduce risk appetite.

- Market Corrections: The cryptocurrency market is prone to sudden corrections, which could lead to significant price drops.

Conclusion

The potential for Bitcoin to reach $200,000 by 2025 hinges on the continued growth of institutional demand and the evolving role of Bitcoin as a hedge against macroeconomic risks. While the forecasts are promising, investors should remain aware of the potential risks and uncertainties inherent in the cryptocurrency market.