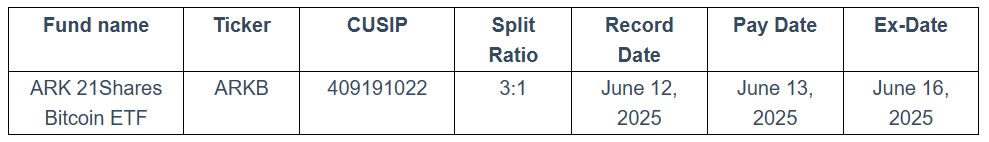

The ARK 21Shares Bitcoin ETF (ARKB) will undergo a 3-for-1 share split later this month as the fund’s issuer, 21Shares, says it is looking to boost its appeal to retail investors.

The stock split is slated for June 16 and is designed to “make shares more accessible to a broader base of investors and enhance trading efficiency,” 21Shares said on June 2.

The exchange-traded fund’s (ETF) investment strategy aiming to track the price of Bitcoin (BTC) won’t change, and its Bitcoin holdings will remain identical, 21Shares said. It added that the ETF will continue trading as usual, and the total net asset value of the fund will also remain unchanged.

A stock split is when a company divides its existing shares into multiple new shares. In a 3-for-1 split, each share becomes three, but the total value remains the same.

Some investors may feel priced out when asset or share prices rise, which can dissuade them from buying certain stocks. This leads some companies or ETF issuers to split their stock and lower the price per share, making it more affordable to retail investors, even though the underlying value is unchanged.

ARKB closed June 2 trading at $104.25 a share, meaning if a stock split happened now, one share would be priced at a third of the current value at just under $35.

Quick Summary of the News:

- ARK 21Shares Bitcoin ETF (ARKB) announces a 3-for-1 stock split.

- The split is scheduled for June 16.

- The goal is to make shares more accessible to retail investors and improve trading efficiency.

- The ETF’s investment strategy and Bitcoin holdings will remain unchanged.

- The total net asset value of the fund will remain the same.

Why It Matters:

This stock split highlights the ongoing efforts to broaden access to Bitcoin investments. By lowering the per-share price, ARKB aims to attract retail investors who may have been hesitant due to the higher initial cost. This could potentially increase demand for the ETF and, indirectly, for Bitcoin itself.

