Argentina’s Watchdog Clears Milei in LIBRA Memecoin Scandal: What’s the Real Impact?

Argentine President Javier Milei did not breach any of his presidential duties when he promoted the Libra memecoin, the country’s Anti-Corruption Office said in a recent decision.

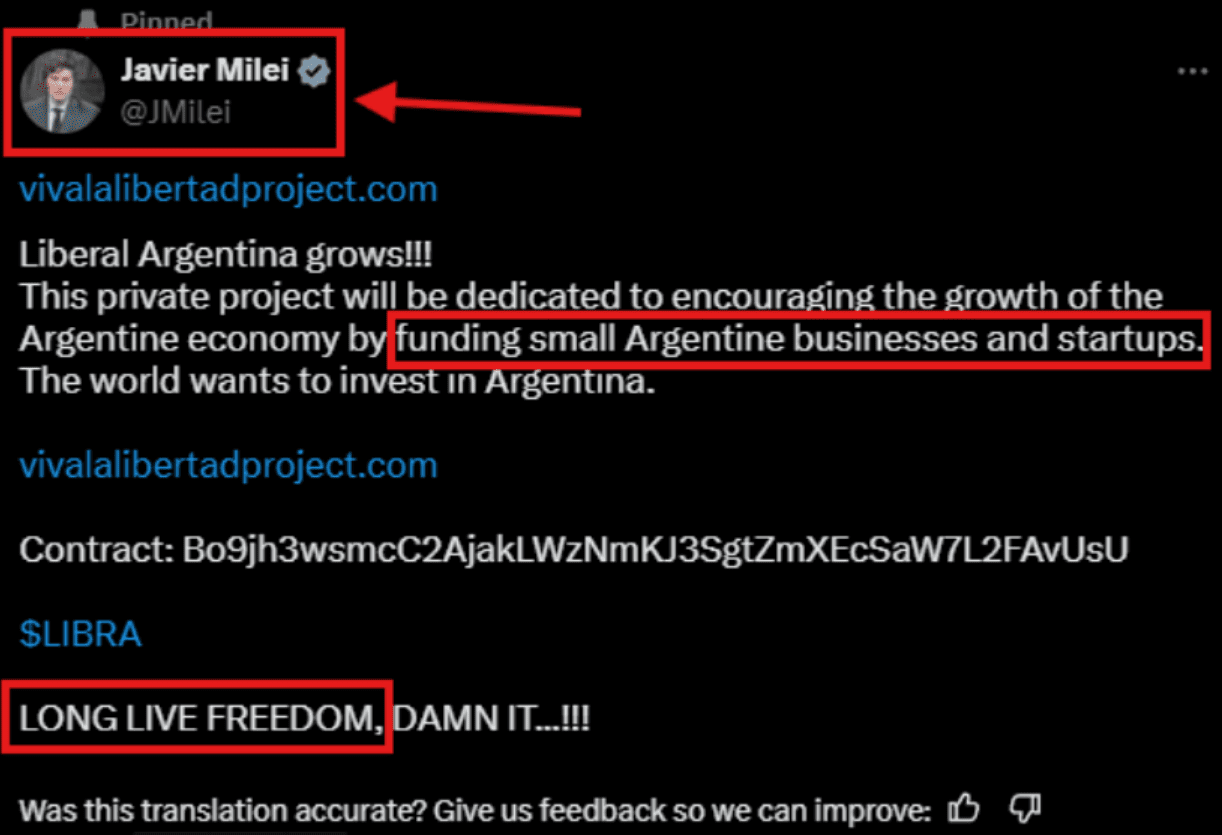

In a June 5 resolution, the Anti-Corruption Office said Milei was acting in a personal capacity when he endorsed the Libra (LIBRA) token in a Feb. 14 X post, and therefore, Milei did not violate Argentina’s federal ethics laws for public officials.

The decision is significant as Milei’s endorsement supposedly contributed to investors losing a combined $251 million, prompting members of the opposition party to call for Milei’s impeachment.

LIBRA reached a $4 billion market cap shortly after Milei’s X post but crashed around 94% hours later, possessing many characteristics of a classic crypto pump-and-dump.

