Key Points:

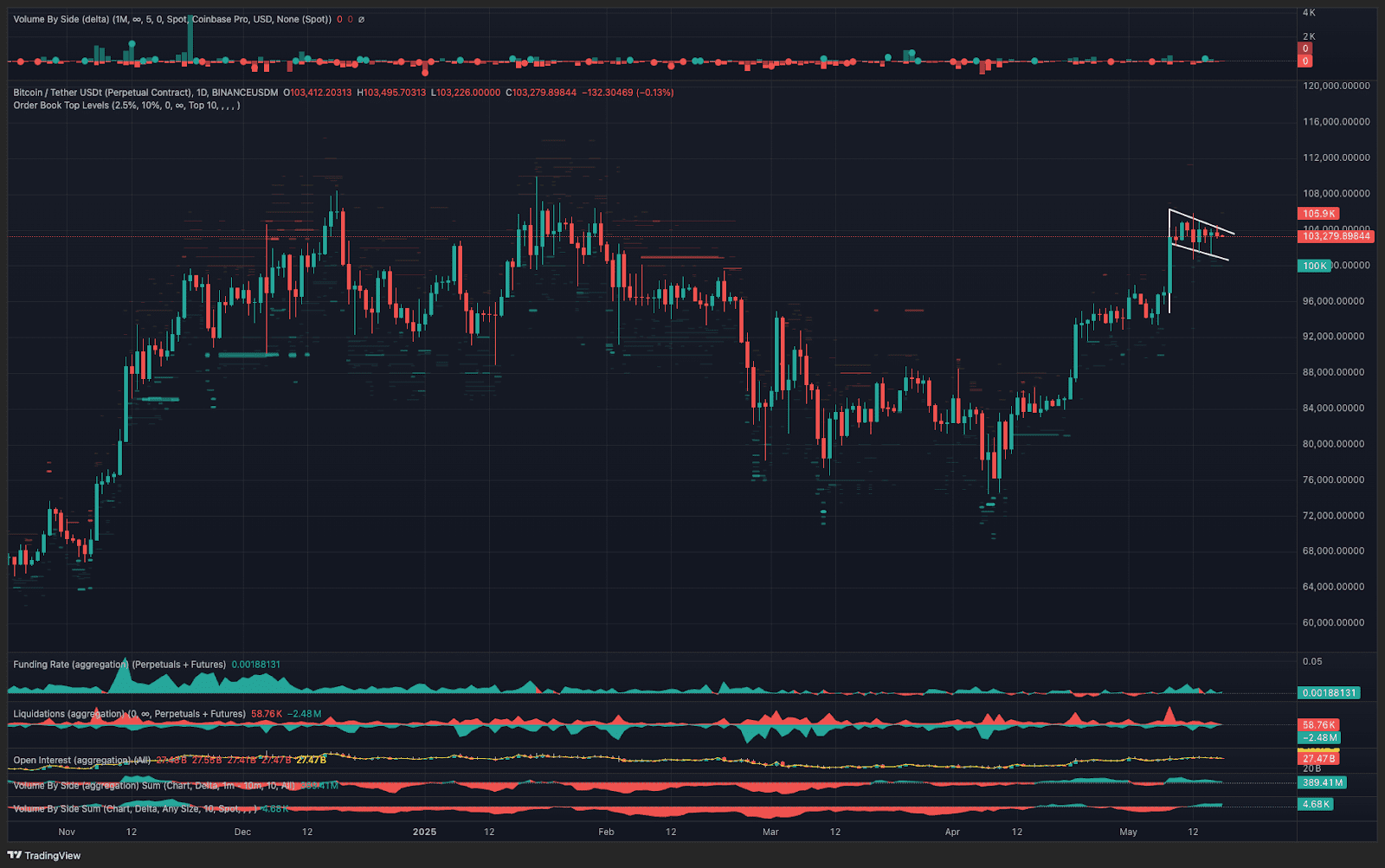

- Bitcoin is consolidating in a bull flag pattern, suggesting a potential continuation of its uptrend.

- Weak profit-taking indicates underlying bullish momentum.

- Analysts are eyeing a potential pullback to the $90,000 – $100,000 support range before a rally to new highs.

Bitcoin (BTC) is currently trading below the $105,000 resistance zone, leading to speculation about its next move. However, a closer look reveals a potential bull flag formation, a continuation pattern that suggests the uptrend could resume. A bull flag forms after a significant price increase, followed by a period of sideways consolidation.

Understanding the Bull Flag Pattern

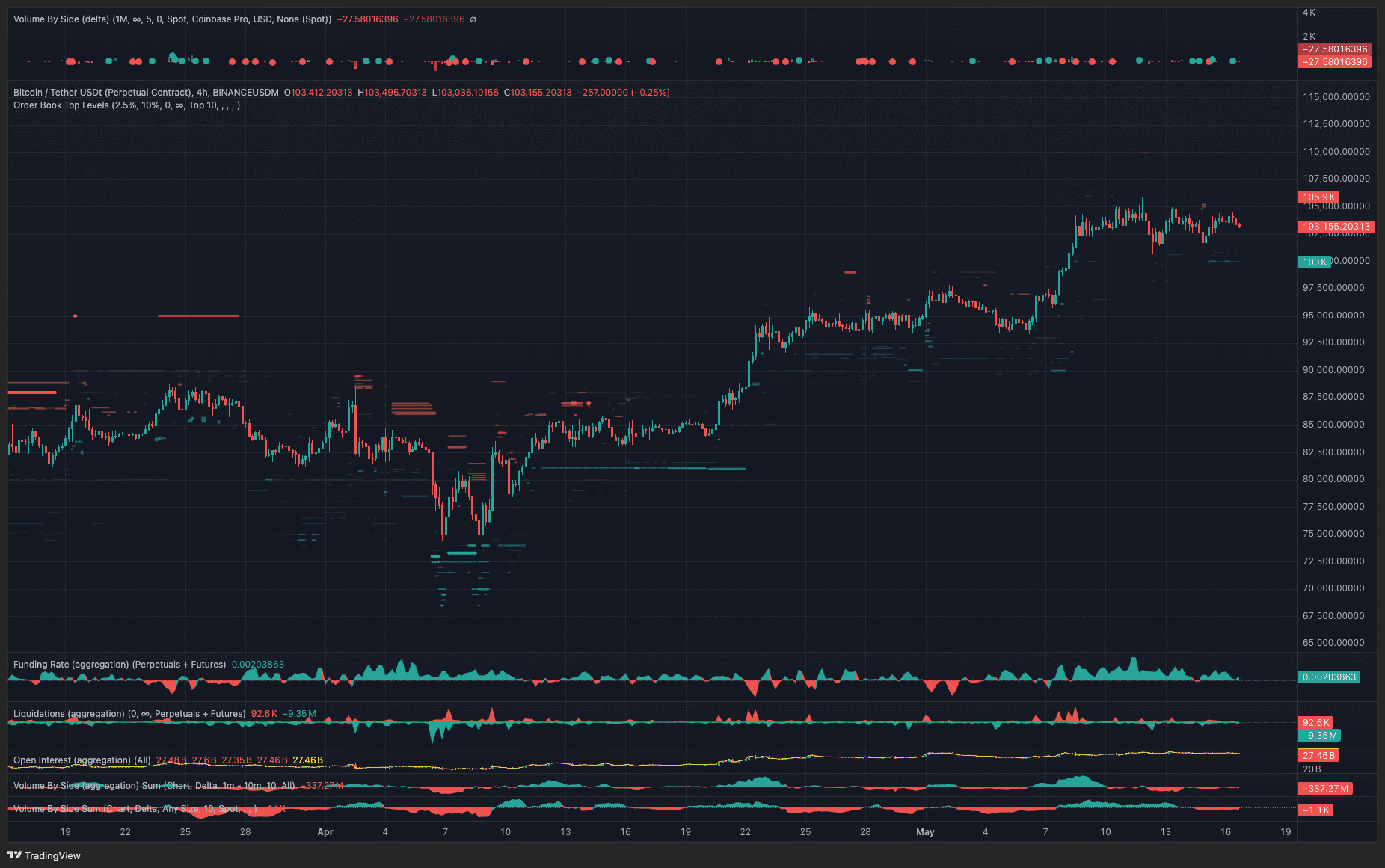

The consolidation phase within a bull flag often indicates indecision among buyers and sellers. In Bitcoin’s case, the lack of strong buying volume during this phase is notable. However, this doesn’t necessarily signal a bearish reversal. Instead, it could indicate that the market is absorbing previous gains and preparing for another leg up.

Factors Supporting a Potential Rally

- Strong Previous Momentum: Bitcoin’s surge from $74,400 to $105,900 was fueled by substantial liquidations in margin markets, robust spot volumes, and significant inflows into spot BTC ETFs.

- Corporate Adoption: Several companies have announced plans to purchase Bitcoin and establish BTC treasuries, signaling long-term confidence in the asset.

