Bitcoin’s potential to reach new all-time highs faces headwinds from growing recession concerns. However, progress in upcoming trade negotiations between the United States and China could provide crucial support, according to crypto analysts.

Recession Fears and Bitcoin’s Trajectory

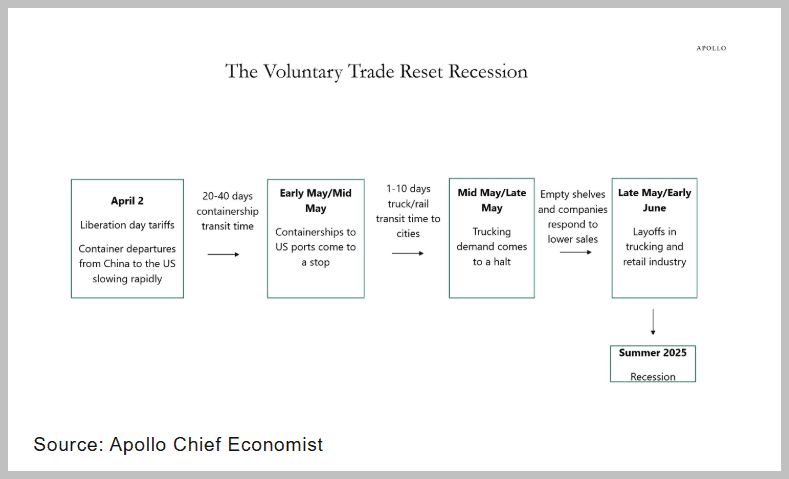

Analysts at Apollo Global Management suggest a possible recession by the summer, potentially impacting global risk assets like Bitcoin (BTC). This economic downturn could stem from unresolved trade tensions between the US and China. The outcome of tariff negotiations is a critical factor influencing both the likelihood of a recession and Bitcoin’s price movements.

The Importance of May’s Trade Negotiations

May is a critical period as Chinese shipments reach US shores, and exemptions on specific tariff categories are set to expire. A failure to negotiate could trigger an economic recession, potentially leading to significant losses for Bitcoin.

According to Aurelie Barthere, principal research analyst at crypto intelligence platform Nansen, reaching deals, or at least ‘agreements in principle,’ is the most probable scenario, establishing a reciprocal tariff ‘floor’ around 10%. This would signal the US’s and China’s economic interest in avoiding trade disruptions. This scenario would likely see Bitcoin revisit its all-time high.

