This analysis provides a technical overview and price predictions for major cryptocurrencies and traditional market indicators as of May 5th. We’ll cover Bitcoin, Ethereum, XRP, BNB, Solana, Dogecoin, Cardano, SUI, the S&P 500 Index, and the US Dollar Index, focusing on key support and resistance levels.

Key Takeaways:

- Bitcoin (BTC): Facing resistance at $95,000. Key support lies at the 20-day EMA ($92,204).

- Ethereum (ETH): Showing strength above moving averages, potential rise to $2,111.

- XRP: Stuck between resistance and $2 support, breakout could lead to $3.

- BNB: Struggling below moving averages, watch for a break above $620 or a fall to $520.

- Solana (SOL): Finding support at the 20-day EMA ($143), potential rise to $180.

- Dogecoin (DOGE): Likely to stay within the $0.14 to $0.21 range.

- Cardano (ADA): Battle between bulls and bears near moving averages, watch for a break above $0.75 or below moving averages.

- SUI: Bouncing off the 20-day EMA ($3.09), potential rise to $3.90.

- S&P 500 (SPX): Recovering, potential resistance at 5,800.

- US Dollar Index (DXY): Facing resistance at the 20-day EMA (100.38), watch for a break above or below 99.

Detailed Analysis:

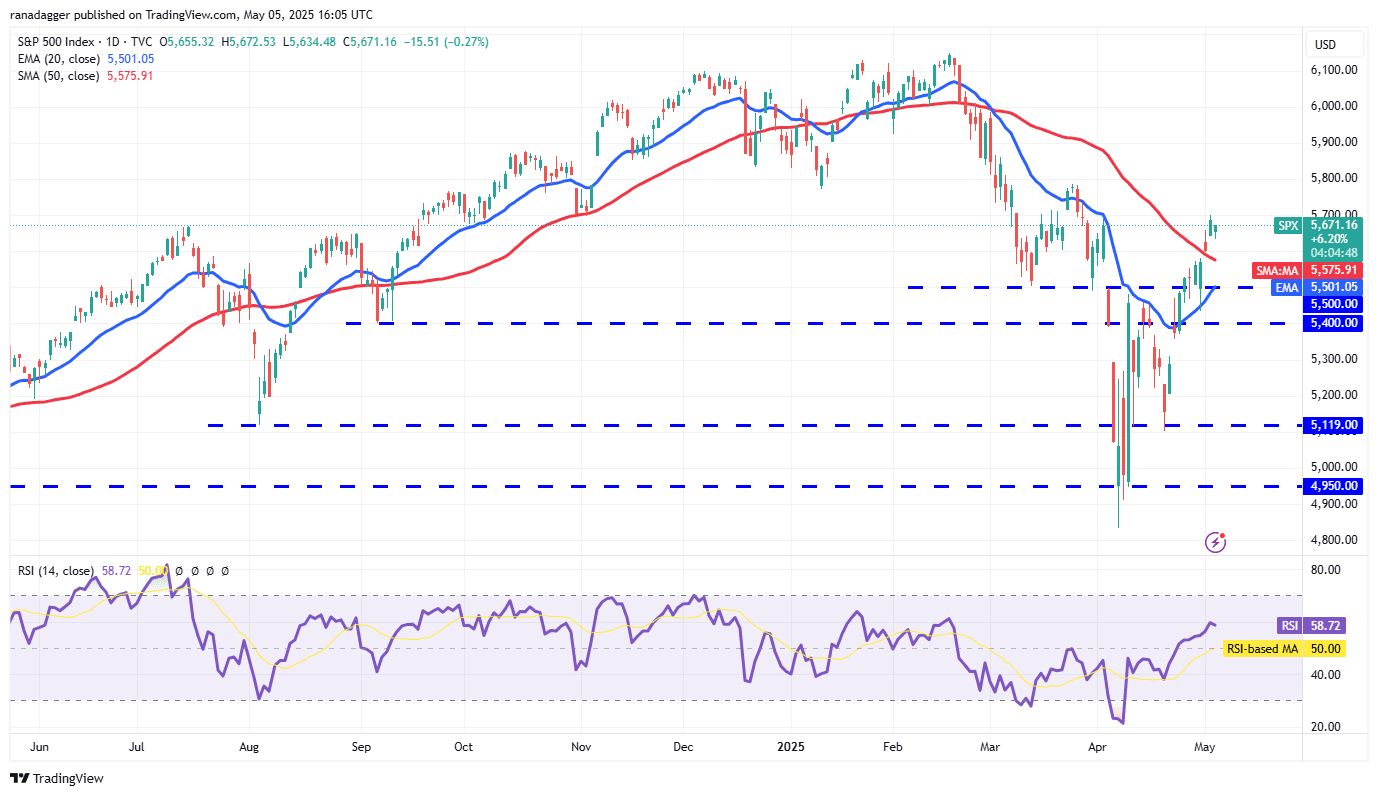

S&P 500 Index (SPX) Price Prediction

The S&P 500 Index has demonstrated a recovery, surpassing the 50-day simple moving average (5,575). The 20-day exponential moving average (5,501) is trending upward, and the relative strength index (RSI) is positive, indicating bullish momentum. The next potential target is 5,800, where strong selling pressure is anticipated. A decline from this level may find support at the 20-day EMA. Conversely, a drop below the 20-day EMA would signal a weakening bullish trend, potentially leading to a decline toward 5,400 and subsequently to 5,300.