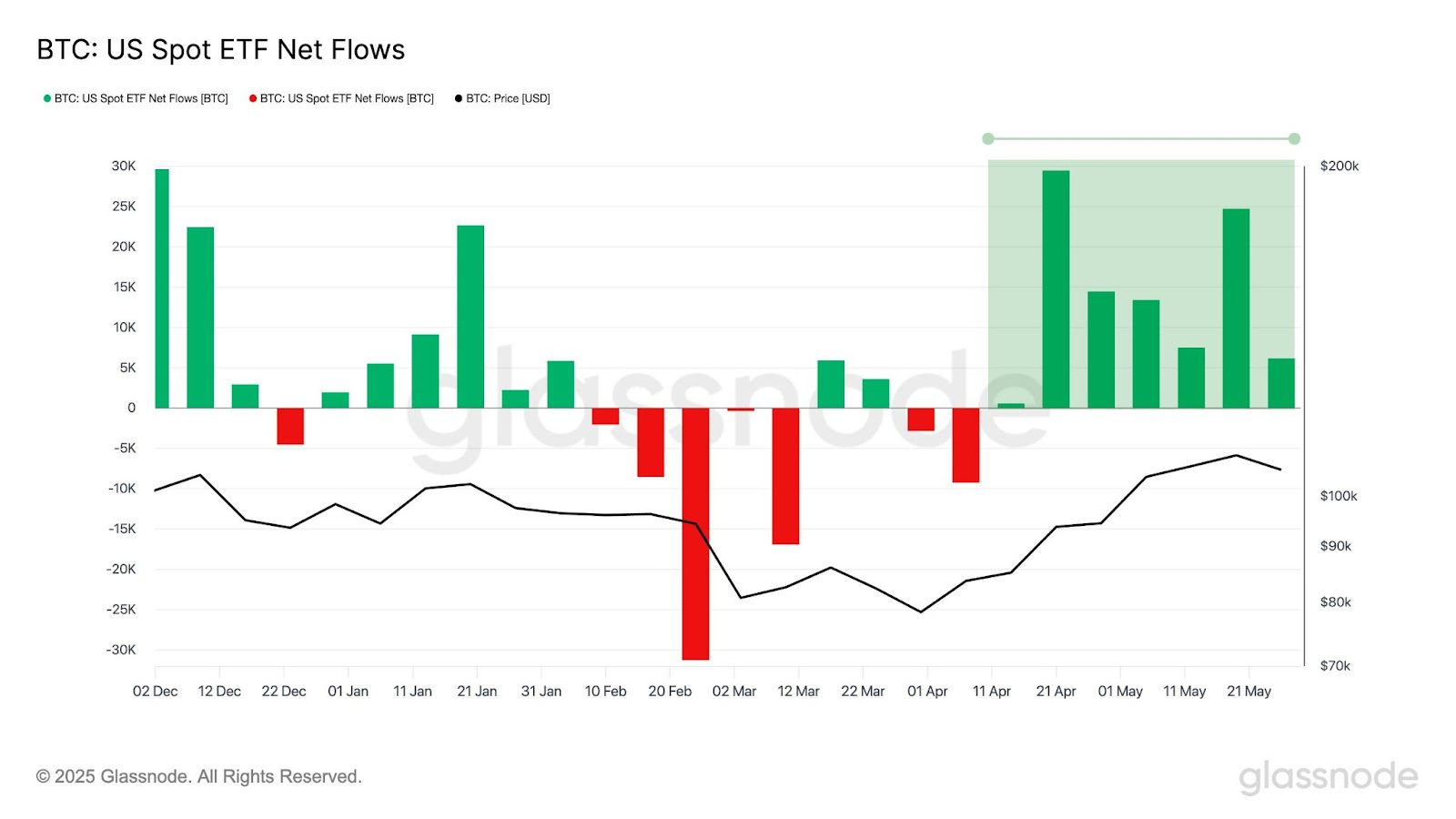

However, the move also comes at a time when ARKB has experienced significant outflows. The timing raises questions about whether this is a proactive strategy or a reactive measure to stem the bleeding.

The ARK 21Shares Bitcoin ETF, a joint offering between 21Shares and investment manager ARK Invest, has recently been the worst-performing fund in terms of flows out of the 11 spot Bitcoin ETFs in the US.

It has seen six consecutive trading days of outflows totalling $430 million. That trend didn’t change on June 2, when $74 million left the product, according to CoinGlass.

However, it is the third-largest fund in terms of total aggregate inflows with $2.37 billion, trailing similar ETFs from BlackRock and Fidelity.

ARKB currently has $4.8 billion in assets under management with a year-to-date return of 7.35%.

Market Impact:

While a stock split doesn’t fundamentally change the value of the ETF or its underlying assets, it can influence investor behavior.

| ETF | AUM (USD Billion) | YTD Return | Net Flows (Past Week) |

|---|---|---|---|

| BlackRock (IBIT) | 20 | 8.12% | Positive |

| Fidelity (FBTC) | 11.5 | 7.85% | Positive |

| ARK 21Shares (ARKB) | 4.8 | 7.35% | Negative ($430 Million) |

Note: Data is for illustrative purposes and may not be entirely up-to-date.

The table illustrates that while ARKB has a decent YTD return, its recent net outflows are concerning compared to its competitors. The stock split could be a strategy to reverse this trend.

Expert Take or Personal Insight:

While making Bitcoin ETFs more accessible is generally positive, the timing of ARKB’s stock split raises eyebrows. Is it truly about empowering retail investors, or is it a tactic to mask deeper problems, such as the recent significant outflows? My suspicion leans towards the latter. While increased retail participation can provide a temporary boost, the ETF needs to address the underlying reasons for the outflows to ensure long-term sustainability. The market is competitive, and investors are clearly shifting towards ETFs perceived as more stable or offering better risk-adjusted returns.

Actionable Insight:

- Traders: Watch the trading volume and price action of ARKB post-split. A significant increase in retail buying could provide a short-term boost.

- Investors: Consider the reasons behind ARKB’s recent outflows. Compare its performance and risk profile with other Bitcoin ETFs before making investment decisions. Don’t be swayed solely by the lower share price.

- All: Monitor Bitcoin’s overall performance. ETF flows are often correlated with Bitcoin’s price trends. A sustained Bitcoin rally could benefit all spot ETFs, including ARKB, regardless of the stock split.

Conclusion:

The ARKB stock split is a development worth watching. While it aims to democratize access to Bitcoin investment, its true impact will depend on whether it can attract and retain retail investors in the long run, and more importantly, address the reasons behind recent outflows. The coming weeks will reveal whether this is a successful maneuver or merely a cosmetic fix.

Bitcoin ETFs outflows increase

Spot Bitcoin ETFs in the US have reversed a trend of inflows, with an aggregate net outflow of $1.2 billion over the past three trading days, according to CoinGlass.

The outflows accelerated as Bitcoin prices dropped 4% in a fall from over $108,000 to just below $104,000 on June 2.

Glassnode reported that last week’s inflow of more than 6,100 BTC marked the seventh consecutive week of net inflows, “highlighting consistent demand despite cooling momentum.”