Key Takeaways:

- Bitcoin’s rally to $98,000 met resistance, triggering profit-taking.

- A daily close above $95,000 is crucial for Bitcoin to target $100,000.

- High profit-taking volume poses a risk, but strong ETF demand and potential Fed rate decisions could act as bullish catalysts.

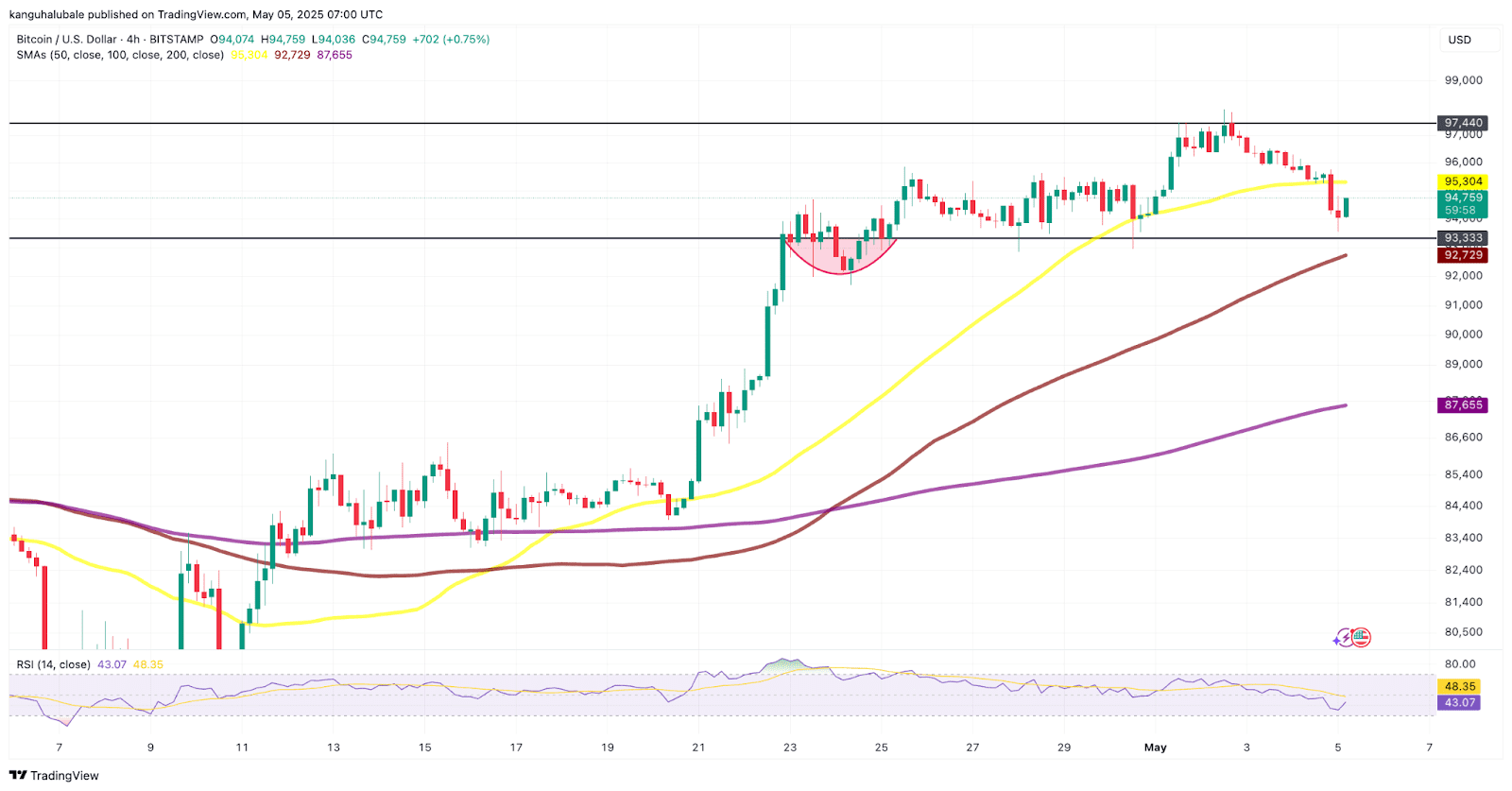

Bitcoin (BTC) has been trading choppily between $93,000 and $98,000, struggling to break through resistance at $98,000. The current market dynamic is characterized by elevated profit-taking, which introduces the potential for volatile price swings.