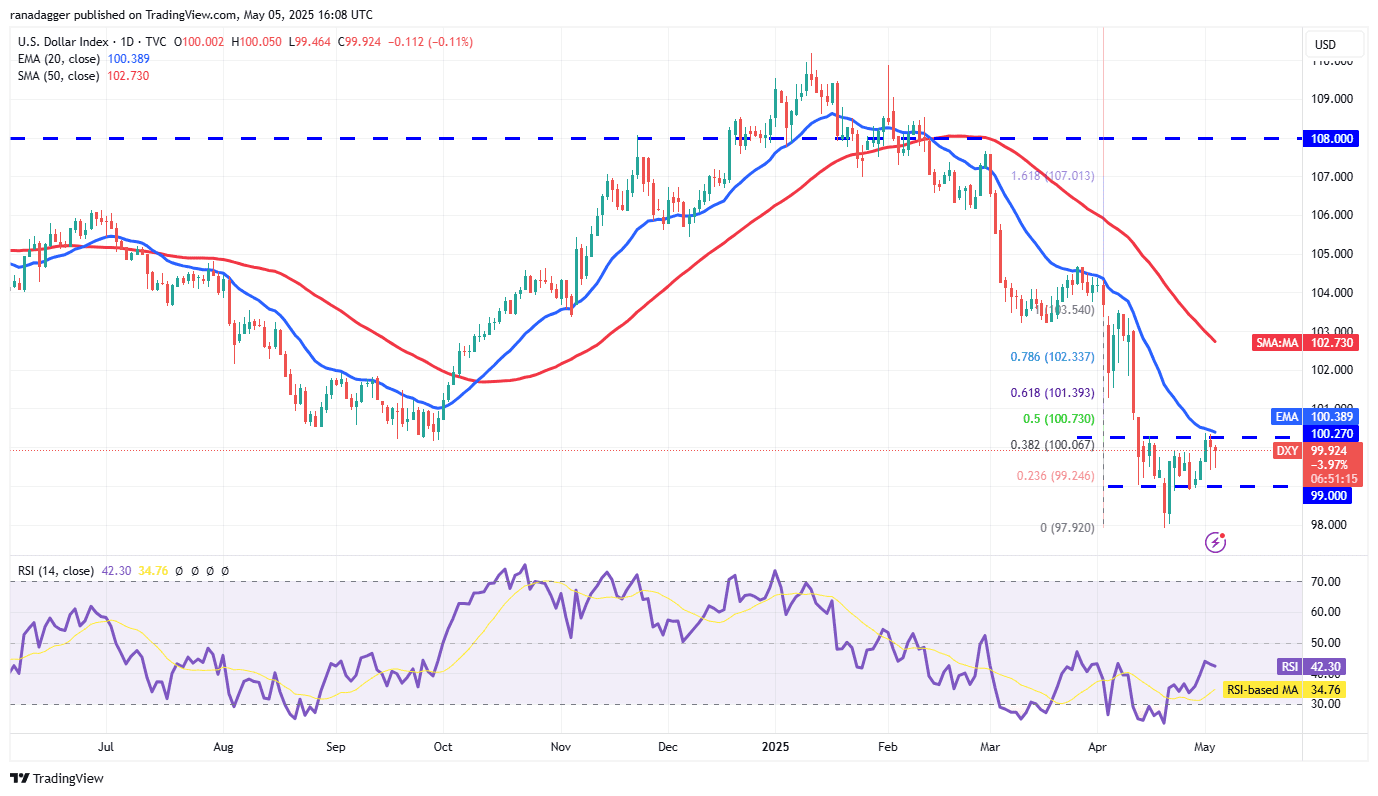

US Dollar Index (DXY) Price Prediction

The US Dollar Index rebounded from the 99 support level on April 29 and reached the 20-day EMA (100.38) on May 1. Buyers face resistance at this EMA, but the lack of significant bearish momentum suggests a potential breakout. If the index surpasses the 20-day EMA, it could rise to the 61.8% Fibonacci retracement level of 101.39 and then to the 50-day SMA (102.72). Failure to maintain this upward trajectory and a break below 99 could lead to a decline toward the critical support at 97.92.

