Key Takeaways:

- Galaxy Digital plans to list on the Nasdaq on May 16, pending shareholder and Nasdaq approval.

- Nasdaq-listed crypto firms experienced significant gains in April, recovering from macroeconomic uncertainty.

- CEO Mike Novogratz believes the Nasdaq listing will expand the company’s investor base and enhance its U.S. presence.

- Galaxy Ventures Fund I LP is expected to raise around $175 to $180 million by the end of June to invest in crypto and blockchain startups.

Galaxy Digital, a prominent crypto investment firm currently listed on the Toronto Stock Exchange (TSX), is preparing to transition to the U.S.-based Nasdaq on May 16, 2025. The move is contingent upon approval from both its shareholders and the Nasdaq itself.

This decision comes at a time when several crypto-related companies listed on the Nasdaq have demonstrated robust gains in April, signaling a recovery from recent macroeconomic instability. These gains reflect renewed investor confidence in the crypto market and the underlying technologies driving it.

Mike Novogratz, the founder and CEO of Galaxy Digital, emphasized the strategic importance of this listing. He stated on April 30 that the move would position the company to realize its vision of becoming a gateway for investors seeking secure and efficient access to the digital asset and artificial intelligence sectors.

Why Nasdaq? Expanding Investor Reach

The primary driver behind Galaxy Digital’s Nasdaq listing is to broaden its investor base. A special shareholders’ meeting is scheduled for May 9 to secure the final go-ahead for the move. Once approved, Galaxy Digital will trade under the ticker symbol GLXY on the Nasdaq.

During a transition period, Galaxy Digital will maintain its listing on the TSX, where it has been trading since July 2020. This dual-listing approach aims to ensure a smooth transition for existing shareholders and facilitate access for new investors on the Nasdaq.