Bitcoin’s Potential Resilience During a Recession

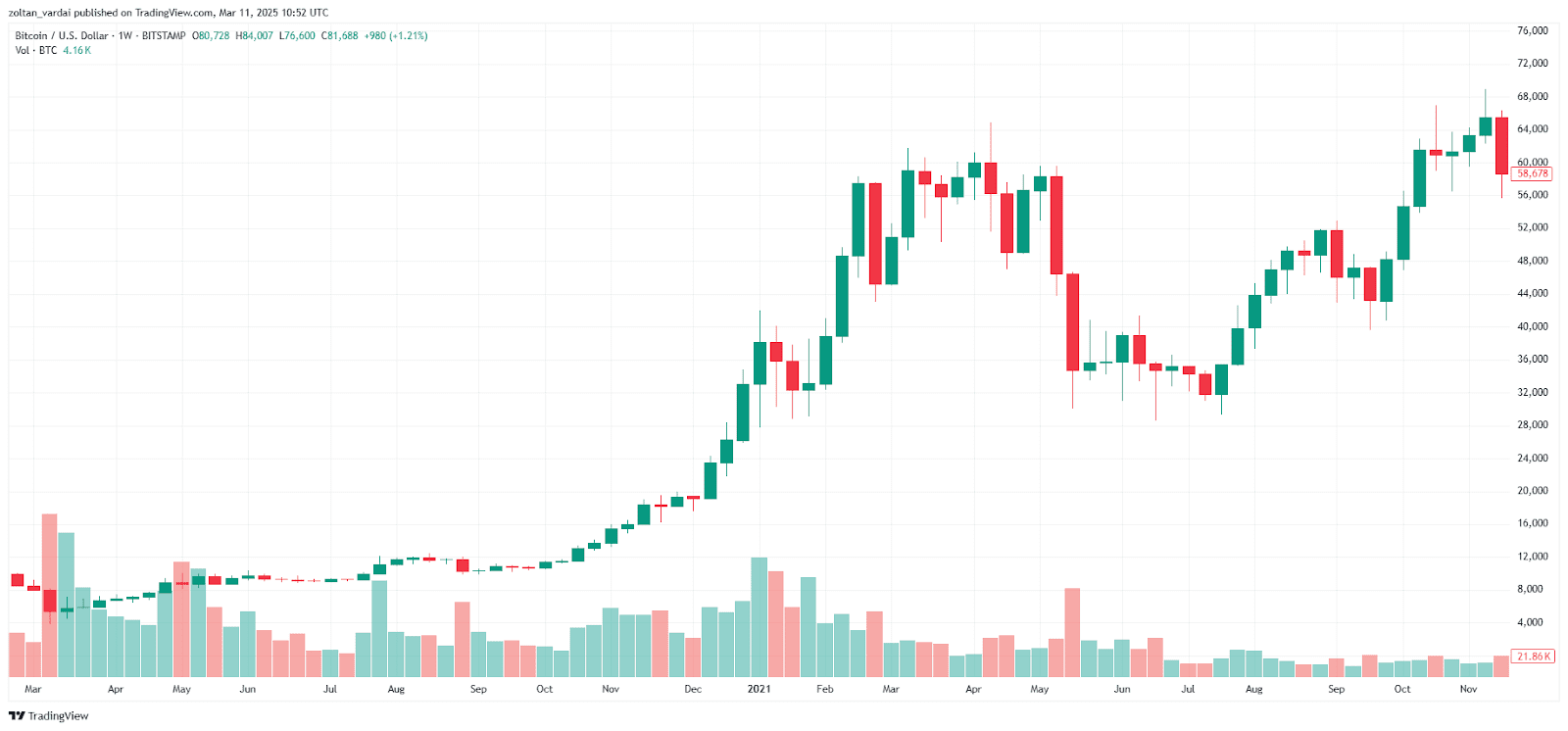

Despite recessionary pressures, Bitcoin may exhibit resilience. Historically, Bitcoin has demonstrated the ability to rebound after economic downturns, often viewed as a hedge against inflation. Here’s a breakdown of potential scenarios:

- Initial Volatility: Bitcoin and other cryptocurrencies may initially decline alongside risk assets as investors sell off their holdings.

- Hedge Against Inflation: Bitcoin could recover, especially if seen as a safe haven against inflation, similar to gold.

- Stagflation Scenario: In an environment of high inflation and slow growth (stagflation), Bitcoin may perform well, attracting investors seeking to preserve value.

However, Bitcoin’s increasing correlation with tech stocks introduces an element of uncertainty. The following points elaborate on these factors:

- Correlation with Tech Stocks: Bitcoin’s performance is increasingly linked to the stock market, particularly tech stocks, making it susceptible to broader market trends.

- Historical Performance: Following the COVID-19 crash in March 2020, Bitcoin experienced a substantial rally, driven by the Federal Reserve’s asset purchase program.

Expert Opinions and Market Outlook

Industry experts offer varied perspectives on Bitcoin’s potential performance amid economic challenges:

- Anndy Lian: Author and intergovernmental blockchain adviser, believes Bitcoin could rebound after initial volatility, particularly if seen as a hedge against inflation. He suggests monitoring economic policy shifts to gauge market direction.

- Marcin Kazmierczak: Co-founder and COO of RedStone, believes crypto markets will likely decline alongside broader risk-on assets and equities if a recession occurs. He points to potential economic contagion from tariffs and trucking slowdowns.

Factors Influencing Bitcoin’s Price

Several factors could influence Bitcoin’s price in the coming months:

- US-China Trade Negotiations: Progress in these negotiations could alleviate recession fears and boost Bitcoin’s price.

- Inflation and Stagflation: Bitcoin’s performance as a hedge against inflation could be crucial in a stagflation environment.

- Institutional Adoption: Growing institutional adoption of Bitcoin could provide some support, but may not be enough to overcome broader market trends.

- Economic Policy Shifts: Changes in economic policy could significantly impact market direction.

Conclusion

Bitcoin faces a complex landscape with potential recessionary pressures and the crucial influence of US-China trade negotiations. While a recession could initially negatively impact Bitcoin’s price, its potential as a hedge against inflation and historical resilience offer reasons for optimism. Monitoring trade negotiations, economic policy shifts, and institutional adoption will be essential for investors to navigate the market effectively.