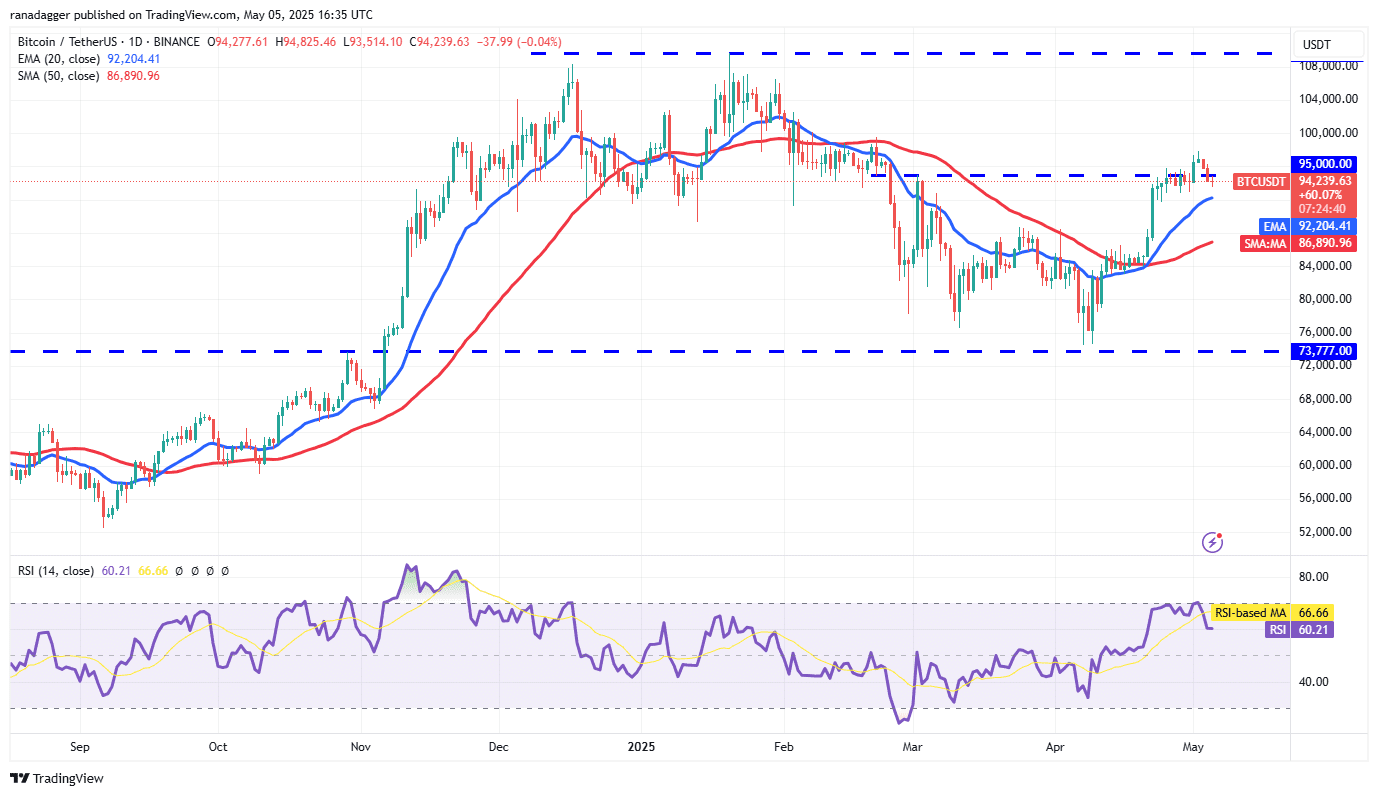

Bitcoin (BTC) Price Prediction

Bitcoin dipped below the $95,000 support on May 4, with bears attempting to push the price down to the 20-day EMA ($92,204). Bulls need to defend the 20-day EMA to maintain positive momentum. A strong bounce from this level could propel BTC back to the $100,000 mark. However, a break below the 20-day EMA indicates weakening bullish sentiment and could lead to a pullback toward the 50-day SMA ($86,890), potentially establishing a trading range.