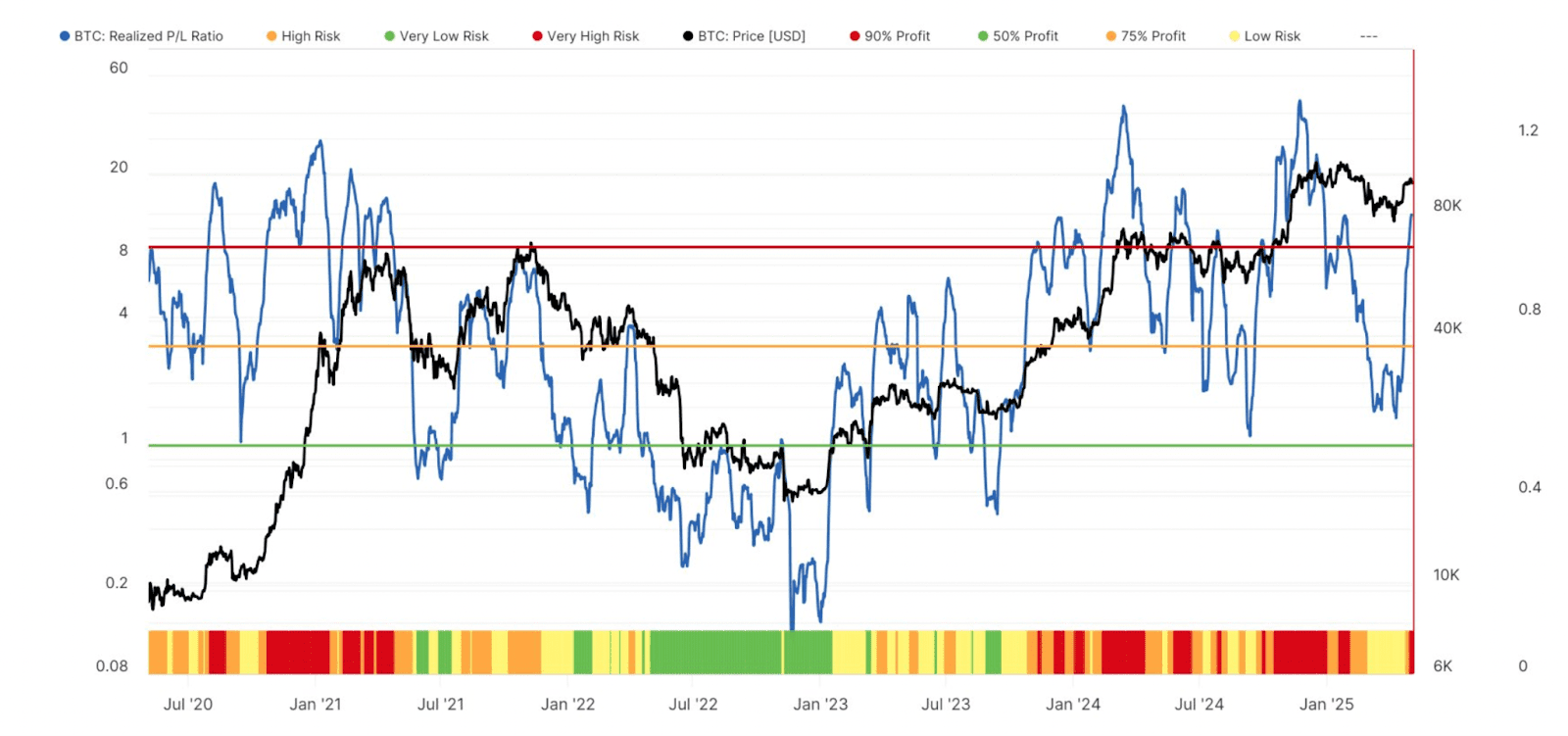

Profit-Taking Exceeds Statistical Norms

Analysis from Glassnode indicates that recent price increases have pushed profit-taking volume above typical levels. The Realized Profit/Loss ratio reveals that profits significantly outweigh losses, suggesting increased selling pressure as investors secure gains. One analyst noted that for every dollar lost, nine dollars were realized in profit, a scenario that is “risky.”

