Bitcoin’s price trajectory is a subject of intense speculation. Recent analysis focusing on Bitcoin’s ‘age’ and historical growth patterns suggests a potential surge to $350,000 by 2025. This projection is based on a logarithmic model illustrating Bitcoin’s price increase relative to its age.

Key Takeaways:

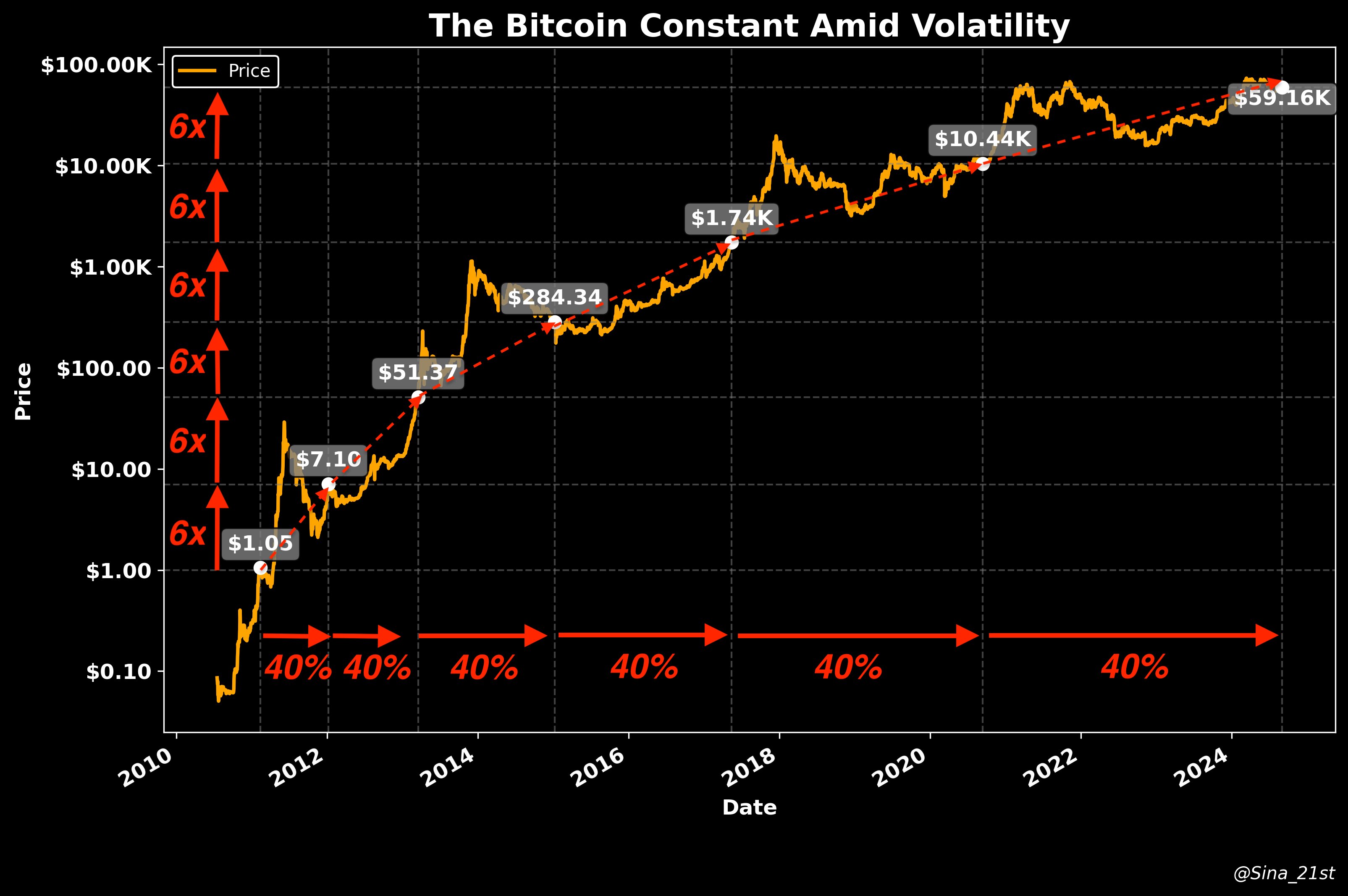

- Historical Pattern: Bitcoin’s price has historically increased approximately sixfold with each 40% increase in its age.