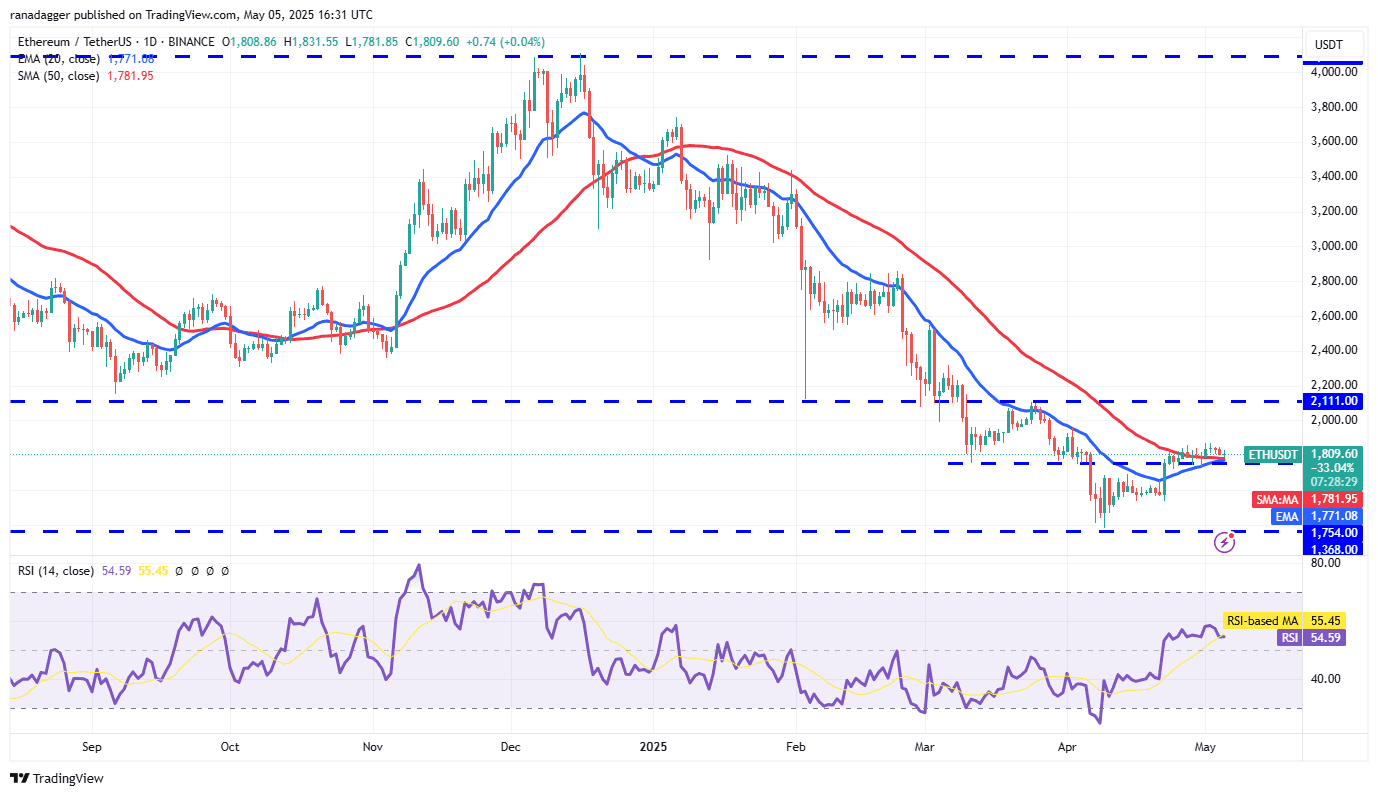

Ethereum (ETH) Price Prediction

Ethereum has maintained its position above the moving averages, signaling strength. The 20-day EMA ($1,771) is gradually increasing, and the RSI is positive, suggesting upward potential. Minor resistance exists at $1,957, but a breakthrough could lead to a surge toward the $2,111 level, where bears may pose significant resistance. Conversely, a break below the moving averages could trigger a decline toward $1,537 and subsequently to the critical support at $1,368.

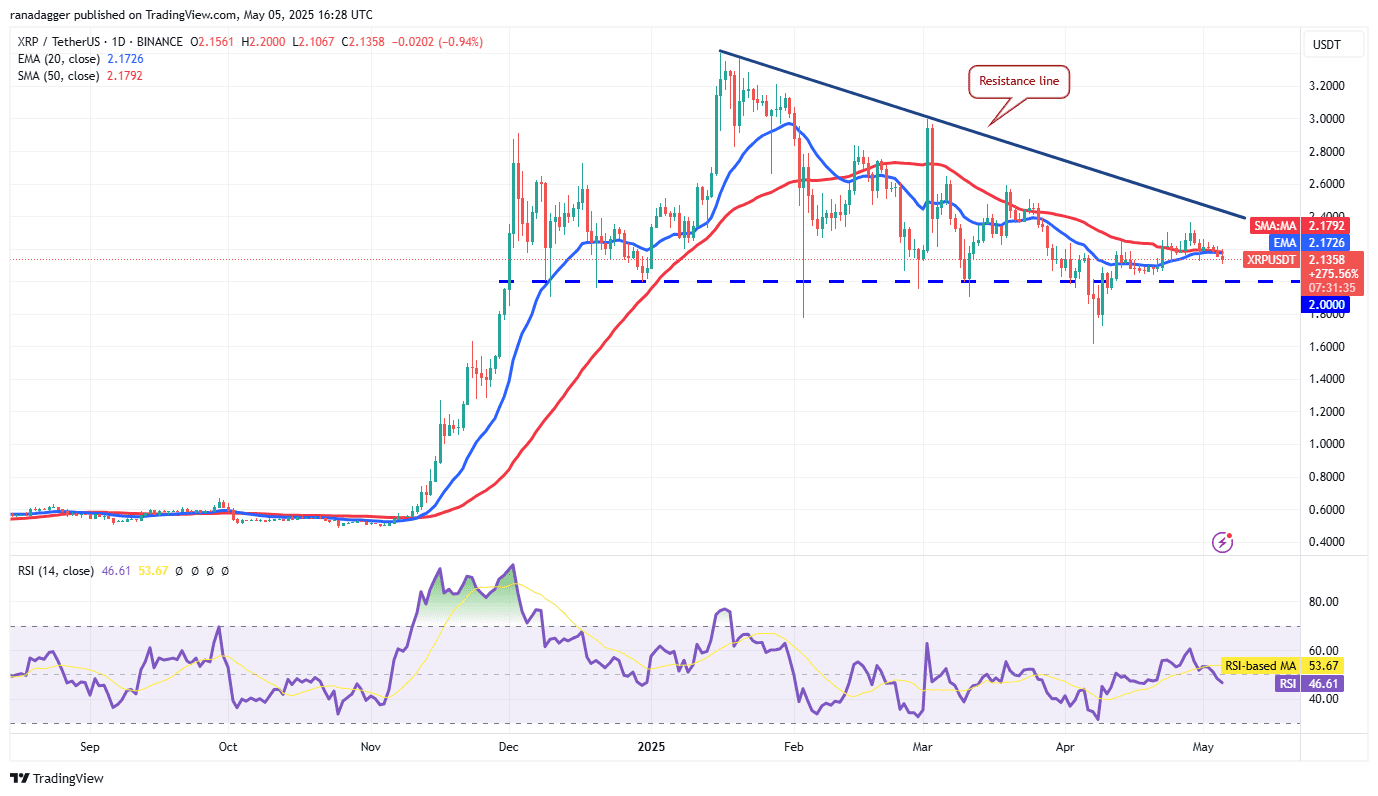

XRP Price Prediction

XRP is currently trading between a resistance line and $2 support, indicating consolidation. Flattening moving averages and an RSI near the midpoint suggest a balance between buyers and sellers. A breakthrough above the resistance line could lead to a surge to $3, indicating a short-term trend reversal. Conversely, a break below $2 would empower sellers and could lead to a retest of the $1.61 support level.