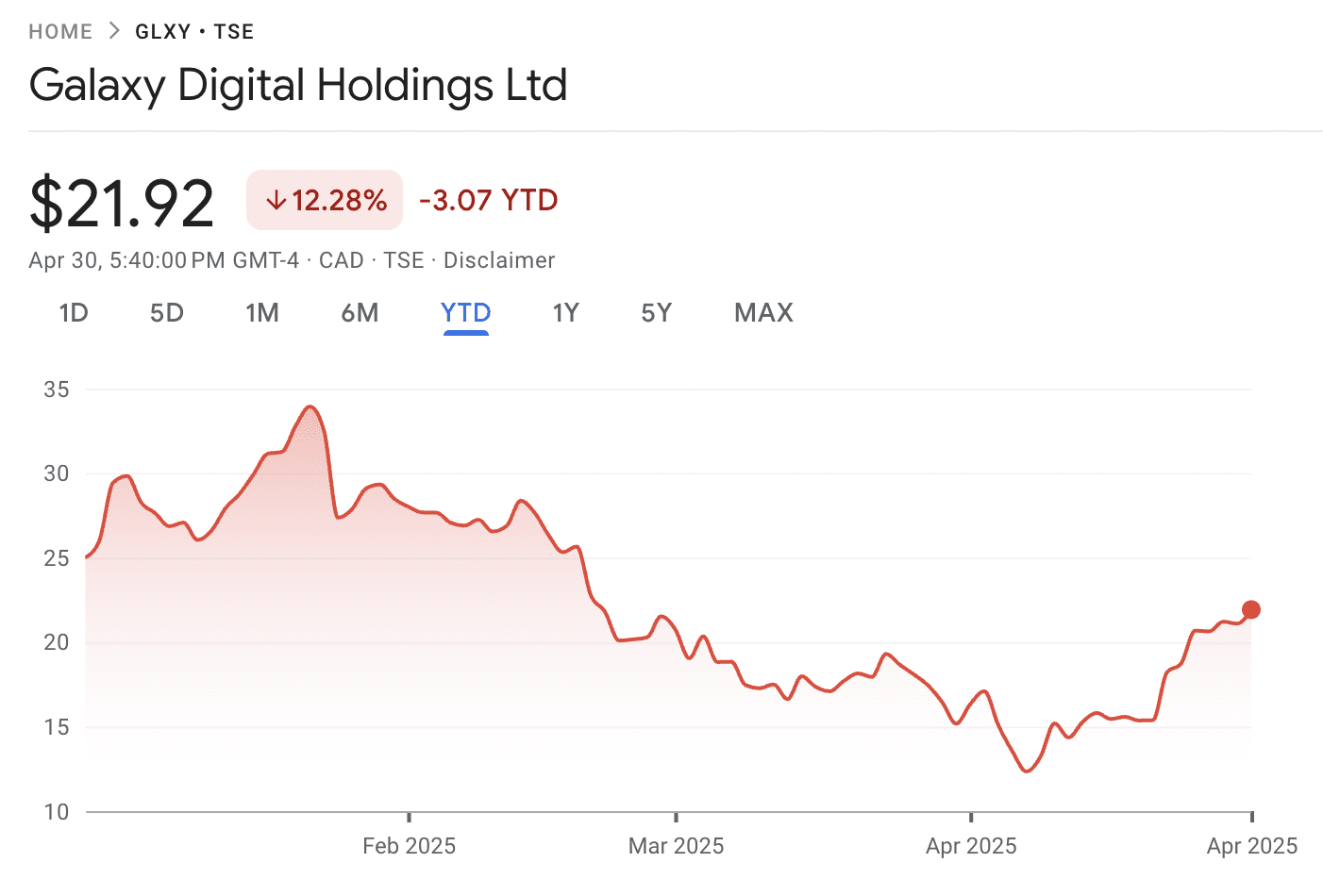

While Galaxy Digital’s stock (GLXY) has experienced a 12.28% decline on the TSX year-to-date, mirroring broader market trends, the company is optimistic about the potential benefits of the Nasdaq listing. The move is expected to attract a wider range of institutional and retail investors, potentially leading to increased trading volume and improved stock performance.

Broader Market Context: Nasdaq and Crypto Firms Show Resilience

The Nasdaq 100 index has shown resilience despite market fluctuations. While down 7.33% year-to-date, it remained stable in April, prompting some market observers to downplay the previously bearish sentiment. This stability suggests a potential for continued recovery in the tech and growth sectors, including crypto-related companies.

Novogratz, a well-known advocate for cryptocurrencies and particularly Bitcoin, has consistently expressed confidence in the long-term prospects of the digital asset market. His firm, Galaxy Digital, has been actively involved in investing in and supporting the growth of crypto and blockchain startups.

Galaxy Ventures Fund I LP: Fueling Crypto Innovation

On April 17, it was reported that Galaxy Ventures Fund I LP is on track to raise between $175 million and $180 million by the end of June. This fund will be strategically deployed to build a diversified portfolio of approximately 30 promising crypto and blockchain startups. This move underscores Galaxy Digital’s commitment to fostering innovation and driving growth within the broader crypto ecosystem.

Anthony Pompliano, a prominent figure in the crypto community, highlighted the positive market trends in a recent social media post. He noted that the Nasdaq 100’s performance in April defied the prevailing negative sentiment, emphasizing the underlying strength of the market.

Nasdaq-Listed Crypto Firms See Gains

Several crypto-related companies already listed on the Nasdaq have experienced significant gains in the past month. This positive trend further supports Galaxy Digital’s decision to pursue a Nasdaq listing and highlights the growing investor interest in the crypto sector.

For example, Coinbase (COIN) has increased by 17.80%, Michael Saylor’s MicroStrategy (MSTR) is up by 31.86%, and Bitcoin mining company CleanSpark (CLSK) has risen by 21.58%. These gains demonstrate the potential for strong performance among crypto-related stocks on the Nasdaq.

The Future of Galaxy Digital

Galaxy Digital’s planned Nasdaq listing represents a significant step in the company’s evolution and its ambition to become a leading player in the digital asset and artificial intelligence sectors. The move is expected to provide increased access to capital, enhance its brand recognition, and attract a broader range of investors.

With its focus on innovation, strategic investments, and a commitment to the long-term growth of the crypto market, Galaxy Digital is well-positioned to capitalize on the opportunities presented by the evolving digital landscape.