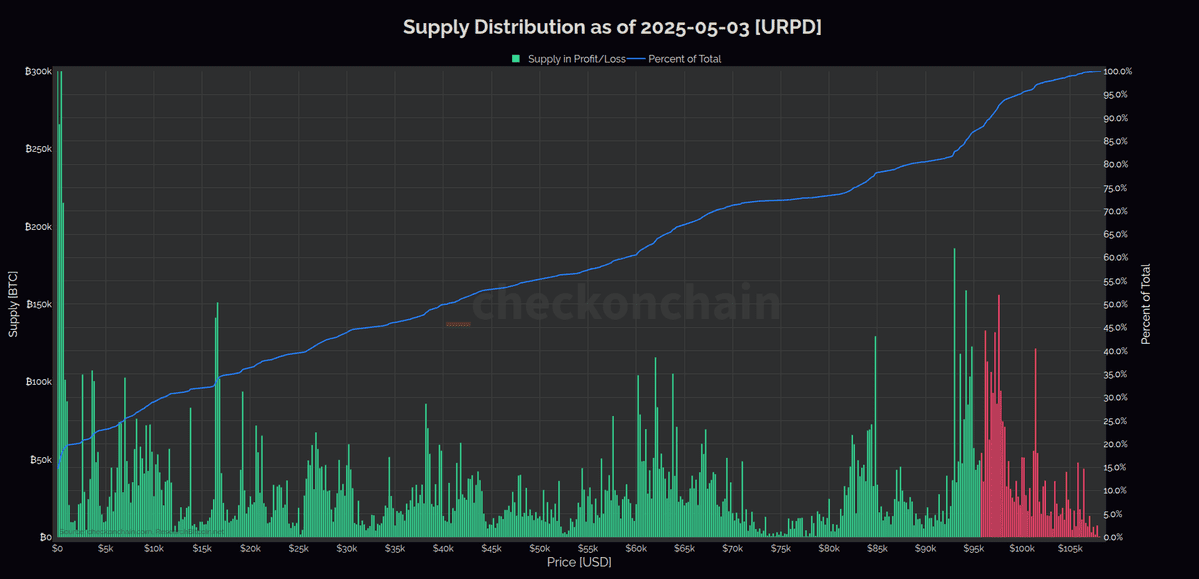

As reported, selling activity has intensified near the $95,000 mark, particularly among short-term traders.

Bitcoin’s “Decision Point”

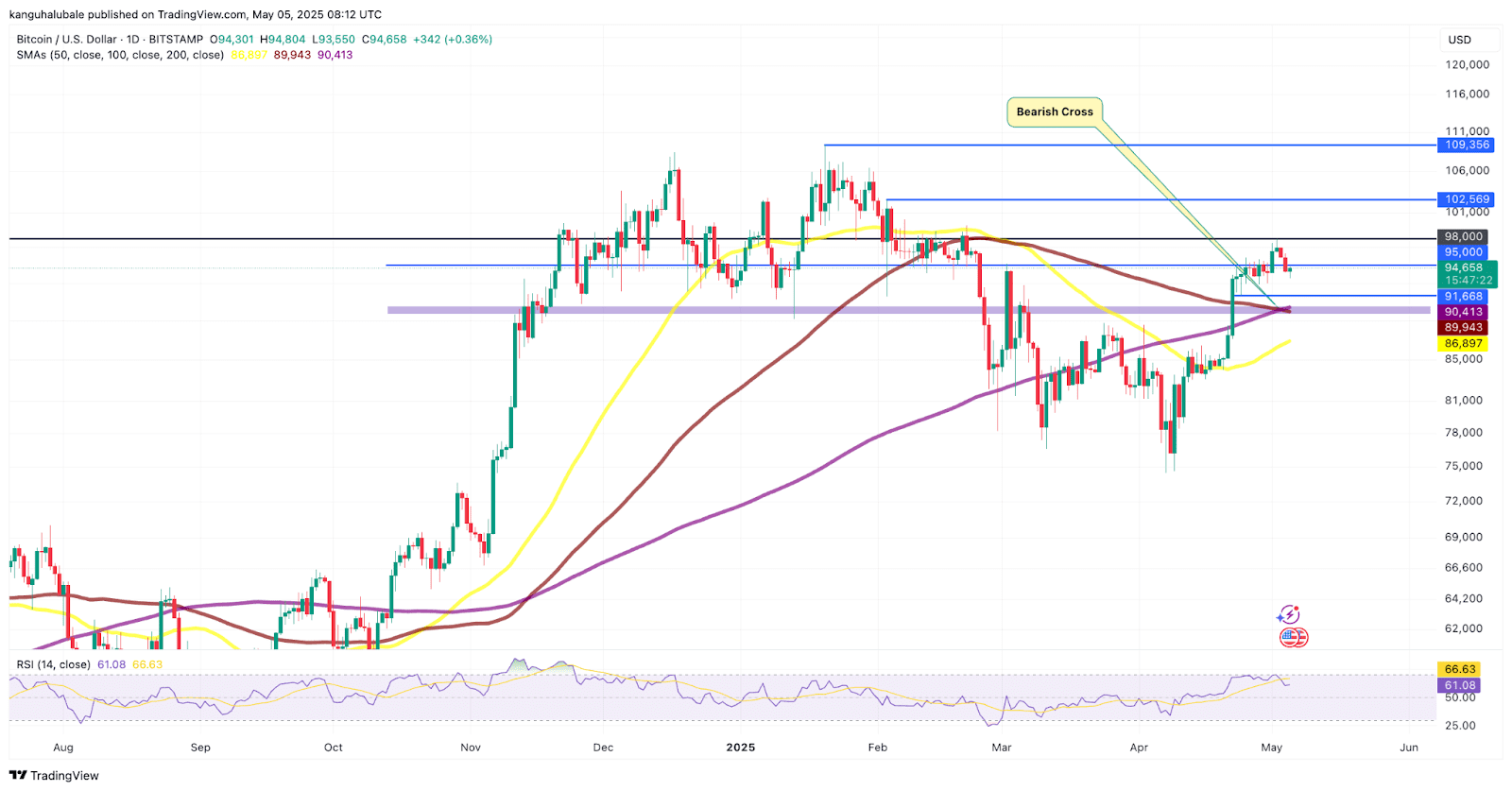

Market analysts describe the current situation as a critical “decision point.” Bitcoin needs to decisively break through this price zone to avoid a significant correction. The market’s next move hinges on whether buyers or sellers gain the upper hand.

Currently, around 86% of the Bitcoin supply is in profit. Historically, when this figure exceeds 80-90%, increased profit-taking often leads to market corrections.

“We’re sitting right in the middle of a decision point, and all it will take is one big red or green candle from here to convince people of a lower high, or bull continuation, respectively.”

Key Price Levels to Monitor

To aim for $100,000 and higher, Bitcoin must turn the $98,000 resistance into a solid support level. A daily close above $95,000 is the immediate prerequisite.

Potential Bullish Catalysts:

- Spot Bitcoin ETF Demand: Recent ETF inflows indicate continued institutional interest.

- Federal Reserve (Fed) Meeting: The upcoming Fed interest rate decision could influence market sentiment. A dovish stance might boost Bitcoin.

Potential Bearish Scenarios:

- Failure to overcome $98,000 resistance.

- Increased profit-taking triggering a sell-off.

Bears will try to maintain the $98,000 resistance, potentially driving the price down to $92,000. Below this level, the next targets are $90,000 (convergence of the 100-day and 200-day SMAs) and then the $85,000-$75,000 range. A drop to $75,000 would erase all gains made after the recent tariff pause news.

Bitcoin’s Price Prediction and Summary

In conclusion, Bitcoin is at a crossroads. Overcoming the $98,000 resistance is crucial. Monitoring key price levels, ETF demand, and the Fed’s actions is essential for understanding Bitcoin’s next move.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves risk.