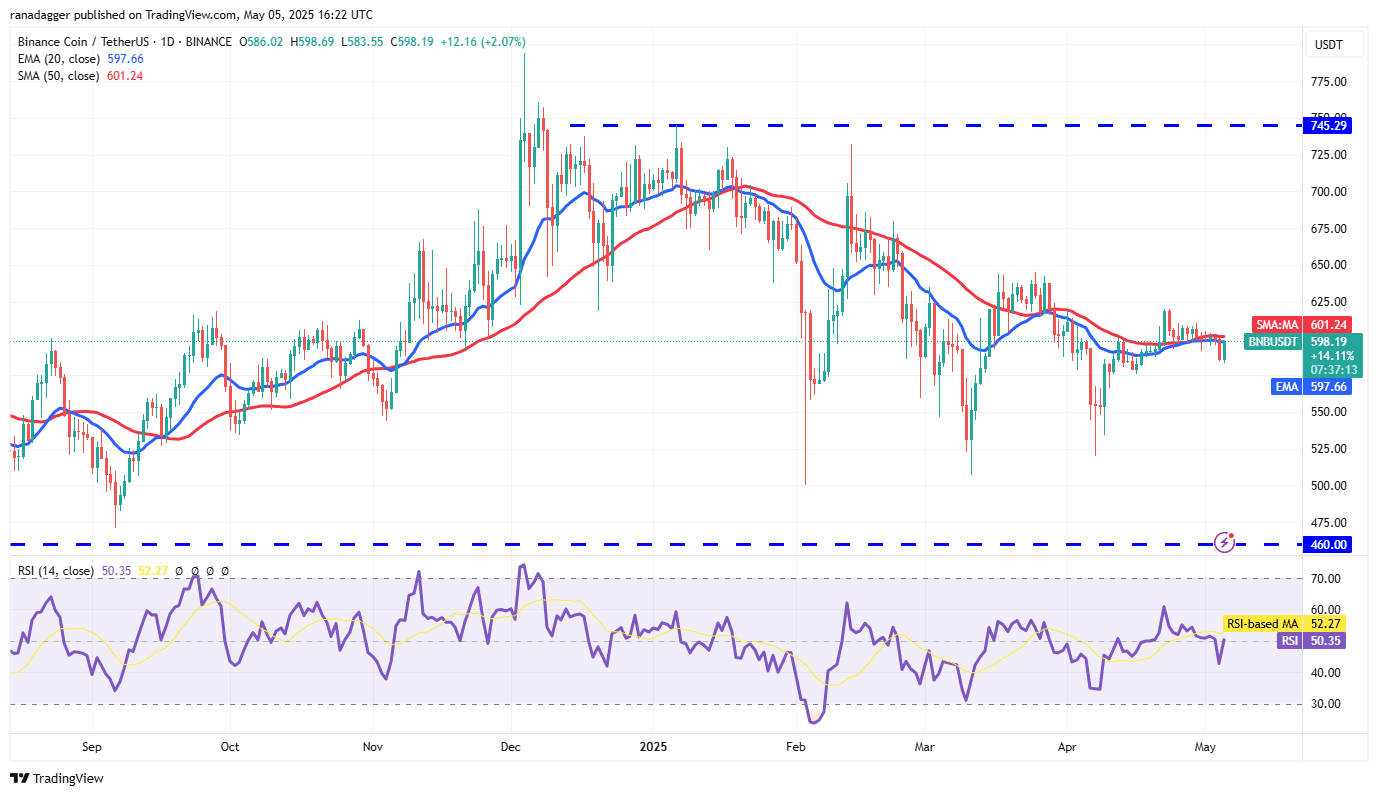

BNB Price Prediction

BNB fell below moving averages on May 4, with bears struggling to maintain lower levels. A push above the moving averages by buyers would indicate buying at lower levels, potentially leading to a test of the $620 resistance. A successful breakout could send BNB toward $644. However, a rejection at the moving averages could empower bears, potentially leading to a decline toward the $576 to $566 support zone and potentially as low as $520.