Quick Summary of the News

- Argentina’s Anti-Corruption Office cleared President Milei of ethical breaches related to promoting LIBRA.

- The Office stated Milei acted in a personal capacity when endorsing the memecoin on X.

- The endorsement preceded a significant crash in LIBRA’s value, leading to substantial investor losses.

- Opposition members had called for Milei’s impeachment following the incident.

- A separate task force investigating the scandal was shut down by Milei in May.

Why It Matters

This decision has several layers of significance. Firstly, it highlights the risks associated with celebrity endorsements in the crypto space. Even seemingly innocuous social media posts can have a massive impact on market sentiment and investor behavior. Secondly, it raises questions about the ethical responsibilities of public figures when discussing or promoting digital assets. While Milei has been cleared of legal wrongdoing, the incident underscores the potential for reputational damage and the need for greater transparency.

Furthermore, the case emphasizes the wild west nature of the memecoin market. The rapid rise and fall of LIBRA, fueled by social media hype, serves as a cautionary tale for investors. It demonstrates how quickly fortunes can be made and lost in this highly speculative segment of the crypto ecosystem.

Market Impact

While the immediate market impact of the Anti-Corruption Office’s decision is likely minimal, the long-term effects could be more pronounced. Here’s a potential impact assessment:

| Area | Potential Impact |

|---|---|

| Memecoin Sentiment | Could fuel further speculation, as the lack of repercussions might embolden similar endorsements. |

| Regulatory Scrutiny | May prompt increased regulatory interest in celebrity endorsements of crypto assets globally. |

| Investor Confidence | Could erode trust in memecoins and increase demand for more established cryptocurrencies. |

| Milei’s Popularity | While legally cleared, his image might continue to suffer in Argentina. |

Expert Take or Personal Insight

The Milei/LIBRA saga is a perfect illustration of why caution is paramount in the crypto world. While the Anti-Corruption Office found no legal breach, the moral implications remain. Leaders should be mindful of their influence, especially when it comes to promoting assets susceptible to pump-and-dump schemes. The decision, while legally sound according to Argentina’s framework, doesn’t negate the losses suffered by many investors. It highlights the gap between current regulations and the fast-evolving crypto landscape.

I believe this event will serve as a future case study for regulatory bodies worldwide. We might see stricter guidelines emerging for public figures engaging with the crypto market, to protect retail investors from potential scams.

Actionable Insight

Here’s what traders and investors should consider:

- Diversify: Don’t put all your eggs in the memecoin basket. Allocate a smaller percentage of your portfolio to higher-risk assets.

- Do Your Research: Before investing in any cryptocurrency, especially memecoins, conduct thorough research. Understand the project’s fundamentals (if any), team, and community.

- Be Wary of Hype: Be extremely cautious of endorsements, especially on social media. Remember, influencers are often paid to promote projects, and their interests may not align with yours.

- Risk Management: Set stop-loss orders to limit potential losses. Only invest what you can afford to lose.

Despite the Anti-Corruption Office’s decision, a federal criminal court is still investigating Milei’s involvement in the LIBRA token scandal.

Task force also found no wrongdoing

On May 19, Milei signed a decree to shut down a task force established to investigate the Libra scandal.

No action was taken against Milei or any other Argentine official allegedly tied to the scandal.

However, some critics say a legitimate investigation wasn’t conducted adequately in the first place.

“It was always a fake, they never dared to investigate anything at all, and they’re covering each other up because they’re completely up to their necks in it,” Itai Hagman, an economist and member of the Chamber of Deputies of Argentina, said in a May 20 X post.

Milei still damaged his image

Data from polling platform Zuban Córdoba in March suggested that the Libra scandal negatively impacted Milei’s image and the national management approval rating.

The latter of those metrics fell from 47.3% in November to 41.6% in March after 1,600 respondents were asked whether Milei still has their trust after the incident.

Conclusion

The Javier Milei/LIBRA case serves as a stark reminder of the inherent risks in the crypto market, particularly within the memecoin sector. While legal absolution has been granted, the ethical questions and potential market ramifications linger. Moving forward, expect increased scrutiny on public figures endorsing crypto projects and a greater emphasis on investor education and responsible trading practices. The crypto market is constantly evolving, and so too must the frameworks that govern it.