Key Takeaways:

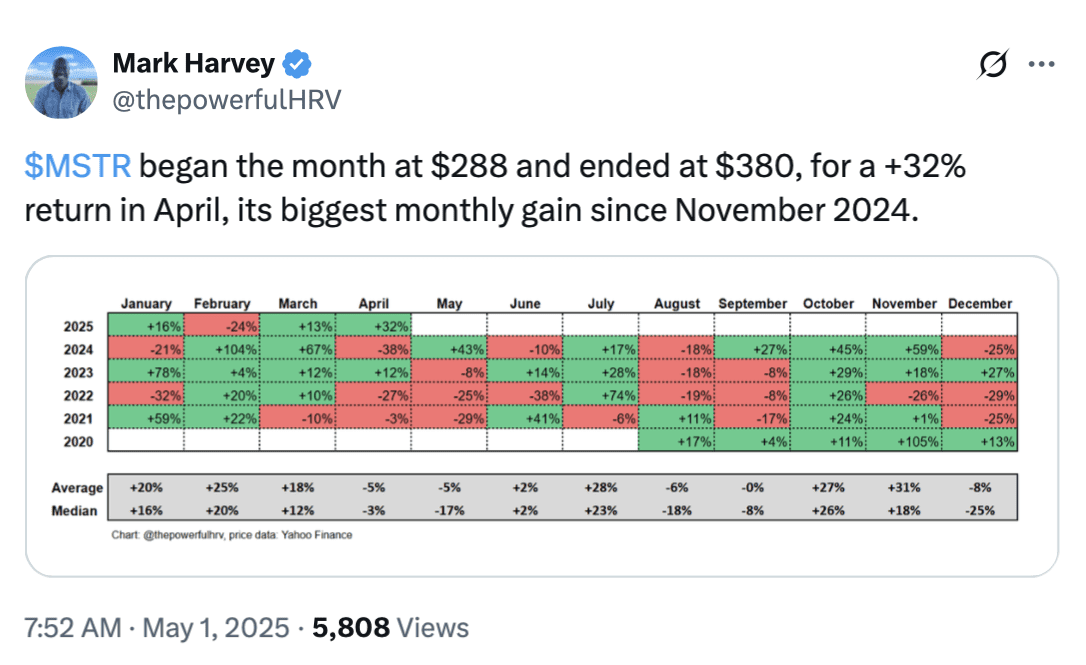

- Strategy’s stock (MSTR) jumped 32% in April, marking its best month since November.

- Market speculation suggests a significant capital raise announcement during the Q1 earnings call on May 1, driven by growing Bitcoin investments.

- Analysts forecast a marginal 1% year-over-year revenue increase to $116.6 million for Q1 2025.

Strategy (MSTR), formerly MicroStrategy, witnessed its stock price climb dramatically in April, closing at $380.11 on April 30. This represents a 32% increase from its March 31 closing price of $288.

Driving Factors Behind the Surge:

- Bitcoin Holdings: Strategy’s substantial Bitcoin holdings play a key role in its stock performance. The increasing value of Bitcoin directly impacts MSTR’s perceived value.

- Anticipated Capital Raise: Rumors of a significant capital raise during the Q1 earnings call have fueled investor interest. This potential raise is speculated to be used for further Bitcoin acquisitions.

- Q1 Earnings Preview: The upcoming Q1 2025 earnings report is a major catalyst. Analysts are closely watching for revenue figures and any announcements regarding future strategies.

Deeper Dive into Strategy’s Recent Performance

The 32% gain represents Strategy’s strongest monthly performance in five months. The company, led by Michael Saylor, has heavily invested in Bitcoin, making its stock closely tied to the cryptocurrency’s performance.

Earnings Expectations:

Analysts anticipate Strategy to report revenue of $116.6 million for Q1 2025. While this represents a slight increase year-over-year, it’s a decrease of 3.4% compared to the previous quarter’s $120.7 million. In Q4 2024, Strategy reported a net loss of $670.8 million after increasing its Bitcoin holdings.

The Capital Raise Rumor:

Thomas Fahrer, founder of Apollo Sat, suggested that Strategy might announce a massive $100 billion capital raise during the earnings call. While this remains speculation, it highlights the market’s anticipation of significant moves by Strategy in the Bitcoin space.

Strategy’s Bitcoin Strategy:

Strategy continues to actively accumulate Bitcoin. As of recently, Strategy holds 553,555 Bitcoin, valued at approximately $52.57 billion. This aggressive accumulation strategy has made Strategy a prominent player in the Bitcoin market and a key proxy for Bitcoin investment.

Potential Future Strategies:

Richard Byworth, a partner at Syz Capital, proposed that Strategy could adopt a more aggressive Bitcoin buying strategy, potentially acquiring companies to utilize their cash reserves for Bitcoin purchases. This highlights the ongoing debate about the best approach for Strategy’s Bitcoin investment strategy.

Understanding Google’s AI Overview and Why This Matters

Google’s AI Overview aims to provide users with concise and informative summaries of search results directly within the search engine results page (SERP). To optimize content for this feature, it’s crucial to:

- Provide Clear and Concise Information: Google’s AI is designed to extract key information, so prioritize clarity and brevity.

- Use Structured Data: Employ headings, subheadings, lists, and tables to organize content logically, making it easier for AI to understand and extract information.

- Answer Common Questions Directly: Anticipate the questions users are likely to ask and provide direct, factual answers within the content.

- Focus on Expertise, Authority, and Trustworthiness (E-A-T): Demonstrate your expertise through well-researched and accurate information. Build authority by citing credible sources. Establish trustworthiness by presenting information objectively and transparently.

- Optimize for Mobile: Ensure your content is mobile-friendly, as Google prioritizes mobile-first indexing.

By focusing on these elements, content creators can significantly increase their chances of having their content featured in Google’s AI Overview, reaching a wider audience and establishing themselves as trusted sources of information.

This analysis provides an overview of Strategy’s recent stock surge, the driving factors behind it, and the potential future strategies the company might pursue. The company’s Q1 earnings call will be a crucial event to watch for further insights into Strategy’s direction.