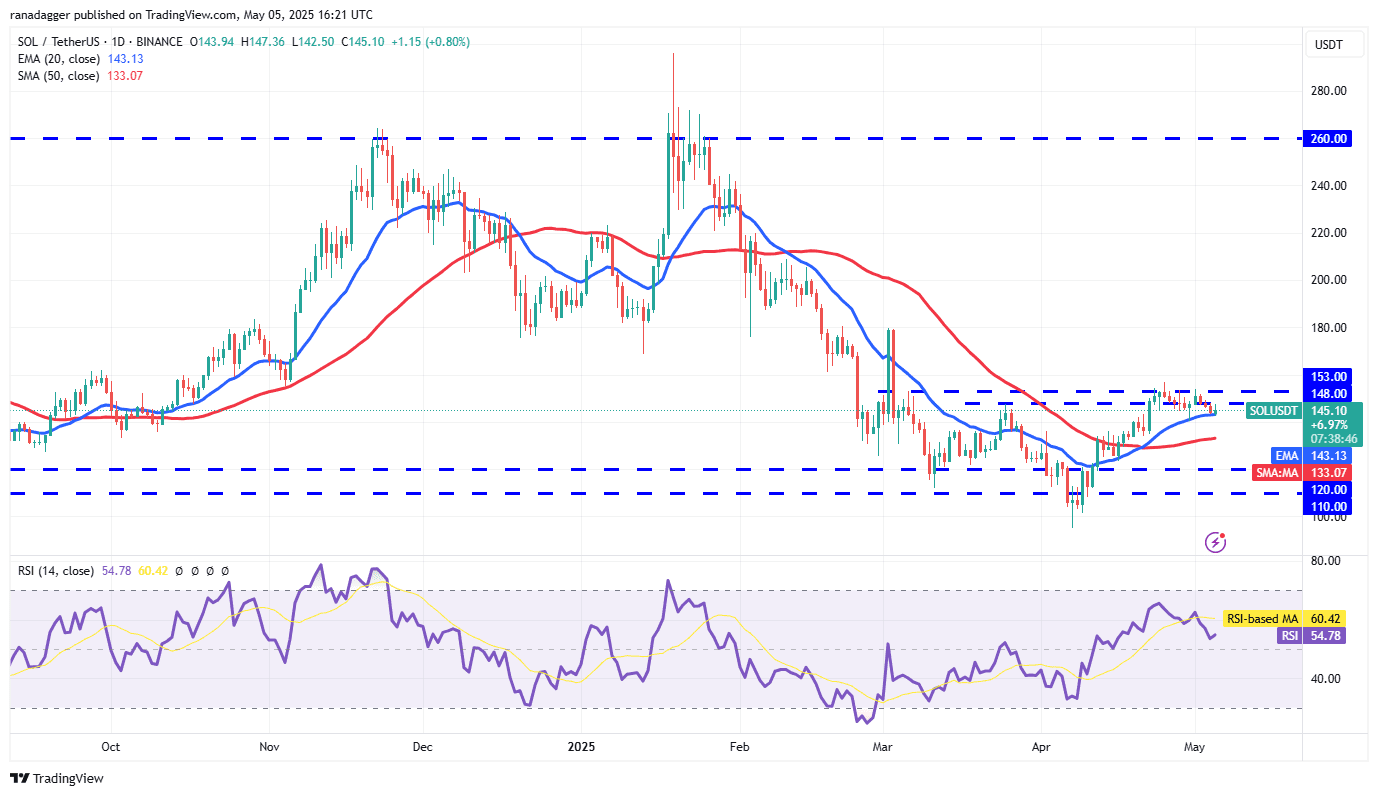

Solana (SOL) Price Prediction

Solana is currently finding support at the 20-day EMA ($143), signaling buying interest on dips. Bulls will aim to push the price above the $153 resistance. A successful breach could propel SOL toward $180, potentially bringing the $110 to $260 range into play. Conversely, bears need to push the price below the 20-day EMA to prevent further upside. This could lead to a decline towards the 50-day SMA ($133), potentially leading to consolidation between $110 and $153.

