Basel Medical’s $1 Billion Bitcoin Investment: Stock Plummets Amid Investor Concerns

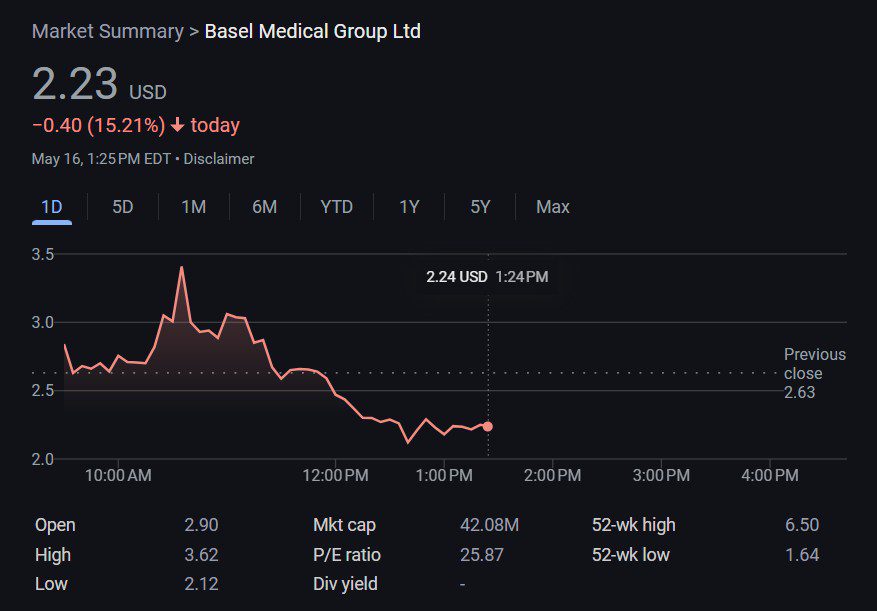

Shares of Basel Medical Group (BMGL) experienced a significant drop of approximately 15% after the Singapore-based healthcare company revealed its intention to allocate $1 billion to Bitcoin (BTC) for its corporate treasury. This decision has sparked debate and raised questions among investors, leading to a notable market reaction.

Basel Medical’s Bitcoin Acquisition Strategy

On May 16, Basel Medical announced it was in discussions to acquire $1 billion worth of Bitcoin through a share-swap arrangement with institutional investors and high-net-worth individuals. The company believes this strategic move will strengthen its balance sheet and provide greater financial flexibility for mergers and acquisitions (M&A). Basel Medical also anticipates that its Bitcoin treasury will serve as a diversified asset base, mitigating risks associated with market volatility.

According to Basel Medical’s CEO, Darren Chhoa, accumulating Bitcoin will enable the company to quickly capitalize on strategic opportunities as it builds a premier healthcare platform across high-growth Asian markets.

Investor Skepticism and Stock Decline

Despite Basel Medical’s optimistic outlook, investors responded negatively to the announcement, causing the company’s stock to decline by around 15%. This reaction underscores the uncertainty and apprehension surrounding the adoption of Bitcoin as a corporate treasury asset. Investors may be concerned about the volatility of Bitcoin and its potential impact on the company’s financial stability.

The Broader Context: Corporate Bitcoin Treasuries

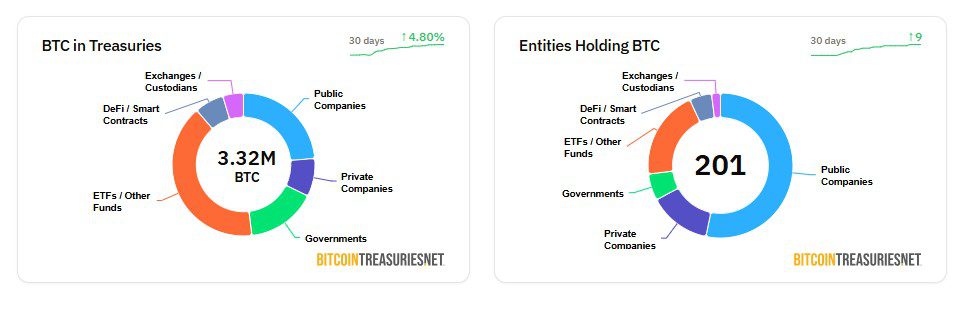

Basel Medical’s decision aligns with a growing trend of corporations allocating a portion of their treasury reserves to Bitcoin. Companies like MicroStrategy and Tesla have made substantial investments in Bitcoin, viewing it as a potential hedge against inflation and a store of value.

As of May 16, corporate treasuries collectively held approximately $80 billion worth of Bitcoin. This figure highlights the increasing acceptance of Bitcoin as a legitimate asset class among institutional investors and corporations.

Potential Benefits and Risks of Corporate Bitcoin Treasuries

Investing in Bitcoin as a corporate treasury asset offers several potential benefits:

- Hedge against inflation: Bitcoin’s limited supply and decentralized nature can serve as a hedge against currency debasement and inflation.

- Diversification: Bitcoin’s low correlation with traditional asset classes can improve portfolio diversification and reduce overall risk.

- Enhanced returns: Bitcoin’s potential for capital appreciation can enhance investment returns.

However, corporate Bitcoin treasuries also entail risks:

- Volatility: Bitcoin’s price is highly volatile, which can lead to significant fluctuations in the value of corporate treasury holdings.

- Regulatory uncertainty: The regulatory landscape surrounding Bitcoin is evolving, which can create uncertainty for corporations.

- Custody and security: Safely storing and managing Bitcoin requires specialized expertise and infrastructure.

Past Examples and Lessons Learned

GameStop experienced a similar market reaction when it announced plans to stockpile Bitcoin. The company’s stock price declined significantly as investors questioned the rationale behind the investment.

These examples highlight the importance of transparent communication and a clear investment strategy when incorporating Bitcoin into a corporate treasury. Companies need to articulate the rationale behind their Bitcoin investments and address investor concerns about volatility and risk.

Conclusion

Basel Medical’s $1 billion Bitcoin investment has triggered a mixed response from investors. While the company believes this move will strengthen its financial position and facilitate its expansion plans, investors have expressed concerns about the volatility and risks associated with Bitcoin.

The future success of Basel Medical’s Bitcoin strategy will depend on the company’s ability to manage the risks associated with Bitcoin and communicate its rationale effectively to investors. As more corporations explore Bitcoin as a treasury asset, it will be crucial to learn from past examples and develop best practices for managing corporate Bitcoin holdings.