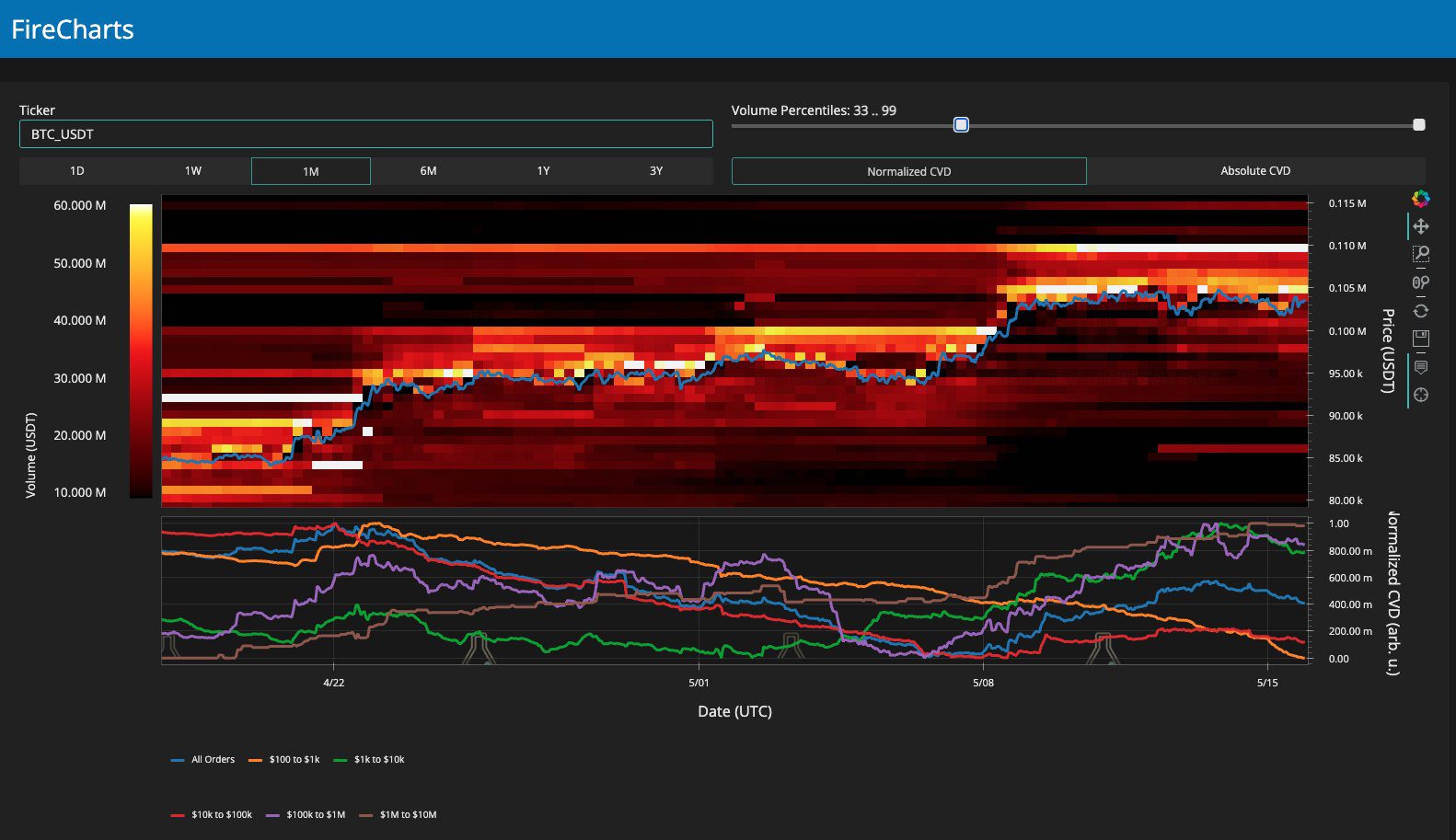

- On-Chain Data: Data from Glassnode indicates that profit-taking among short-term holders hasn’t reached levels typically seen before major price corrections, suggesting further upside potential.

Profit Taking and Market Dynamics

The current consolidation phase is a natural result of the recent 40% price recovery. Profit-taking in futures markets is expected near range highs. However, as Glassnode points out, the magnitude of profit-taking hasn’t reached extreme levels, leaving room for further price appreciation.

