Bancor Sues Uniswap for Patent Infringement: A Deep Dive into the DEX Dispute

Bancor, a pioneering force in decentralized finance (DeFi), has initiated legal action against Uniswap, a leading decentralized exchange (DEX), alleging patent infringement. The lawsuit centers around Bancor’s patented technology underpinning the ‘constant product automated market maker’ model, a fundamental component of many DEXs. Bancor claims Uniswap utilized this technology without permission, leading to significant profits for the latter.

According to Bancor’s May 20th announcement, the core technology was developed in 2016 and patented in January 2017. This technology, which involves using mathematics to add or withdraw resources from a liquidity pool, forms the basis of Bancor’s intellectual property claim.

Bancor asserts that Uniswap’s protocol, launched in November 2018, incorporates this patented invention. Given that both companies operate within the decentralized finance (DeFi) space and are considered competitors, the lawsuit carries substantial weight within the industry.

“When an organization continuously uses our invention without our authorization and does so as a means of competing with us, we must take action,” stated Mark Richardson, project lead at Bancor, highlighting the company’s rationale for pursuing legal recourse.

As of the time of the initial report, Uniswap had not issued a public response to the lawsuit, which was filed in the U.S. District Court for the Southern District of New York.

The lawsuit explicitly states that “With this lawsuit, Bprotocol Foundation and LocalCoin seek compensation for Uniswap Labs’ unlicensed use of Bancor’s patented technology and Uniswap Foundation’s inducement of infringement.”

Understanding the ‘Constant Product Automated Market Maker’

The heart of the dispute lies in the ‘constant product automated market maker’ (AMM) technology. This mechanism allows for the automated trading of digital assets without relying on traditional order books. Here’s a simplified explanation:

- Liquidity Pools: AMMs rely on liquidity pools, which contain reserves of two or more different tokens.

- Constant Product Formula: The core of the AMM is a mathematical formula, typically x * y = k (where x and y are the quantities of the two tokens in the pool, and k is a constant). This formula ensures that the product of the token quantities remains constant.

- Automated Price Discovery: As trades occur, the ratio of tokens in the pool changes, automatically adjusting the price of the assets. Larger trades have a greater impact on the price.

Bancor claims its patented technology covers the specific implementation of this constant product formula, particularly the method of dynamically adjusting the reserves in the liquidity pool.