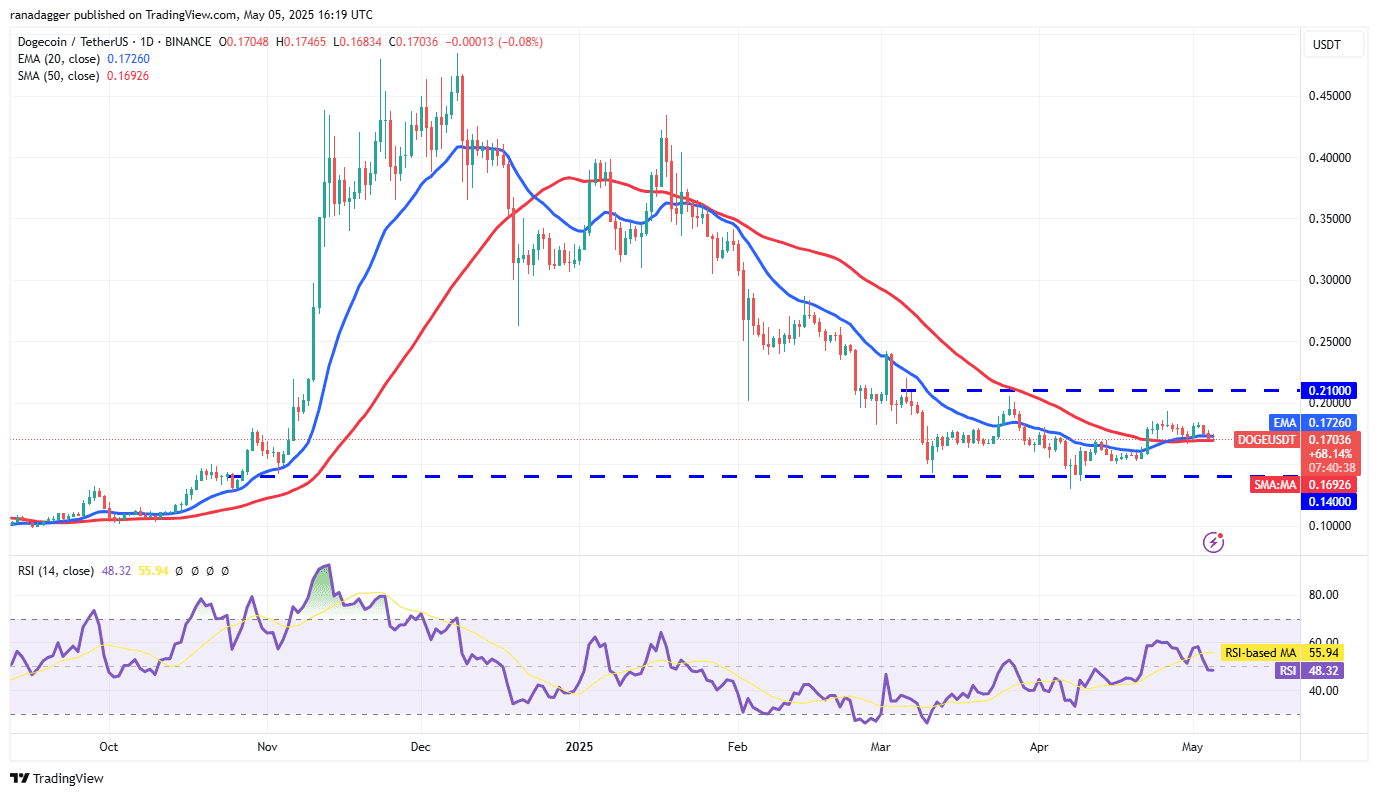

Dogecoin (DOGE) Price Prediction

Dogecoin has remained above the moving averages, but lacks strong rebound momentum. The flat moving averages and RSI near the midpoint suggest DOGE is likely to stay within the $0.14 to $0.21 range. If the price rebounds from the moving averages, bulls will try to reach $0.21. A break above this level could send DOGE to $0.28. Conversely, a break below the moving averages could lead to a decline towards the $0.14 support.