Potential Pullback to Support Levels

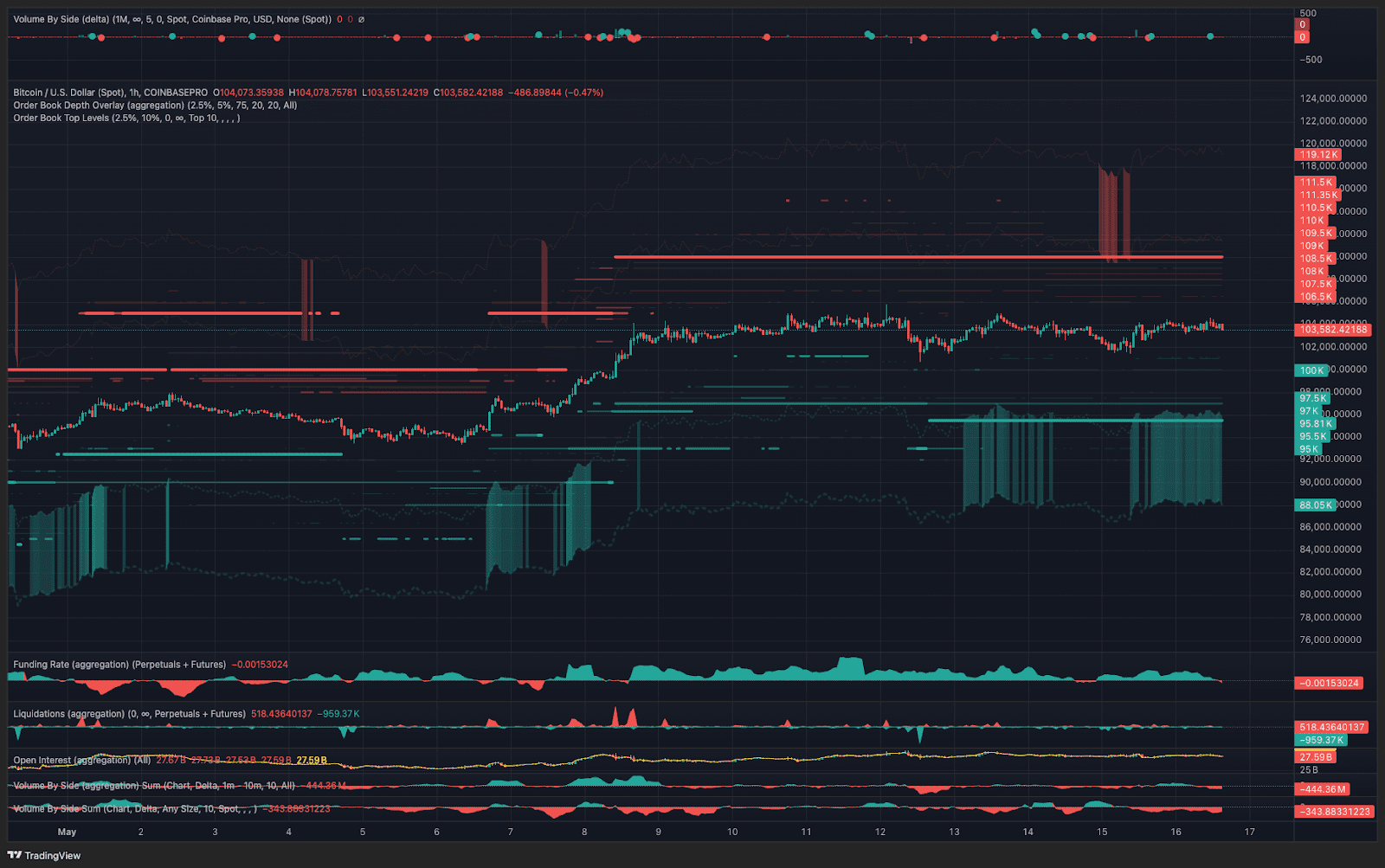

While a rally to new highs is possible, some analysts suggest a potential pullback to test support levels before a sustained uptrend. Bitcoin market liquidity resource Material Indicators points to $100,000 as a legitimate support test level. Analyst Daan Crypto Trades identifies $90,000 as a key long-term support level.

The Importance of Liquidity

Liquidity plays a crucial role in Bitcoin’s price movement. When sell-side liquidity is absorbed during a price increase, it can pave the way for further gains. However, a lack of liquidity can lead to price volatility and potential pullbacks.

External Factors to Consider

Broader market conditions can also influence Bitcoin’s price. For instance, the performance of US equity markets and geopolitical events can impact investor sentiment and risk appetite, indirectly affecting Bitcoin.

Alternative Scenarios and Technical Analysis

Technical analysis involves the use of charts and indicators to predict future price movements. A bull flag pattern is just one of many technical indicators used by traders and analysts. Other indicators, such as moving averages, relative strength index (RSI), and MACD, can provide additional insights into Bitcoin’s price trends.

The Role of Institutional Investors

Institutional investors, such as hedge funds and corporations, are increasingly involved in the Bitcoin market. Their participation can significantly impact price volatility and long-term trends. Large institutional purchases can drive prices higher, while institutional selling can lead to price corrections.

Conclusion

Bitcoin’s price action is currently characterized by a potential bull flag pattern. While a pullback to support levels is possible, strong underlying momentum and positive on-chain data suggest that a rally to new all-time highs remains a viable scenario. Investors should carefully consider all factors, including technical indicators, market conditions, and fundamental analysis, before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investing in Bitcoin and other cryptocurrencies involves significant risk. Consult with a qualified financial advisor before making any investment decisions.