APS Buys $3.4M in Tokenized Real Estate: A Game Changer for RWA?

Pan-European fund manager APS became the first institutional investor to directly acquire tokenized real estate assets through MetaWealth’s blockchain-based investment platform, according to an announcement shared with Cointelegraph.

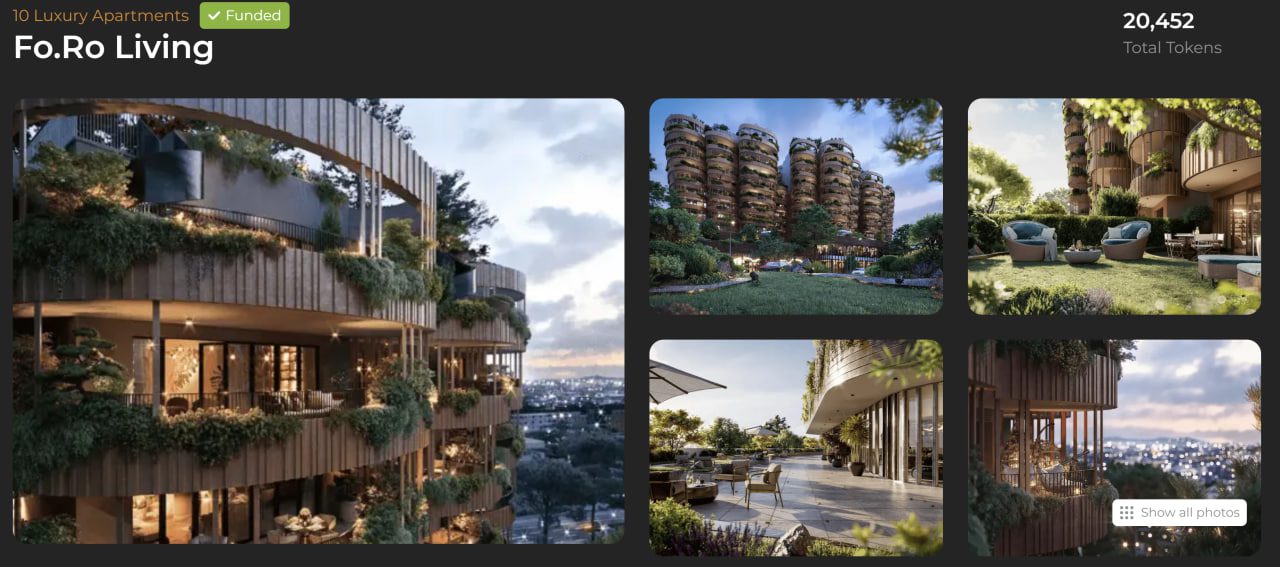

APS, which manages over 12 billion euros ($13.7 billion) in assets, purchased 3 million euros ($3.4 million) in tokenized bonds tied to two Italian residential properties listed on MetaWealth: Fo.Ro Living Rome and Porta Pamphili Rome. Each tranche was split evenly at 1.5 million euros.

APS acquired the same tokenized assets that are available to retail investors. The bonds were transacted and recorded on the blockchain, which adds transparency and programmability to the process.

“Tokenisation represents a transformative shift in investing, offering increased liquidity and streamlined transactions while maintaining compliance and security,” said Mihai Pop, a manager at APS.

Quick Summary of the News

- APS Investment: APS, a major fund manager, invested $3.4M in tokenized real estate.

- MetaWealth Platform: The investment was made through MetaWealth, a platform specializing in fractionalized real estate ownership.

- Italian Properties: The investment targets tokenized bonds linked to two residential properties in Rome.

- Transparency: The transaction was recorded on the blockchain, ensuring transparency.

- Institutional Adoption: This marks a significant step in institutional adoption of RWA tokenization.

Why It Matters

This investment by APS is significant for several reasons:

- Validation of RWA Tokenization: It provides further validation for the concept of tokenizing real-world assets. An established fund manager allocating capital to tokenized real estate demonstrates increasing confidence in this emerging market.

- Increased Liquidity: Tokenization aims to unlock liquidity in traditionally illiquid assets like real estate. Institutional participation can significantly boost liquidity and market depth.

- Accessibility: The fact that APS invested in the same tokenized assets available to retail investors underscores the potential for democratizing investment opportunities.

- Efficiency: Blockchain-based transactions offer increased efficiency and transparency compared to traditional real estate transactions.

Market Impact

The RWA tokenization market is still nascent but growing rapidly. This move by APS could encourage other institutional investors to explore this space, leading to increased capital inflows and further development of the ecosystem.

Expert Take or Personal Insight

While exciting, it’s crucial to remember that the RWA tokenization space is still developing. Regulatory frameworks are evolving, and the long-term performance of these assets remains to be seen. However, the entry of institutional players like APS suggests that RWA tokenization has the potential to revolutionize how we invest in real estate and other asset classes. The key will be navigating the regulatory landscape and building robust, transparent platforms.

Actionable Insight

For traders and investors:

- Monitor RWA Platforms: Keep an eye on platforms like MetaWealth and others involved in RWA tokenization. Track their transaction volumes, the types of assets being tokenized, and the regulatory developments surrounding them.

- Research Institutional Interest: Follow news regarding institutional investment in RWA tokenization. This can provide valuable signals about the direction of the market.

- Understand the Risks: Be aware of the risks associated with RWA tokenization, including regulatory uncertainty, liquidity challenges, and potential security vulnerabilities.

Conclusion

APS’s investment in tokenized real estate is a noteworthy event, underscoring the growing potential of RWA tokenization. As more institutions enter this space, we can expect increased innovation, liquidity, and accessibility in the real estate market and beyond. The future looks bright for RWA, but careful monitoring and due diligence are essential.