Arca Dumps Circle Shares After Public Spat Over IPO Allocation: What Does It Mean?

Arca Chief Investment Officer Jeff Dorman said the digital investment company has sold all of its Circle shares following the stablecoin company’s recent listing on the New York Stock Exchange.

The update followed a scathing open letter published by Dorman on social media on June 5, criticizing Circle for giving the investment firm a “throwaway” allocation in Circle’s initial public offering (IPO).

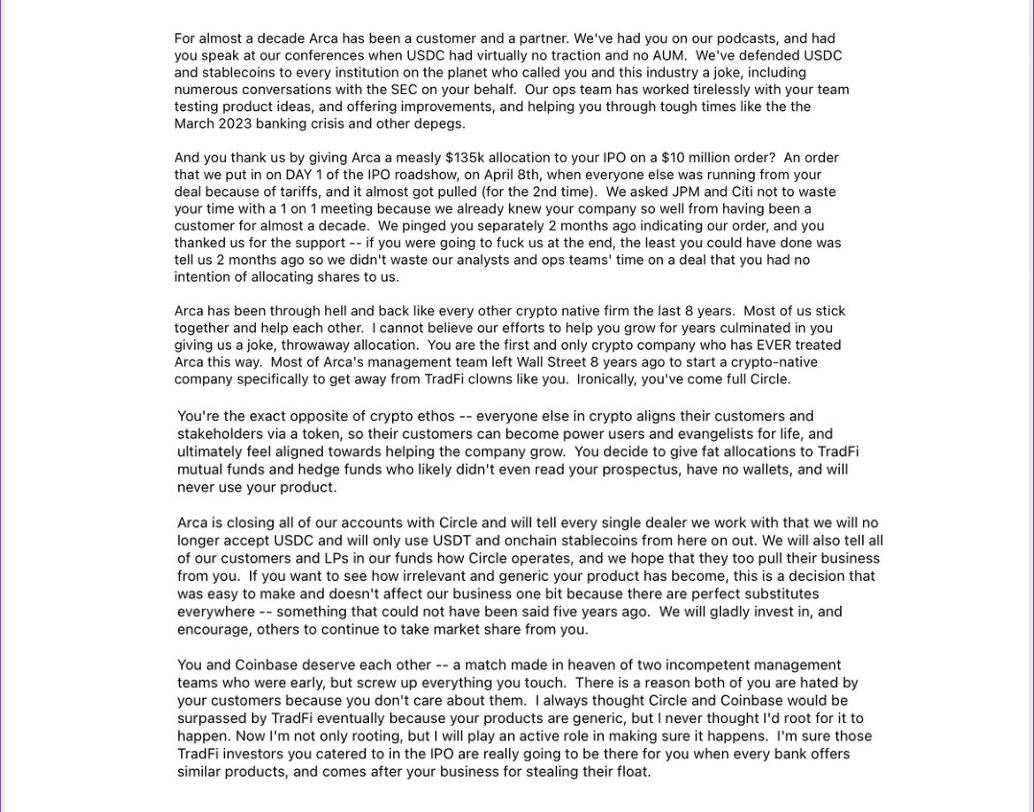

According to Dorman, Arca submitted an order for $10 million in Circle shares in April 2025 and only received a $135,000 allocation despite being a long-time supporter and one of the earliest investors to submit a bid. The executive wrote in a now-deleted letter:

“We pinged you separately two months ago indicating our order, and you thanked us for the support. If you were going to f[***] us at the end, the least you could have done was tell us two months ago so we didn’t waste our analysts’ and ops teams’ time on a deal that you had no intention of allocating shares to us.”

“Arca is closing all of our accounts with Circle and will tell every single dealer we work with that we will no longer accept USDC,” Dorman continued.

Cointelegraph reached out to Circle for comment on the letter but hadn’t received a response by the time of publication.

Circle’s public listing is a significant development in the crypto industry as the issuer of the world’s second-largest stablecoin, Circle-USD (USDC), with a total market capitalization of over $61 billion, now has access to the world’s deepest capital market.

