A prominent crypto trader is challenging the narrative of an impending bear market for altcoins, suggesting that the highly anticipated altcoin season is just beginning, with many altcoins trading near their lowest prices.

Michaël van de Poppe, founder of MN Trading Capital, stated in a recent X post that fears of a bear market are premature, emphasizing that altcoins are currently at their bottom and ready for substantial growth in the coming months. He anticipates that this phase will bring significant opportunities for investors over the next 12-24 months.

Altcoin Season Predictions Heat Up

Despite recent gains in several altcoins, many remain below their peak values from earlier in the year. This has led to a debate among analysts about whether altcoin season has truly arrived.

For instance, Solana (SOL) has seen a 17.84% increase in the past month, currently trading at $175.17. However, it is still down 32% since January 19th. Similarly, XRP has gained 1.98%, trading at $2.31, but remains 29.35% lower than its January levels.

Van de Poppe’s bullish outlook contrasts with some Bitcoin (BTC) traders who have cautioned about a potential pullback after Bitcoin reached its all-time high of $111,970.

Other analysts share van de Poppe’s optimistic view. Crypto trader Davinci Jeremie predicts that altcoins will soon experience a “wildfire” of growth, while Moustache asserts that altseason is not just a meme but a real possibility.

The anticipation of altcoin season often hinges on the performance of Ether (ETH) relative to Bitcoin. Many believe that altcoins will surge once Ether demonstrates a period of outperformance.

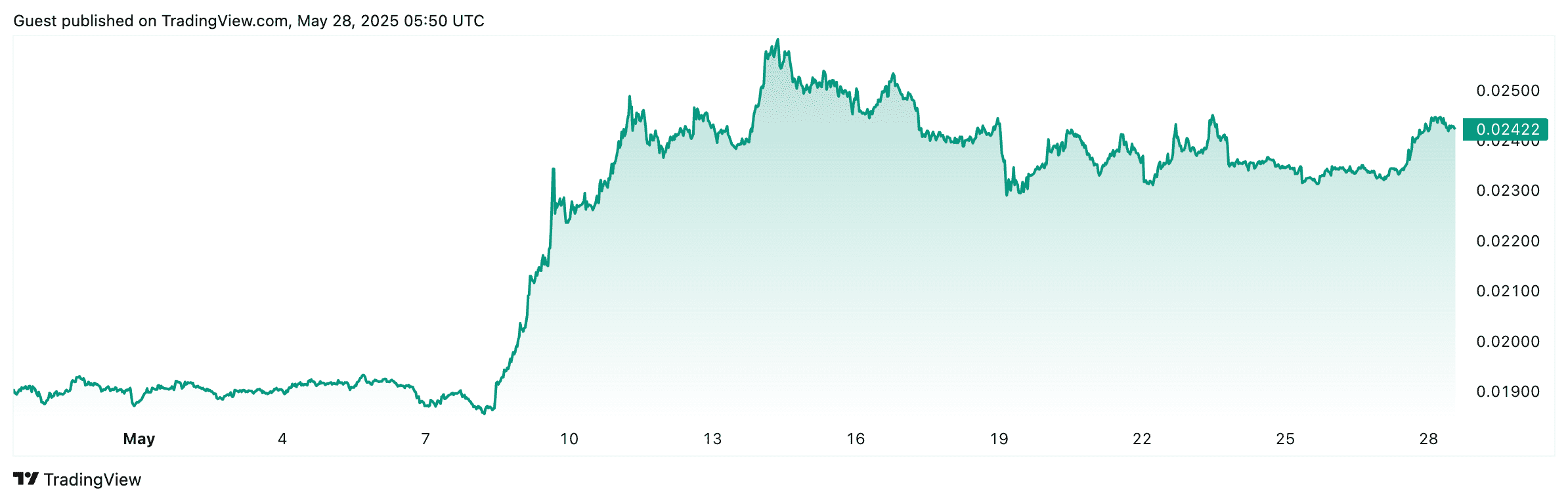

Currently, the ETH/BTC ratio is 0.02430, marking a 26.74% increase over the past 30 days. This suggests a potential shift in momentum towards Ether and, subsequently, other altcoins.

However, CoinMarketCap’s Altcoin Season Index, which gauges the performance of the top 100 altcoins against Bitcoin over the last 90 days, currently indicates a bias towards Bitcoin, with a score of 24 out of 100.

Key Altcoin Gainers

Despite the overall market leaning towards Bitcoin, several altcoins have shown significant gains. Fartcoin led the top 100 cryptocurrencies with a 316.72% increase over the past 90 days, followed by Four (FORM) at 148.15% and Virtuals Protocol (VIRTUAL) at 107.47%.

What is Altcoin Season?

Altcoin season is a period in the cryptocurrency market when altcoins (alternative cryptocurrencies to Bitcoin) outperform Bitcoin in terms of price appreciation. This often leads to significant gains across the altcoin market, attracting increased investor interest and trading volume.

Factors Influencing Altcoin Season:

- Bitcoin’s Dominance: A decline in Bitcoin’s market dominance often signals the start of altcoin season. As Bitcoin’s dominance decreases, investors tend to shift their focus and investments towards altcoins.

- Ethereum’s Performance: Ethereum (ETH) is often considered a bellwether for the altcoin market. When ETH outperforms BTC, it can trigger a rally in other altcoins.

- Market Sentiment: Overall market sentiment plays a crucial role. Positive news, technological advancements, and increased adoption of altcoins can fuel altcoin season.

- New Projects and Technologies: The introduction of innovative blockchain projects and technologies can drive investor interest and capital into specific altcoins.

- Trading Volume: A significant increase in trading volume for altcoins is a key indicator of altcoin season.

How to Prepare for Altcoin Season:

- Research: Thoroughly research various altcoins to understand their fundamentals, technology, and potential for growth.

- Diversification: Diversify your portfolio across different altcoins to mitigate risk.

- Stay Informed: Keep up-to-date with the latest news, trends, and developments in the cryptocurrency market.

- Risk Management: Implement proper risk management strategies, such as setting stop-loss orders and allocating capital wisely.

Disclaimer: This article does not provide financial advice. Cryptocurrency investments are speculative and involve substantial risks. Always conduct thorough research and consult with a financial advisor before making any investment decisions.