- 2025 Target: If this pattern continues, Bitcoin could potentially reach $351,046 in 2025.

- Fractal Analysis: Technical analysis points to $84,000 as a key support level, indicating potential for further upward movement.

The ‘Aging’ Chart: A Logarithmic Perspective

The analysis, highlighted by 21st Capital co-founder Sina, uses a log-log graph to plot Bitcoin’s price against its age. This approach reveals a linear relationship, suggesting predictable long-term growth driven by Bitcoin’s limited supply and network dynamics. The model’s core assumption is that Bitcoin’s price increases sixfold for every 40% increase in its age.

The math behind the $351,046 price target involves examining Bitcoin’s age in years and applying the 6x price multiplier. For example, between 2017 (age 8.83 years, $19,666 peak) and 2021 (age 12.83 years, $68,000 peak), the age increased by 45%, while the price increased by approximately 3.4x. Adjusting for the chart’s trendline, the projected price at age 16.33 years (in 2025) is $351,046, a 5.2x increase from the 2021 peak.

However, it’s important to acknowledge that the model isn’t perfectly accurate. Historically, the 6x peak in value has often preceded the 40% increase in Bitcoin’s age. Furthermore, the model has shown discrepancies, underestimating early growth and overestimating recent performance. External factors such as regulatory uncertainty, market volatility (e.g., the 2021 crypto crash), and macroeconomic pressures (e.g., rising interest rates) can influence Bitcoin’s price independent of its age.

Despite these factors, the model demonstrates the long-term uptrend of Bitcoin, captured via a non-linear graph. This suggests that network maturity, rather than calendar cycles, dictates the asset’s growth pattern.

Fractal Analysis and Key Support Levels

In addition to the ‘aging’ chart analysis, other technical indicators suggest continued bullish momentum for Bitcoin. Anonymous Bitcoin analyst blackwidow identified a fractal pattern comparing the current market setup to the 2024 support at $58,000. This analysis pinpoints $84,000 as a crucial support level.

According to the analyst, this $84,000 level, the point of control (POC) with the highest trading volume, represents a significant re-entry point for traders anticipating a breakout. If this support holds, a rapid move upward into the summer is anticipated, potentially creating a long-term investment opportunity.

Similarly, crypto trader Titan of Crypto suggests that Bitcoin is gearing up for new highs, potentially targeting $125,000. This prediction is based on Bitcoin bouncing off the orange line of the Golden Ratio Multiplier and aiming for the blue line, currently situated at $125,000.

Understanding the Limitations

It’s crucial to remember that these are projections and not guarantees. The cryptocurrency market is notoriously volatile, and numerous factors can influence Bitcoin’s price. Market sentiment, regulatory developments, technological advancements, and macroeconomic conditions all play a significant role. Investors should conduct thorough research and consider their own risk tolerance before making any investment decisions.

The Future of Bitcoin: Factors to Watch

While models like the ‘aging’ chart and fractal analysis provide intriguing insights, several factors will determine Bitcoin’s future price trajectory:

- Regulatory Landscape: Clarity and consistency in cryptocurrency regulations worldwide will significantly impact investor confidence.

- Institutional Adoption: Increased adoption by institutional investors can provide substantial capital inflows and validate Bitcoin as a mainstream asset.

- Technological Developments: Innovations like the Lightning Network, aimed at improving Bitcoin’s scalability and transaction speed, can enhance its utility and drive adoption.

- Macroeconomic Conditions: Inflation, interest rates, and overall economic stability can influence investor appetite for Bitcoin as a hedge against traditional assets.

In conclusion, while the $350,000 price target based on the ‘aging’ chart and fractal analysis is compelling, it’s essential to approach such predictions with caution. Bitcoin’s future remains uncertain, but its underlying technology, limited supply, and growing adoption suggest continued relevance in the evolving financial landscape.