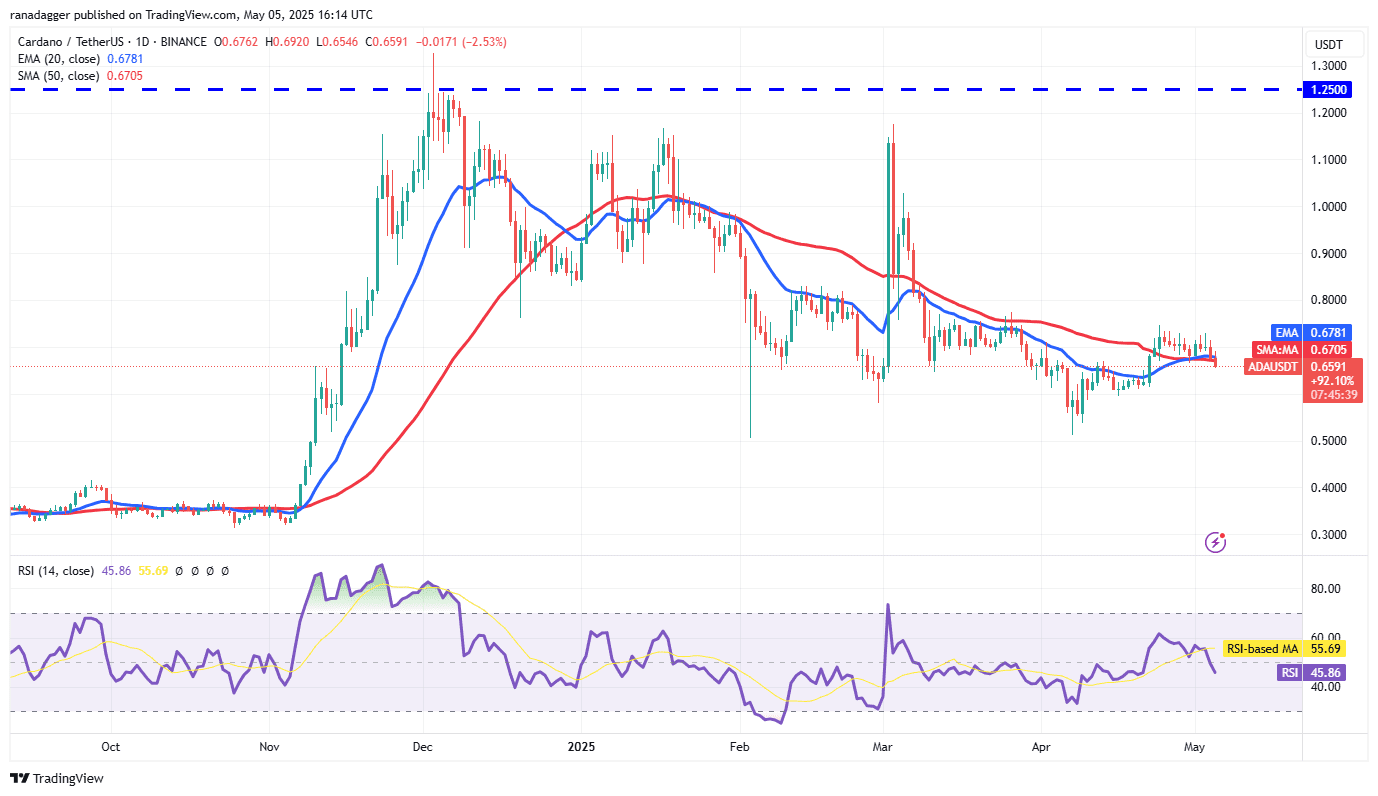

Cardano (ADA) Price Prediction

Cardano is facing a battle between bulls and bears near the moving averages. Flat moving averages and an RSI near the midpoint offer no clear advantage. A break above $0.75 would signal strength and open the door to $0.83. A close below the moving averages would favor bears, potentially leading to a decline towards the $0.58 support and potentially to $0.50.

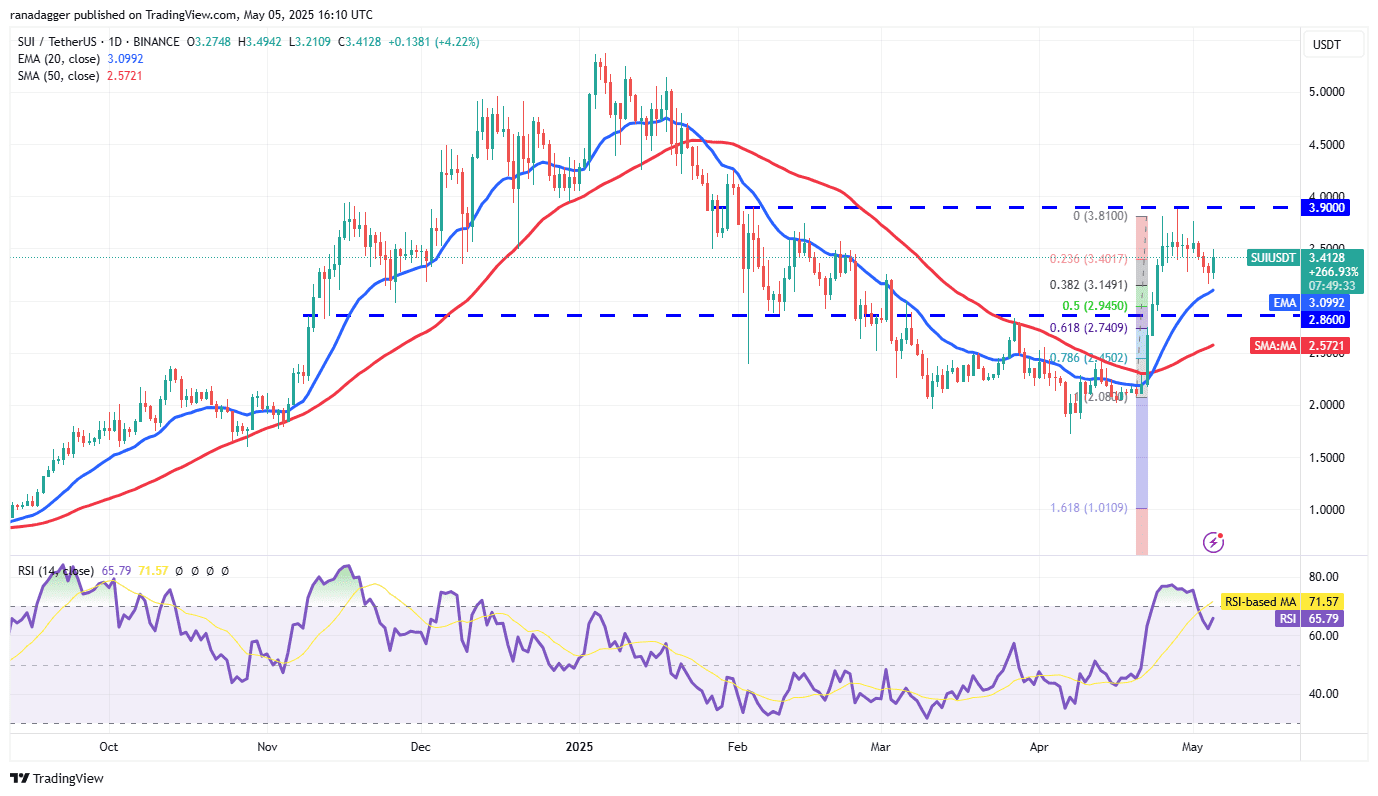

SUI Price Prediction

SUI is attempting to bounce off the 20-day EMA ($3.09), indicating buying interest at lower levels. Bulls will target $3.90, a level expected to act as strong resistance. The upward-sloping 20-day EMA and positive RSI favor buyers. A break above $3.90 could catapult SUI to $4.25 and then $5. If the price reverses from the current level or overhead resistance and falls below the 20-day EMA, it would signal weakening bullish momentum, potentially leading to a decline toward $2.86 and then the 50-day SMA ($2.57).

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Trading cryptocurrencies involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions.