Regulatory Actions & Enforcement: US DOJ seeks to seize $225M in crypto linked to “pig butchering” scams. Separately, New York authorities froze $300K tied to […]

Author: Bruno

NFTs Evolving: From Speculative Assets to Core Digital Infrastructure

NFTs aren’t dead – they’re evolving into the backbone of digital infrastructure. This news analysis explores how NFTs are moving beyond speculation to underpin gaming, AI, and Web3.

Bitcoin Treasuries at Risk? Corporate BTC Holdings Face Price Pressure Test

A growing trend of companies adding Bitcoin to their treasuries is raising concerns about potential vulnerabilities during market downturns. Will these new Bitcoin banks hold up?

Bitcoin to $130K: Will Selling Pressure Really Vanish?

Bitwise CEO Hunter Horsley predicts a dramatic shift in Bitcoin holder behavior once BTC hits $130,000. Will sell pressure truly evaporate at this level?

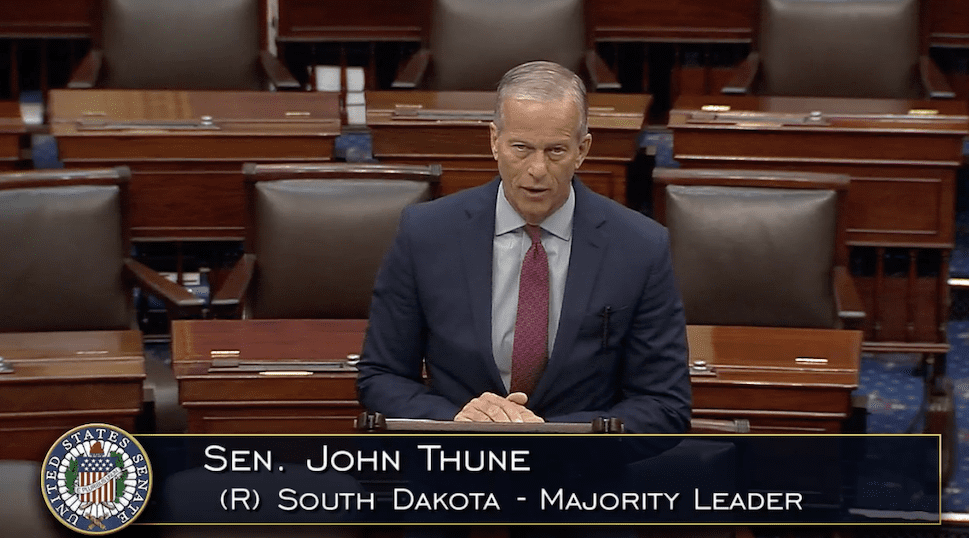

GENIUS Act Advances in US Senate: A Step Closer to Stablecoin Regulation?

The GENIUS Act, aimed at regulating stablecoins, has moved forward in the US Senate following a successful cloture vote. This signifies progress but also highlights ongoing debates surrounding crypto regulation and potential political influences.