Bitcoin, Altcoins Poised to Rally on US-China Tariff Agreement

A temporary truce in the trade war between the US and China, marked by a 90-day tariff agreement, has ignited optimism in the cryptocurrency and stock markets. Investors are keenly observing the potential for a broader market recovery, buoyed by the prospect of tax relief measures.

On May 12, the White House announced a mutual reduction in tariffs to 10% for a 90-day period starting May 14. This 24% decrease from previous tariffs signals a move towards de-escalation.

During a press conference in Geneva, US Treasury Secretary Scott Bessent emphasized the shared desire to avoid economic decoupling. He stated, “The consensus from both delegations is neither side wants to be decoupled. What has occurred with these very high tariffs was an equivalent of an embargo, and neither side wants that. We do want trade. We want more balance in trade.”

Aurelie Barthere, a principal research analyst at Nansen, suggests that the positive sentiment surrounding the negotiations and the temporary suspension of tariffs mitigates the risk of sudden escalation. This could enable altcoins and traditional stock markets to mirror Bitcoin’s (BTC) upward trajectory.

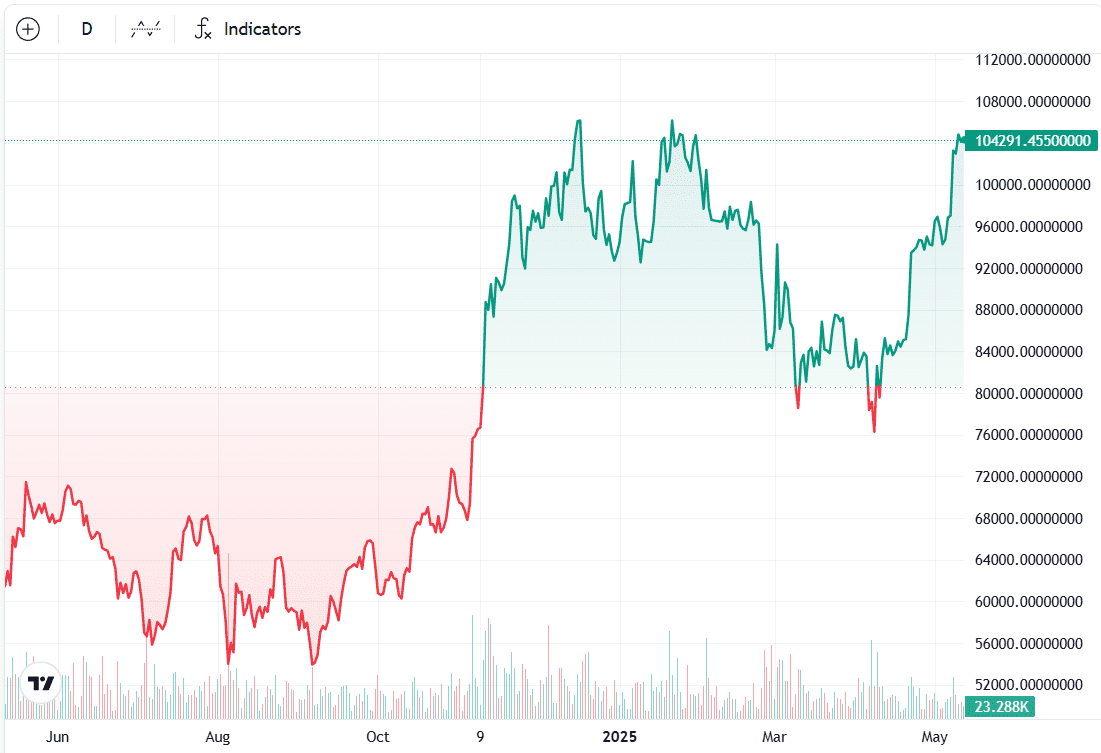

Barthere told Cointelegraph, “Bitcoin is already trading close to its all-time highs. However, with the latest easing in trade tensions, it now appears that altcoins, US equities, and the US Dollar Index (DXY) are well-positioned for a catch-up rally.”

She further highlighted Bitcoin’s recent outperformance compared to other risk assets, attributing it to its relative immunity to tariff-related anxieties.

“I also expect the US dollar to perform strongly against prior safe-haven currencies such as the euro, Swiss franc and Japanese yen, reflecting improved global risk sentiment,” Barthere added.

Nansen previously estimated a 70% likelihood of crypto and stock markets finding their floor by June, with subsequent recovery contingent upon the resolution of trade discussions.

Tax Relief: A Potential Catalyst for Further Gains

Bitcoin is currently within striking distance of its all-time high, recorded in January 2025. Cointelegraph Markets Pro data indicates it needs to gain roughly 4.8% to reclaim its peak.

Barthere believes that the market could surpass previous highs if substantial tax cuts are implemented, stating:

“There is potential for risk assets to move beyond the January peak levels if we see a generous tax cut package materialize. This would need to go beyond merely extending the expiring tax cuts, and include additional income tax reductions as well as corporate tax cuts on top.”

She alluded to Secretary Bessent’s suggestion of a potential unveiling of such a package by mid-July, which could act as a “significant additional catalyst” for market growth.

The confluence of constructive trade talks and promising technical chart formations has led analysts to predict a potential Bitcoin rally to $150,000, contingent on the development of a bull flag pattern on the weekly chart.

Factors Influencing the Potential Rally:

- US-China Tariff Agreement: The 90-day suspension of additional tariffs has improved market sentiment and reduced the risk of sudden escalation.

- Potential Tax Relief: The possibility of significant tax cuts could provide a substantial boost to risk assets, including Bitcoin and altcoins.

- Technical Analysis: Emerging chart patterns, such as the bull flag, suggest a potential for further price appreciation.

- US Dollar Strength: Improved global risk sentiment could lead to a stronger US dollar, impacting the performance of other currencies.

Risks to Consider:

- Reversal of Trade Agreement: The agreement is only for 90 days; a failure to reach a longer-term resolution could negatively impact the markets.

- Unforeseen Economic Events: Unexpected economic downturns or geopolitical events could disrupt the rally.

- Regulatory Changes: Changes in cryptocurrency regulations could impact market sentiment and prices.

In conclusion, the cryptocurrency and stock markets are exhibiting signs of potential recovery following the US-China tariff agreement. While several factors contribute to this optimistic outlook, investors should also remain aware of potential risks and exercise caution.