Uniswap’s Dominance in the DEX Landscape

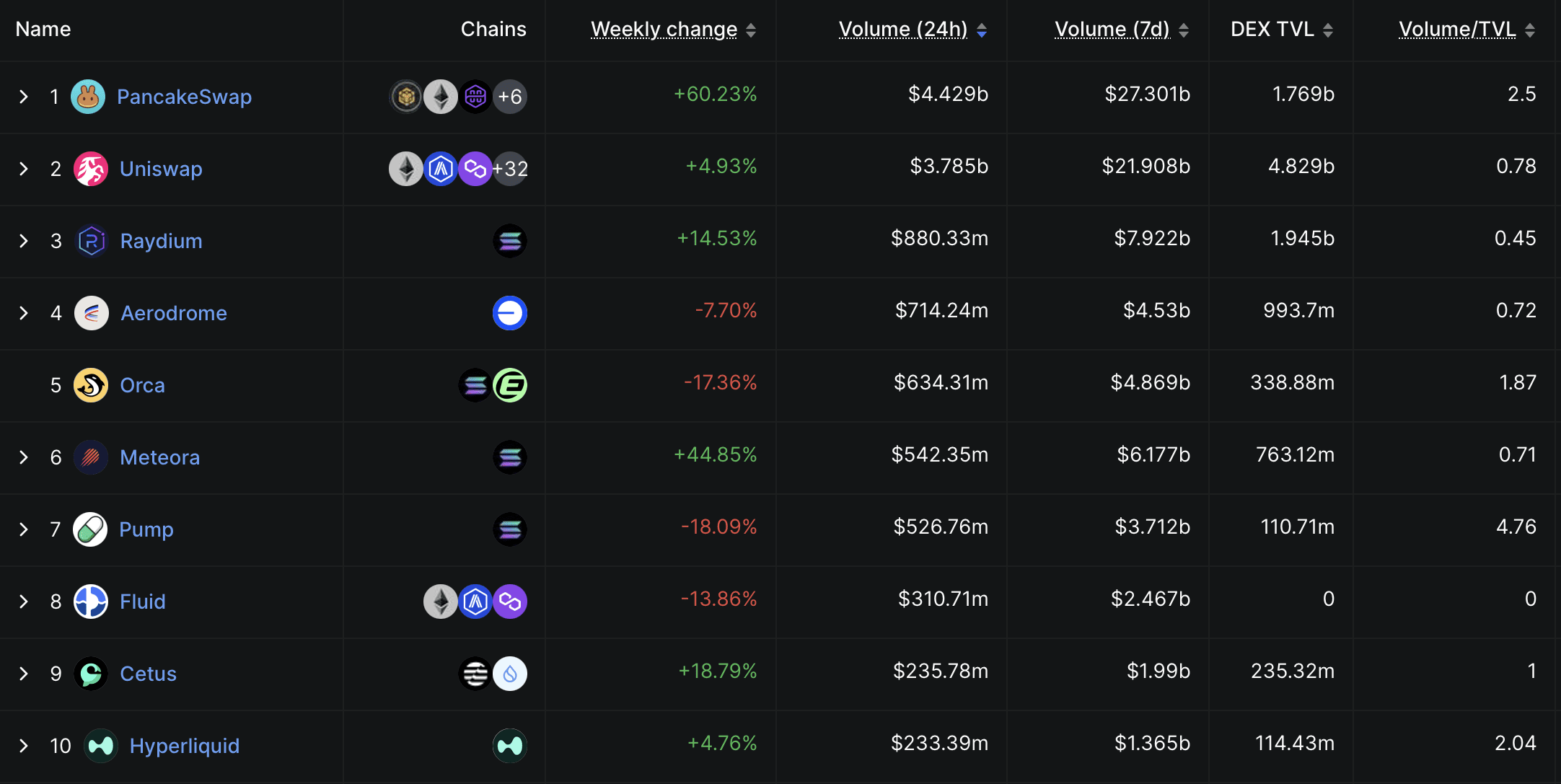

The lawsuit highlights a significant disparity in market share between Bancor and Uniswap. Data from DefiLlama, a crypto data aggregator, illustrates this point:

- Uniswap: Ranks as the second-largest DEX by 24-hour trading volume, processing nearly $3.8 billion.

- Bancor: Holds a much smaller market share, ranking No. 142 with approximately $378,579 in 24-hour trading volume.

Uniswap’s leading position in the DEX market is further evidenced by its lifetime trading volume, which exceeds $2.8 trillion.

Implications for the DeFi Industry

The outcome of this lawsuit could have far-reaching consequences for the DeFi industry. Here are some potential implications:

- Patent Protection in DeFi: The case will test the validity and enforceability of patents related to DeFi technologies. A victory for Bancor could encourage other companies to pursue patent protection for their innovations.

- Innovation and Open-Source Development: Some argue that patents stifle innovation in the open-source and permissionless environment of DeFi. A ruling in favor of Uniswap could reinforce the importance of open-source development and discourage patent trolling.

- Future Lawsuits: This case could set a precedent for future patent disputes within the DeFi sector, potentially leading to increased legal battles and uncertainty.

- Centralization vs. Decentralization: The debate around patents in DeFi often touches on the core principles of decentralization. How can innovation be protected while maintaining the open and permissionless nature of the industry?

Bancor’s Richardson argues that unchecked use of patented technology could hinder innovation across the DeFi industry. The lawsuit aims to protect Bancor’s intellectual property and ensure fair competition.

Key Takeaways

- Bancor is suing Uniswap for patent infringement related to its ‘constant product automated market maker’ technology.

- The lawsuit highlights the growing importance of intellectual property rights in the DeFi space.

- The outcome of the case could have significant implications for the future of innovation and open-source development in DeFi.

- Uniswap has yet to publicly respond to the lawsuit.

The Bancor-Uniswap lawsuit is a landmark case that will undoubtedly shape the legal and technological landscape of decentralized finance. The industry will be watching closely as the case progresses.