Circle lists on the NYSE to trading frenzy

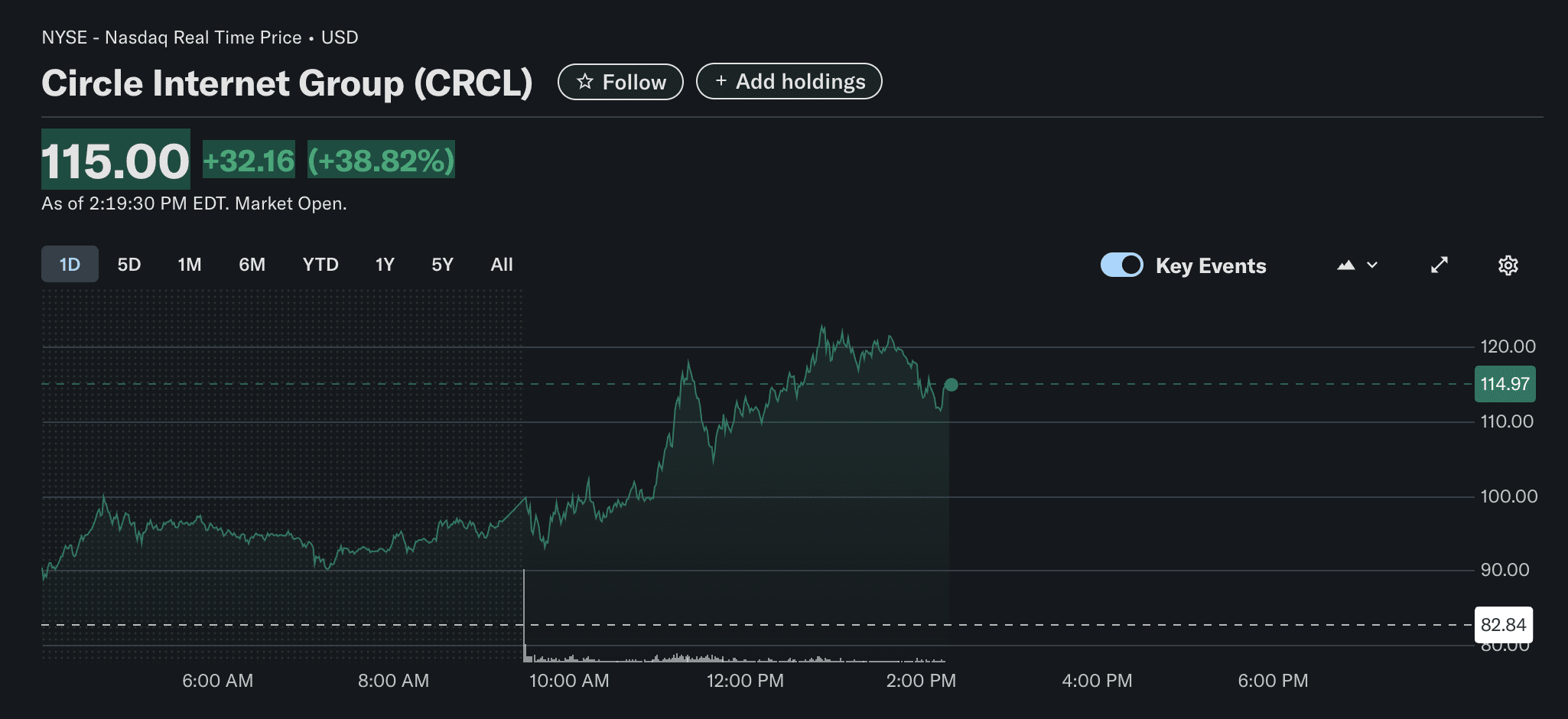

Circle began trading on the NYSE on June 5 under the ticker CRCL, following an IPO that raised $1.05 billion.

The company’s shares surged by 167% on its debut, closing out the trading day at $82.

The stock continued the rally on June 6 and is currently trading hands around $115 per share during intraday hours.

Quick Summary of the News:

- Arca, a digital asset investment firm, sold all its Circle (CRCL) shares following the company’s IPO.

- Arca’s CIO, Jeff Dorman, publicly criticized Circle for a small IPO allocation despite a $10 million order.

- Dorman expressed disappointment, stating Arca would close accounts with Circle and reject USDC.

- Circle’s IPO raised $1.05 billion and saw its stock surge by 167% on its debut.

- CRCL stock continues to rally, trading around $115 per share.

Why It Matters

This situation highlights the importance of strong relationships and fair allocation practices in the IPO process. While the immediate impact of Arca’s sale may be limited, the public criticism raises questions about Circle’s handling of its early investors and partners. It could also deter other firms from participating in future offerings if they fear similar treatment. The value of any public company is based on trust and transparency, which this certainly challenges.

Market Impact

While CRCL stock has performed well initially, this event could lead to increased scrutiny and volatility.

Here’s a hypothetical look at how events like this *could* impact trading volume. Please note this data is purely illustrative and not based on real-time information:

| Date | Event | Trading Volume (Hypothetical) |

|---|---|---|

| June 5 | Circle IPO Debut | 10 Million Shares |

| June 6 | Arca’s Criticism Public | 15 Million Shares (Increase in volatility) |

A sustained negative sentiment could eventually affect investor confidence in Circle and, potentially, the broader stablecoin market, though USDC’s strong position provides a buffer.

Expert Take or Personal Insight

It’s understandable that Dorman is upset. IPO allocations are often political, but alienating early supporters is rarely a good long-term strategy. While Circle’s strong debut indicates current market confidence, they need to address these concerns swiftly to maintain that trust. This also showcases the inherent risks in relying too heavily on single entities, even those as large as Circle, in the crypto space. Diversification remains key for investors.

Actionable Insight

Traders and investors should watch CRCL’s stock price and trading volume closely over the next few weeks. Monitor news and social media for further developments or responses from Circle. Any significant drop in price or sustained increase in trading volume could indicate growing concerns among investors. Consider your risk tolerance and diversification strategy accordingly.

Conclusion

Arca’s public departure from Circle is a cautionary tale for the crypto world. While Circle’s IPO represents a milestone for the industry, this incident underscores the importance of transparency, fairness, and communication in maintaining long-term relationships and investor confidence. Moving forward, it will be crucial to observe how Circle navigates this situation and whether it impacts the company’s future performance and the broader stablecoin ecosystem.