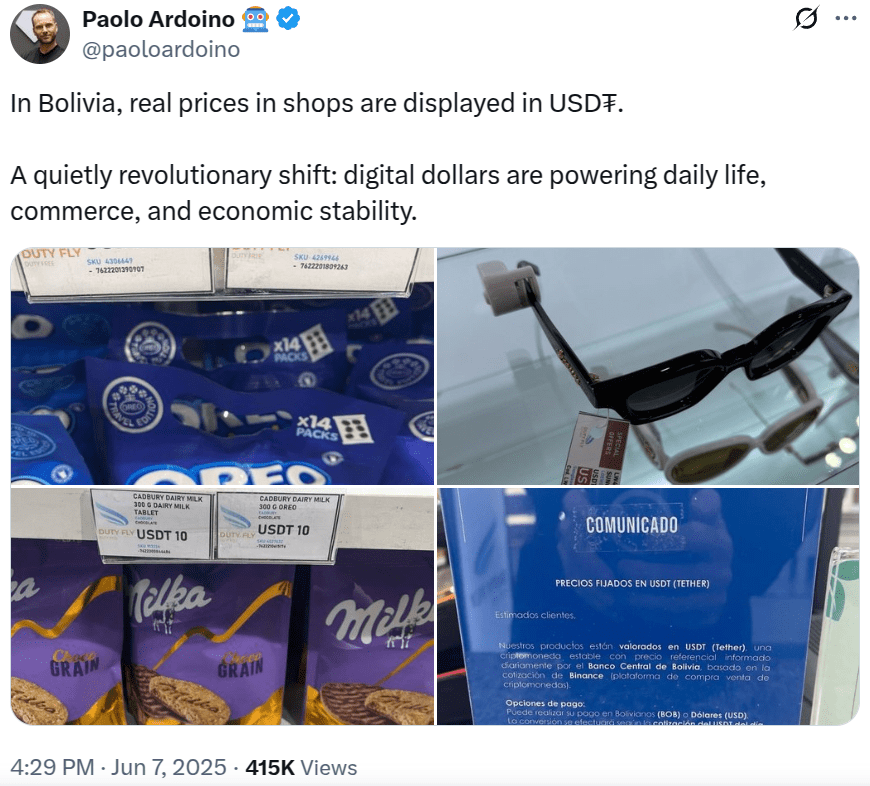

The appearance of Tether’s USDT on price tags in a Bolivian airport shop, as highlighted by Tether CEO Paolo Ardoino, signals a growing reliance on stablecoins as a pricing benchmark in the nation’s struggling economy.

Author: Bruno

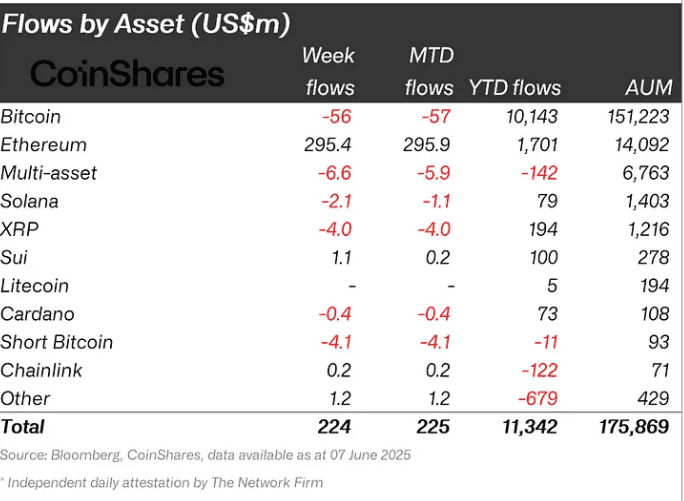

Ether Funds Surge: $296M Inflows Signal Renewed Investor Confidence

Ether-based investment products are leading the way in crypto investment inflows, marking a significant shift in sentiment despite overall market caution surrounding US Federal Reserve decisions.

Kaia to Launch Won-Pegged Stablecoin as South Korean Payment Stocks Surge

Kaia, backed by Kakao, plans a South Korean won-based stablecoin amidst a crypto-friendly political climate, boosting payment stocks like Kakao Pay.

Ethereum’s GDPR Privacy Roadmap: Balancing Compliance and Decentralization

A novel Ethereum privacy roadmap proposes a modular design and privacy-enhancing technologies to navigate EU GDPR regulations while preserving the blockchain’s core principles.

Strategy Adds 1,045 BTC for $110M: Will Bitcoin’s Price Follow?

Strategy continues its aggressive Bitcoin accumulation strategy, purchasing an additional 1,045 BTC for $110.2 million. This move signals strong conviction in Bitcoin’s long-term potential, but what does it mean for the market?